The quest for higher stock prices is a constant theme in the financial media. However, this pursuit is not without its hurdles, and in the financial landscape, three formidable threats loom large. These three primary threats can create a perfect storm of market turbulence that sends traders and investors scurrying for safe havens to protect their funds. The trio are:

- higher interest rates,

- a surging US dollar,

- elevated crude oil prices

These three markets stand as formidable challenges to the stability and prosperity of stock markets worldwide.

Firstly, the specter of rising interest rates casts a long shadow over the stock market’s fortunes. As central banks adjust monetary policies to combat inflation or address economic imbalances, higher interest rates can become a harsh headwind for stock prices. Investors often seek the safety and predictable returns of fixed-income assets when interest rates climb, diverting capital away from equities and weakening the demand for stocks. However, there are times when the rapidity of interest rate increases or the lack of faith in U.S Treasury instruments add additional risk to investing and trading decisions.

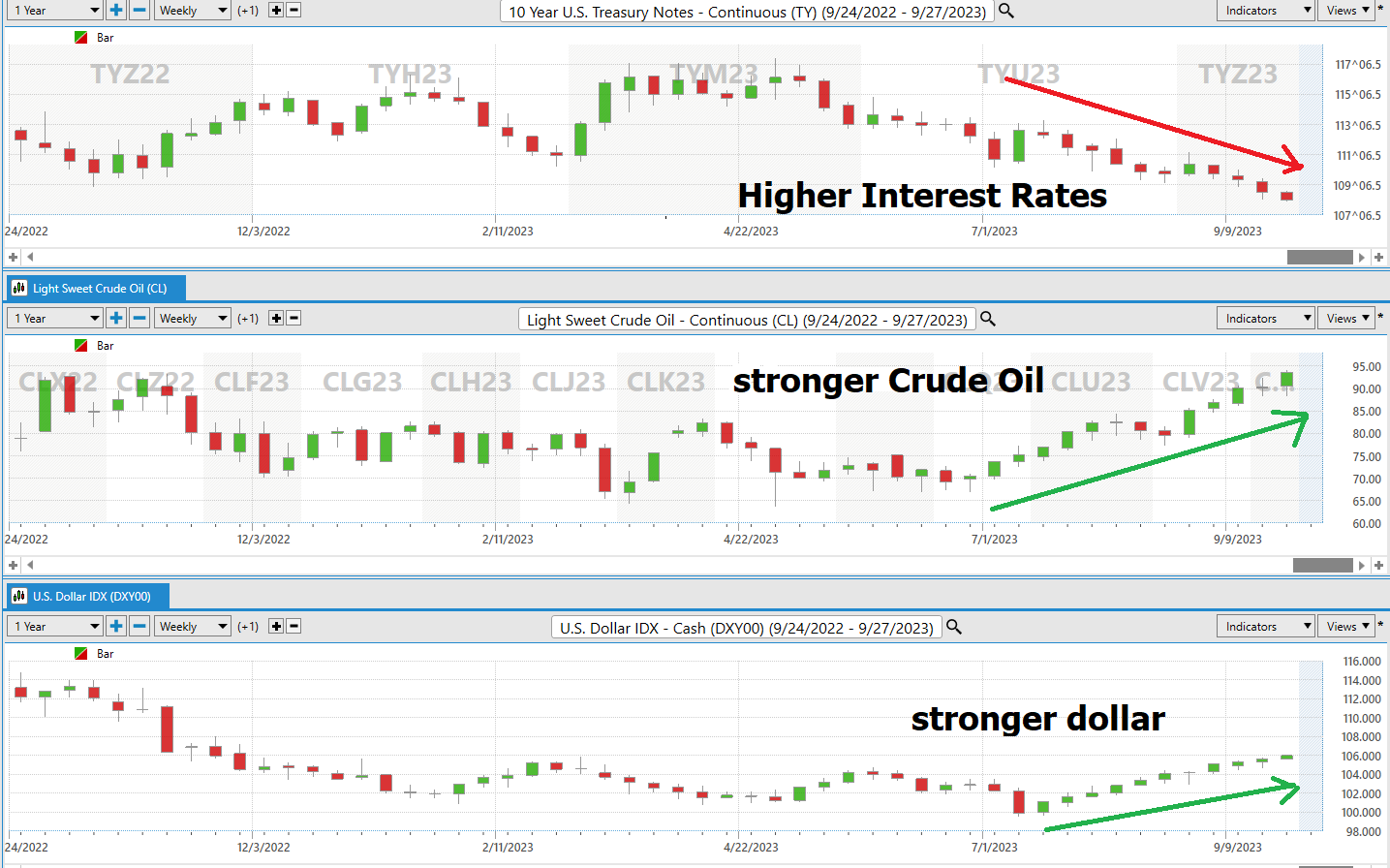

Here is a chart of the U.S Treasury note market. Observe how it is making new 10-year lows. Also observe that this will be the third year in a row that Treasury Note investors took losses by investing in government obligations. This is something that has not occurred since 1787, and not exactly a vote of confidence for investing in government debt obligations.

Secondly, a strengthening US dollar can exert significant pressure on global markets. When the US dollar flexes its muscles and becomes exceptionally strong on the international stage, it triggers a chain reaction of economic havoc around the world. One immediate consequence is that countries heavily reliant on exports find their goods and services becoming more expensive for foreign buyers. This leads to a decline in their export volumes, hurting domestic industries and causing layoffs. Moreover, countries that have borrowed in US dollars, often to take advantage of lower interest rates, now face higher repayment costs as their own currencies weaken against the strong dollar. This can lead to debt crises, as nations struggle to service their dollar-denominated debts, potentially sparking a wave of credit defaults and financial instability.

Here is a chart of the U.S. Dollar over the past few months. Currently, the U.S. Dollar is up 2.3% year to date. But it has rallied almost 7% in the last 10 weeks.

Another critical issue arises with commodity prices, especially in developing economies that rely on raw material exports. A robust US dollar tends to depress commodity prices, making it harder for these countries to earn revenue from their natural resources. This not only undermines their economic growth but also strains their fiscal budgets, as they lose a significant source of income. Furthermore, the strong dollar can attract investors seeking higher returns, leading to capital flight from emerging markets and causing their currencies to depreciate even further. Overall, a strong US dollar can set off a domino effect of economic challenges, disrupting global trade, financial stability, and the livelihoods of millions of people worldwide.

Lastly, elevated crude oil prices add another layer of complexity to the equation. Oil prices, often influenced by geopolitical tensions or supply and demand imbalances, can directly impact a wide range of industries and sectors within the stock market. When oil prices surge, it can lead to higher production costs, reduced consumer spending power, and increased uncertainty, all of which can weigh heavily on stock prices. High crude oil prices are disruptive to economic growth because they increase production costs for businesses and lead to higher prices for consumers, reducing overall spending and potentially causing economic slowdowns. Additionally, high oil prices traditionally pose a threat of higher inflation as they drive up the prices of various goods and services due to increased production and transportation costs, which can erode purchasing power and hinder economic stability.

Observe in the chart below how Crude Oil prices have rallied over 35% from their July lows and are now making new 52-week highs.

In this article, we will delve deeper into each of these three primary threats to higher stock market prices, analyzing their individual impacts and the intricate interplay that occurs when they converge. Understanding the dynamics of higher interest rates, a stronger US dollar, and elevated crude oil prices is essential for traders and investors seeking to navigate the tumultuous waters of the financial markets and safeguard their investments during times of uncertainty.

If we look at these three forces concurrently this is what they look like on a chart . I have taken the liberty of highlighting the last 10 weeks of price action. I think you will agree that this is the wrecking ball of stock market valuations. Imagine running the finance department of a corporation when borrowing costs have increased exponentially, energy prices are on the rise and the U.S dollar grows stronger make American goods more expensive.

One of the major worries that traders and investors face when dealing with fiat currencies is that everyone can quickly and easily understand the concept that “ALL FIAT eventually GOES to ZERO.” If you spend enough time studying international finance, it is super simple to understand that governments are in a race to debase. They have unsustainable debt levels and historically the only means of managing the level of debt that has been accumulated is always to devalue the currency. One theory which has received a tremendous amount of attention over the past few years is the Dollar Milkshake Theory. This ideology agrees with the long-term ideas that all fiat eventually goes to zero. But it lays out a roadmap which is starkly different than what most investors and traders have thought about.

Imagine the world’s economy is like a big milkshake, and the US dollar is the main ingredient in that shake. This theory, called the “Dollar Milkshake” theory, helps us understand what happens when the value of the US dollar goes up. Right now, the world has a lot of debt, and much of that debt is in US dollars. It’s like owing someone money in dollars. Now, here’s the twist: when interest rates go up, and the dollar becomes stronger, it becomes more expensive for people, companies, and countries to pay back that debt. It’s kind of like if you borrowed money from a friend, and suddenly they asked for more money back than you expected.

So, as interest rates rise and the dollar gets stronger, people and countries who owe money in dollars get worried. They need more dollars to repay their debt, but those dollars are now more expensive. So, they start buying more dollars in a hurry to try and pay back what they owe. It’s like a rush to get as many dollars as possible. This can create a situation where everyone wants dollars, and the value of the dollar goes even higher. It’s a bit like a snowball effect, where one thing leads to another. The challenge from an international perspective is that foreign governments print more money to handle their debts, but they use a large portion of that new money to purchase US dollars. So, in a nutshell, you have the dollar rising in value and the rapidity of its increase wreaks havoc on international trade.

When the dollar gets too strong, it makes things more expensive for other countries to buy from the United States. So, American companies sell fewer products abroad, which hurts our economy. Also, when other countries must pay back their debt in more expensive dollars, it strains their budgets and leads to financial troubles. So, the Dollar Milkshake theory is like a warning bell, telling us that when the dollar gets stronger, it can create a lot of chaos in the world of money and finance.

Now, let’s start with the basics. The US dollar is like the heavyweight champ of the financial world. It’s the go-to currency for global trade, kind of like the most popular player in a sports team. But here’s the twist: it’s not just about how many dollars are out there; it’s about how fast they change hands that can cause issues. When the dollar’s value jumps up too quickly, it can create problems for economies and investments.

Some folks believe that the dollar’s role is fading, that its value will only go down. They argue that the US is making so many dollars that the world will be swimming in them, and their value will sink like a lead balloon. While the US is indeed printing tons of dollars, other countries are doing the same with their own currencies. So, in theory, it should all even out in terms of value. But here’s the tricky part: everyone still needs dollars, whether they like it or not, because the world’s financial system is closely tied to the dollar. This constant need keeps the demand high, even as countries try to reduce their reliance.

Now, picture this: the US dollar starts soaring in value, while other economies slow down. The result? Fewer dollars floating around globally, which makes their price skyrocket. Countries dealing with economic troubles still need dollars to buy stuff and pay off their dollar-based debts. So, they start printing more of their own money to get dollars, which only drives the dollar’s value higher. It’s like a whirlpool. As the dollar climbs, other nations might devalue their own currencies, and investors might rush to the US for safety, bringing even more money in.

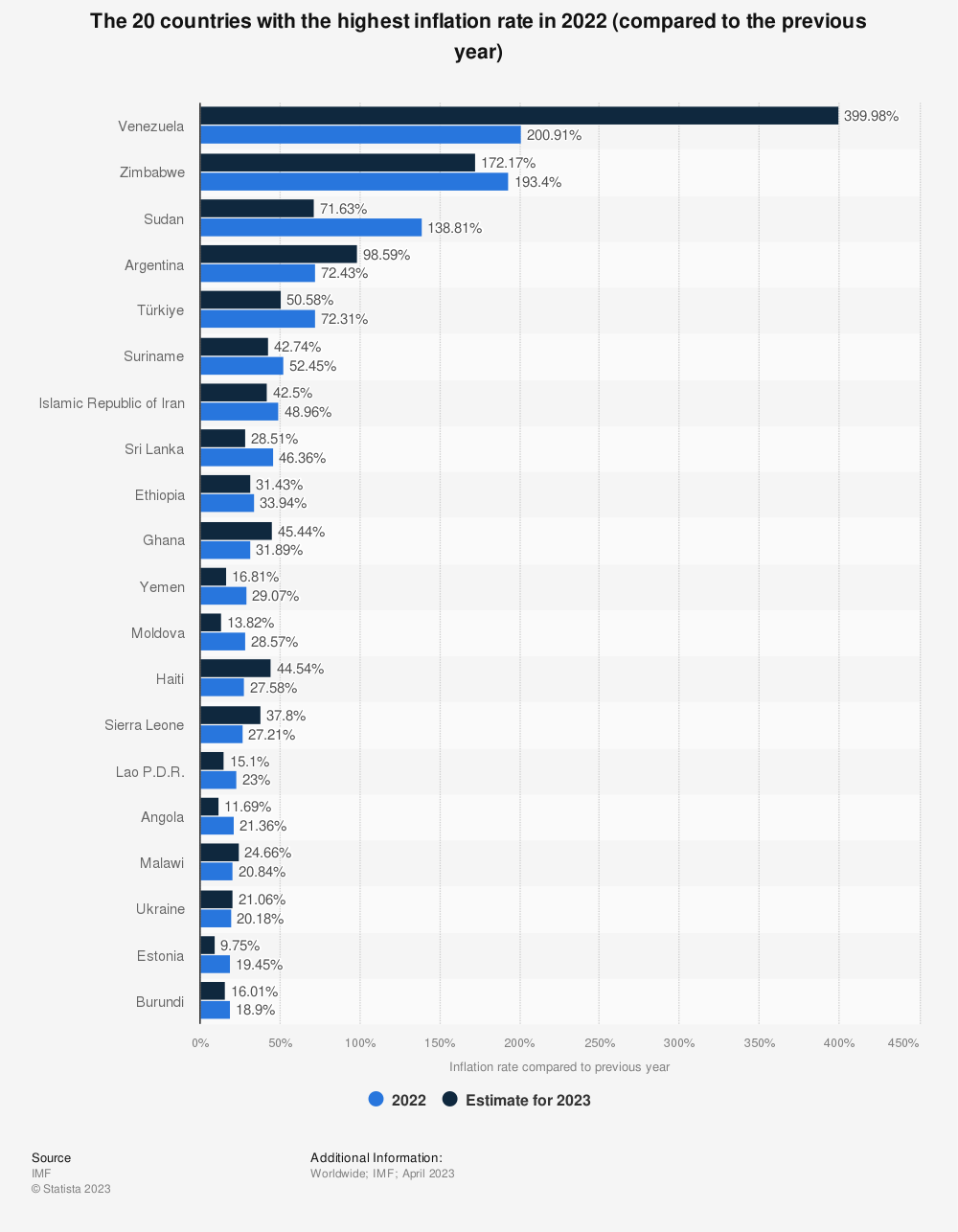

But here’s the kicker, as the dollar gets stronger, it creates chaos elsewhere. People start flocking to the dollar as a safe haven, and we’re already seeing that in action. Look at the listing of countries internally whose economies have been decimated by inflation in 2022 and 2023.

As you study those countries decimated by inflation ask yourself this one important question: where does scared money go? Traditionally it flocks to the strongest currency which currently is the U.S. dollar. But that is fraught with danger and treachery as well.

In this financial frenzy, central banks try to keep things in check, but the global markets are like a giant rollercoaster—once they start, they’re hard to stop. So, what’s the takeaway?

Be Prepared.

Pay Attention.

When the US slurps up that dollar milkshake, things can get pretty wild. There are no easy answers, and that’s why we all need to keep a close eye on the strength of the U.S dollar. More importantly, we want to make sure that we are not deceived by its strength. It’s a mix of complex financial forces, but understanding it is crucial for anyone navigating the ever-changing world of money and finance.

This applies every bit as much to analyzing stocks as it does in trying to make sense of the daily news cycle.

Let’s look at a few stocks which have been decimated recently because of rising crude oil prices, higher interest rates and a higher dollar. Specifically, I am referring to the airlines.

Look at how effectively artificial intelligence was in keeping traders on the right side of the right trend at the right time!

We’ve just taken a deep dive into the intriguing world of the Dollar Milkshake theory. As we’ve explored this theory, we’ve uncovered the intricate dynamics of the global financial system, where the US dollar reigns supreme. It’s like a colossal milkshake of liquidity, with the dollar at its core, swirling through the international financial landscape.

Now, one key takeaway here is that the Dollar Milkshake theory predicts a bull market in the US dollar. This trend has already been in motion for some time, and there are compelling reasons behind it. As the Federal Reserve raises base rates and engages in quantitative tightening, it limits the global supply of dollars. And guess what? Foreign countries and companies need a hefty amount of those greenbacks just to cover interest payments on their dollar-based debt.

But hold on because there’s a twist to this story. As much as the Dollar Milkshake theory points to a stronger US dollar, it also warns us that this isn’t a tale with a happy ending. In fact, it’s quite the opposite. The road ahead could be fraught with challenges and disruptions. We’ve seen the central banks of the world inject trillions of dollars into the global economy, creating what we could call a “liquidity milkshake.” However, the United States has taken a different path, transitioning from injecting liquidity to sipping it up through rising interest rates. It’s like we’ve swapped out the syringe for a straw, and as we lift those rates, we’re drawing liquidity into our domestic markets, pushing asset prices higher.

In conclusion, the Dollar Milkshake theory offers us a glimpse into the intricate dance of currencies, central banks, and global economies. It’s a complex blend of economic forces that has captured the attention of forex traders and investors worldwide.

As we navigate this ever-changing financial landscape, one thing becomes abundantly clear: this is a story that’s far from over, and only time will tell whether it leads to a financial disaster for globalism or a triumph for USD hegemony and Americanism.

If you’re aiming to make a real splash in these turbulent waters, you better be prepared to go deep. It’s all about being in the right place, at the right time, armed with the right game plan. And let me tell you, the top-notch traders out there? They’re not just hungry for profits; they’re downright obsessed with avoiding losses. They’ve got a rock-solid system, a discipline that acts as their compass, especially when navigating today’s wild market twists and turns.

But here’s where the plot thickens: the future of trading is undeniably intertwined with technology. I’m talking about the kind of tech that powers neural networks, machine learning, and artificial intelligence . Picture a world where the expected and the unexpected align perfectly. That’s the sweet spot, my friends, and that’s precisely where you want to be. AI isn’t just a fancy gadget; it’s your golden ticket to the big leagues. Now, let me ask you this: in the past year, how many of your trading decisions would you rate as ‘stellar’? Compare that to what an AI could have achieved. We humans, we’re stubborn creatures. We make mistakes, let our egos take a hit, and sometimes, we forget to learn from them. But machines? They thrive on those missteps, turning them into steppingstones toward perfection. If AI can outplay us in Poker and Chess, what makes you think trading’s any different?

It all boils down to knowledge, but not just any knowledge – the right kind of knowledge. And true magic happens when you put that knowledge to work. AI, my friends, is your ace up your sleeve in this unpredictable market rodeo. So, are you ready to take the plunge? Join me in exploring how artificial intelligence , machine learning, neural networks, and intermarket analysis can be your compass to navigate and find your next grand trade. It’s all part of our Live Artificial Intelligence Training. We’re diving into the deep end, and you’re invited to come along for the ride. Don’t miss out on discovering how AI and its tech-savvy cousins can help you uncover your next big win in the world of trading.

Please visit with us at our – Next Free Live Training.

It’s not magic. It’s machine learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.