-

View Larger Image

Welcome to the Artificial Intelligence Outlook for Forex trading.

VIDEO TRANSCRIPT

Hello everyone, and welcome back. My name is Greg Firman, and this is the Vantage Point AI Market Outlook for the week of December 18th, 2023. Now, as we move into year-end, the dollar has made the move as we anticipated in last week’s weekly Outlook. With the dollar usually weak after the non-farm payroll on Tuesday and Wednesday, this past week we’ve had the Fed. The FED has finally conceded that rate hikes are coming to an end and cuts are on the horizon, which immediately weakened the dollar.

U.S. Dollar Index

But again, if we look at our Vantage Point software, our MA diff cross, the medium-term trend crossing over the long-term trend, was one day ahead of this particular move. Our T cross long, our current monthly opening price, contained price action along with our verified resistance high from November 22nd. So, again, with all of this resistance building, in my respectful opinion, even if the Fed said nothing, the tightening cycle is coming to an end, and it would just prolong the inevitable.

Now, on Friday, we’ve seen some recovery here on the dollar, but again, our main levels for next week are the long-predicted and our T cross long at 102.97 and 103.52. Now, we have our current yearly opening price also sitting at 103.66. It is very unlikely that the dollar will be able to retake that level, and again, starting in January 1, we will get a new yearly opening price, which is a very exciting time of year. Things are not looking great in 2024 for the dollar, but things can change very quickly in these particular markets. Right now, our neural index strength is showing caution that a retracement is likely. So, those retracement points I’ve outlined here, and I believe that will contain the dollar index for the remainder of the year.

GOLD

Now, with that move in the dollar, all other markets responded to that, and that’s what we were looking for. Now, midweek, we can see that we had support building down here at about the 1975 mark, and just waiting, we’ve got profit-taking ahead of the Federal Reserve announcement. The second the FED even mentioned the word rate cut, gold went right back up. Now, it went under a little bit of selling pressure on Friday, but I believe that to be more profit-taking. Our T cross long coming in at 2013, and again, it’s not just the month of December that has a good seasonal pattern. January is also very good usually for gold too, and the FED is just kind of sweetened the pot a little bit here. But again, there will still be some volatility. But our predicted differences are moving up. We’re holding above our T cross long that’s coming in at or about the 2013 area, and the yearly opening price way down here at 18.24, the quarterly opening at 18.48 providing very good support. We can see as we did in this particular weekly Outlook back in October, we had very strong support on the current yearly opening price, and with that, prices accelerated from that particular point. Again, making that point in time indicator in Vantage Point that looks at the current monthly opening, the current yearly, weekly, and quarterly opening, we get these specific levels that we can trade from. We just match our Vantage Point indicators to those current opening prices.

S&P 500 Index

Now, when we look at stocks, stocks again have moved higher, but I will point out that this move started long ago, guys, way back in November on the initial dollar selloff. So right now, we’ve pushed higher, but not a lot of follow-through from Wednesday’s move. The high there is 4709. We’re going to finish out the week closing at 4719. Good support here down at our long-predicted 4678. Our T cross long at 4600. But again, our quarterly, our yearly, and our monthly opening prices not under any real threat at the particular time. But a retracement would be normal before we go into year-end and before we start January. The indicators are a little bit mixed. Obviously, we’re in heavily overbought territory, but that certainly does not deter a market from going higher. Overbought, oversold, that’s a very, very old methodology here, guys. We’ve got a lot of algorithms trading these markets. They don’t care if it’s overbought or oversold. They continue to sell; they continue to buy. So for now, a bit of a retracement here that would likely be starting the week next week would likely be between 4678 and the 4600 mark.

Crude Oil

Now, when we look at light crude oil, a very minor recovery from the FED, but as you can see, that fizzled out pretty quickly. Our T cross long there coming in at 73.16. We remain short while below that level. The current monthly opening price, 75.74, the yearly opening price, 80.73, and the quarterly at 89.99. This is a very, very bearish setup, guys, but again, we discussed this, or I discussed this, excuse me, in this particular AI weekly Outlook back in November. The second we lose the current yearly opening price, that would be the trigger point to see this go lower. Now, being below the Vantage Point T cross long just again made it that much easier to see this move. Again, we do have a couple of strong verified support lows here now, 67.44, and we’ve got another one that’s coming in at about the 6,900 mark, so we’re going to use that for support next week. The indicators are moderately bullish on oil, but at this time of year, again, not an overly strong seasonal pattern for the long side here. I believe we’ll likely go sideways for a little bit longer.

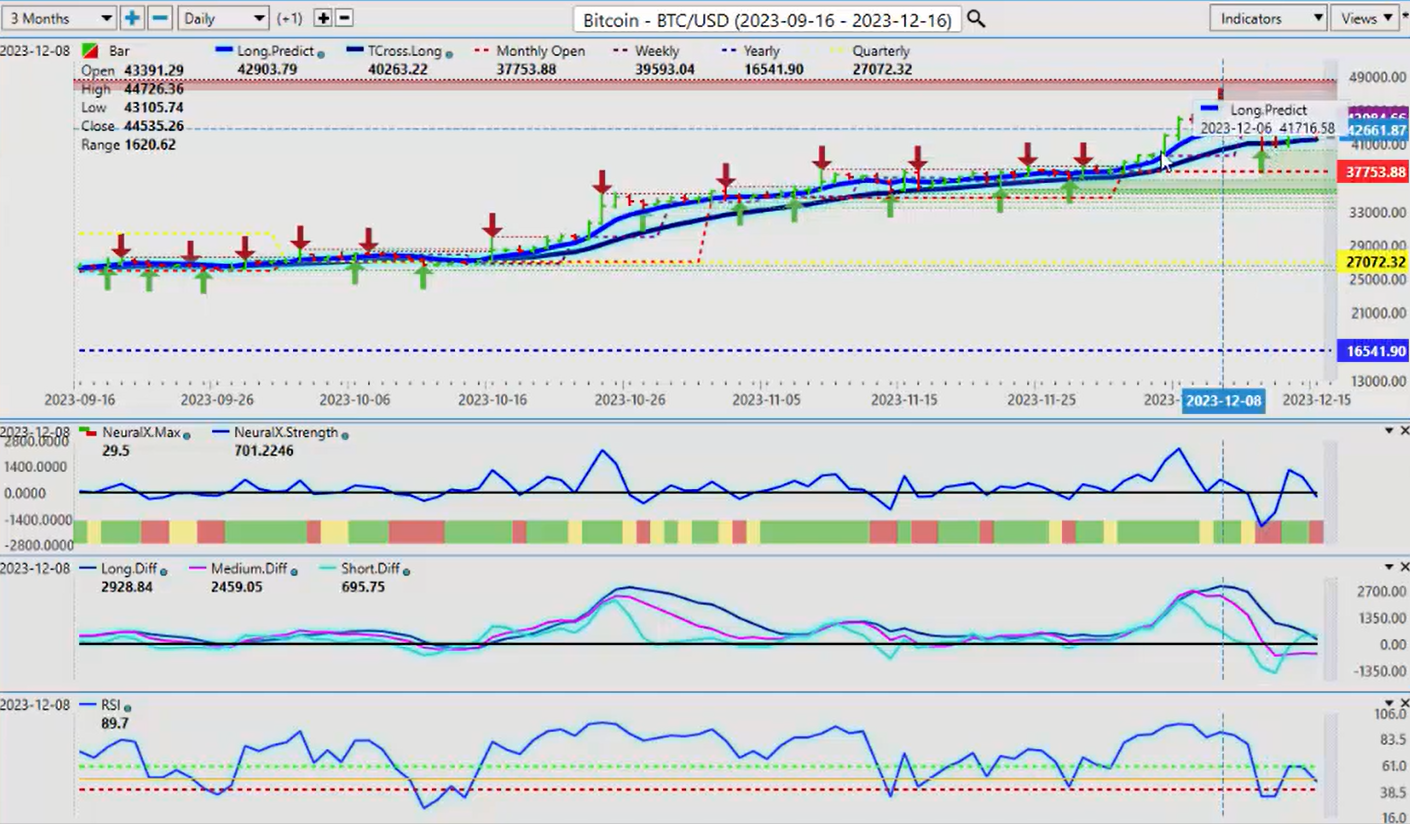

Bitcoin

Now, when we look at Bitcoin, Bitcoin not really benefiting from this US dollar selloff, which I do find very interesting. We had this initial spike up; I believe that this is retail traders coming into Bitcoin after the initial spike or that break of that 38,000 mark. So the retail traders have come in, pushed it higher, but very quickly, the market, this particular asset class, has fizzled out. Now, this entire past week, you can see that the market is hitting the V Point predicted moving average, the T cross long, specifically at about 41,431. We’ve hit this again on today, on Friday. So again, if we lose this level, then we could see Bitcoin slide lower, but in order to buy it, I think we need a break of the most current high at 44726 to confirm that upside bias. And right now, the Vantage Point indicators do not support that at the current time.

Euro versus U.S. Dollar

Now, as we go into some of our main Forex pairs this week, the Euro really benefiting from that dollar selloff. But you can see as quickly as the Euro made the gains, it gave it right back on Friday on profit-taking because always remember that for a Forex pair, there’s a dual transaction. When they buy Euro/US, they buy the Euro, they sell the dollar. But if they long Euro/US and they close that trade, what are they doing? They’re actually selling the Euro and buying the dollar back. So that profit-taking is driving it lower. But this is why we use the predicted moving averages as pivot or anchor points because we can identify 108.49 is our key level for next week. As long as we hold above that level, longs are still good. We also have our monthly opening price at 108.88, so good support here down all the way down. But you can see, again, this is why we use current yearly opening, current monthly, current weekly, current quarterly opening because, again, it came right down within 20 or 30 pips of the current yearly opening price. And long before the FED made that announcement, the Euro was already rising. So again, maybe they leaked the information, maybe they didn’t, but right now, a bullish setup remains intact on the Euro. We just need it to correct a little bit lower, that area likely 108.49.

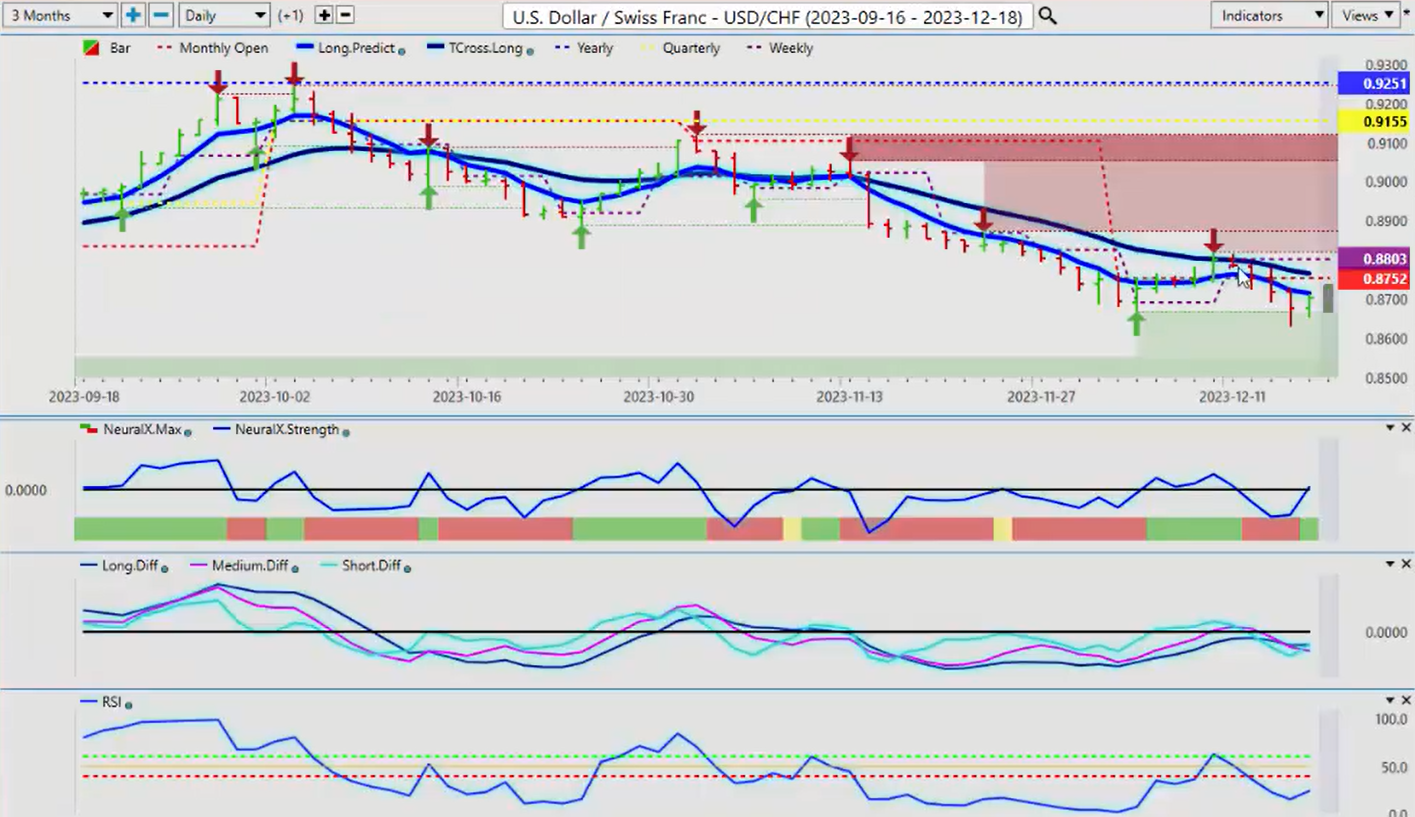

U.S. Dollar versus Swiss Franc

Now, the US Swiss franc again coming up, hitting into that Vantage Point T cross long very early in the week this past week, and you can see every single day it came up and hit that T cross long at 87.85 and continued to fail, and then we had a bigger move down. Now we’ve flattened out, but our T cross long is at 87.64. The indicators here are saying a very mixed bag here. The neural index is saying we’re going to correct higher on Monday, but the MA diff cross is saying we’re likely going lower by Tuesday or Wednesday. So look for a move higher on Monday to reset those particular shorts, anywhere near the current monthly opening price that’s coming in at about the 8,800 mark, or excuse me, 87.52. T cross long 87.64, and this past week, 88.03. The weekly opening contained basically contained this pair for the better part of the week. So watch those levels again for another shot at a potential short here.

British Pound versus U.S. Dollar

Now, pound dollar again has moved up aggressively. The same thing here, guys. The pair has gotten all tangled up in the Vantage Point T cross long this past week and then used that as a leverage point to spike up. Now, that’s exactly what we look for, 125.55. So to start the week next week, your T Cross long is at 125.88. Our long-predicted 126.47, that is likely your area to consider longs. We also have the Vantage Point predicted low at 126.22 for Monday, so that’s a good area. And then the final area of support would come in at the T cross long at 125.88. Now, the 125.48 was the weekly opening. That’s going to reset right around the same area for next week, right around 126.80. So that’s going to be our sweet spot for next week to look for it to hold above that so we can get back in with these longs. The only slight concern I’ve got up here is this verified resistance high from November 28th, and that’s coming in at 127.33. So we can also buy a break of that particular level.

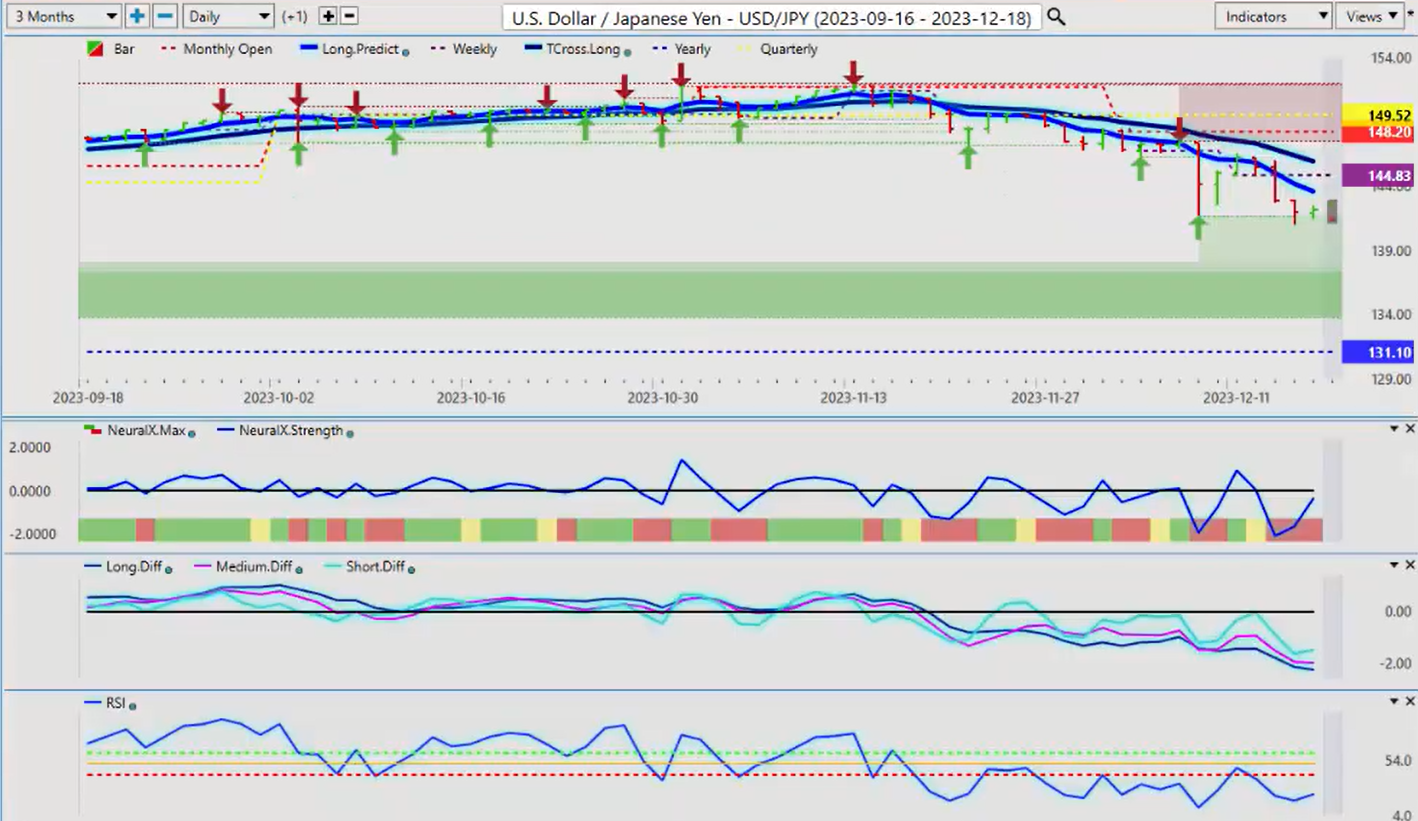

U.S. Dollar versus Japanese Yen

Now, the dollar-yen again, and as I’ve discussed over the last several weekly outlooks, the concern with buying this up here, even with a bullish signal, is that the interest rate differential is going to change between the Bank of Japan and the Federal Reserve. Now, if the FED cuts three times in 2024, that’s still not going to make a huge difference here on the carry trade, only in my respectful opinion. So again, this pair could find some support here, but I don’t believe that’s going to be anytime soon. But our current low is 141.67. That’s the area we’ll keep our eye on. I don’t anticipate a test of the current yearly opening price, but anything is possible. I will say that yearly opening price is 131. That would be a pretty significant move if that were to happen by year-end, but I do think we can get to that level potentially by mid to late January before we start to reverse. So again, shorts still carry the edge here. Our T cross long is at 145.89. That’s our line in the sand. Watch that area very closely. But as you can see, you can trade the Vantage Point long-predicted on a daily basis by selling into that. But we’ve got a bit of a gap between these long-predicted at 143.61 and T cross long at 145.89. I would target between those two levels for shorts going into next week’s trade.

U.S. Dollar versus Canadian Dollar

Now, as we look at some of the additional equity-based pairs in the energy sector, the Canadian dollar, I believe the Canadian dollar will be the next bank that will talk about pending rate cuts. And I say that because Canada’s biggest trading partner is the US. So if the FED is cutting, there is certainly no reason for the Bank of Canada to be hiking or to even be on hold given the state of the Canadian economy, which is very much softening here. So right now, the US-Canada, be very mindful of what I just said. I don’t think you’re going to get a big reversal, but you are going to get a reversal higher. It’s not a question of if; it’s a question of when. So right now, we’ve got a bit of a gap to fill here, and that’s why I don’t like shorts now. Our T cross long is at 134.87, or 135.65, excuse me, and our long-predicted is at 134.87. I would not even consider shorts, guys, until we come up and test that particular area. Our predicted high for Monday, for example, is 134.28. There is a significant gap between that and the long-predicted and the T cross long. So let this thing retrace a little bit back towards its yearly opening price, and then we can reassess. The yearly opening price is 135.51. You can see we’ve been tangled up this all week. But again, I believe the Bank of Canada will be the next one that will be discussing rate cuts, not just the US.

Australian Dollar versus U.S. Dollar

Now, the Aussie, the Aussie has clearly benefited from that talk of rate cuts. We’re pushing higher, as we discussed in last week’s weekly Outlook that the Aussie would be a favorable pair to trade as long as stocks go higher, same as the Kiwi/US. But for now, once again, I think we’ve got a little bit of a gap to fill here. So between the long-predicted and the T cross long, those two areas come in at 66.46 and 65.98. That area looks pretty good. Again, a mixed signal, neural index strength pointing down. The neural index is green, however, but the short, medium, and long-term crossovers have all completed on the zero line. The predicted RSI is running sideways, but that’s perfectly normal after a big move like this on Wednesday. We had a little bit of follow-through on Thursday, then we have profit-taking on Friday. But nothing in this particular trend at the current time has changed. The Aussie is not cutting anytime soon, so it gives them a slight advantage. But again, right now, we’ll continue to monitor this pair. But let these gaps get filled before we reset our longs.

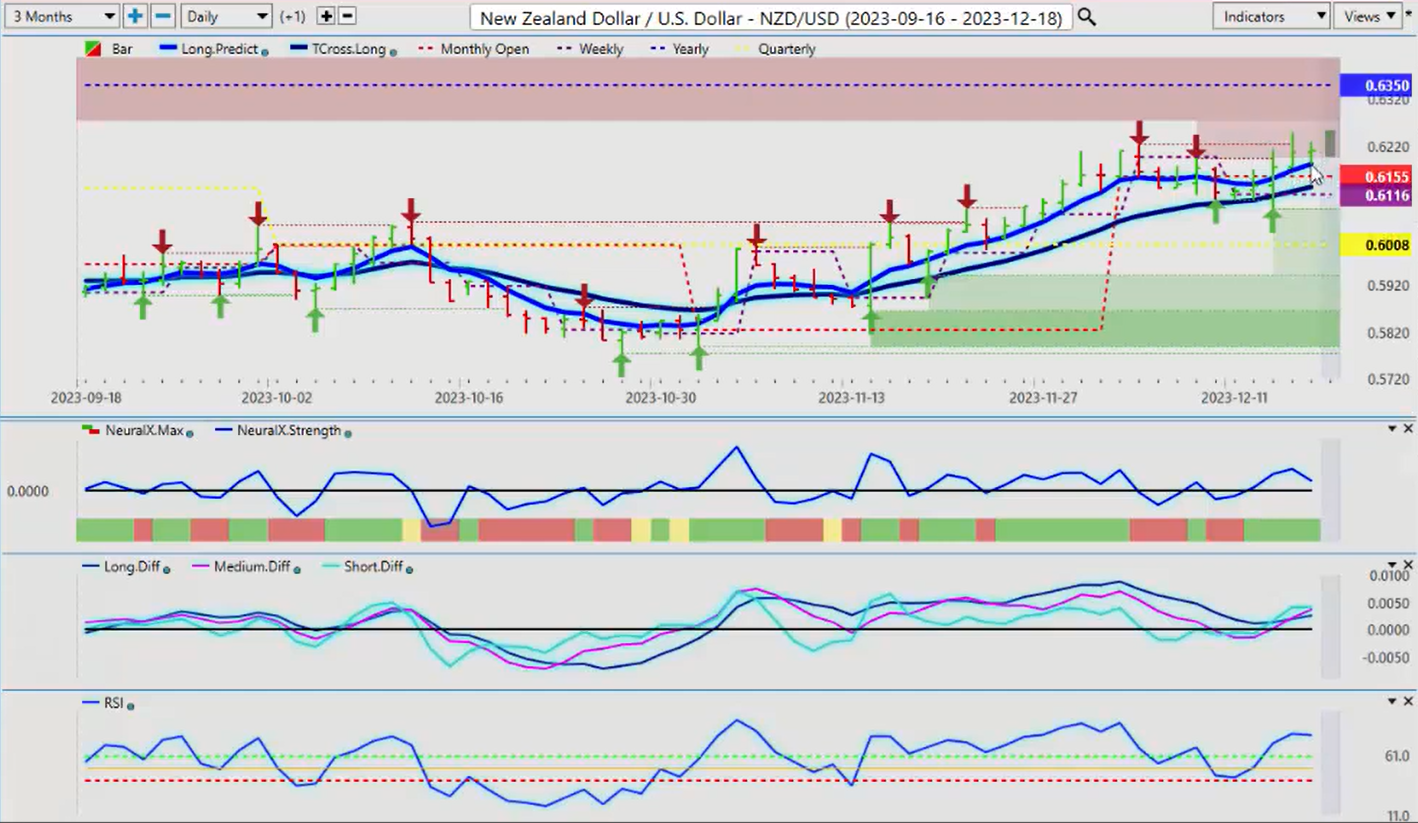

New Zealand Dollar versus U.S. Dollar

The same thing would apply to the Kiwi. When we look at this, you can see it just broke above our long-predicted. Using the T cross long as a pivot area to buy from on Thursday, we come down, touch the long-predicted to the number at 61.67, and then we push higher again. But we didn’t make a new high on this one, guys. And that’s par for the course on a Friday because there’s going to be some profit-taking. The indicators here are basically pointing to a fresh new uptrend is in progress, and I believe that to be true. And I will continue to leverage the quarter-opening price as a potential area that it could come to. But I think it’s very, very unlikely. I believe the T cross long at 61.32 will contain the downside for next week’s trade. So with that said, this is the Vantage Point AI Market Outlook for the week of December 18th, 2023.