I was speaking with friends and family over the holidays and one of our favorite topics of conversation was trading and the U.S. economy. As we start a New Year, I find it crucial to try and look back objectively and learn from history to layout a helpful narrative for the coming year with the hopes of correctly anticipating an amplification of current economic trends and anticipating how they might manifest in the financial markets.

First off, let’s look at what I consider to be the most critical trends affecting everything in the economy.

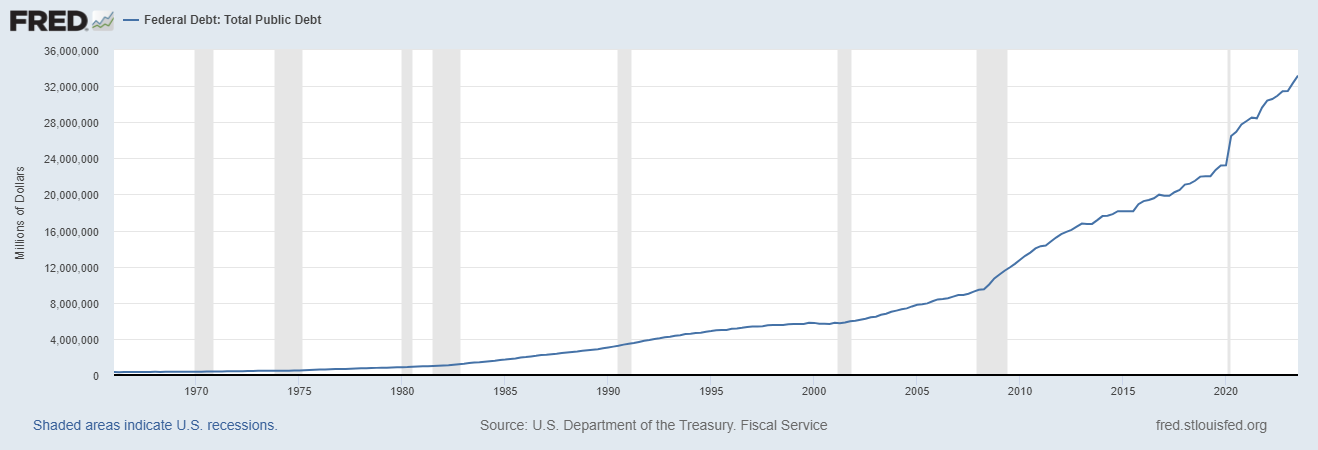

Most people are unaware that the Federal Debt crossed $34 trillion over the past few days. This is the highest level in history and certainly not a cause for celebration.

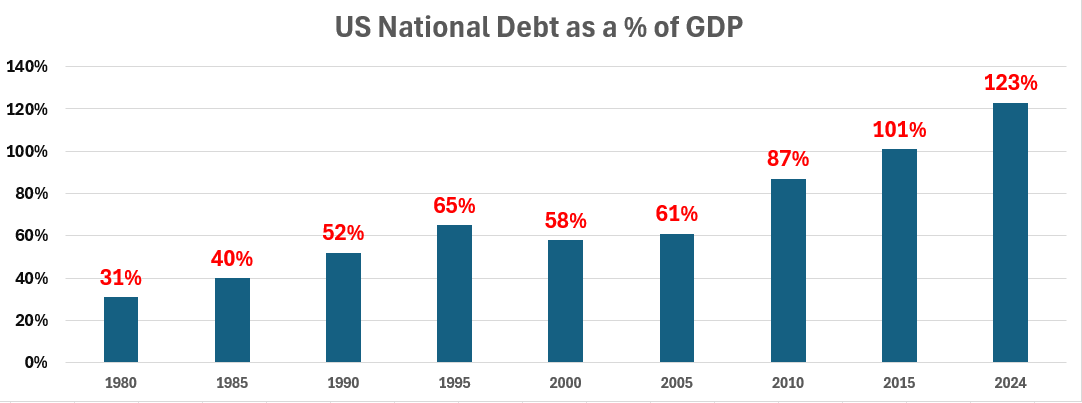

What is patently obvious about the Federal Debt is that it’s the 800 pound gorilla in the room. Over the last 5 years Federal debt has grown by 55%! That level of exponential growth is hard for the analytical mind to understand. It’s deeply troubling to observe that the US national debt, in relation to GDP, is escalating at a rate that should sound the alarm bells for everyone.

Since 2005 the National Debt as a percentage of GDP has doubled which clearly shows that since the Great Financial Crisis of 2008, we have become a nation addicted to printing money and we should expect this trend to accelerate moving forward.

What’s most concerning about this trend is how our political leaders and monetary authorities dismiss any concern over the potential risks this creates for the citizens. We’re told continuously that the economy is “strong and resilient” and that “debt does not matter.” The bigger problem associated with these statements is drawing a correlation between the economy and the stock market. True, the S&P 500 was up 24% in 2023 which is a stellar performance. But there’s a giant disconnect between what’s occurring in the stock market and what’s happening in the economy.

Let’s review the top stock performers of 2023:

NVIDIA Up 239%

Apple Up 48%

Microsoft Up 57%

Alphabet (Google) Up 59%

Amazon Up 81%

Tesla Up 102%

Meta Up 194%

These returns are genuinely impressive! However, they’re disconnected from what my experience has been in talking with business owners in the broad economy, most of which have seen their revenue and earnings contract over the past year.

When I look at and focus on four primary data points – the national debt, the debt-to GDP ratio, tax receipts to the federal government and the interest payments on the debt I see a recipe for continued currency debasement as far as the eye can see.

Let me explain.

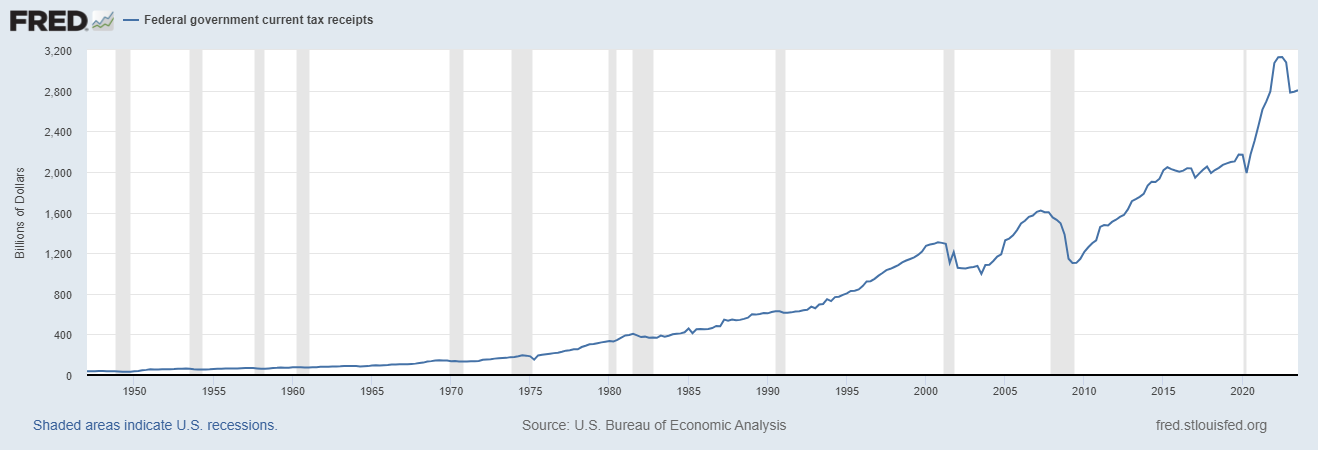

Here is a chart of tax receipts to the Federal Government.

As you study that chart consider the following: taxes are transactional in nature. Taxes fundamentally are transactional in their essence. They hinge on the occurrence of economic exchanges. This principle underscores a critical aspect of taxation: if transactions cease or slow down, tax revenue dries up. When you purchase an item or engage in a sale, that’s when taxation comes into play, acting as a fiscal bridge between the transaction and the government’s revenue system. This mechanism is vital for the sustenance of public finances. However, it also reveals a vulnerability; in the absence of active buying and selling, in scenarios like economic downturns or market stagnation, the flow of tax revenue is severely impeded. This direct correlation between market activity and tax collection not only highlights the transactional nature of taxes but also underscores the importance of a robust, dynamic economy for the health of a nation’s treasury. Without the pulse of continuous transactions, the lifeblood of tax revenue ebbs, leaving public finances in a precarious state.

When I study that chart, I ask myself the most basic of questions: How can you have a robust, strong, and resilient economy when tax revenues are down 13% annually? The mere fact that tax policy has not changed implies that there are less transactions that can be taxed. This reality contradicts the “strong and resilient” economy narrative that we are being fed.

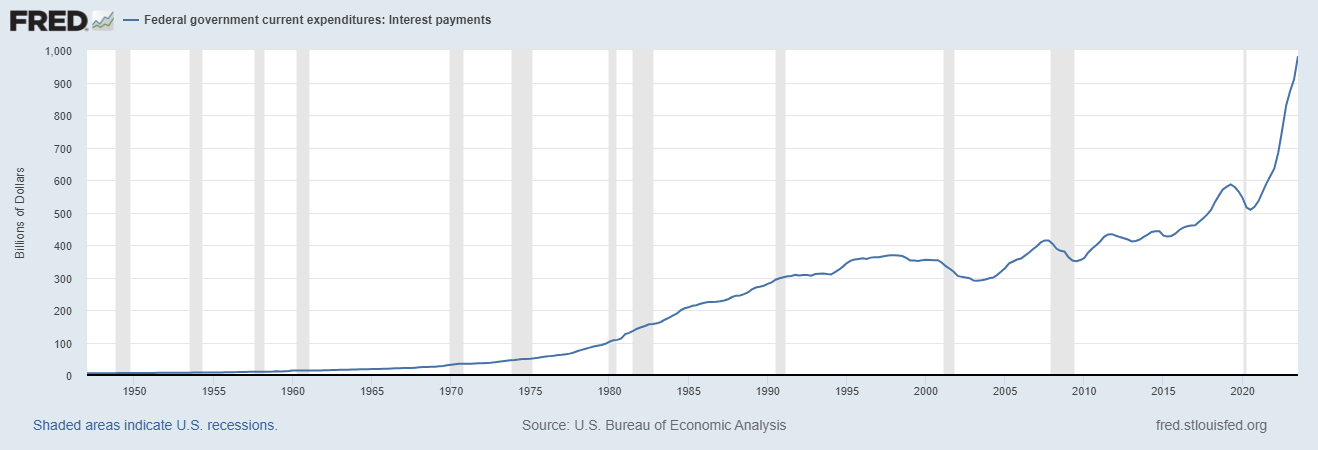

Next, look at the following chart of interest payments on the Federal Debt.

Here’s a simple question to confront as you study the chart above. What would you call the economic environment where interest on the national debt increases exponentially and tax revenues to the Federal Government contracts by 13%?

My answer, characterized by exponentially increasing interest on national debt coupled with a significant contraction in tax revenues, could be termed a “Fiscal Crisis” or “Sovereign Debt Crisis.” This scenario indicates a severe imbalance between government obligations and its revenue-generating capacity. The exponential increase in debt interest suggests unsustainable borrowing practices or rising interest rates, while the sharp decline in tax revenues points to economic downturn, reduced consumer spending, or ineffective tax policies. Such a situation often leads to increased borrowing costs, credit downgrades (which have already occurred), and potential default risks, severely impacting the nation’s economic stability and investor confidence. This environment necessitates urgent fiscal consolidation measures and potentially, external financial assistance or restructuring of existing debt.

Keep in mind that in 2023, Moody’s and Fitch, the credit rating agencies, both downgraded US Debt. Now in 2024 we are in an election year. While the relationship between national debt and presidential election years is not straightforward or consistent, it depends on a variety of factors including existing economic conditions, political priorities, and unforeseen events. However, some general observations can be made:

During election years, incumbents or political parties in power usually increase spending to boost the economy and gain favor with voters. This can lead to an increase in debt if the spending is not offset by increased revenue or budget cuts elsewhere.

The economic policies of the incumbent administration can influence debt levels. For example, policies favoring tax cuts or increased government spending can lead to higher debt, especially if these measures are used as a strategy to stimulate economic growth or to garner electoral support.

The state of the economy plays a significant role. In times of economic downturn, governments may increase spending to stimulate growth, which will raise debt levels. Events like wars, natural disasters, or economic crises (such as the 2008 financial crisis or the COVID-19 pandemic) can lead to increased government spending irrespective of election cycles.

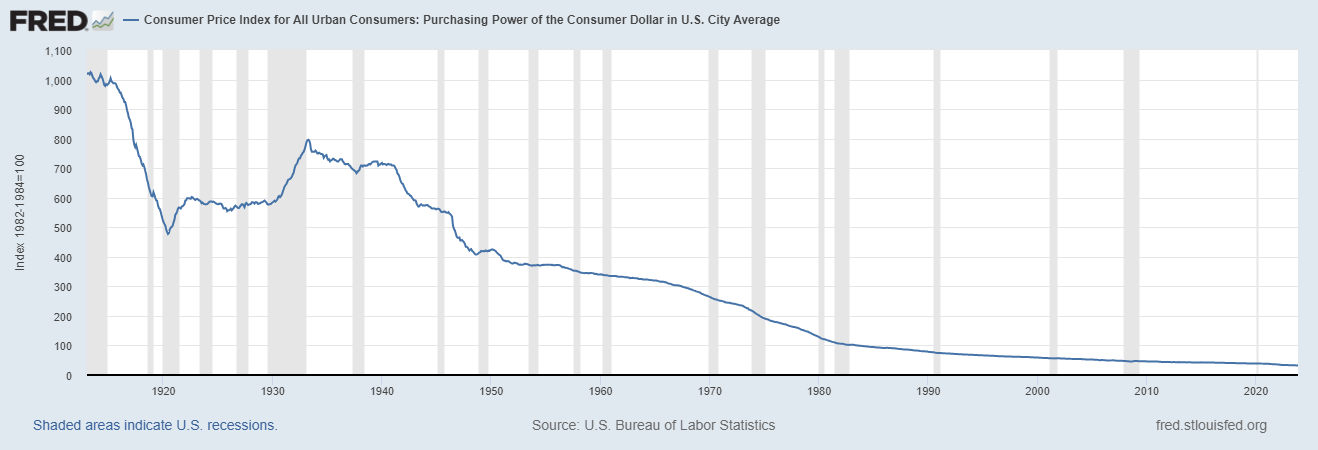

The reason these considerations and factors are important is that if you believe that debt levels will increase faster in 2024 than they did in the past, you want to find a way to own assets that benefit from currency debasement. Stated another way, is there any reason to believe that the loss of purchasing power will not continue moving forward? After all the U.S. Dollar has lost roughly 98% of its purchasing power since the Federal Reserve was established.

I work very diligently to focus on what’s important. Right now, the one story that is driving the economy is how will the government fund its spending? Everything else takes a backseat to that predicament.

Since March of 2020, the U.S Treasury Market had lost over 46% of its value. Since U.S. Treasuries have long been considered the Gold Standard for saving this problem amplifies the troubles inherent in the U.S economy. Remember the banking crisis from 2023? How did they get into trouble? They owned U.S. Treasuries. How was that predicament papered over? The Federal Reserve made bank held treasuries 100% whole and loaned banks monies to offset those losses.

Compounding these troubles, the most recent U.S. Treasury auctions have not been well received. Buyers are all pouring into the short end of the Yield Curve and are unwilling to purchase anything that has a longer than 3-year maturity. Adding fuel to the fire the U.S. government runs out of money, due to its recent debt ceiling negotiations on January 19 th . Next week, Congress makes its return to the nation’s capital with a pressing agenda on the horizon. The looming Jan. 19 and Feb. 2 debt ceiling deadlines cast a shadow over Capitol Hill as legislators grapple with the Herculean task of settling government spending through September. The Republicans, ever the fiscal hawks, have raised their voices, demanding a reduction in fiscal 2024 discretionary spending that goes below the caps painstakingly agreed upon back in June.

But that’s not all; there’s more drama in the script. Lawmakers are also looking to provide much-needed emergency aid to Ukraine and Israel, stirring a cauldron of geopolitical tension. And, in a twist worthy of a political thriller, they’re contemplating the inclusion of unrelated U.S. border security provisions into the mix.

The reason this is such a pressing concern is because of the recent performance of US Treasuries. Most astute investors and traders will not touch the US Debt market with a ten-foot pole. Would you? How can you have a strong and resilient economy when the Treasury Market which is used to fund its obligations is a total mess?

Here are some additional articles which I have written about this theme over the past few years:

Are We Witnessing the Beginning of a Sovereign Debt Crisis Internationally?

De-Dollarization, Sovereign Debt and Why It Matters!

Where Are The Safe Havens? Risk, De-Dollarization and The Bond Rating Agencies

The stakes in Washington couldn’t be higher as we approach a pivotal moment in fiscal policymaking. Failing to secure approval for the dozen fiscal 2024 spending bills would send shockwaves through Washington agencies, plunging them into an unwelcome shutdown mode. However, the looming specter of the November presidential elections adds an extra layer of complexity to the already delicate negotiations.

The staggering $34 trillion federal debt figure serves as a stark reminder of our nation’s fiscal woes, a testament to the reluctance of our political leaders to grapple with the tough decisions that lie ahead. This sobering milestone underscores the pressing need for courageous leadership and a commitment to address our fiscal challenges head-on.

Until all of these issues: the Federal Debt, Interest of the Debt, Debt to GDP and Federal Tax Receipts show improvement it is impossible for me to embrace the narrative that we have a strong and resilient economy. Instead, I’m putting my attention and energy into finding markets and trends that have proven to be immune to currency debasement and avoiding cash and cash equivalents like US Treasuries.

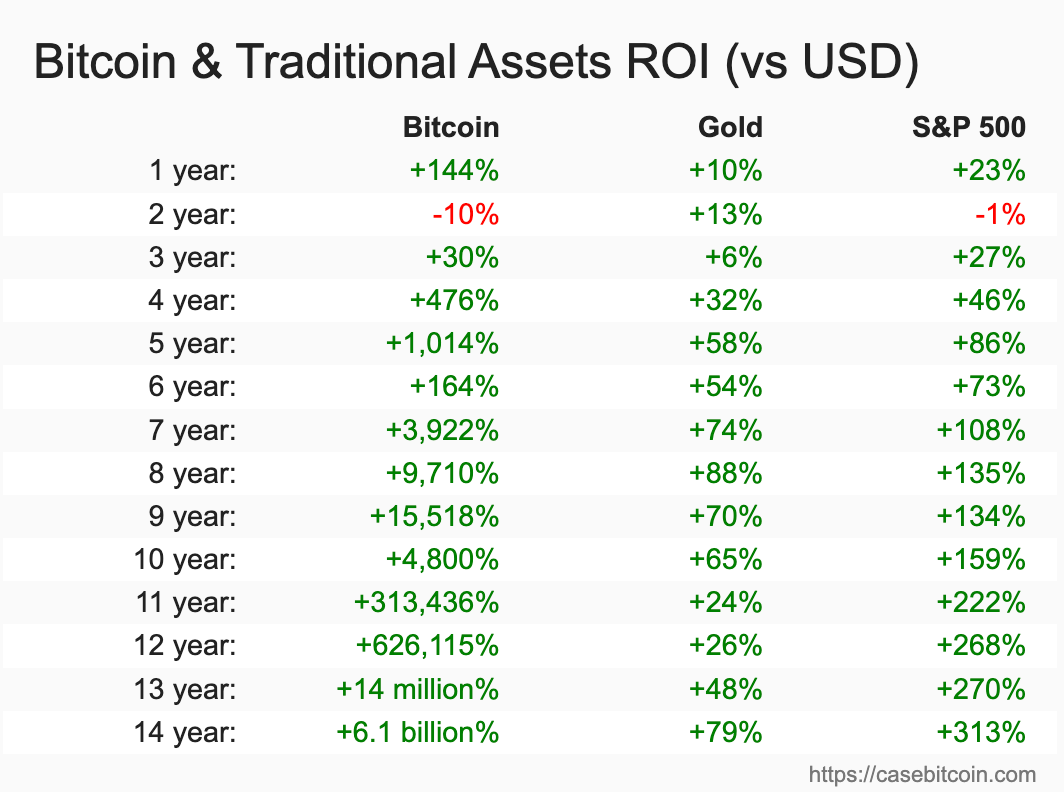

This is how the currency debasement trend has affected investments for the last 14 years.

In the theater of economic history, currency debasement stands out as a stark manipulation of fiscal integrity, a deliberate ploy by governments to stretch their financial prowess, often at the expense of the currency’s true worth. This age-old tactic, reminiscent of diluting a fine wine, has evolved from the ancient practice of reducing precious metals in coins to the modern-day frenzy of unrestrained money printing, invariably fueling inflation. It’s a saga that spans from Roman emperors devaluing their denarii to contemporary governments turning to the printing press in crisis times. This financial alchemy, typically a response to war funding or economic downturns, has repeatedly led to dire consequences, underscoring the perilous dance between economic necessity and fiscal responsibility. It’s a narrative steeped in power plays and greed, a cautionary tale of the ramifications of meddling with the fundamental essence of an economy’s lifeblood – its currency.

As we enter 2024 my expectation is that currency debasement will accelerate. The alternatives the government has to address the debt is to increase taxes which is unlikely to occur in a presidential election year.

My solution to this problem is the trend analysis of Stocks, Gold, and Bitcoin as offered by artificial intelligence and the trading opportunities that it presents.

In the high-stakes world of trading, the trifecta of success hinges on mastering three critical questions: the size of your trades, their duration, and the choice of what to trade. Amidst this, the savvy trader must swiftly discern the expected market movements from the actual, pinpointing opportunities with surgical precision.

In this arena, the only true barometer of success is the movement of prices. Everything else fades into the background, a mere cacophony of distractions. This is a tough pill to swallow for many traders, who often mistakenly seek harmony between the narratives spun by financial news and the actual rhythm of the markets.

The reality is starkly different.

Consider this: while Wall Street may hang on every word of the latest headlines, the astute trader should instead be attuned to the nuances of artificial intelligence trading software and its ability to decipher market trends. The key is not to get entangled in the web of headline news and its correlation, or lack thereof, with the market dynamics.

As a trader, your compass should only point in three directions: up, down, or sideways. Everything else is extraneous, a distraction from the core of trading. Navigating this landscape is no easy task. That’s why I advocate immersion into the world of artificial intelligence trading software. It’s not just a tool; it’s your ally in carving a path through the complex tapestry of market movements, enhancing your trading acumen.

What was your performance in the markets last year?

Now subtract inflation from whatever your gains or losses were.

That is the level of currency debasement that you experienced in your portfolio.

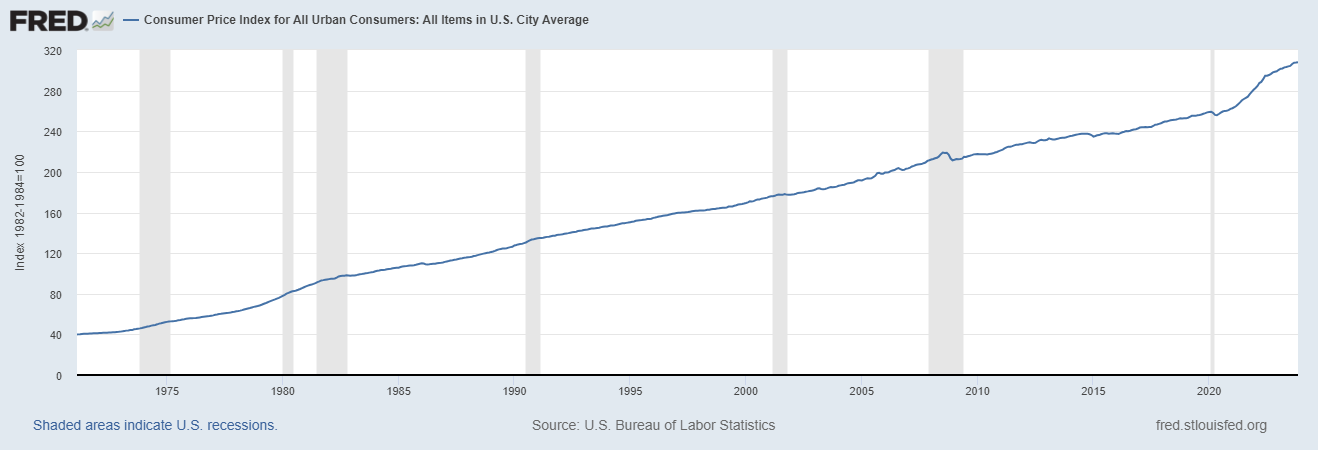

Maybe you’ve read some news stories which applaud the Fed’s handling of the economy claiming that inflation has been vanquished. Does this chart of the Consumer Price Index look like it has reversed course? Call me skeptical but there is nothing in this long-term chart which shows that inflation has slowed.

In the complex world of finance, the bond market’s stability is critical – distress-signaling a situation where there’s no longer any safe ground, much like being in a casino where your chips are constantly losing value. This might sound like a grim prognosis, but it’s a hard truth. Find me a company or country that’s flourishing with a failing bond market, and I’ll stand corrected. But history often tells a different story.

Turning the pages back to 2023, we saw a dramatic shift in the global economic order, a clear move away from the U.S. dollar’s longstanding reign as the world’s reserve currency. This strategic shift towards de-dollarization was led by the BRICS nations – Brazil, Russia, India, China, South Africa, and more recently, Saudi Arabia. These economic powerhouses, driven by a desire to bolster their financial independence and stability, collectively took a stand against the dollar’s dominance. This didn’t immediately undercut America’s economic strength, but it certainly raised eyebrows in the investment world, leading to a reevaluation of potential in other nations’ currencies and securities. This trend sent ripples across the global financial landscape, the effects of which are still being felt, even as markets try to comprehend the effects of these far-reaching changes.

Looking forward, it’s evident that the battle lines in this global financial narrative have been clearly drawn.

Let me tell you something, and you might want to sit down for this. The real juice in trading? It’s not in racking up wins; it’s in dissecting your losses. Now, most folks can’t stomach this. Why? Because their egos are too bloated to admit they goofed up. But here’s the kicker: this is exactly where Artificial Intelligence takes the cake. You see, Machine Learning – this brilliant tech marvel – is wired to learn from every stumble, every faceplant. It’s not about licking wounds; it’s about turning those scrapes into a roadmap for success. AI doesn’t just beat human analysis; it leaves it in the dust, every single time.

We’re living in a time that’s more than just exciting – it’s revolutionary. What hurts us teaches us. Sure, mistakes can hit your wallet hard, but for A.I., every error is a golden ticket to mastery, to excellence. Remember, A.I. has already trounced humans in Poker, Chess, Jeopardy, Go – you name it. So, why would trading be any different? Think about it. Why should trading be the exception?

I invite you to learn how to forecast the stock market at our Next Free Live Training.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.