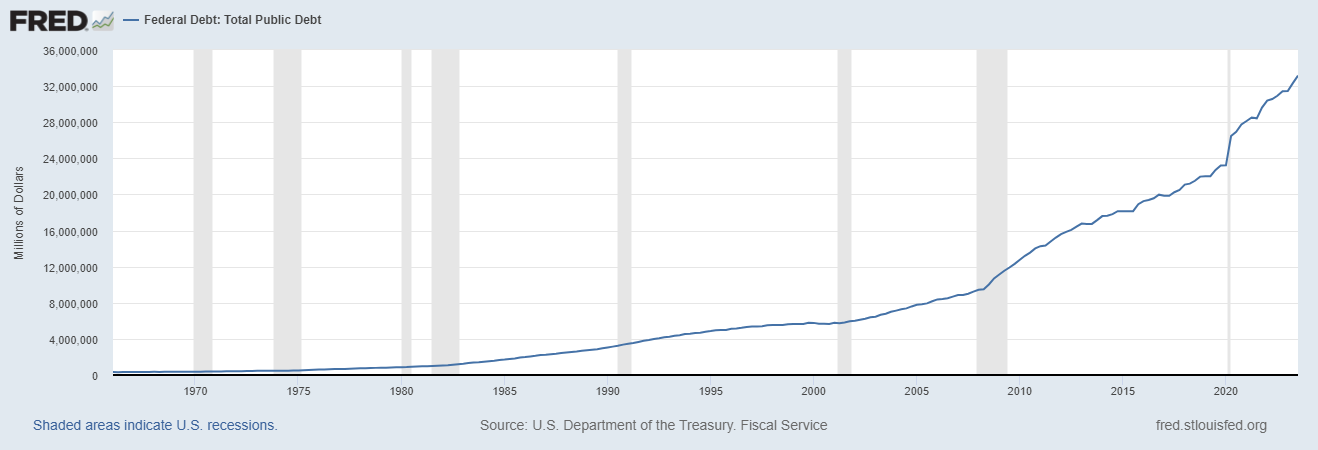

Let’s do a deep dive into the ever-mounting national debt that’s sending shockwaves through the global financial landscape. Last night, I took a deep dive into the heart of this fiscal behemoth, and what I uncovered is nothing short of staggering. We’ve officially crossed the mind-boggling threshold of $34 trillion! A jaw-dropping figure, no doubt. And brace yourselves, as we’re piling on over $100 billion every single month! According to the U.S. government, in just a century, our federal debt has skyrocketed from a mere $403 billion in 1923 to a mind-numbing $34.1 trillion in 2024. But that’s not all; it doesn’t even account for the nearly $1 trillion more piled on since the end of Q3 last year.

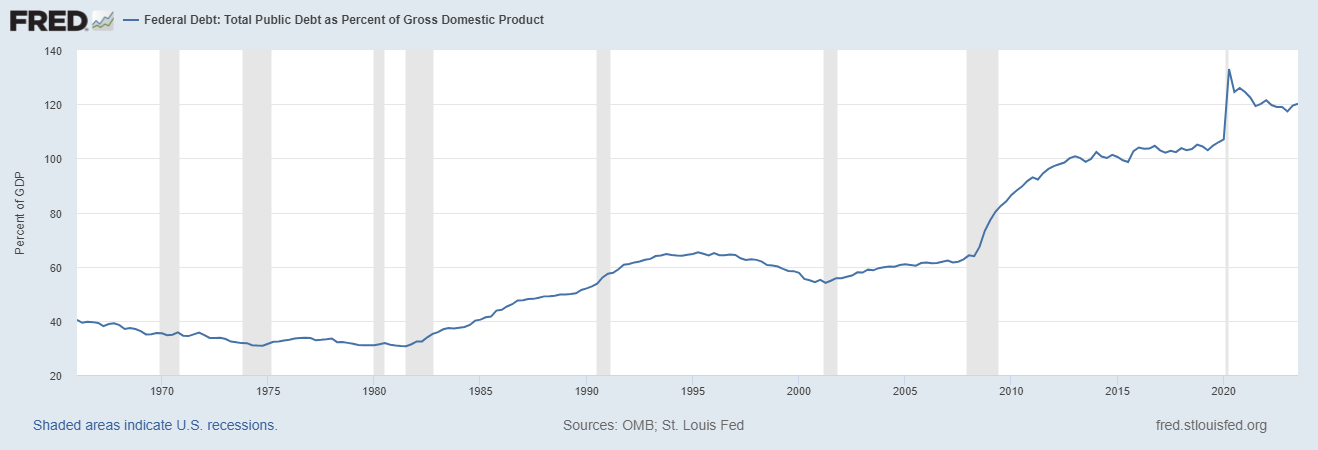

Now, let’s talk percentages. Our debt-to-GDP ratio is spiraling out of control. We managed to keep it in check during the 60s and 70s, but since the 80s, it’s been a one-way ticket to fiscal disaster. Today, it stands at a daunting 122%.

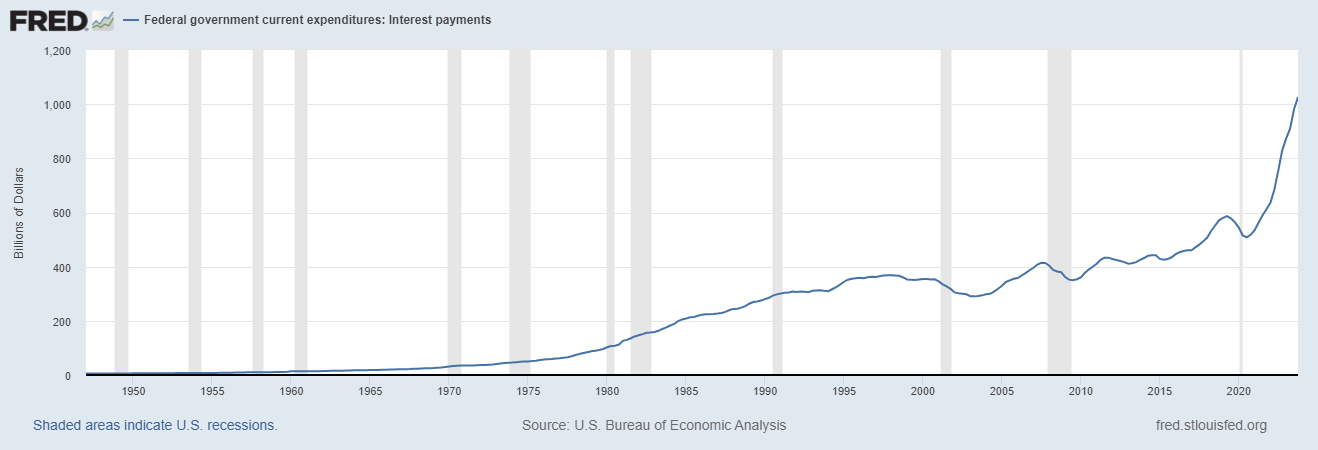

But the real kicker here is the cost of servicing this monstrosity. The U.S. government is shelling out over a trillion bucks a year in interest payments alone. This number has shot up like a rocket in the past four years, and with interest rates stubbornly high, there’s no relief in sight. The higher this interest tab grows, the worse off we, the American people, become.

Furthermore, the government forecasts a bleak outlook for the next decade. The Congressional Budget Office (CBO) predicts trillion-dollar deficits over the next ten years, resulting in a cumulative deficit of $20.3 trillion between 2024 and 2033.

This, my friends, is our new normal – a society grappling with overwhelming debt, forced to take on more debt to service existing obligations, all while addressing ongoing challenges such as proxy wars, border issues, and escalating entitlement programs for our aging population.

If the U.S. government was a publicly traded company, it would be considered to be a ZOMBIE company. ZOMBIES are companies that are incapable of meeting their debt obligations from existing cash flows. ZOMBIES need to borrow more to remain alive. And that is the unfortunate fate of our Federal government.

It’s abundantly clear that the government’s playbook at this juncture contains only two plays: increasing taxes on the American people or devaluing the currency to monetize the debt.

Neither of these options is a winner, but it seems the government is left with no choice. As investors, we need to seriously think about where to put our money in these troubled times. It’s the difference between prospering and floundering. There will be opportunities aplenty – from stocks to assets like Bitcoin, and even private market ventures.

The purpose of this article is to shine a light on the challenge for traders in a financial climate of perpetual currency debasement and exponential growth of government debt.

I want to pose a question to act as a thought exercise. Imagine that you are no longer in the United States. Instead, I have magically transported you with a time machine to a country months before the monetary authorities in that country began to superinflate the currency. My question is very simple: How do you protect yourself?

Here is a list of countries that have experienced hyperinflation.

**Venezuela:**

**Zimbabwe:**

**Sudan:**

**Lebanon:**

**Germany (1920s):** Post-World War I Germany experienced one of the most famous hyperinflation periods, particularly in 1923, due to war reparations and political turmoil.

**Hungary (1940s):** Following World War II, Hungary suffered the highest rate of hyperinflation ever recorded.

**Zimbabwe (2000s):** Zimbabwe’s hyperinflation in the late 2000s was one of the most severe in modern history, leading to the abandonment of its national currency.

**Yugoslavia (1990s):** The breakup of Yugoslavia was accompanied by severe hyperinflation, particularly in Serbia and Montenegro.

**Greece (1940s):** Post-World War II Greece experienced hyperinflation due to war debts and political instability.

**Argentina (1980s):** Argentina faced hyperinflation during the late 1980s, which was a result of economic mismanagement and political instability.

**Brazil (1980s and early 1990s):** Brazil experienced a prolonged period of hyperinflation due to economic and political challenges.

**Nicaragua (1980s):** Civil war and political issues led to hyperinflation in Nicaragua during this period.

**Bolivia (1980s):** Bolivia experienced severe hyperinflation in the mid-1980s, attributed to economic mismanagement.

This list is not exhaustive, as hyperinflation is a relatively rare but highly impactful economic event. I pose this question not to imply that hyperinflation will occur in the United States but rather to demonstrate that “protection” is limited in these instances to a handful of choices.

Milton Friedman, a Nobel Laureate economist, had a simple yet powerful way of explaining hyperinflation that can be understood by anyone. According to Friedman, inflation is an extremely rapid and out-of-control increase in prices. He famously said, “Inflation is always and everywhere a monetary phenomenon.” This means that inflation happens when there’s too much money chasing too few goods.

Imagine you’re at an auction with limited items to bid on, and everyone suddenly receives a lot more money to spend. What would happen? The prices of those few items would skyrocket because everyone has more money to spend and they all want to buy the same things. This is like what happens in hyperinflation – when a government prints a lot of money, there’s more money in everyone’s hands, but there aren’t enough goods and services to buy. So, prices go up very quickly.

Friedman preached that hyperinflation is caused by how much money is circulating in an economy, which is controlled by the government’s monetary policy. When a government prints too much money, it decreases the value of that money. This means people need more and more money to buy the same things they used to buy, which is why prices go up. In simple terms, hyperinflation is like having a lot of money but that money is becoming less and less valuable.

The reason this is worth pondering today is that the solutions for individuals in an inflationary environment are limited to converting the debased currency into something that retains its value. In a hyperinflationary economy, where the value of money decreases rapidly, people often try to convert their money into assets that are more likely to retain their value. This is because holding onto cash becomes less desirable as it loses purchasing power quickly. Here are some of the common assets people might turn to:

**Foreign Currency: ** People often buy stable foreign currencies, like the US Dollar or the Euro, because these tend to hold their value much better than the inflating local currency.

**Precious Metals: ** Gold and silver are traditional hedges against inflation. Their value tends to remain stable or even increase when a local currency is losing value rapidly.

**Real Estate: ** Property has proven to be a good store of value during hyperinflation, as its value in terms of the inflating currency often rises. It also has intrinsic value as a tangible asset.

**Commodities: ** Investing in physical goods like oil, grains, or other raw materials can be a way to preserve value. These commodities have intrinsic value and their prices often increase in hyperinflationary conditions.

**Cryptocurrencies: ** In some cases, people might turn to cryptocurrencies like Bitcoin as they are decentralized and not controlled by any government’s monetary policy. However, cryptocurrencies can be very volatile.

**Durable Goods: ** People might also invest in durable goods like cars, appliances, or electronics. These items can retain value or even appreciate in a hyperinflationary environment.

**Art and Collectibles: ** Items like artworks, antiques, and collectibles can also serve as a store of value, though their markets can be less liquid and more unpredictable.

**Non-Perishable Food** Non-perishable foods are items with a long shelf life that do not require refrigeration, making them ideal for long-term storage and emergency situations. These include canned goods, dry staples like rice and pasta, preserved foods, and items like nuts and powdered milk. While convenient and durable, they may not offer the full nutritional benefits of fresh foods, making balanced diet considerations important.

It’s important to note that what works best can depend on the specific circumstances of the hyperinflationary environment, including factors like the availability of these assets, government regulations, and the overall economic situation. The key idea is to convert money into assets that are not likely to lose value as quickly as the inflating currency.

I want to share with you something that I did during the pandemic which I hope you find helpful. When I heard the news that lockdowns were occurring and that The Fed was printing trillions of dollars, I chose to do something completely unconventional. I took several thousand dollars and invested in canned goods that I consume regularly. While this has all the vibes of a survivalist mentality, my perspective was that non-perishable foods would hold their value better than financial assets. Since the start of the pandemic in March 2020, the S&P 500 Index is up 48%. That sounds super impressive! The cost of the canned goods that I acquired has increased by 55%. I share this with you not because I feel that you should follow my lead. Rather, I mention it because that simple action on my part has conditioned me to be highly skeptical of government and economic forecasts who try to tell me that the economy is doing great when the S&P 500 Index has underperformed nonperishable canned goods! If the price of food is rising faster than the broader stock market indexes, I feel I have earned the privilege of being skeptical of monetary authorities. Such a disconnect between the two can be indicative of underlying economic instability and may warrant a closer examination of fundamental economic drivers, government policies, and global supply chains, reminding us of the importance of staying vigilant and critical in assessing the broader economic landscape.

In March 2020 I used to buy cheesecake once a week at a price of $6.99. Today that exact same cheesecake is $12.99. That represents an 85% increase in price which is almost twice the increase of the S&P 500 over the same time frame. What makes this financial landscape even more absurd is that 80% of all money managers underperform the S&P 500 Index.

My point and purpose in making these analogies is to illustrate that in an age of currency debasement we cannot afford to think traditionally. The price of a cheesecake should not be increasing faster than the stock market indexes. What kind of world is it when our experts tell us that everything is strong and resilient when the price of food is rising faster than the most popular investments?

How healthy can an economy be when this occurs?

In times of economic turmoil, when the trust in fiat currency diminishes significantly, a phenomenon akin to treating money like a ‘hot potato’ emerges. This metaphor captures the urgency with which people try to rid themselves of their national currency – a currency that is rapidly losing its value due to inflation or other economic crises. In such scenarios, holding on to cash becomes financially perilous; it’s akin to holding a ticking time bomb that erodes wealth with each passing moment. The psychology of the populace shifts dramatically – where once the currency was a symbol of stability and trust, it now becomes an emblem of uncertainty and loss. This palpable fear drives individuals and businesses alike to convert their liquid assets into something more stable and less susceptible to the whims of the volatile economy.

The heart of this rush away from fiat currency is a collective flight to safety, an instinctual move to preserve wealth and hedge against the continuous devaluation of the currency. People turn to alternative forms of assets – those that historically have shown resilience in the face of economic adversity. Real estate, precious metals like gold and silver, stable foreign currencies and even collectibles and art become the sanctuaries for storing value. These assets are perceived as more tangible and less vulnerable to the factors causing the currency’s decline, such as unchecked monetary policy or political instability. The key idea is to convert money into assets that are not likely to lose value as quickly as the inflating currency. This behavior underscores a fundamental shift in mindset – from earning and saving in the traditional sense to a defensive posture focused on wealth preservation.

However, this shift towards tangible assets in a broken economy is not just a matter of financial prudence; it represents a deeper, more systemic distrust in the financial institutions and the government that backs the fiat currency. As people scurry to invest in assets less likely to depreciate, it’s not only about safeguarding their savings but also about finding a semblance of control in an otherwise uncontrollable economic environment. This phenomenon is a stark reminder of the fragile nature of trust in monetary systems and the profound impact its erosion can have on society. It also highlights the adaptability of people in finding ways to protect their financial well-being, even in the most challenging economic climates. The flight to safety in assets of enduring value is a testament to the enduring human instinct to seek stability and security amid uncertainty.

The terms “inflation” and “hyperinflation” are often used interchangeably, but there exists a crucial distinction between the two. The primary differentiator is not the outcome but the speed and severity with which a currency’s value is eroded. Both inflation and hyperinflation share a common root cause: currency debasement. This process involves a reduction in the purchasing power of a currency, resulting in higher prices for goods and services. Whether its inflation or hyperinflation, the fundamental issue is that the currency becomes less valuable over time.

Inflation, in its milder form, is considered by most mainstream economists to be a natural occurrence in most economies. Central banks intentionally target low to moderate inflation rates, typically in the range of 2-3%. This controlled inflation is considered healthy for economic growth. It stimulates spending and investment, as consumers expect prices to rise gradually. Hyperinflation, on the other hand, is an extreme and rare phenomenon characterized by a rapid and uncontrollable increase in prices.

Hyperinflation tends to result from a complex interplay of factors, including excessive money printing, loss of confidence in the currency, and economic instability. Once hyperinflation takes hold, it has devastating consequences for a nation’s economy and its citizens:

**Loss of Savings: ** People’s savings quickly become worthless as the currency’s value plummets.

**Destruction of Investment: ** Investments and assets denominated in the collapsing currency lose value, causing economic turmoil.

**Economic Chaos: ** Commerce and trade become impractical due to rapidly changing prices, leading to disruptions in daily life.

**Social Unrest: ** Hyperinflation often leads to protests, riots, and even political instability as citizen’s demands a solution.

In summary, the essential difference between inflation and hyperinflation is the speed and severity of currency devaluation. Inflation becomes hyperinflation when it spirals out of control, wreaking havoc on economies and the lives of those affected. Recognizing this crucial distinction is vital for policymakers and citizens alike to safeguard against the catastrophic consequences of hyperinflation and to maintain a stable and prosperous economic environment.

The point I am making is that the only difference between inflation and hyperinflation is the speed with which currency debasement is occurring.

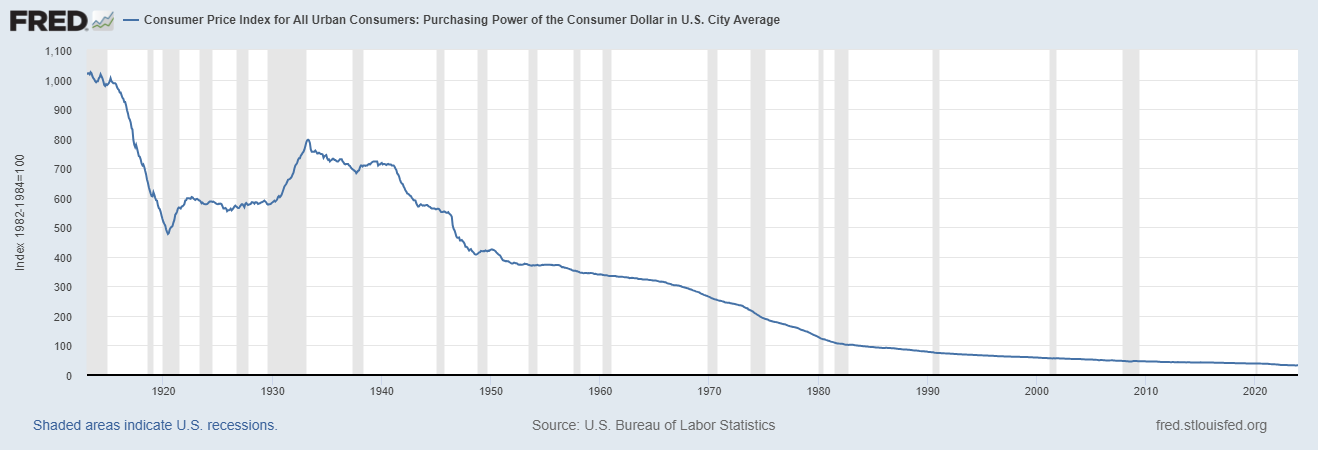

Here is the chart of purchasing power published by the Federal Reserve. The U.S. Dollar has lost 98% of it purchasing power since the Federal Reserve Act was passed.

When it comes to monetary policy, we often consider central banks as the architects, those diligent economists and financial experts analyzing data, making decisions with the hope of steering our economy towards prosperity. However, it’s crucial to remember that central bankers do not operate in isolation. Enter politicians – they wield enormous power through fiscal policy decisions, regardless of what central banks do. This creates a complex situation where central banks must constantly recalibrate to hit a moving target, a formidable challenge indeed.

During the pandemic of 2020, an extraordinary alignment emerged. Politicians and central bankers were in sync. The central bank was slashing interest rates and mastering the art of quantitative easing, while politicians were injecting fiscal stimulus packages into the economy with vigor. Money flowed generously, markets surged, liquidity crises were averted, and inflation embarked on an upward trajectory. This synchronization, although possibly detrimental to savers, underscored the potent results of coordinated efforts.

However, this harmony began to wane in 2021. The Federal Reserve, recognizing an overheated market, launched an aggressive interest rate hike campaign, raising rates at an unprecedented pace, eventually surpassing the 5% threshold. The catch? Politicians appeared to be out of step.

Our elected representatives continued passing legislation that infused money into the system. We witnessed the Infrastructure Investment and Jobs Act, the CHIPS and Science Act of 2022, the Inflation Reduction Act and billions earmarked for proxy wars worldwide. While the central bank applied the brakes, politicians seemed to keep their foot firmly on the accelerator.

This misalignment between politicians and central bankers only compounds the central bank’s challenges.

But there’s more to the story. Recently, politicians like Senator Elizabeth Warren, Senator John Hickenlooper, Senator Sheldon Whitehouse and Senator Jacky Rosen have publicly called for the Federal Reserve to lower interest rates. Their argument? High rates exacerbate the housing affordability crisis. They may have a point, but they conveniently overlook their own role in this predicament – years of excessive fiscal spending. Why do Real Estate price continue to climb year after year? It’s simply because real estate holds its value in an era of currency debasement. An average house in 1913 cost $4000 which was the equivalent of 200 ounces of gold. Today an average house costs slightly more than $400,000 which just happens to be 200 ounces of gold! Priced in gold the house has not appreciated at all. Priced in a debased currency, the house has increased 100 fold! You can read the letter from the 4 Senators to Fed Chair Powell here.

Before we all agree that this is simply an innocent request should we not investigate why the price of Real Estate has increased 100-fold over the last 110 years? Might the cause be simple currency debasement which both sides of aisle have been promoting forever?

If the Fed and leading politicians both agree that the currency needs to be debased more, should that not alarm anyone who is holding even the slightest amount of currency?

Currency debasement. It’s a gradual process, almost like a slow-motion heist happening right under our noses. You see, most people don’t pay much attention to a 2-3% inflation rate; they just chalk it up to the cost of living. But here’s the thing, if a crook were to break into your home and steal 2% of your belongings, you’d call it theft, right? Well, inflation is no different; it’s like having your pocket picked, and it’s happening to your hard-earned savings.

When they keep churning out more and more of a monetary good, like our dollars, it makes every other dollar we hold less valuable. It’s a sneaky process, and it’s like a slow erosion of your wealth. See, money is supposed to be a store of value, a reliable medium of exchange, and a unit of account. But when they play fast and loose with the printing press, it loses that store of value part. It’s like playing a game with a constantly changing rulebook.

And why does this matter? Well, it matters because money is the lifeblood of our economy. It’s what makes trade and commerce possible, and when they mess with it, it’s like poking a hole in the ship. When this occurs people begin to store their wealth in other things.

This leads us to a fundamental question – should politicians be meddling in the central bank’s decisions? Both sides of the political spectrum have been guilty of this, from President Trump’s tweets about the strength of the dollar to President Biden’s summoning of Fed Chairman Jerome Powell, reminiscent of a school principal reprimanding a student. And now, Senators are getting in on the act attempting to influence the Fed’s stance on monetary policy.

If we desire a genuinely independent central bank, as it should be, it is simply inappropriate for politicians to exert overt influence on its decisions.

In my personal opinion, the Fed has done a horrible job of managing the economy. The mandate of the Federal Reserve is to promote maximum employment, stable prices (including moderate inflation), and moderate long-term interest rates. It’s truly bizarre to think that loss of purchasing power is considered necessary and normal.

The entirety of Economics begins with the lesson of scarcity, a lesson that politics seems to willfully ignore. Politicians often act as if resources are endless, promising the moon to constituents to gain electoral favor. This blatant disregard for the basic economic principle of limited resources not only demonstrates a disconnect from reality but also a dangerous trend in political promises that can’t possibly be fulfilled.

Perhaps there is a lesson to be drawn from this comparison. Nevertheless, one thing remains certain – politicians and central bankers are playing distinct tunes at this juncture. This only amplifies the central bank’s already formidable challenges, and the ultimate casualties in this scenario are the American people. The institutionalization of plunder in our economy marks a dangerous trend. It leads to a system that not only permits but endorses these acts and justifies and glorifies them.

When we talk about what’s best for our country, the most crucial question is often not the nature of the action itself, but who is in the position to make that call. This question goes beyond mere policy—it’s about who holds power, who shapes the narrative, and ultimately, who controls the direction of our society. When it comes to money, you cannot ignore this question and are forced to recognize that there is nothing normal about currency debasement.

In the world of trading, staying ahead of the curve is the key to success. Among the numerous factors influencing market trends, two factors have been particularly significant in recent times: the relentless growth of national debt and the continuing debasement of currencies.

I watched the Federal Reserve’s Press conference yesterday and was really surprised by their conclusions that the economy was stronger than they expected.

They continue to promote a narrative of a strong and resilient economy and I simply scratch my head and think about the reality that cheesecake prices have massively outperformed the S&P 500 index.

Wall Street wants interest rates to be lowered. Traditionally the Fed only lowers interest rates when the economy is not doing well.

In a year of a Presidential election like 2024 I expect monetary madness to reign supreme. What I constantly remind myself of is that our tendency is to conflate the devaluation of currency with the generation of wealth, and this can have detrimental consequences and lead to very poor trading and investment decisions.

My suggestion to all of this madness is for you to consider the power and effectiveness of artificial intelligence in your trading and investment decisions. As I write these words I cannot tell you what is going to happen next. However, I do know what the current trends are on assets that I can trade to protect my purchasing power.

It makes absolutely no sense for stocks to be trading at these levels. But the trend is very clearly up.

I utilize this exact same logic to find the best move forward when I look at stock, forex, crypto and even Treasury instruments.

Sure I have my opinions. But I have learned that in this financial landscape my focus needs to be to stay on the right side, of the right trend at the right time. This is why I trade with artificial intelligence software .

Allow me to cut right through the fancy talk and political spin. What we’re witnessing here is nothing short of a financial shell game, plain and simple. The FED wants us to believe that when the numbers on our assets go up, we’re all getting richer, right? Well, don’t be fooled!

The truth is, when they start messing around with our currency, devaluing it bit by bit, it’s like they’re picking our pockets while we’re not looking. Sure, your real estate might seem like it’s shooting to the moon, but take a closer look, folks. If it’s all because the money in your wallet can’t buy you half of what it used to, then what good is it?

And don’t get me started on how this impacts ordinary folks. It’s the hardworking Americans with fixed incomes and savings who bear the brunt of this currency manipulation. It’s like a hidden tax that hits them where it hurts the most. Meanwhile, these big businesses, they’re left guessing and struggling to plan for the future because they can’t trust the stability of their own currency.

Folks, when you’re in the trading trenches, remember this: the only scorecard that counts is how well you’ve nailed those price predictions. All that noise you hear the endless chatter on financial networks, the so-called experts and their market gossip – it’s just a sideshow to the real action.

While Wall Street hangs on to every word of the daily financial circus, the savvy trader ought to be honing in on the pearls of wisdom that artificial intelligence trading brings to the table. These aren’t just number-crunching gadgets; they’re the market’s heartbeat, slicing through the chaos of daily headlines, getting to the heart of what truly moves those markets.

For traders, the compass should be as clear as day: up, down, or sideways. Everything else? It’s mere distraction. Navigating these waters requires more than gut feeling; it’s about harnessing the power of AI trading software as your North Star, guiding you through the unpredictable twists and turns of market trends, elevating your trading game.

Now, let’s talk about your post-pandemic market performance. Got that figure in your mind? Excellent.

Now, consider this: Are you keeping up with the price of cheesecake or canned goods?

The race to debase is a reality that hits everyone right in the gut. The only question worth asking is what are you going to do about it?

We delve deep into these topics in our no-cost trading master classes, where we impart the wisdom of trading with artificial intelligence, machine learning, and neural networks.

To explore the transformative potential of AI in trading, I invite you to join us for a FREE Live Training session.

Discover how AI can help you minimize risk, maximize rewards, and provide peace of mind in your trading journey. Don’t miss this opportunity to equip yourself with the knowledge and tools that can make all the difference.

It’s not magic.

It’s machine learning.

Make it count.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.