Key Takeaways

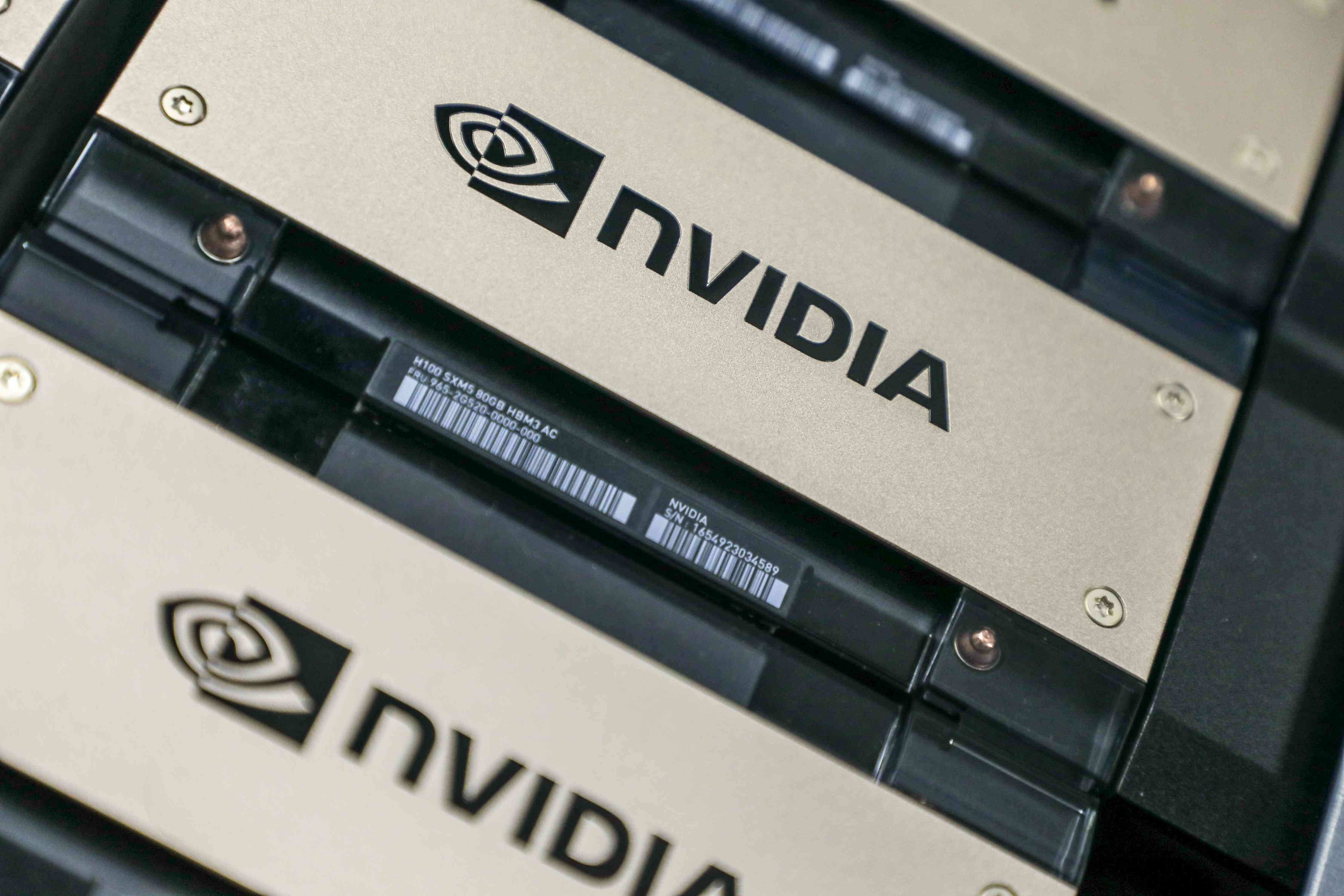

- Nvidia, AMD, and other chip stocks gained Friday, rebounding from recent losses as analysts suggested they have further to climb as AI demand surges.

- Despite Friday’s gains, many chip stocks haven’t completely recovered from losses earlier this month.

- July has been a tough month for chip stocks amid concerns about tightening trade restrictions and as investors rotated into small-cap stocks, expecting they could benefit from Federal Reserve rate cuts.

Shares of Nvidia ( NVDA ), Advanced Micro Devices ( AMD ), Broadcom ( AVGO ), and other chipmakers were on the rise Friday, rebounding from recent losses, as analysts said the torrid rise in chip stocks this year on surging demand for artificial intelligence (AI) is likely nowhere near its peak.

The iShares Semiconductor ETF ( SOXX ) was up more than 2% in afternoon trading Friday, recovering from losses Thursday, though the fund was still down about 7% from the start of the month after a few difficult weeks for chip stocks.

A Tough Month for Chip Stocks

Semiconductor stocks took a hit this month amid concerns about tightening trade restrictions and as investors rotated into small-cap stocks , expecting they could benefit from Federal Reserve rate cuts.

On Friday, the government reported that inflation moderated in June, reinforcing expectations of a rate cut in September on the heels of other encouraging economic data earlier in the month.

However, analysts suggested the recent pressure on chip stocks could be short-lived as the broader rally in chip stocks this year makes a comeback on strong fundamentals and surging demand for AI.

The Start of the Tech Bull Run on an ‘AI Tidal Wave’

“This is the start… not the end of this tech bull run in our view fueled by this AI tidal wave of spending on the doorstep,” Wedbush analysts wrote in a note Thursday.

The analysts said they anticipate companies and governments combined could spend over $1 trillion over the next few years to fuel what they called the “AI Revolution.”

Chipmakers are likely to be key beneficiaries of that surge in AI spending, with Bank of America analysts expecting that those most exposed to data center and AI end markets like Nvidia and Broadcom could have the most to gain.