The one thing I notice in my conversations with others is a lack of trust in news, media and the pronouncements from our most revered institutions. Recently I was having a conversation with a childhood friend. He mentioned to me the home he grew up in 45 years ago, for which his family paid $30,000, is on the market today for just shy of one million dollars! That level of price appreciation is mind boggling! Within understanding that simple transaction lies a loss of purchasing power that is corrosive to the fabric of a healthy economy.

When you study economics in school the focus is on recognizing the challenges of supply and demand imbalances. Traditionally, the study of economics has centered heavily around the concepts of supply and demand, the bedrock principles that dictate market dynamics. This focus delves into how the quantity of goods and services available (supply) and the desire for them (demand) determine the price and quantity of goods and services sold. Supply and demand analyses often underpin discussions of price levels, market equilibrium, and resource allocation. However, this traditional approach has frequently overlooked a critical aspect: the loss of purchasing power of a currency. This phenomenon, a decrease in the amount of goods or services that one unit of currency can buy, is often overshadowed by more immediate market forces. The erosion of purchasing power, typically a result of inflation, reflects a decline in the real value of money over time, which can significantly impact economic decisions and consumer behavior, yet it receives scant attention in conventional economic models.

Certain investments, however, traditionally benefit from the loss of purchasing power of a currency. Chief among these are tangible assets like real estate and commodities, including precious metals like gold and silver. These assets often act as a hedge against currency devaluation because their value is not directly tied to the currency’s purchasing power. As the value of the currency falls, these assets tend to retain their worth or even appreciate, making them an attractive investment during times of monetary devaluation. Additionally, equities can also benefit, as companies can raise prices along with inflation, potentially increasing their revenues and share prices. The underlying cause of the loss of purchasing power is typically inflation, which can result from excessive money supply growth, demand-pull factors, or cost-push factors. This inflation erodes the currency’s value, leading investors to seek refuge in assets that are perceived as maintaining or increasing in value even as the currency’s buying power diminishes.

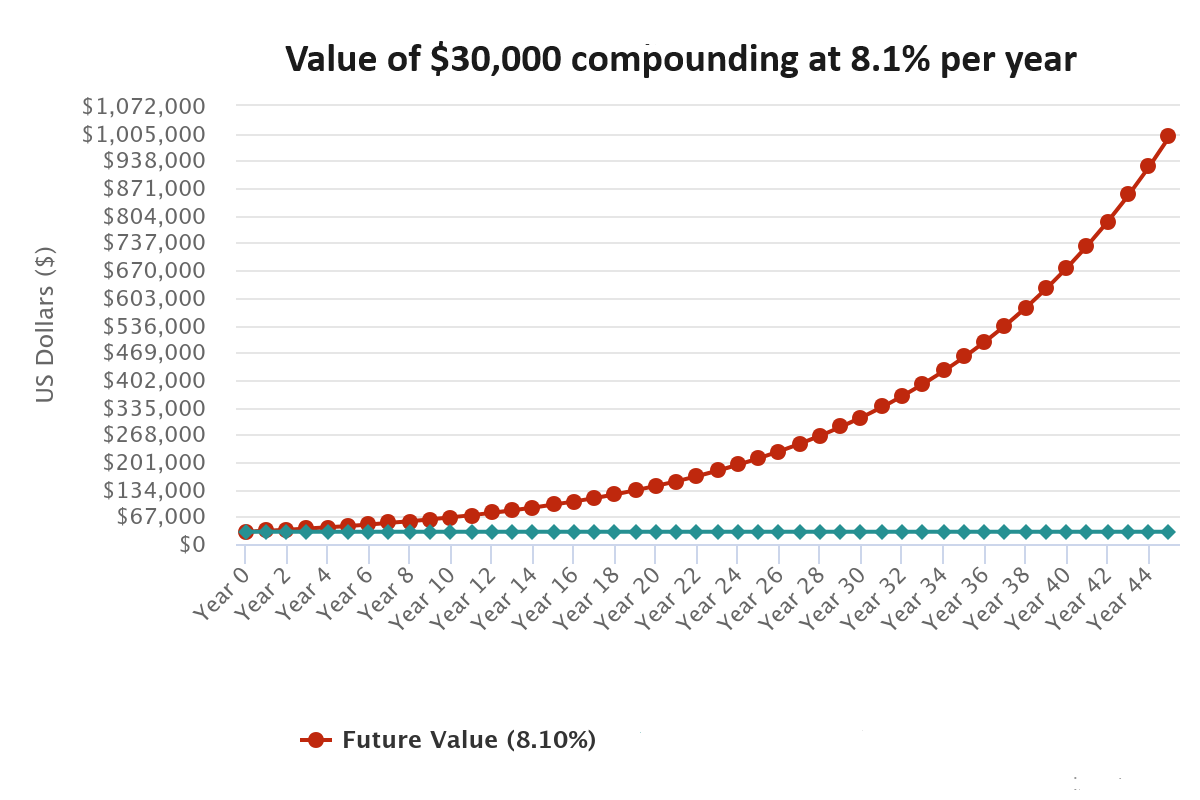

Here is a chart of the price of my friend’s childhood home compounding at an annual growth rate of 8.1% per year.

The reason I share this chart with you is because of the economic confusion it creates. Let me explain.

The initial perception of seeing a $30,000 home grow to $1,000,000 is that it appears that you are $970,000 wealthier. The reality is you have $970,000 more units of currency and chances are that the purchasing power of those currency units are intact. But not one in a thousand people will be able to discern that you maintained purchasing power because the currency buys less.

Instead, we equate currency debasement with wealth creation, and this is a very toxic formula.

Let’s break this down further. From 2008 to 2023, we’ve witnessed a striking dichotomy in the financial world. On one side, there are the heavy hitters – those running hedge funds, launching IPOs, getting involved in SPACs, delving into venture capital, or managing substantial investment portfolios. These players have seen a significant surge in their stock values, a remarkable increase of 87% after adjusting for inflation. Contrast that with the other end of the spectrum, where we find the average American worker, conscientiously saving in a bank account. The return on their savings? Minuscule interest. And shockingly, the real value of these savings has nosedived by an alarming 45%.

This scenario highlights a profound economic divide. Our financial system appears to be tailored to benefit the wealthy and the politically connected, while leaving the everyday American struggling to keep up. We’re seeing a widening gap where the affluent enjoy sizable growth in their investment values, whereas the typical working-class individual faces a drastic erosion in their savings, effectively halving their purchasing power. The end results show we have all been conditioned to buy less with more.

This is the reality confronting our economy – it’s more than mere statistics; it’s about the impact on real lives, real families. It raises critical questions about the increasing tilt of our economic scales in favor of the affluent elite. It’s time to ask ourselves why the average American’s share of the proverbial economic pie is shrinking, while a select few seem to enjoy ever-expanding portions. This is the economic landscape we are navigating, and it demands our attention and understanding.

The economic phenomena of price inflation and currency debasement, though interrelated, are distinct concepts that require careful differentiation. Price inflation refers to the general increase in prices of goods and services over time, typically measured by indices like the Consumer Price Index (CPI). It can result from various factors, including supply and demand imbalances. For instance, if the demand for housing sharply increases relative to supply, it can lead to higher house prices. On the other hand, currency debasement pertains to the decrease in the value of money itself, often caused by an increase in the money supply. This decrease in currency value means that each unit of currency buys less than it did in the past, a phenomenon directly impacting the purchasing power of individuals. While price inflation reflects changes in the price level of a basket of goods and services, currency debasement is a broader measure of the value of the currency in the economy.

Take the example of a house whose price escalates from $30,000 to $1,000,000 over 45 years. Part of this price increase can indeed be attributed to the classic supply and demand dynamics. Over decades, factors like population growth, urbanization, and changes in demographics can drastically increase the demand for housing, while supply may not keep pace due to limited land availability, zoning laws, or construction costs. However, a significant portion of this price increase can also be attributed to currency debasement. As the value of the currency erodes over time, it takes more money to buy the same asset. This phenomenon, often reflected in the long-term trend of rising prices for real estate, is a direct consequence of the currency’s reduced purchasing power. What fascinates me is that the $30,000 value 45 years ago was not considered rich by any stretch of the imagination. It’s hard to believe and comprehend that 45 years later we should conclude that $1,000,000 is likewise not considered a wealthy amount of money in 2024.

The societal impact of mistaking currency debasement for real wealth increase is profound. When people see the nominal value of their assets, like real estate, skyrocket, they often believe they are getting richer. However, if this increase is due to the loss of purchasing power, they are not actually wealthier in real terms. The danger lies in the illusion of increased wealth, which can lead to misinformed financial decisions and unsustainable economic behavior. For instance, individuals might take on excessive debt, believing their assets have increased in real value. This misunderstanding can condition a society to accept and normalize getting less for more, undermining the ability to make sound economic decisions. It’s crucial for economic literacy to encompass an understanding of the distinction between genuine wealth growth and the superficial gains caused by currency debasement.

Currency debasement, the gradual erosion of a currency’s value, has far-reaching and corrosive effects on an economy. It diminishes purchasing power, meaning consumers and savers find their money buying less over time, effectively reducing their wealth. This erosion of value leads to higher living costs and reduced savings, exacerbating income inequality as those with fixed incomes or savings are hit hardest. Businesses face unpredictable costs and investment challenges, discouraging long-term planning and growth. Furthermore, currency debasement can undermine trust in the financial system, as people seek alternative stores of value, potentially destabilizing the economy. Overall, it creates a precarious economic environment, marked by uncertainty, and skewed financial decision-making, with the most significant burden often falling on the less affluent segments of society. This unfortunately is the economic climate that our monetary authorities have engineered.

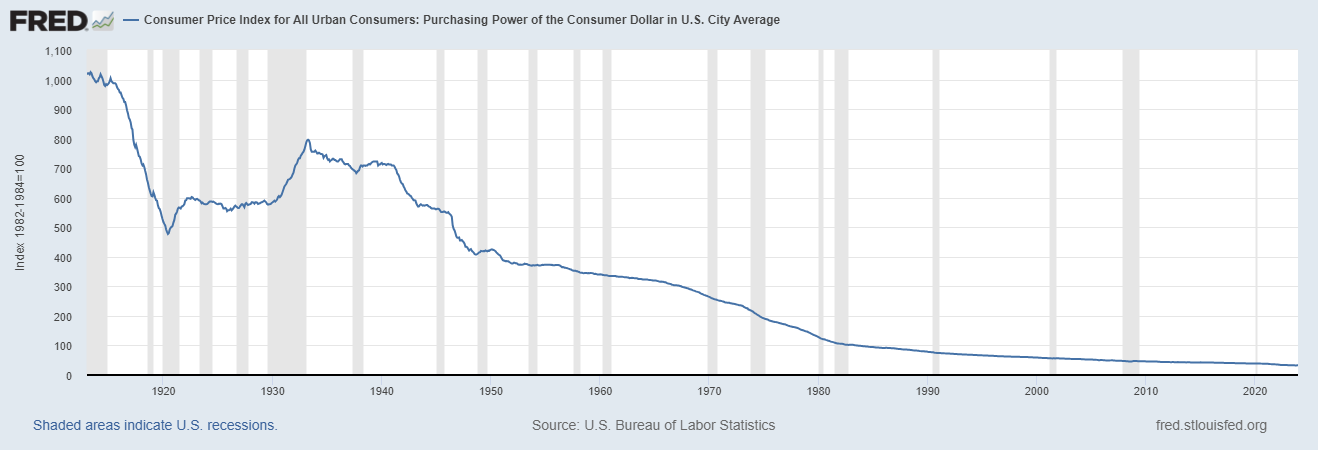

Here is a chart of from the Saint Louis Federal Reserve which clearly shows how since the Federal Reserve Act was passed that the U.S. Dollar has lost 97% of its purchasing power.

Will there ever be any accountability for this level of failure? I doubt it. Loss of purchasing power is built into the economic calculations today more than ever. To give you an idea of how crazy the financial news has become, we cheer on the sidelines hoping that the Fed will reduce inflation down to their 2% target. Apparently losing 2% of our purchasing power is acceptable annually! Yet, hardly anybody believes the facts and figures that are reported by our economic authorities.

The loss of purchasing power is a subtle yet pervasive economic phenomenon that significantly impacts society’s spending habits and overall financial health. Over time, this trend leads to a gradual normalization of higher prices, conditioning people to accept that more money is needed for the same, or even fewer, goods and services. This erosion of purchasing power can often be insidious, happening over extended periods, making it harder for individuals to notice immediate effects, but its cumulative impact on savings and living standards is profound.

This conditioning has profound societal implications, particularly in how it shapes consumer behavior and perceptions of wealth. As people get used to paying more for the same items, there’s an adjustment in the perceived value of money and goods. For example, what was once considered expensive becomes normalized. This shift can lead to a decrease in the perceived quality of life, as individuals and families find it increasingly challenging to maintain their standard of living. It also impacts savings, as money set aside loses value over time, eroding future purchasing power and financial security. In response, consumers may resort to spending more immediately rather than saving, under the rationale that money will be worth less in the future. This behavior can lead to a vicious cycle of decreased savings and increased spending, further fueling inflation.

The loss of purchasing power worsens social inequalities. Those with fixed incomes, such as retirees on pensions or workers with stagnant wages, find it increasingly difficult to keep up with rising costs. In contrast, individuals with assets that appreciate in value, like property or stocks, may not feel the pinch of inflation as acutely. This dichotomy widens the wealth gap, as the wealthy see their assets grow in value while those with limited means struggle with diminishing real income. The societal consequence is a deepening divide between economic classes, with the less affluent experiencing a more pronounced decline in purchasing power. These dynamic underscores the importance of understanding and addressing the root causes of purchasing power loss, as it is not just an economic issue, but a social one that affects the fabric of society.

The average consumer is now exhibiting a deep-seated skepticism towards their political and monetary authorities. The root of this distrust? A series of decisions by those in power that, to put it mildly, have been startling in their lack of foresight and effectiveness. We’re talking about a litany of policy choices and actions – the prolonged engagements in Iraq and Afghanistan, the sweeping measures of the Patriot Act, the controversial Wall Street bailout and the ensuing debate over ‘Too Big to Fail’, a prolonged zero interest rate policy, the successive rounds of quantitative easing, and the economic stimulus measures coupled with lockdowns. Not to mention the recent Inflation Reduction Act, among others. I am not trying to make political commentary here.

It is crucial to contextualize this in terms of fiscal impact. As of 2024, these policy decisions and actions have ballooned the U.S. national debt to an astonishing $34 trillion. This number is particularly stark when compared to the beginning of the 21st century, when the national debt stood at just $5 trillion. This escalation in debt reflects not just a series of policy decisions but speaks to a broader narrative of what some might term throwing broken money at every problem, a term used to describe the aggressive interventionist approach of the federal government in economic matters. This increase in debt raises fundamental questions about fiscal sustainability and the economic legacy being left for future generations.

When you study the theater of history you are quickly reminded of the stark punctuations between debt, bankruptcy, war and political upheaval. This is critically important for traders to comprehend today because of the precarious nature of the U.S. Treasury market. Treasuries are yielding 4% while inflation was recently reported at 3.7%. Combine these two variables and Treasury investors can currently net a positive yield of 3/10ths of 1% return if they go out 10 years on the yield curve. This is after U.S. Treasuries have lost 46% since March of 2020.

The Fed must support the U.S. Treasury market because no one is buying U.S Treasuries and the government must fund its obligations. If interest rates fall, as Wall Street believes they will, Treasuries become more unattractive. If interest rates rise, the government has trouble paying the interest on the national debt. Between these two issues traders and investors try to define risk so that they do not lose the value of their savings.

It’s treacherous to say the least.

Look, there are those out there claiming the economy is on the upswing, pointing to figures like the gross domestic product (GDP) growth and various employment rates. But let me tell you, there’s a glaring issue with using these metrics as the be-all and end-all indicators of economic health. They utterly fail to differentiate between what’s genuinely beneficial private economic activity and what’s just government spending. And believe me, there’s a world of difference between the two. The government is in a unique position where it can just take money and resources from the public and spend it as it pleases, hiring left and right. The real value or utility of this spending to the everyday American? Often, it’s questionable at best.

Now, let’s talk about the real backbone of our economy – the private sector. This is where the rubber meets the road. It’s the private businesses, the entrepreneurs, the small and large companies alike, that produce goods and services which fulfill the needs and wants of people. It’s these private enterprises that truly impact our economic well-being.

What we’re witnessing in the private sector of the US economy right now is nothing short of a recession. But here’s the kicker: this massive government spending is inflating our GDP, keeping it just above water, above that technical recession line. And those job reports? They’re heavily skewed with government hires.

So, when you see all this rosy economic data splashed across the headlines, yet you hear the growing grumbles and worries of the American people, don’t be fooled. This isn’t some mystery, it’s not fake news, nor is it mere partisanship. It’s the result of letting the government’s printing press become the primary engine driving our questionable economic growth.

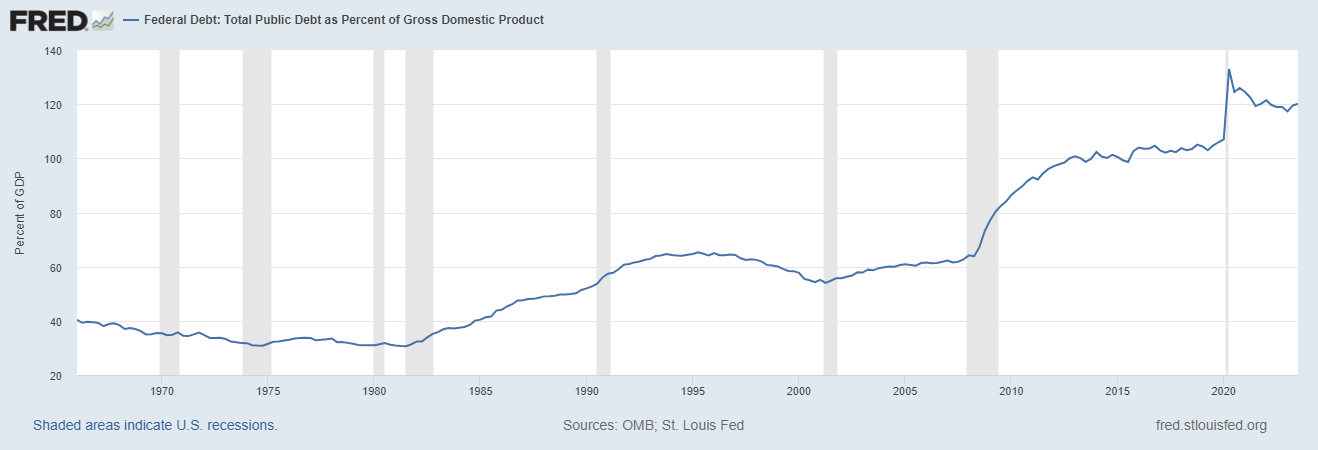

Here’s a startling fact that should make every American sit up and take notice. Since the dawn of the 19th century, we’ve seen 51 out of 52 countries with gross government debt exceeding 130% of their GDP hit the wall – they’ve defaulted. This default comes in various forms: restructuring their debt, devaluing their currency, suffering through crippling high inflation, or just flat-out failing to meet their obligations.

Now, let’s add a crucial footnote here about Japan. This nation’s debt has been sky-high for years, yet somehow, they’ve managed to avoid this fate… so far. But let’s not gloss over this too quickly. Because when you look at the numbers, a 98% failure rate is as close to a sure thing as you can get in the financial world. A 98% chance – those are the kind of odds any savvy investor would jump at. To bet against that, to think you can be the exception to a rule that’s held almost unbroken for over two centuries, well, that’s a gamble only a fool would make. The following chart from the St. Louis Fed shows how Debt to GDP is currently 121%! This is one of the primary reasons why investors are shunning U.S. Treasuries. While the U.S. government would most likely not default on its debt, the last three years of Treasuries price action has been devastating for savers and pension funds.

Here’s my take on tackling the complexities of today’s trading world: lean heavily into the cutting-edge analysis of stocks, gold, and Bitcoin, as unraveled by the prowess of artificial intelligence trading software , and grab hold of the trading opportunities it lays bare.

In the high-octane universe of trading, your success hinges on nailing three things: the size of your trades, how long you hold them, and most crucially, what you’re trading. The real deal for any trader worth their salt is to separate the wheat from the chaff – to distinguish between what the market is expected to do and what it’s actually doing, and to do so with laser-like precision.

Remember, in the trading game, the only score that matters is how accurately you’ve predicted price movements. Everything else – the incessant buzz of financial news, the punditry, the market rumors – it’s all just noise, a distracting backdrop to the main event.

While Wall Street hangs on every word of the financial news cycle, the shrewd trader should be zeroing in on the insights offered by artificial intelligence in trading.

These tools aren’t just about crunching numbers; they’re about reading the market’s pulse, cutting through the noise of daily headlines, and zeroing in on what truly drives market movements.

For traders, the compass should always point one of three ways: up, down, or sideways. Everything else? It’s just static. Navigating this terrain requires more than gut instinct; it calls for the sophisticated edge that artificial intelligence trading software provides. It’s not just a tool; it’s your guiding light through the murky waters of market trends, refining your trading skills.

Now, think about your market performance post-pandemic. Got that number? Good. Now, adjust that figure by factoring in a cumulative inflation rate of about -14%. What you’re left with, that’s the real measure of your trading acumen in these tumultuous times.

The race to debase is very real. Everyone feels it.

The only question is what are you going to do about it?

We explore these themes in our complimentary trading classes where we teach traders how to trade with artificial intelligence, machine learning, and neural networks.

I invite you to learn how to forecast the stock market at our Next Free Live Training.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.