I look at a lot of charts every week. Every now and then something catches my attention and forces me to deep dive to try and understand what it is I’m looking at. The fundamental premise of technical analysis is what ‘everyone knows’ is reflected in the current price of an asset. The challenge with this fact is when you see a chart that is terrifying, and you don’t understand, you need to work backwards and try to figure out, what is it that everybody knows?

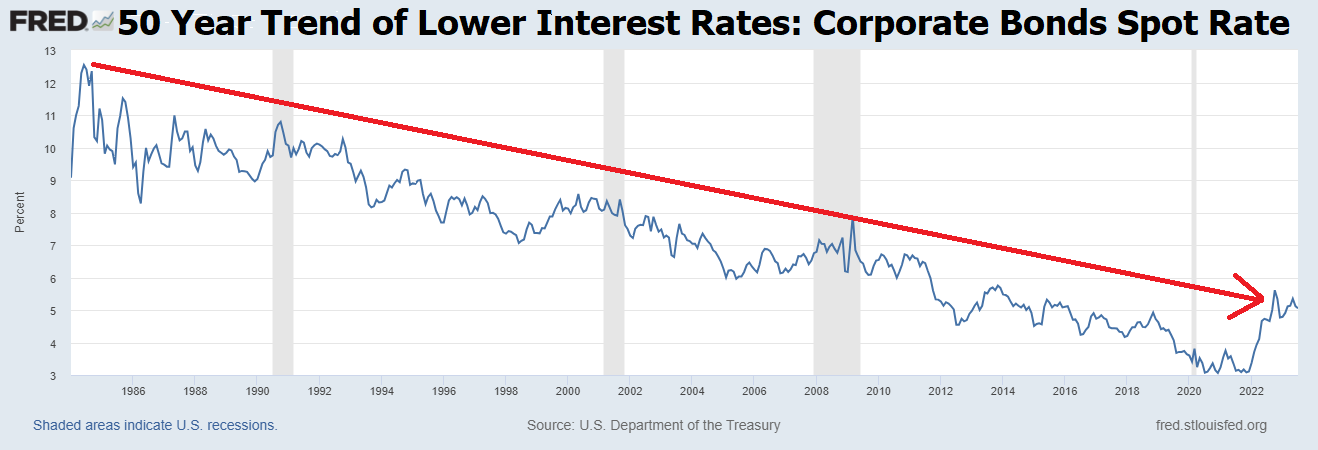

Two charts caught my attention this past week. Here they are:

This is a chart maintained by the St. Louis Federal Reserve of the Corporate Bond Spot Rate over the last 50 years. Up until 2022, clearly the long-term trend has been for lower interest rates.

Next, Let’s look at a monthly chart for the last 10 years of the U.S. Treasury Note Market.

Both charts confirm the reality that we are at a critical point in the interest rate market, and it is very possible that the long-term trends we have witnessed over the last five decades are changing and we are moving from a structural lower interest rate environment into a formational higher interest rate environment. In this article, I’ll address the implications of this reality and explore the effect on global markets.

The U.S. Treasury market is estimated to exceed $20 trillion. The U.S. Stock market comparatively speaking is estimated to be at $46 trillion. On Wall Street, one of the adages which traders learn early in their trading careers is:

“When interest rates are low, stocks will grow. When Interest rates are high, stocks will die.”

The purpose of this axiom is not to instill fear in traders. Rather, it’s to remind traders when the cost of capital increases, it’s much harder for businesses to profitably navigate the financial terrain. When this occurs investors and traders traditionally opt for the safety and yield offered by the full faith and credit of the US. Government. The yield which the government offers and promotes on Treasury instruments is always competing against the perceived risk of investing in other financial instruments.

Over the years, the one truth I’ve learned in watching markets is to pay very close attention to those markets that are testing or violating their ten-year trading ranges. These breaches are market signals to the world that massive change is occurring which the market is trying to process through its price discovery mechanism.

Stated another way, whenever you witness an asset making a new ten-year high, you are witnessing a market that is comparatively among the strongest of all markets. The inverse is equally true as well, that whenever you witness a market testing or breaching its ten-year lows, it is comparatively speaking amongst the weakest of all markets.

For the U.S. Treasury market to find itself on this list of markets testing their ten-year lows validates the recent downgrade by the credit rating agencies of U.S. government debt.

The reason that those two previous charts caught my attention is because of what is going on in China. The potential collapse of China looms large, and the financial turmoil surrounding Chinese Evergrande is back in the spotlight as the company files for Chapter 15 bankruptcy protection in New York. Despite months of efforts to devise a debt restructuring plan, Evergrande’s struggles persist due to a lack of necessary credit and support. Many on Wall Street are referring to Evergrande as China’s Lehman Brothers moment. Before this crisis hit two years ago, Evergrande had more than 200,000 employees, raked in more than $110 billion in annual revenues and owned more than 1,300 developments in hundreds of cities. Today it is bankrupt.

Hedge funds are making aggressive moves by offloading Chinese stocks , with major players like BlackRock, Allianz expressing growing skepticism about China’s future economic prospects. Even banking giant JPMorgan is slashing its growth forecasts for China.

This turmoil is sending shockwaves through the Chinese economy, reigniting calls for aggressive easing. This is especially critical since these issues are also pressuring home prices downward in China. To clarify, real estate holds a unique significance in China, often being the sole investment avenue available to its citizens. In the West, however, investors enjoy a plethora of options, from stocks and liquid bond markets to a range of savings vehicles and private investment opportunities. The robust structure of Western economies caters to investor needs, but China’s investment ecosystem remains comparatively shallow and limited. Consequently, the ballooning real estate market that absorbed much of China’s savings is turning into an economic bubble, pushing authorities to intervene yet again.

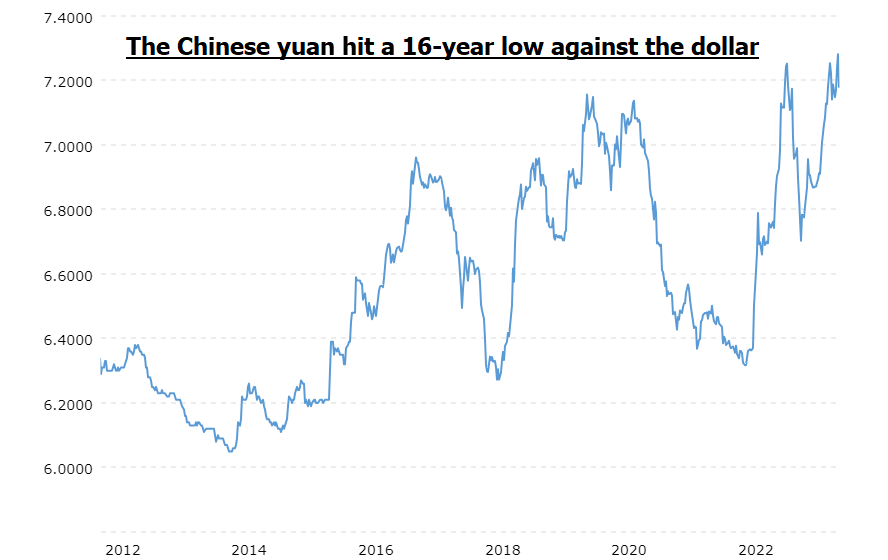

Over the past week, the People’s Bank of China, the nation’s central bank, infused the most short-term liquidity since February. Just as the US Federal Reserve has encountered limitations, China faces the same roadblocks. Cutting rates and printing money erode currency value, aiming to boost prices. However, for an economy reliant on securing US dollars for international trade, a plummeting currency is a perilous prospect.

While current data may seem like an abrupt emergence of problems, it’s crucial to recognize that many of these issues stem from long-term trends finally surfacing. These are pressures that have been brewing beneath the surface for years.

Interest rates are teetering on the edge of a breakdown. The 30-year U.S. Treasury yield is singing its highest note since 2011, while the 10-year is following suit. From a technical standpoint, it’s like they’re getting ready to pop the champagne cork, and higher interest rates are on the menu. The largest purchasers of Treasuries historically are now becoming net sellers in 2023.

China has gone from holding 1.3 trillion dollars of U.S. Treasuries to 835 billion. Japan – they’re shedding U.S. Treasuries like a snake sheds its skin, going from 1.3 trillion down to 1.1 trillion. And let’s not forget the Federal Reserve. They’re playing it coy, tapering their balance sheet, letting those assets drift away like autumn leaves in the wind.

Why is this so important?

Simple question: If you were China or Japan and your economy was contracting, would you continue your sale of U.S. Treasuries? If so, lower Treasury prices mean higher interest rates.

Furthermore, for years, China has been the driving force behind global economic expansion. However, recent weeks have brought about a worrisome deceleration in its economic pace.

International leaders and investors, who once relied on China to counteract global weaknesses, now find themselves grappling with a different reality. Uncharacteristically, China’s own economic slowdown has transformed it from a stronghold into a source of concern.

Even Hong Kong’s Hang Seng (HSI) Index couldn’t escape the downward spiral, tumbling into bear market territory, having plunged over 20% from its peak earlier this year. The Chinese yuan also hit a 16-year low against the dollar, prompting the central bank to mount an unprecedented defense by pegging the currency to a substantially higher rate than the market anticipated.

The predicament at hand stems from a promising burst of activity after the initial Covid lockdowns, which has now fizzled out. The growth engine is sputtering, marked by falling consumer prices, a deepening real estate debacle, and a sluggish export sector. Youth unemployment is so dire that official data on the matter has been withheld.

As if these challenges weren’t enough, a major housing developer and a prominent investment firm have recently defaulted on their payments, rekindling concerns that the ongoing housing market deterioration might pose heightened risks to financial stability for the world economy.

The threat of economic contraction in China can send ripples across the globe. Imagine China as a big factory that makes many things that people in other countries buy. If China’s factory slows down or stops making things, it affects the businesses that sell those things around the world. This can lead to job losses and less money being spent, which can hurt economies in other countries too. Moreover, China is like a puzzle piece that fits into the larger world economy. If this puzzle piece doesn’t fit well or goes missing, it can make the whole economic picture look unclear and uncertain.

The knock-on effects of China’s economic contraction are like a game of falling dominoes. For instance, if Chinese people stop buying as many cars as possible or phones, it can hurt the companies that make those products, not only in China but also in other countries that supply parts to China. When these companies struggle, they might cut down on production or even lay off workers. This, in turn, affects the people who work for those companies, causing them to spend less. The cycle continues, creating a chain reaction of problems that spreads from one place to another. This is why many countries watch China’s economy closely, as what happens there can have a big impact on economies and people all around the world.

While Evergrande continues to navigate its debt restructuring, these woes have reignited worries about China’s economic trajectory. It’s a tale far removed from the global financial turmoil of 2008 and the pandemic’s early days, leaving many to wonder what course China will chart next. When China contracts the expectations are that the rest of the world will also.

In the United States, earlier this year, in March 2023, we had a banking crisis. While no one likes to talk about what caused the banking crisis, it was the TOXIC U.S. Treasuries on the books of banks, which were acquired when interest rates were significantly lower. Why have we not heard much more about the banking crisis? Regulators decided that financial institutions did not have to mark their portfolios to the market. When someone says that financial reporting is “marked to market,” it means that the values of assets and liabilities in a company’s financial statements are adjusted to reflect their current market prices. This practice ensures that the financial statements provide an accurate representation of the company’s financial position based on real-time market conditions. Marking to market is especially relevant for assets that are actively traded in public markets, such as stocks and bonds. It helps provide transparency, reduces the potential for manipulation, and provides stakeholders with up-to-date information about the company’s financial health.

The SEC ruling mandating traders to mark their portfolios to market aims to uphold the order and integrity of the marketplace. This regulation necessitates that traders regularly reassess the value of their assets based on current market prices, ensuring transparency and accuracy in financial reporting. By enforcing this practice, the SEC aims to prevent manipulation, misinformation, and potential market distortions that might arise from outdated or inaccurate valuations. Ultimately, marking portfolios to market helps maintain a fair and level playing field for all market participants and enhances the overall credibility of financial markets.

How did this sleight of hand occur by not requiring banks to mark their portfolios to market? It’s called creative accounting with the help of the Fed.

Securities that banks intend to hold until they mature are not subject to mark-to-market accounting. Instead, they are recorded at amortized cost. So, banks are permitted to move all of their large losses into a different compartment and simply claim they are holding those assets to maturity.

Chew on that creative accounting for a minute and let me know if it makes you believe more or less in the Fed’s actions? What are the knock-on effects of this kind of policy?

I’ve been chewing on this issue for a few months now and regardless of how I look at it, I see danger.

Haven’t we just allowed regulators to change the definition of solvency? Aren’t they just kicking the can down the road?

The world is literally teetering on the edge of a margin call, and the TOO BIG TO FAIL institutions are allowed to play by a completely different set of rules than everybody else.

If there was ever a reason to use artificial intelligence in your trading and investing, I have just described it in this article . The fundamental story which I’ve described is not user friendly towards expecting higher prices in financial assets.

I could be wrong.

But that is not the point I am making. Instead, I’d like to emphasize that what every trader and investor needs is a reliable tool that regardless of what is going on in the world will help keep them on the right side, of the right trend at the right time. That tool is Artificial Intelligence .

If you agree with my bearish sentiments for a global contraction, you should pay attention to the downtrend as evidenced in the following charts of the S&P 500, Ford and Apple.

So, here’s the deal. The next forty years won’t be a rerun of the last forty. We’re entering a new era, and the playbook from 1980 to 2020 isn’t going to cut it anymore. No more burying your head in passive index funds and hoping it all works out. Today’s investors need to be sharp, active, and ready for whatever curveballs the market throws at them.

Let’s talk strategies, because in these uncharted waters, you need more than just a life vest. You need a well-thought-out game plan. Look, I’m not advocating for knee-jerk reactions or wholesale shifts in your investment strategy. That’s a surefire way to lose your way in the fog of uncertainty. I’m not an advisor and I’m not giving investment advice. This is purely educational speculation. So, instead, consider these steps:

1. Stay Informed: Keep your finger on the pulse of the market. Understand the trends, the dynamics, and the interplay between different asset classes. Knowledge is power, and when you know what you’re dealing with, you’re better equipped to make informed decisions.

2. Diversification: Remember that old adage, “Don’t put all your eggs in one basket”? Well, it’s still gold advice. Diversifying your portfolio across different assets can act as a safety net when one sector takes a hit. It won’t shield you entirely, but it can soften the blow.

3. Hedge Your Bets: Hedging isn’t just for the pros. It’s a prudent move for any investor looking to mitigate risks. Think about options, inverse ETFs, or other strategies that can help counterbalance potential losses.

4. Be Opportunistic: Market turmoil often breeds opportunities. If prices are plummeting, it might be a good time to scoop up assets that are undervalued. You could keep cash reserves ready for those potential bargain buys.

5. Stay Calm: Emotional investing rarely leads to good outcomes. Panic selling can lock in losses, and chasing trends can leave you burned. Stay level-headed, stick to your strategy, and remember that markets are known for their ups and downs.

Now, I’m not one to paint doomsday scenarios. Just because the skies might look stormy doesn’t mean we’re destined for a financial apocalypse. But it’s better to be prepared than caught off guard. Whether it’s a market dip, a surge in interest rates, or something completely unexpected, having a well-thought-out strategy in place will serve you well.

And here’s the thing – the financial landscape is always evolving.

We’re heading into uncharted territory. It’s time to adapt, to learn, and to arm ourselves with the knowledge and tools to navigate this brave new world of finance.

So, as you move forward, keep your eyes open, your wits sharp, and your strategy flexible. And remember, in the face of uncertainty, knowledge is your greatest ally. Stay informed, stay diversified, and stay ready to seize opportunities when they come knocking.

Knowledge. Useful knowledge. And its application is what A.I. delivers.

You should find out. Join us for a FREE, Live Training . We’ll show you at least three stocks that have been identified by the A.I. that are poised for big movement… and remember, movement of any kind is an opportunity for profits!

Discover why Vantagepoint’s artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

Pay Attention.

Visit with us and check out the A.I. at our Next Free Live Training.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.