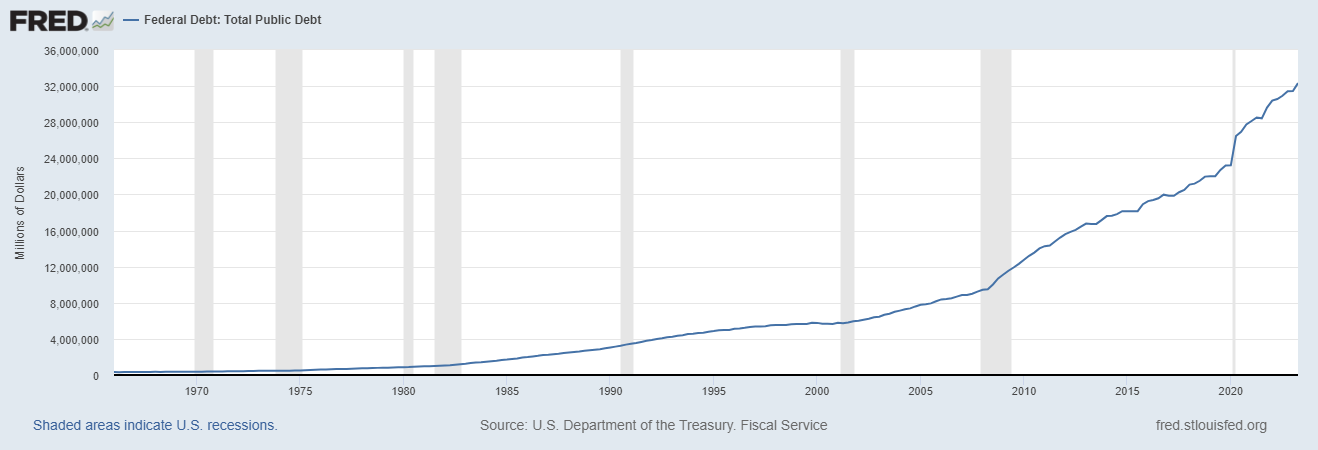

Here’s a chart I filter most of my economic understanding from. The chart may look relatively innocent, but it illustrates one of the largest problems that traders and investors face in trying to understand financial information.

Let me explain:

The United States began tracking financial statistics in 1790. From that date until the year 2000 the Gross National Debt amounted to $5.7 trillion. Since the pandemic in the first quarter of 2020, to the present time we have piled on an additional 9 trillion to the national debt in only 3 years! That is EXPONENTIAL GROWTH, and it is treacherous and supremely dangerous.

One of the most challenging issues for people is understanding what mathematicians refer to as the exponential function.

When something is projected to grow exponentially at first it appears rather harmless. But there comes a point of reckoning in its exponential growth curve where its speed and quantity wreak havoc upon everything in its path.

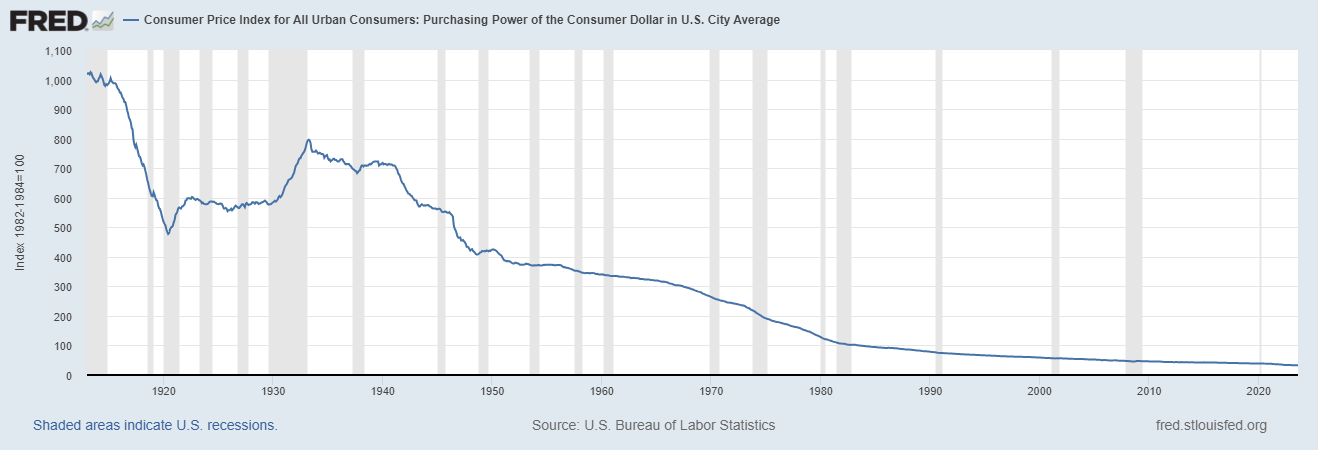

Exponential debt growth, while seemingly beneficial in the short term, poses several significant problems that can have far-reaching consequences for an economy. One of the most pressing issues is the link between such debt accumulation and inflation. When a government or institution continually borrows at an exponential rate, it can flood the economy with excess money supply. This, in turn, can lead to demand-pull inflation, where too much money chases too few goods and services. As prices rise, consumers and businesses find their purchasing power eroded, making it increasingly difficult to afford everyday necessities and investments.

Moreover, exponential debt growth WILL contribute to currency debasement, which is the devaluation of a nation’s currency. As governments accumulate debt, they often resort to printing more money to service those debts. This increase in the money supply can lead to a depreciation of the currency’s value relative to other currencies, reducing its purchasing power on the global stage. A weaker currency can impact international trade, making imports more expensive and potentially leading to trade imbalances. Additionally, it can reduce the attractiveness of a nation’s assets, discouraging foreign investment and causing economic instability.

Loss of purchasing power is a direct consequence of both inflation and currency debasement. As the value of money decreases, consumers find it harder to maintain their standard of living. They may need more money to buy the same goods and services they once could with less. This can lead to reduced savings and investments, hindering long-term economic growth. In essence, exponential debt growth creates a cycle of inflation, currency devaluation, and reduced purchasing power that can be challenging to break free from, ultimately threatening an economy’s stability and prosperity.

The United States began tracking financial statistics in 1790. From that date until the year 2000 the Gross National Debt amounted to $5.7 trillion. Between the years of 2000 to 2016 a period of 16 years, the Gross National Debt grew 182% to a staggering $19.9 trillion. In the last 7 years, the debt has grown almost $14 trillion more.

This growth of debt is exponential in nature. The United States reached its first trillion dollars of national debt in the early 1980s. To be more specific, the U.S. government’s national debt crossed the trillion-dollar mark for the first time in 1981. This occurred during the presidency of Ronald Reagan. For context we are projected to add over $1.9 trillion to the national debt just for the second half of 2023.

The one conclusion you can draw from studying these numbers is that if you believe that DEBT is good, the United States economy has never been in a better place. However, if you have concerns about debt and recognize how it can be highly destructive to freedom and productivity, you will arrive at completely different conclusions.

The numbers are worthy of every trader’s consideration as history clearly demonstrates that currencies are eventually devalued when this amount of new debt is added to an economy. Simply servicing the interest load on that debt is quickly rising to become one of the largest items on the nation’s budget.

I spend a lot of time trying to understand the maneuvers of the U.S. Treasury and Federal Reserve. In full transparency, I can readily admit that I do not comprehend the majority of what they do. They appear to operate from the framework that DEBT is essential and necessary with complete disregard to the economic implications.

Dr. Al Bartlett was a math professor from the University of Colorado who emphasized the significance of understanding the exponential function in the context of planning. He was known for his lectures on the exponential function and the consequences of exponential growth.

Let’s roll up our sleeves and dive headfirst into the powerful world of exponentials compounding. You see, when something grows over time, whether it’s population, the demand for good ol’ oil, debt, or even the money supply, and you chart that baby over time, well, it’s got a shape to it, just like a hockey stick. Now, if that growth’s happening on a percentage basis, that’s what we call exponential growth. Let me illustrate this with a little tale inspired by the brilliant Dr. Albert Bartlett.

Imagine I’ve got a magic eye dropper, and I plunk down a single drop of water on your left hand. But here’s the kicker: that drop doubles in size every single minute. First minute, nothing much, just two tiny drops. Keep that doubling up, and in six minutes, you’ve got yourself enough water to fill a dinky thimble.

Now, hold onto your hats, folks, ’cause we’re taking that magical eye dropper to the heart of Yankee Stadium, right on that pitcher’s mound, high noon. Picture this: the park’s sealed up tight, and I’ve shackled you to the nosebleeds. Your mission? Break free before that stadium turns into one colossal water park. How long do you have before you drown? Well, not long at all, my friends, ’cause by 12:50 on the very same day, that itty-bitty drop of water will have turned Yankee Stadium into a ginormous pool. But here’s the real kicker – at 12:45, the stadium’s still 93% empty, and that’s when you’ll realize time isn’t on your side. This, my friends, is the essence of exponential growth: slow and steady at first, but when it hits that vertical climb, it’s a race against the clock. Dr. Bartlett once said, “the greatest shortcoming of the human race is the inability to understand the exponential function.” And he hit the nail on the head. So, remember, once you’re on that vertical ride, time’s your most precious asset.

To provide an easier comprehension of this subject I did the math. Here is what the horrifying progression looks like:

– At 1 minute: 2 drops of water

– At 2 minutes: 4 drops of water

– At 3 minutes: 8 drops of water

– At 4 minutes: 16 drops of water

– At 5 minutes: 32 drops of water

– At 6 minutes: 64 drops of water

– At 7 minutes: 128 drops of water

– At 8 minutes: 256 drops of water

– At 9 minutes: 512 drops of water

– At 10 minutes: 1,024 drops of water

So, after 10 minutes, we poured in 1,024 drops of water of water.

Let’s continue the example with drops of water for 40 more minutes:

– At 11 minutes: 2,048 drops of water

– At 12 minutes: 4,096 drops of water

– At 13 minutes: 8,192 drops of water

– At 14 minutes: 16,384 drops of water

– At 15 minutes: 32,768 drops of water

– At 16 minutes: 65,536 drops of water

– At 17 minutes: 131,072 drops of water

– At 18 minutes: 262,144 drops of water

– At 19 minutes: 524,288 drops of water

– At 20 minutes: 1,048,576 drops of water

– At 21 minutes: 2,097,152 drops of water

– At 22 minutes: 4,194,304 drops of water

– At 23 minutes: 8,388,608 drops of water

– At 24 minutes: 16,777,216 drops of water

– At 25 minutes: 33,554,432 drops of water

– At 26 minutes: 67,108,864 drops of water

– At 27 minutes: 134,217,728 drops of water

– At 28 minutes: 268,435,456 drops of water

– At 29 minutes: 536,870,912 drops of water

– At 30 minutes: 1,073,741,824 drops of water

– At 31 minutes: 2,147,483,648 drops of water

– At 32 minutes: 4,294,967,296 drops of water

– At 33 minutes: 8,589,934,592 drops of water

– At 34 minutes: 17,179,869,184 drops of water

– At 35 minutes: 34,359,738,368 drops of water

– At 36 minutes: 68,719,476,736 drops of water

– At 37 minutes: 137,438,953,472 drops of water

– At 38 minutes: 274,877,906,944 drops of water

– At 39 minutes: 549,755,813,888 drops of water

– At 40 minutes: 1,099,511,627,776 drops of water

– At 41 minutes: 2,199,023,255,552 drops of water

– At 42 minutes: 4,398,046,511,104 drops of water

– At 43 minutes: 8,796,093,022,208 drops of water

– At 44 minutes: 17,592,186,044,416 drops of water

– At 45 minutes: 35,184,372,088,832 drops of water

– At 46 minutes: 70,368,744,177,664 drops of water

– At 47 minutes: 140,737,488,355,328 drops of water

– At 48 minutes: 281,474,976,710,656 drops of water

– At 49 minutes: 562,949,953,421,312 drops of water

– At 50 minutes: 1,125,899,906,842,624 drops of water

So, after 50 minutes of doubling the amount of water poured into the stadium every minute, we have a whopping 1,125,899,906,842,624 drops of water of water in the stadium. That’s more water than you can probably imagine! This example illustrates how exponential growth can lead to incredibly large numbers very quickly.

The reason I’m sharing this example is, in my mind, DEBT is overwhelming the economy in a similar fashion. Most of us become numb to the value of what a trillion dollars means and how quickly it is being created.

I watched the Federal Reserve’s Press conference yesterday and was really surprised by their conclusions that the economy was stronger than they expected.

What troubles me about yesterday’s Fed Meeting is that the four most important events of the last month were not even discussed. I am referring to:

Oil Prices have surged 33% from their August lows.

US Treasury credit was downgraded by the credit rating agencies. This reality has raised concerns about its fiscal health and creditworthiness.

The U.S. Treasury has updated its borrowing estimates, indicating plans to borrow nearly $1.9 trillion in the second half of the year, contributing to a growing national debt.

The BRICS nations concluded their meeting in South Africa last month with 51 additional nations applying for membership threatening the U.S. dollars reserve currency status.

The BRICS development is massive for the simple reason that all these nations in the past were buyers of U.S Treasuries. If these nations abstain from buying U.S. debt how does the government get funded?

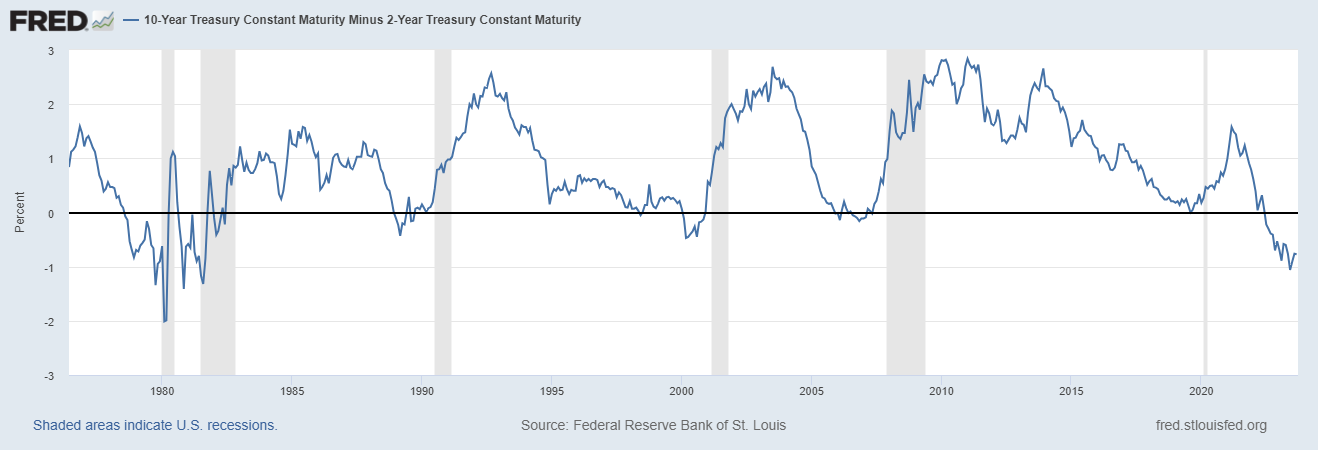

The banking crisis that occurred in March is still fresh on every market participant’s mind. What caused the banking crisis? Banks were LONG treasuries in a rising interest rate environment.

Yet, the FED is telling us that their base case is to manufacture a soft landing by keeping rates higher for longer and we have dodged a recession. Yet, our government is running wartime deficits in a peacetime economy.

I really want to believe them, but common sense tells me they are wrong. RIDDLE ME THIS: We have 200% of the debt that we did before the 2008 Great Financial Crisis. Interest Rates are higher than in 2008. Yet we are being told that this time is different, and we will have a better outcome?

Call me skeptical!

Look at the following chart of U.S Treasury Notes. They are trading at the lowest level of the last 10 years. Why? Perceived RISK. The U.S. is creating debt almost as quickly as the water dropper example. Sure, you potentially are beating inflation if you believe the government’s numbers. But what happens to interest rates when the government has trouble selling these Treasuries? Historically whenever a market makes 10-year lows and 52 week lows simultaneously is an indication of a very distressed market.

Ladies and gentlemen let’s get real about the state of our economy. The idea that we’ve dodged a recession is a fantasy. Sure, we had a little boost in GDP growth thanks to government stimulus in 2023, but let me tell you, that’s no long-term solution. It’s like putting a band-aid on a sinking ship. You see, fiscal stimulus might make things look rosy for a while, but it wreaks havoc on our economy down the line, leading to higher taxes, soaring interest rates, and, yes, inflation that can wreck us.

Now, here’s the kicker: while consumers and businesses enjoyed low-interest rates, banks and lenders are stuck with tons of underwater assets, like mortgage-backed securities and bad debt. That’s a ticking time bomb for our banking system. Plus, those pandemic savings we had. They’re drying up fast, my friends.

But the real reason the recession’s been put on hold is Powell’s Bank Term Funding Program (BTFP), essentially a lifeline for our financial system. However, it’s a temporary fix. Banks are feeling the heat, with lending standards tighter than a drum. The yield curve’s been upside-down for over a year.

The M2 money supply is dwindling, and the Fed’s balance sheet is shrinking, sucking money out of the markets, and pushing asset prices down. The writing’s on the wall, folks. Delinquencies are on the rise, and our housing markets in a deep freeze. Housing has never been more expensive. And let’s not forget the rest of the world isn’t faring much better. So, folks, when it comes to stocks, patience is key. With all these warning signs, it’s clear there’ll be a better time for that market surge.

It’s worth taking a moment to dissect the global economic landscape, and the situation isn’t as rosy as some might hope, especially for those who believe in the strength of the United States. The truth is that the U.S. economy seems to be standing in relative isolation compared to the rest of the world. While the U.S. managed to maintain some semblance of economic stability, other major players in the global arena aren’t faring as well.

Over in the European Union, the economic picture appears to be a rollercoaster ride, with periods of growth followed by bouts of recession. It’s a bit of an economic seesaw, and this instability can have ripple effects that extend beyond Europe’s borders.

China, on the other hand, was once hailed as the savior of the global economy after the Great Financial Crisis (GFC). However, their approach to economic growth, fueled by massive borrowing and a fixation on building a colossal, fixed asset bubble, is now showing its drawbacks. China’s debt levels have skyrocketed to concerning heights, rendering it a debt-disabled economy. This shift in fortune means that China can no longer be the reliable engine of global economic rescue that it once was. In essence, the world has lost one of its key economic stabilizers.

In light of these global economic dynamics, it’s essential to recognize that while the U.S. might seem relatively strong in comparison, the interconnectedness of our global economy means that no nation is an economic island. Economic challenges in one part of the world can inevitably reverberate across borders, making it crucial for nations to work together to find solutions that promote global economic stability.

What does this all mean? How do you go about making sense of it all?

The only thing you can pretty much guarantee is that currency debasement is a given. Look at the 98% loss of purchasing power of the U.S. Dollar since the Federal Reserve Act was passed in 1913.

That is why I would suggest to you that today more than ever you need artificial intelligence to help guide and navigate these volatile trends.

Let me lay it out for you straight. The Fed…? They’ve been stirring up one heck of a ruckus in the stock market. I mean, it’s like a rollercoaster ride out there. All this wild up-and-down action? It’s like they’re whispering in the ears of traders, saying, “Forget long-term investing, everyone let’s speculate!”

You see, the Fed, with all its monetary policy shenanigans, wields this mighty wand. They tinker with interest rates and other financial hocus-pocus that sends investment capital on a merry-go-round. When they make a move, the whole market holds its breath and then goes bonkers. Investor sentiment? Well, it’s as fickle as a cat on a hot tin roof.

Picture this: Interest rates go up, or they tweak their QE stuff, and suddenly, it’s pandemonium. Investors start playing a guessing game about future returns, and bam! Stock prices are on a wild seesaw. It’s like watching a hurricane tear through a trailer park.

And here’s the kicker – those stock market swings? They’re like the market’s mood ring, reflecting how investors perceive the Fed’s actions. Buy or sell, it’s all riding on what they think of the Fed’s grand plans. It’s as clear as day; the Fed’s got the starring role in this market volatility drama.

Now, let’s shift gears, shall we? Artificial intelligence, machine learning, and neural networks, my friend, they’re your trading allies. These are the heavy artillery of decision-making in the trading trenches.

A.I., it’s your ninja advisor in this battle of stock market gains, spotting patterns that escape the naked eye. Machine learning? That’s your data crunching powerhouse, churning through mountains of trading data faster than you can say “bull market.” And those neural networks? They’re like your wisest old trading buddy, learning from past wins and losses to keep you on the right side of the right trend at the right time.

With these three titans on your side, you’ll be making calls that’d make Warren Buffett nod in approval. Staying ahead, catching the right wave at the perfect moment – that’s the name of the game.

And let’s talk straight – our dollars? They’re taking a hit.

But here’s the deal: I’ve given you my take on the economic landscape, but I never let my opinions mess with my trading. I roll with what I see, hear, feel, and understand. And believe me, that’s a tiny piece of the puzzle. That’s why I trust my A.I., neural networks, and machine learning buddies to lead the way.

Here’s a nugget of wisdom – everyone’s had their fair share of terrible trades. Winners and losers, we’ve all tasted both. But what separates the champs from the chumps? The winners learn, my friend. They turn their losses into gold mines of knowledge.

A.I.? It’s a champ because it learns from what doesn’t work and focuses on finding the path to success. It’s like a relentless feedback loop, shaping the fortunes of every top trader out there.

Think about it – A.I. applies mistake prevention to uncover the truth and the actionable. It’s a tireless, 24/7 problem-solving machine. And that, my friend, is a game-changer.

So, don’t just sit around waiting for the Fed to do the hokey pokey. Get yourself informed with the top-notch insights AI can provide. I mean, seriously, if A.I. can thrash humans at poker, chess, Jeopardy, and Go, what makes you think trading is any different?

Knowledge, my friend. It’s power, and A.I.? It’s the key to unlocking that power and using it to your advantage. So, go out there and make those savvy moves. Your financial future will thank you.

Join us for a FREE Live Training.

We’ll show you at least three stocks that have been identified by the A.I. that are poised for big movement… and remember, movement of any kind is an opportunity for profits!

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

Intrigued? Visit with us and check out the a.i. at our

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.