-

View Larger Image

Macy’s (M)

This week’s stock analysis is MACY’S (M) which highlights an opportunity this month for potential gains. From the cross-over on November 6 th , let’s explore how artificial intelligence could have helped you locate this opportunity.

VantagePoint Software Prediction

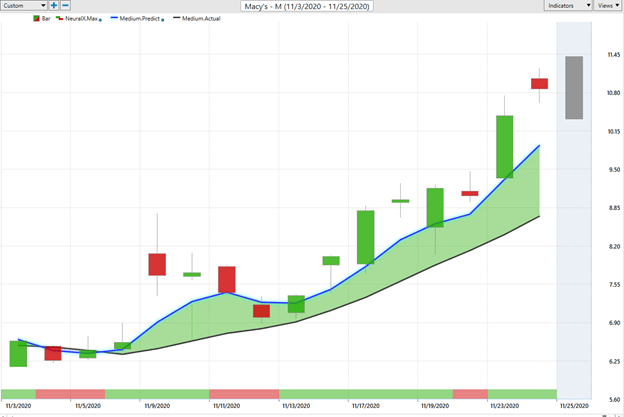

When using the VantagePoint software in your trading, the predictive blue line acts as your North Star. When the predictive blue line rises above the black line it is the first indication that an UPWARD trend is forming.

VantagePoint began to showcase signs of a trend change on MACY’S on 11/6/20. The Neural Index (The Green/Red Bar below the candles) turned green accompanied by a trend change in the medium term forecast (the Predictive Blue Line moving above the Black Line.) These two indicators when paired together provide a very reliable guide for determining future price action.

The momentum upward was evident the following day with a huge move up, followed by a three-day retracement. The Neural Index, returned to green on 11/13/20 and the trend began to resume upward.

Over the last year Macy’s (M) has had a 52 week low price of $4.38 and a 52 week high price of $18.57. This annual price range equates to $14.19. The artificial intelligence has captured $4.27 a share in just the last 13 trading sessions. This provide a pretty good idea of how artificial intelligence will focus your energy on the right market, at the right time.

It is not uncommon for companies like MACY’S (M) to rise seasonally before major holiday events like Christmas.

From a fundamental perspective, earnings are important: Macy’s on Nov. 19, lost 19 cents per share during the third quarter, as revenue fell 23% to $3.99 billion . Same-store sales fell 21%. However, none of those figures were as bad as analysts expected. Digital sales jumped 27% during the quarter, but that was slower than the 53% growth logged in the second quarter.

In generations past, Macy’s defined the possibilities of retail penetration. What started as a New York City dry goods shop in the 1850s grew to include Bloomingdale’s and became a holiday beacon, with its own holiday parade. However today Macy’s has stiff competition from Amazon, the online leader in eCommerce.

With the Vantagepoint software as momentum is rising, the Artificial Intelligence signals that the best purchasing opportunities are at or below the predictive blue line .

This feature allows ai Power Traders to look for short term swing trading opportunities based upon a pullback on the stock. At this particular juncture on the MACY’S chart, traders are trailing the stock with a protective stop loss to minimize risk on the trade. However, look at the multiple amazing entry possibilities that the predictive blue line offered to traders over the last 13 sessions.

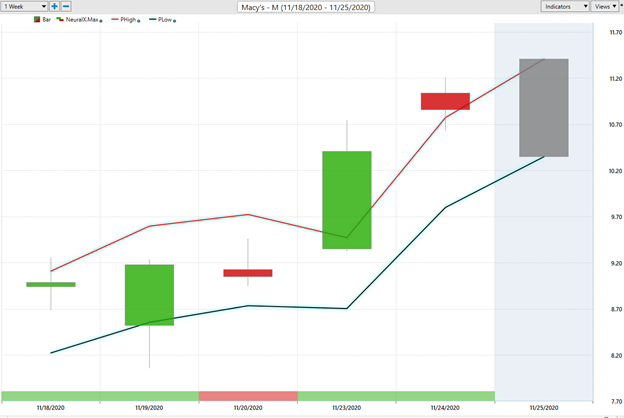

Another valuable aspect of the Vantagepoint software is that it provides forecasts for the next trading days high price and low price. This is an extremely valuable feature for short term swing traders who are looking for a better trade entries and exits.

Intermarket Analysis of Macy’s

A powerful feature of the Vantagepoint Software is the ability to look at the intermarket analysis of individual stocks and other instruments. This feature quickly highlights the key drivers of an underlying assets price. These key drivers are the statistically most correlated assets to MACY’S (M) . Here is a quick graphic showing what the key drivers are:

These are all of the stocks, ETF’s and Futures contracts most closely aligned with MACY’S (M) price movement.

About Macy’s

Macy’s is an American department store chain founded in 1858 by Rowland Hussey Macy. It became a division of the Cincinnati-based Federated Department Stores in 1994, through which it is affiliated with the Bloomingdale’s department store chain; the holding company was renamed Macy’s, Inc. in 2007. Macy’s has a market cap of $3.3 billion. On average it trades over 39 million shares a day. Macy’s has conducted the annual Macy’s Thanksgiving Day Parade in New York City since 1924 which has a worldwide audience. They have also sponsored the city’s annual Fourth of July fireworks display since 1976.

Macy’s Herald Square is one of the largest department stores in the world. This location covers almost an entire New York City block, features about 1.1 million square feet of retail space. The value of Herald Square location has been estimated at around $3 billion.