“It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.” – Henry Ford

Throughout my entire life there has been one conversation that has occurred regularly around the subject of money. Most people know that the financial system does not work efficiently or fairly, but they have trouble clearly defining the problem and producing an alternative solution.

In modern life, money plays a starring role, influencing nearly every facet of our existence. Yet, it’s a startling reality that many individuals spend their days without a comprehensive understanding of the profound historical tapestry and intricate mechanics of money.

Consider this: as you swipe your credit card for groceries or deposit your paycheck, you’re participating in a system with roots stretching back millennia. From the barter exchanges of ancient civilizations to the complexities of global financial markets today, the evolution of money is a saga of innovation, power dynamics, and societal change.

But here’s the kicker: most of us aren’t equipped with the knowledge to navigate this landscape effectively. We’re left to maneuver through economic currents without the compass of understanding. This knowledge gap isn’t just a matter of personal finance—it’s a societal issue with far-reaching implications.

Recently I came across Lyn Alden’s new book, “Broken Money.” In this article, I’ll discuss her exploration of monetary history and the importance of understanding how technology shapes economic exchange.

When it comes to understanding money, what’s the average Joe or Jane taught? Well, it’s usually a dash of Keynesian economics 101 , emphasizing big government and central bank maneuvers, all while downplaying the power of the people. Tack on some post-Great Depression macroeconomic musings, and you’ve got yourself a recipe for a system that feels rigged and unfair to most, even if they’re unwittingly living within its confines.

When we talk about good money, it’s got to tick off six boxes: durability, portability, divisibility, uniformity, scarcity, and acceptability. These are the hallmarks of a currency’s worth, shaping its usability and appeal. But here’s the kicker: different types of money have their pros and cons, meaning there’s always a give-and-take when it comes to choosing the best medium of exchange. And we cannot evaluate money without also looking at it being a store of value.

Back in the day, hard money, the kind you can touch and feel, like gold, was hailed as the ultimate form of currency, thanks to its scarcity and rugged durability. But here’s the thing: utility counts too. Enter paper money, not as tough as gold, but, it’s so much more convenient and quicker. Speed, that’s the key. Throughout the ages, humans have been obsessed with making money more portable and, dare I say, user-friendly, which has focused on allowing transactions to occur quicker.

When we talk about managing money, we’re talking about banks, the backbone of the financial system. These institutions have been around for centuries, providing credit and making money more mobile. But it wasn’t until recent centuries, particularly in Europe, that we saw the rise of modern banking. And do you know what came next? Central banks, the government’s cash cow, especially during times of war.

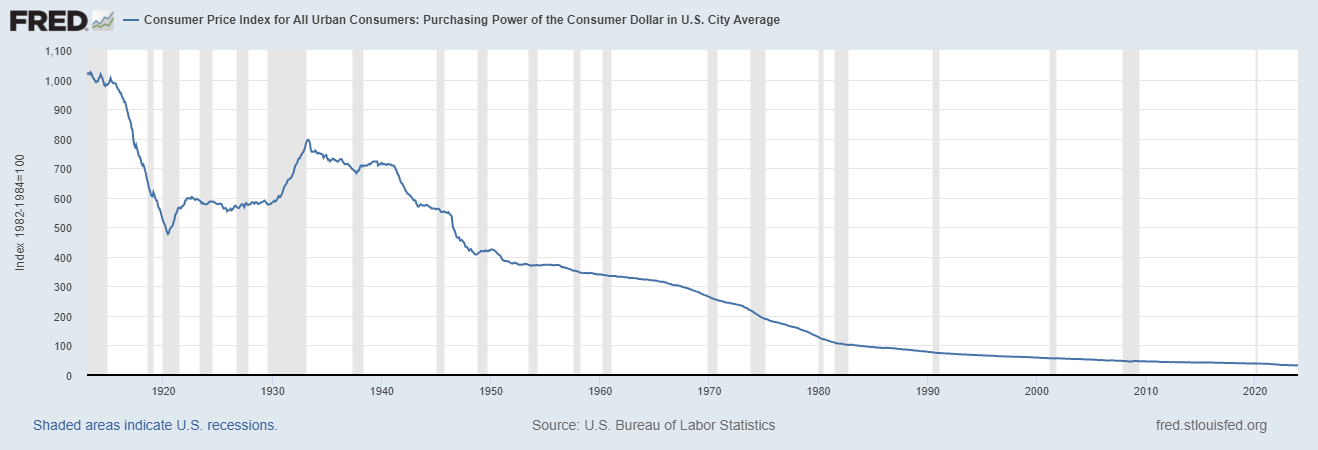

But here’s where it gets interesting: speed became paramount. Enter fiat currency, promising quicker, easier transactions. And with governments backing it up with legal tender laws and taxes, well, fiat currency became the only game in town. But let’s not overlook the dark side; where there’s speed, there’s also room for corruption. Fiat currency opened the floodgates for manipulation and abuse. To say nothing of the reality that currencies like the U.S. Dollar have lost almost 98% of their purchasing power since the Federal Reserve Act was passed.

The evolution of fiat currency ushered in a new era dominated by the petrodollar—a strategic move by the United States to supplant gold with the dollar and assert its economic and military hegemony by positioning the dollar as the global reserve currency. However, this geopolitical maneuver has not been without its repercussions, both for nations beyond America’s borders and, increasingly, for the United States itself. As the global financial landscape continues to evolve, the imperative for a fundamental reimagining of the future of money becomes ever more pressing.

You probably already know Lyn Alden. She’s not just any investment researcher—she’s the brains behind Lyn Alden Investment Strategy, where she’s been preaching the gospel of sound investment for ages. With a background in engineering and finance, Alden’s got the chops to back up her advice, specializing in no-nonsense investment strategies with a global twist. And let’s not forget her knack for spotting investment opportunities across macro assets, including the ever-growing world of Bitcoin.

Her latest project: “Broken Money” is a book that aims to shed light on the inner workings of money and the global financial system. With a tone that’s equal parts instructional and analytical, Alden’s mission is crystal clear: to help everyday folks understand why the financial world isn’t firing on all cylinders anymore. By digging into the history of money through a technological lens and calling out the flaws of the fiat monetary system, Alden’s book offers up some bold alternatives. This isn’t just a book for the finance elite—it’s for anyone who’s worried about protecting their savings in today’s uncertain times.

Let me tell you, Alden’s not just talking the talk—she’s walking the walk. She’s shining a bright light on the flaws in our financial system, and they’re serious ones. From the weight of excessive debt to the growing divide of income inequality and the risky game of moral hazard, Alden’s not mincing words. Her message is crystal clear: these aren’t just theoretical or academic problems—they’re real threats to our economic stability, putting everyday folks at risk of financial turmoil and long-term prosperity loss.

But what really sets Alden’s book apart is her ability to break down complex economic concepts into plain language that anyone can understand. Through clear explanations and real-world examples, Alden demystifies the inner workings of our financial system, empowering readers to grasp the forces at play and demand change.

At the heart of the book lies Alden’s exploration of solutions for fixing our broken financial system. From regulatory reforms to alternative economic models, she offers a range of strategies for building a more resilient and inclusive financial infrastructure. By drawing on insights from experts and thought leaders, she paints a comprehensive picture of the challenges we face and the opportunities for meaningful reform.

This book isn’t just about the here and now—it’s about understanding the roots of our financial system and how it evolved over time. From the ancient ledgers of commodity monies to the rise of banking and the structuring of the global financial system, Alden takes us on a whirlwind tour of monetary history. But it doesn’t stop there. She also dives deep into the nitty-gritty of how money is created in modern finance, explores the digital innovations that have reshaped monetary systems in the 20th century, and ultimately, confronts the ethical questions that lie at the heart of all commerce. It’s a journey that is worthy of your time and very thought provoking.

But perhaps the most inspiring aspect of Alden’s message is her unwavering optimism. Despite the enormity of the task ahead, she remains hopeful about the possibility of creating a better future. By equipping readers with knowledge and understanding, Alden inspires them to act and be agents of change in their communities and beyond.

Alden is a bitcoiner, but the book is not necessarily about Bitcoin or its adoption. What makes Alden’s book unique is that it focuses its lens on understanding how technology transforms the definition of money, and how the ideal money would be defined as the most technologically sophisticated and usable. Upon reading the book it is easy to understand how FIAT became universally used and applauded because it made it very simple to transact, but it has failed from the perspective that it is a horrific store of value and forces citizens to speculate to try and maintain their purchasing power.

History is replete with examples that underscore a fundamental truth: if humans possess the ability to print money, they will inevitably succumb to temptation. It’s a universal impulse—everyone wants a shortcut, a quick fix to their economic woes. Yet, as history has repeatedly demonstrated, entrusting individuals with the power to create currency is a perilous gamble—one that invariably leads to abuse and exploitation.

Money makes the world go ’round, it’s the grease that keeps the wheels of our economy turning. But not all money is created equal. Take the U.S. dollar, for example—it may be widely used, but it lacks the durability, supply limits that define good money. And when you’re dealing with bad money, well, let’s just say it’s a recipe for disaster—think wealth evaporation and economic turmoil.

Throughout history, we’ve seen good money come and go, each serving its purpose in society. But as technology and society evolve, so too does our concept of money. And all too often, what was once considered good money ends up failing us, leaving us searching for a better alternative.

Now, let’s talk Bitcoin. Alden’s laying out some compelling reasons why it’s worth paying attention to. Bitcoin has no CEO. No Marketing Department. No Customer Service. It’s grown organically by word of mouth, shared by traders and investors who admire its unique monetary properties.

1) Decentralization: Bitcoin runs on a decentralized network called the blockchain, bypassing the need for banks to meddle in your transactions. This decentralization not only cuts down on the risk of manipulation and censorship but also gives you complete control over your wealth. It’s like taking the power back from the big financial institutions and putting it right in your hands.

2) Limited Supply: Get this—Bitcoin’s supply is capped at 21 million coins. That’s it. No more, no less. In a world where central banks can print money like there’s no tomorrow, Bitcoin offers a refreshing change of pace. Its scarcity makes it a true store of value, protecting against the ravages of inflation that plague traditional currencies. In today’s uncertain world, which is worth its weight in gold.

3) Security: Bitcoin doesn’t mess around when it comes to security. With state-of-the-art cryptographic algorithms, transactions are locked down tighter than a drum, keeping fraudsters at bay and ensuring the integrity of the entire network. And with private keys in hand, individuals have full control over their funds, with no risk of unauthorized access. It’s security you can trust in an uncertain world.

4) Financial Inclusion: Now, this is where Bitcoin truly shines. By breaking down barriers to entry, Bitcoin opens the doors of financial opportunity to the unbanked and underbanked around the globe. With just an internet connection, anyone—yes, anyone—can join the Bitcoin network, gaining access to financial services that were once out of reach. It’s a game-changer for those on the fringes of the traditional banking system, empowering individuals to take control of their finances on their own terms.

5) Hedge against Uncertainty: Bitcoin isn’t just a digital currency—it’s a lifeline in uncertain times. With its decentralized structure and limited supply, Bitcoin serves as a hedge against economic and political turmoil. When traditional assets falter, Bitcoin’s value has the potential to skyrocket, providing a safe haven for preserving wealth. It’s like having a financial parachute when the ground beneath you starts to shake.

6) Borderless Transactions: Bitcoin isn’t just a currency—it’s a passport to the global economy. With its borderless nature, Bitcoin enables individuals to transfer funds across borders with ease, sidestepping the hassles of traditional intermediaries and costly transaction fees. It’s like having a direct line to the world, empowering individuals to transact freely and effortlessly across borders.

7) Financial Sovereignty: Bitcoin isn’t just a digital currency—it’s a beacon of financial freedom. With Bitcoin, you’re the master of your own wealth, with complete control and autonomy over your financial destiny. It’s a game-changer for personal sovereignty, aligning perfectly with the principles of individual empowerment and self-determination. With Bitcoin, the power is truly in your hands.

Alden’s analysis and proposals offer a path toward a more equitable financial system. And in this landscape of change, Bitcoin emerges as a beacon of hope for those seeking to protect their wealth. But let’s not forget, folks, Bitcoin isn’t a panacea. Volatility, regulatory hurdles—these are challenges that must be addressed. And until Bitcoin gains wider acceptance and regulatory clarity, its future remains uncertain. But one thing’s for sure, folks—change is on the horizon, and “Broken Money” is leading the way.

When you print money at little to no cost, you’re not just conjuring wealth out of thin air—you’re devaluing the hard-earned money of everyone else. It’s like a hidden tax, where you’re not losing any wealth yourself, but you’re robbing it from your fellow citizens. And here’s the kicker: this isn’t just about counterfeiting—it’s about governments printing money like there’s no tomorrow. It’s a dangerous game, folks, dependent on people not realizing that their wealth is slowly evaporating. Unfortunately, this is the monetary story of our day! Governments are trying desperately to maintain control of the printing press while the free market is offering far better solutions.

Why is this important?

Last night on CBS, Treasury Secretary Janet Yellen spilled the beans on the state of our economy. When asked if she and President Biden were pleased with how inflation is shaping up, here’s what she had to say:

“We know that Americans are experiencing discomfort because some important prices are higher than they were pre-pandemic, but what I think is really important is that wages have gone up along with prices, so people are better off than they were pre-pandemic.”

Indeed, the narrative surrounding the administration’s handling of the economy appears to face significant headwinds. Recent polling data reveals a stark contrast between official rhetoric and public sentiment. With a mere 14% of American voters reporting an improvement in their financial standing under the current administration, the majority remains unconvinced. This glaring disparity underscores the challenges faced by policymakers in aligning their messaging with the lived experiences of everyday citizens.

I am not taking political pot shots here. This dialogue is what “Broken Money” is all about. How do we measure financial success individually and collectively? When our life revolves around a currency that is perpetually debasing the solutions offered by government officials appear like posturing at best.

This paradox reminds me of Jeff Booth’s book, “The Price of Tomorrow: Why Deflation is the Key to an Abundant Future.” Booth delves into the profound impact of technology on the global economy, particularly focusing on its deflationary nature. Booth argues that advancements in technology inherently reduce production costs, leading to lower prices for consumers. This central thesis challenges traditional economic perspectives that often view deflation as a negative phenomenon.

Booth makes the case that the rapid pace of technological innovation, seen in areas such as artificial intelligence, robotics, 3D printing, and biotechnology, is exponentially increasing efficiency and productivity. This surge in technological capability means that goods and services can be produced at significantly lower costs, with the savings potentially passed on to consumers in the form of lower prices. Essentially, technology acts as a powerful force for deflation because it allows more to be done with less—less labor, less time, and less money.

However, Booth points out a paradox in the current economic system, where, despite the inherent deflationary pressure of technology, we still observe inflation in the economy. He attributes this anomaly to monetary policies that aim to counteract deflation by injecting more money into the economy, thus maintaining inflationary pressures. Central banks around the world, according to Booth, have been on a mission to avoid deflation at all costs, fearing the economic stagnation associated with historical deflationary periods. Yet, Booth argues that this approach overlooks the positive aspects of technology-driven deflation, which can lead to an abundance of goods and services, making them more accessible to a broader section of the population.

In “The Price of Tomorrow,” Booth suggests that embracing technology’s deflationary impact could lead to a future of abundance, where increased efficiency and lower production costs result in lower prices and a higher standard of living for all. He challenges policymakers to rethink economic strategies to harness the benefits of technology-driven deflation rather than fight against it with inflationary monetary policies. Through this lens, Booth’s book is a call to action for embracing a new economic paradigm where technology’s power to reduce costs and improve efficiency is recognized as a pathway to greater prosperity and abundance, rather than a threat to the economic order.

So, who should read “Broken Money”? This book is for anyone looking to educate themselves on the underlying issues of our current financial system and explore alternative strategies for safeguarding their wealth. And if you’re seeking a book that provides a comprehensive yet accessible examination of the past and future of money, “Broken Money” should be at the top of your reading list.

You can’t move forward if you’re stuck in reverse, and that’s exactly where we find ourselves with this whole money printing debacle. It’s like pouring gasoline on a fire and wondering why things keep blowing up. We’ve got to put the brakes on this madness before it’s too late. Otherwise, we’re just spinning our wheels while the financial world and our savings burn.

The question of what is money is what we discuss in our Free Live Online Masterclass Trainings, while teaching people how to trade with artificial intelligence , which I would like to invite you to explore and attend.

Are you feeling the squeeze of a weakening currency? It’s a silent erosion that eats away at your hard-earned wealth, leaving you with less purchasing power than ever before. But fear not, because there’s a solution within reach. Imagine having the power to not just protect but grow your wealth even in the face of currency debasement. Introducing our revolutionary artificial intelligence trading software.

While traditional methods may falter in volatile markets, our A.I.-driven system thrives. It adapts to changing conditions in real-time, making split-second decisions to maximize profits and minimize losses. No more sleepless nights worrying about the value of your investments. Our software empowers you to take control of your financial future with confidence.

If you’ve been paying attention, you know that your currency is under attack. Governments are printing money at an alarming rate, diluting its value, and eroding your purchasing power. It’s a silent thief that robs you while you sleep. But here’s the good news: you don’t have to be a victim any longer.

Picture a future where you’re not just surviving but thriving despite economic turmoil.

The purpose of artificial intelligence trading software is simple: to keep you as a trader on the right side, of the right trend at the right time. A.I. is obsessed with that function as it is always looking at what is the best move forward?

That future is within your grasp with our A.I. trading software . Don’t sit idly by as inflation eats away at your savings. Seize control of your financial destiny today and join the ranks of savvy investors who refuse to settle for mediocrity.

The time for action is now.

The power of artificial intelligence lies in its ability to learn from what doesn’t work, remember it, and then explore alternative solutions. This feedback loop has been instrumental in building the fortunes of every successful trader I know.

Consider this: AI applies mistake prevention to uncover what is true and viable. It’s a continuous, 24/7 process that AI applies to any problem it’s tasked with solving.

This should excite you because it’s a game-changer.

Don’t just sit around waiting for the Fed to change course.

Stay abreast of the highest probability analysis provided by artificial intelligence.

Since artificial intelligence has beaten humans in Poker, Chess, Jeopardy and Go! Do you really think trading is any different?

Knowledge. Useful knowledge. And its application is what A.I. delivers.

You should find out. Join us for a FREE Live Training.

It’s Not Magic.

It’s Machine Learning.

Let’s Be Careful Out There!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.