In the trading world, where investors continually search for strategies that balance risk with reward, the covered call stands out as a sophisticated yet accessible strategy. Pioneered by those looking to optimize their portfolios without taking on excessive risk, this strategy has become a mainstay for savvy market participants.

At its core, a covered call involves an investor holding a position in a stock, then leveraging this position by selling call options on the same stock. It’s a move that signals confidence, not just in the stock’s current value but in the strategic foresight of the investor. The underlying shares serve as a safety net, ensuring the investor can meet their obligations if the call option is exercised. It’s a blend of caution and ambition, aiming to secure a steady income through the premiums earned from selling the options.

**Key Insights to Covered Call Writing**

– The allure of the covered call lies in its ability to generate income through option premiums, a tactic that appeals to investors who forecast only slight fluctuations in the stock’s price.

– By writing call options while holding the stock, investors can dip into the stream of premiums without committing to sell unless the stock surpasses a predetermined price.

– This approach is particularly favored by long-term shareholders, who, despite their commitment to their holdings, recognize the limited short-term growth potential. Instead of sitting idle, they choose to monetize their patience.

– The strategy shines as a pragmatic blend of optimism and realism, allowing investors to hedge their bets while pocketing premiums.

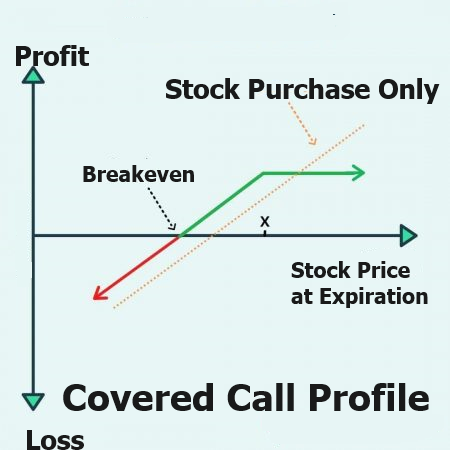

Let’s look at the profile of a Covered Call to better understand the risks, rewards, and the realities.

As the graphic above shows the Covered Call gives away upside potential for downside protection equal to the premium received by selling a call option.

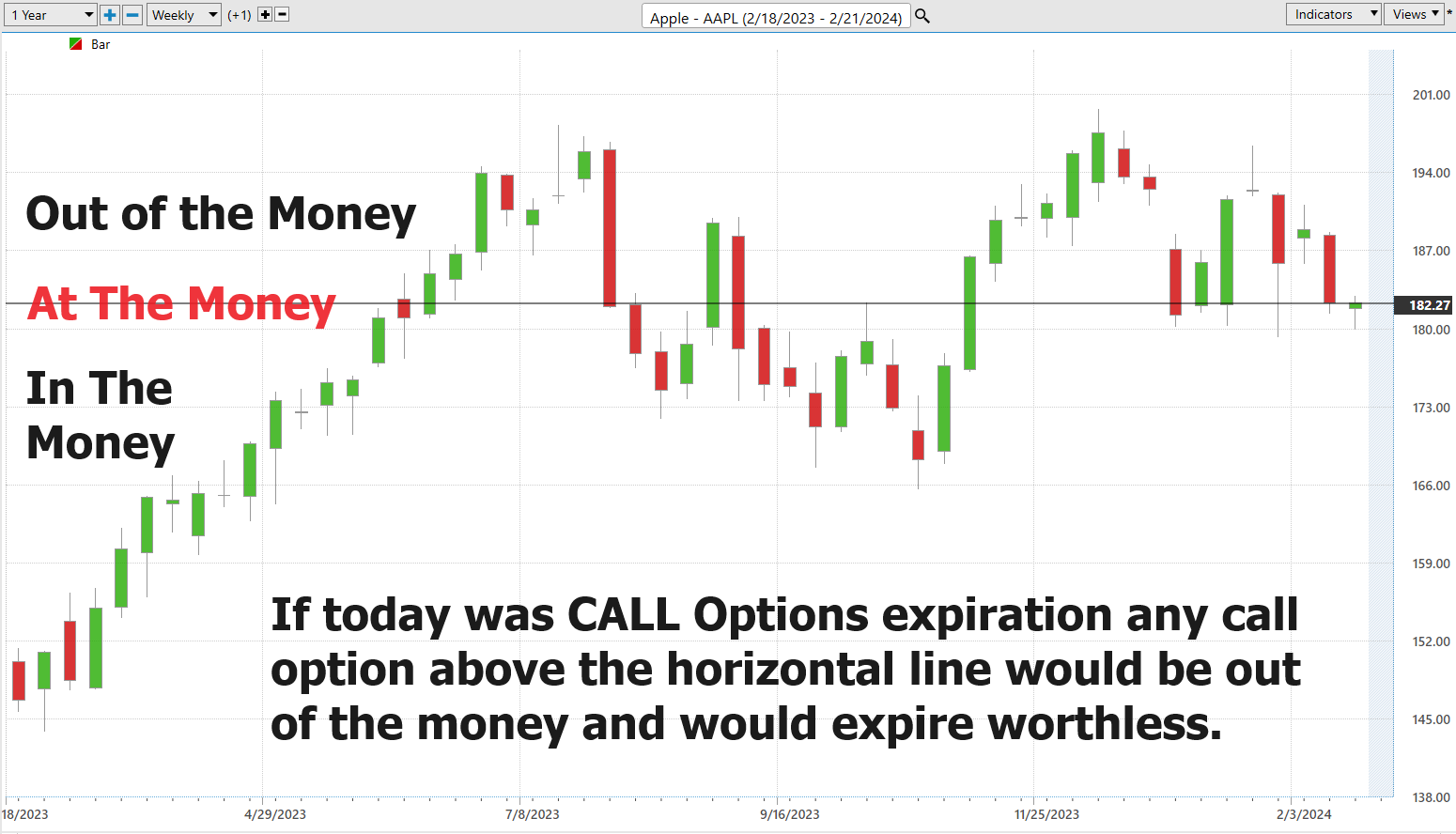

Let’s apply this perspective to Apple stock ($AAPL) at this given time.

As I write this article $AAPL is trading at $182.32.

Going out one year on the options chain the January 17, 2025, options expiration shows that the $AAPL $185 call is trading at $18.35.

If AAPL’s stock price rises above $185, the call option will likely be exercised. Your shares would be sold at $185.

Your profit per share would be the difference between the strike price and your purchase price, plus the premium received. I will break this down shortly.

$AAPL (Apple Inc.) does offer weekly options expirations. Weekly options, also known as “Weeklies,” are short-term options that typically expire on Fridays, except when there are holidays. Apple, being one of the most actively traded stocks, has a robust options market, including weekly expirations. These weekly options allow traders and investors to engage in more precise timing strategies, hedge against events or announcements, or take advantage of short-term market movements. The availability of weekly options for $AAPL provides increased flexibility for options traders looking to implement strategies tailored to their market outlook or to hedge existing positions in their portfolio.

The first step that I suggest covered call writers take is to look at the last 52 weeks to understand the risks and rewards of this potential trade.

Over the past 52 weeks $AAPL has traded as high as $199.62 and as low as $143.90. For the purposes of illustration, I will assume that these boundaries will remain constant over the next 52 weeks. I am doing this simply to be able to illustrate the risks and rewards of implementing a covered call on an annual basis.

Next, what I suggest that traders do is apply a WORST-CASE analysis to APPLE ($AAPL). To do this simply measure the worst declines that have happened in the stock over the past year on a percentage basis.

Over the last 52 weeks we can quickly see that from its 52-week high $AAPL has sold off numerous times ranging from -8.5% to -13.2%. I conduct this analysis pre trade to be able to calculate a potential worst-case scenario on my trade. I always assume that what has happened in the recent past can easily occur again in the future. But by placing these values on the chart I can also see that over the past year, engaging in a covered call on $AAPL when it had sold off 10% was clearly a winning strategy over the longer term.

Covered calls are emblematic of a neutral market stance — the belief that the stock’s price will hover within a relatively tight range. This tactical equilibrium caters to investors with a measured outlook on their investments, providing a path to incremental gains while they await more substantial market movements.

Finding that sweet spot for selling covered calls is akin to catching the perfect wave. It’s all about timing and conditions. Now, consider this: the ideal moment to dive into selling those covered calls? It’s when the stock you’re eyeing, that underlying security, sits comfortably in calm waters—where the outlook is bright but not blinding. We’re talking about a scenario where the prospects are good, steady as she goes, but you’re not expecting any wild swings up or down the chart. Why is this the golden hour, you ask? Well, it’s simple. In such a balanced climate, selling covered calls becomes less of a gamble and more of a strategic move, a way to pocket a pretty penny from premiums without losing sleep over dramatic shifts in stock value. In the world of trading, where the only constant is change, locking in a reliable profit through selling premiums, when the conditions are just right, might just be one of the smartest plays out there.

At its essence, the strategy is about making the most of the status quo. If an investor’s portfolio is anchored by stocks expected to remain steady, then why not extract value from this stability? Covered calls offer a way to do just that, transforming latent assets into potential income sources.

Once a trader comprehends what risk has existed in the market, they can decide as to what are the probabilities that this will occur again while they are in a covered call.

I begin my analysis by looking at the options prices going out 1 year and then working backwards to shorter term durations.

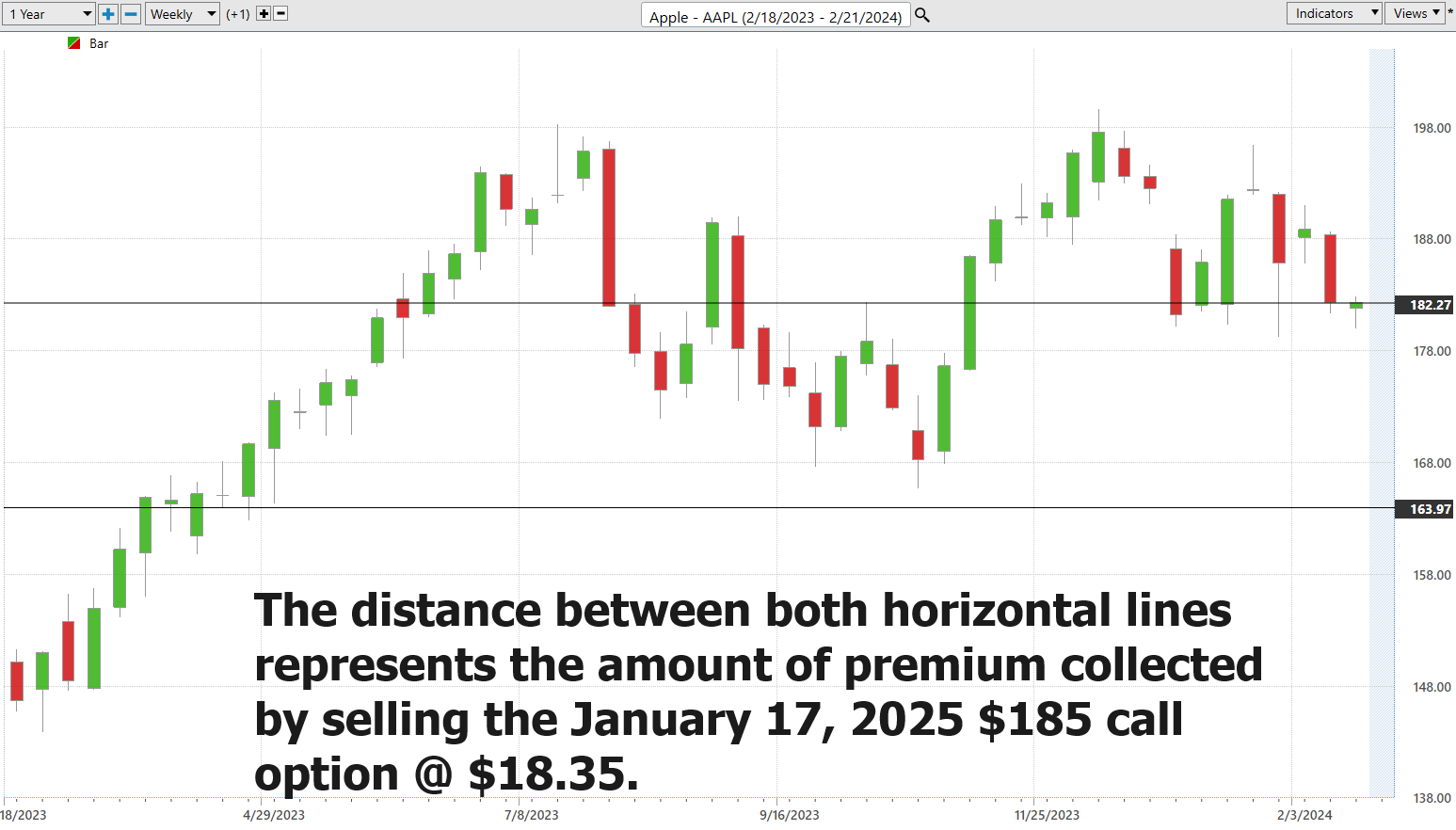

Currently the January 17, 2025, $185 Apple Call Option is trading at $18.35.

The buyer of this option has the right but not the obligation to purchase $AAPL at $185 in exchange for paying me $18.35 per share today.

If I choose to SELL this CALL option, I collect the premium, but I am obligating myself to deliver the $AAPL stock at a price of $185 in exchange for keeping the $18.35 premium.

Let’s build out this trade to clearly understand the risk, reward, and reality.

Buy $AAPL at $182.32

Sell 1 January 17, 2025, $185 Call Option @ $18.35

What I like to do is to thoroughly understand what the $18.35 premium that I am collecting represents. This premium goes into my account right away. It allows me to look at the trade and say to myself that I have a MAXIMUM of $18.35 downside protection on my covered call.

Here is what it looks like on the $AAPL chart.

By placing the premium collected visually on a chart I can quickly see how much downside protection I have acquired by collecting the $18.35 of option premium.

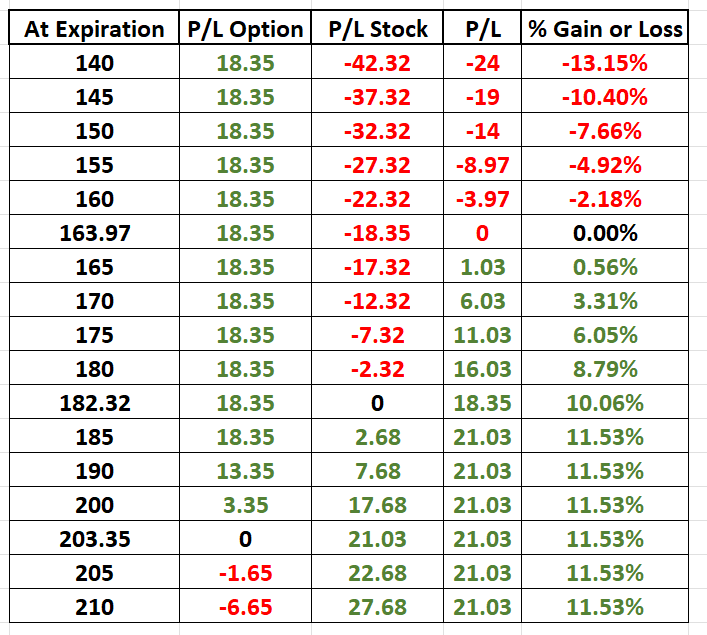

Next, I like to break down the trade by looking at all the possibilities individually and then collectively. I can do this by creating a simple ledger that allows me to see how much profit or loss I experience on each side of the trade.

On the table below you can quickly see what the trade looks like at expiration on January 17, 2025.

If the stock sells off to $140, I lose $42.32 on the APPLE stock, but I gain the full $18.35 in option premium as the option expires worthless. The net result would be a loss of $24 per share which would be a loss of 13.15%.

On the other hand, if at expiration the price of $AAPL is trading at any price above $163.97 I make money on the trade.

By displaying everything on a simple ledger I can quickly see my maximum gain and potential losses very easily. More importantly, I can see the very broad range that $AAPL can trade and still allow me to be profitable. The most exciting aspect of options trading, and particularly covered calls, is when you discover and understand that a stock can move against you quite a bit, and you still will not lose money. This is what inspired me to learn everything I possibly could about options trading.

Whenever trading covered calls the breakeven calculation at expiration is very straightforward. All we need to do is subtract the premium received of $18.35 from the current stock price of $182.32. This tells us that at expiration the stock could trade down to $163.97, and we would not lose any money.

At its core, the reason you want to master Cover Calls is because the premium you collect reduces the cost basis on the stock purchase as well. This has been the preferred method that successful investors have navigated the longer-term volatility of the markets.

The Financial Implications

The calculus of profit and loss in a covered call is straightforward yet profound. The maximum of profit is reached through the combination of the option premium and the stock’s potential appreciation up to the strike price.

In this dance of the covered call strategy, two formidable risks stand at the forefront, casting long shadows over the potential gains. First and foremost, there’s the undeniable threat of financial loss, a specter that looms whenever the stock price tumbles beneath the breakeven threshold. This point of equilibrium, calculated as the stock’s purchase price less the option premium pocketed, marks the line in the sand between profit and peril. In the unforgiving arena of stock ownership, where the stakes are as high as the hopes that fuel them, the risk is not just substantial—it’s paramount. Remember, a stock’s descent to zero wipes the slate clean, erasing 100% of the investment laid on the line. Hence, it’s imperative for those wielding the covered call strategy to not only embrace but also withstand the volatility of the stock market and to understand the worst-case scenario, however improbable it may appear.

Then, there’s the haunting specter of missed opportunity, the second risk that shadows every covered call. This strategy, by its very nature, binds the seller to a predetermined strike price, effectively capping the windfall that could arise from a stock’s surge beyond these bounds. Yes, the premium collected adds a layer of profit, a cushion against regret, but it’s a finite comfort. The heart of the matter is this: when the stock soars, breaking through the ceiling we’ve constructed, we’re left watching from the sidelines, our hands tied by the very strategy we deployed. The lament of “what could have been” echoes in the minds of covered call writers who witness their stocks ascend without them, a stark reminder of the opportunity cost paid for the safety net of premiums. The balance between risk and reward is both delicate and critical, a truth that any investor must confront head-on.

The covered call emerges as a sophisticated yet accessible strategy, offering a blend of income generation and risk management that aligns with both conservative and strategic investment objectives. At its core, this approach leverages your existing stock holdings to craft an additional revenue stream, potentially augmenting the yield of assets, irrespective of their dividend-paying status. This elevation in overall return profile underscores the allure of covered calls in a diversified portfolio.

Notably, the covered call stands out for its comparative risk moderation. By anchoring the option strategy in the bedrock of stock ownership, investors introduce a protective mechanism for the short call, thus navigating the volatile seas of trading with a slightly steadier hand.

Moreover, the covered call strategy is not a one-off maneuver but a repeatable tactic that can be recalibrated and deployed anew with each cycle of option expiry. Whether the market’s movements render your options worthless, thus preserving your stock holdings, or necessitate the relinquishment of shares at the strike price, the opportunity to re-enter the fray, repurchase stocks, and reapply the strategy affords a dynamic rebalancing tool. This iterative capability not only hedges against market volatility but also cultivates an environment of proactive portfolio management, reinforcing the investor’s command over their investment destiny.

What is also important to comprehend is that you do not have to hold the strategy to expiration. You are free to close it out or adapt it at any time. What is also important to do is to explore the shorter-term options to understand the implications on a shorter-term calendar. For example, over the last 5 years the average weekly trading range in $AAPL is 5.63%. Traders armed with artificial intelligence will use this knowledge to engage in covered calls with shorter life spans.

Let me draw an analogy here:

Imagine you’ve bought a ticket to a concert that’s happening in a few months. As each day passes, the concert gets closer. If you decide you can’t go and want to sell the ticket, the value of that ticket might change. If the concert is very popular, the ticket might be worth more closer to the concert date if there are people who really want to go and missed buying tickets early. However, if it turns out the concert isn’t that popular or most people already have tickets, your ticket might become less valuable as the concert date approaches, because there’s less demand and more urgency for you to sell it.

In the world of trading, options are like financial “tickets” that give you the right to buy or sell an asset (like stocks) at a set price before a certain date. The concept of time decay in options trading is somewhat like the changing value of a concert ticket as the concert date approaches.

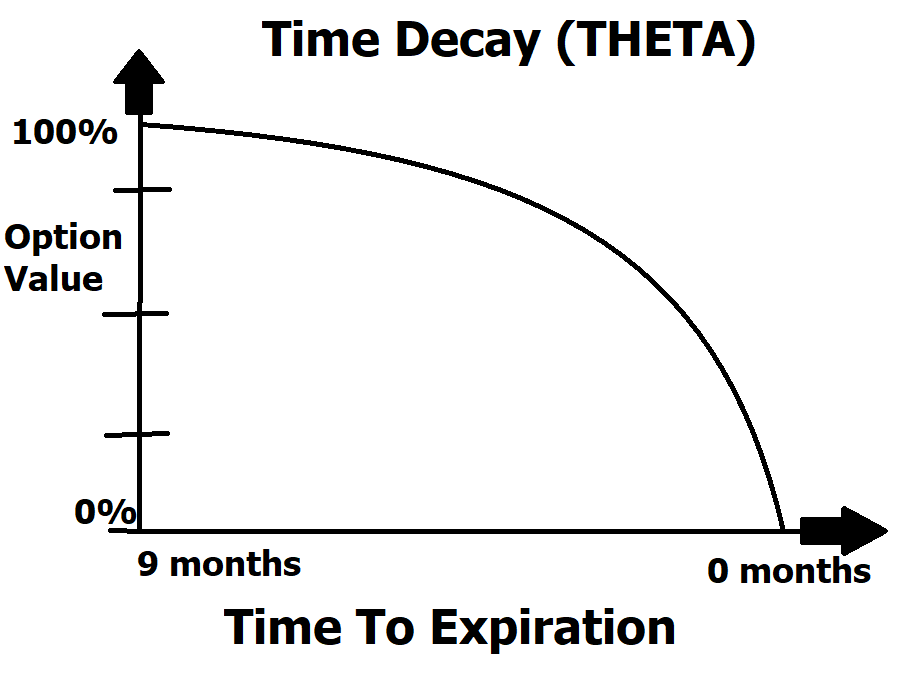

Time decay, known as “Theta,” in options trading, refers to the rate at which the value of an option decreases as it gets closer to its expiration date. Just like our concert ticket, options lose value over time because there’s less time for the stock to move in a way that would make the option more valuable. The closer an option gets to its expiration date without the stock reaching the price needed for the option to be profitable (the “strike price”), the less valuable the option becomes. This is because the chances of the stock making a favorable move decrease as time runs out.

For a new trader, think of time decay like an ice cream cone on a hot day. At first, your ice cream is solid and has its full value. But as time passes, it starts to melt. Similarly, when you buy an option, it has its highest potential value. But as each day goes by, just like the ice cream melting, the option loses a bit of its value, gradually decreasing until the expiration date, when it might have no value left if it’s not in a profitable position (in-the-money).

Understanding time decay is crucial for options traders because it affects how you make decisions about buying, selling, and holding options. It’s especially important if you’re considering holding an option for a longer period, as you need to account for the fact that time is literally money in the world of options trading!

Savvy traders seek to exploit time decay of call options which is always greatest in the last 30 days of an option contracts life.

There are five outcomes of any trade.

1. You make money if stock moves up big

2. You make money if stock moves up a little

3. You make money if stock stays the same

4. You make money if stock moves down a little

5. You make money if stock moves down big

Covered Calls make money in 4 of the 5 potential outcomes listed above. They lose money if the stock moves down big.

When you begin to analytically understand how the cost of time is factored into all options pricing you can create strategies and tactics because they are independent of price direction and trend and focused on time decay.

The covered call emerges as a beacon of strategy and foresight. It’s a testament to the investor’s ability to navigate the intricate dance of risk and reward, crafting a scenario where patience doesn’t just pay off — it profits.

Studying covered calls is essential for investors seeking to enhance their investment strategy for several compelling reasons:

1. **Income Generation**: Covered calls provide an additional income stream from existing stock holdings without requiring further capital investment. This strategy allows investors to earn premium income from options, which can be particularly appealing during periods of low market volatility or when stock prices are relatively flat. It’s a way to potentially increase the returns on your investment portfolio, especially in slow-growing or stagnant markets.

2. **Portfolio Risk Management**: Implementing covered calls can serve as a risk management tool. The premium received from selling the call option can offset some of the potential losses in the underlying stock, thus providing a cushion against market downturns. It’s a conservative strategy that allows investors to maintain their stock positions while reducing downside risk. This aspect of covered calls makes them an attractive option for conservative investors looking to protect their investments.

3. **Market Insight and Discipline**: The process of engaging with covered calls encourages investors to develop a deeper understanding of market dynamics, option pricing, and strategic decision-making. It requires investors to assess their investment objectives and risk tolerance, make informed decisions about which options to sell, and determine appropriate strike prices and expiration dates. This disciplined approach to investing can enhance overall market literacy, improve decision-making skills, and foster a more nuanced appreciation of both the opportunities and risks presented by the financial markets.

By incorporating covered calls into their investment strategy, individuals can not only seek to improve their portfolio’s performance but also gain valuable insights into market mechanisms and enhance their trading skill.

We discuss options trading in our Live Master Class which teaches traders how to trade with artificial intelligence.

Are you ready for a revelation that will redefine how you approach your investments?

Listen up. What I’m about to tell you might just be the most crucial piece of advice you’ll ever hear about making money in today’s shark-infested financial waters.

In our rapidly evolving financial landscape, the key to safeguarding your portfolio—and indeed, to thriving—is no longer a well-kept secret. It’s Artificial Intelligence (A.I.), Machine Learning, and Neural Networks. These technologies are indispensable tools for anyone serious about winning in the markets.

Today, if you’re not leveraging Artificial Intelligence (AI), Machine Learning, and Neural Networks , you’re not just behind; you’re practically handing your money over to those who are.

Let me paint a picture for you. Imagine every bad trade you’ve ever made. Feels bad, right? Now, imagine if you could learn from every single one of those mistakes without ever having to make them again. That’s what A.I. does. It’s like having a trading coach that never sleeps, never stops learning, and is always, always on your side.

This is your chance to turn the tables. With A.I., you’re not just making trades; you’re strategically extracting profits from the market with surgical precision. It’s about small, consistent wins that add up to massive gains over time. And the best part? It removes the guesswork. Your gut feeling is no match for the cold, hard data, and predictive power of AI.

I know what you’re thinking. “Everyone has their theories about what’s going to happen next in the market.” And you’re right. But here’s where we differ—I don’t bet on theories. I bet on A.I. It’s not about what I think will happen; it’s about what A.I. anticipates will happen.

Still with me? Good. Because I’m inviting you to something special. Our next live training session is your front-row ticket to uncovering the secrets of AI in trading. We’ll show you not just one, not two, but at least three stocks that AI has pinpointed as ready to make big moves.

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

It’s not magic. It’s machine learning.

Make it count!

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.