-

View Larger Image

NXP Semiconductors N.V. (NXPI)

This week’s stock analysis is NXP Semiconductors (NXPI) which highlights an opportunity this month for potential gains. From the cross-over on November 2 nd , let’s explore how artificial intelligence could have helped you locate this opportunity.

VantagePoint Software Prediction

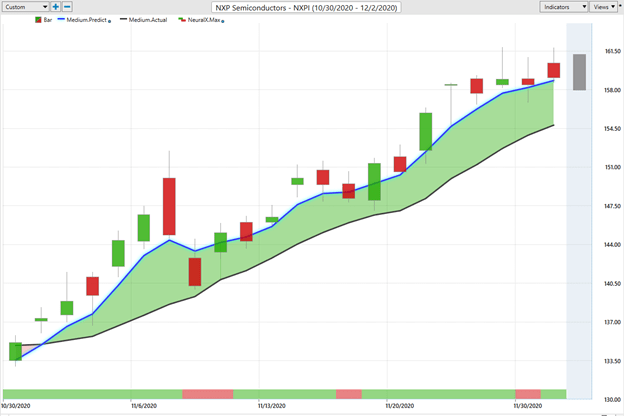

When using the VantagePoint software in your trading, the predictive blue line acts as your North Star. When the predictive blue line rises above the black line it is the first indication that an UPWARD trend is forming.

VantagePoint began to showcase signs of a trend change on NXPI on 11/2/20. The Neural Index (The Green/Red Bar below the candles) turned green accompanied by a trend change in the medium-term forecast (the Predictive Blue Line moving above the Black Line.) These two indicators when paired together provide a very reliable guide for determining future price action.

The momentum upward was evident the following day with a huge move up. For the next five trading sessions the price of NXPI consistently stayed above the predictive blue line indicating tremendous strength. Followed by a one-day retracement the stock has continued to perform well when measured against the broader market.

Some common-sense metrics: Over the last 52 weeks NXPI has traded as high as 161.84 and as low as $58.41. This provides us with an annual trading range of $103.43.

When we divide the annual trading range by 52 weeks, we can determine that the average annual weekly trading range is $1.98.

The artificial intelligence has captured $21.71 a share in just the last 21 trading sessions. This advance is far beyond what would be considered normal for the stock and provides a pretty good idea of how artificial intelligence can focus your energy on the right market, at the right time.

With the Vantagepoint software as momentum is rising, the Artificial Intelligence signals that the best purchasing opportunities are at or below the predictive blue line .

This feature allows ai Power Traders to look for short term swing trading opportunities based upon a pullback on the stock.

At this juncture on the NXPI chart, traders are trailing the stock with a protective stop loss to minimize risk on the trade. However, look at the multiple amazing entry possibilities that the predictive blue line offered to traders over the last 21 sessions. Intelliscan users love this feature of the Vantagepoint software where they can scan for stocks in strong uptrends that have fallen below the predictive blue line.

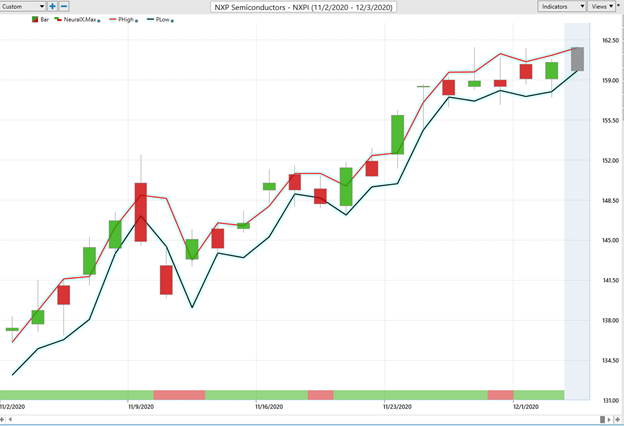

Another valuable aspect of the Vantagepoint software is that it provides forecasts for the next trading days high price and low price. This is an extremely valuable feature for short term swing traders who are looking for a better trade entry and very short-term trades and viable exits.

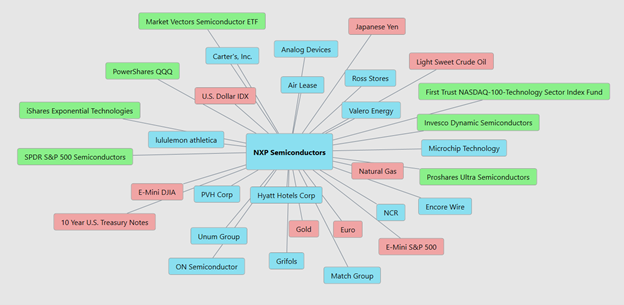

Intermarket Analysis of NXP Semiconductors

A powerful feature of the Vantagepoint Software is the ability to look at the intermarket analysis of individual stocks and other instruments. This feature quickly highlights the key drivers of an underlying assets price. These key drivers are the statistically most correlated assets to NXP Semiconductor (NXPI). Here is a quick graphic showing what the key drivers are at the present moment:

These are all of the stocks, ETF’s and Futures contracts most closely aligned with NXP Semiconductors (NXPI) price movement. This is very powerful and useful information because it very quickly allows you to see the ETF’s, mutual funds and commodities that are very tightly aligned with the price movement of NXPI.

About NXP Semiconductors (NXPI)

NXP Semiconductors N.V. is an American Dutch semiconductor manufacturer with headquarters in Eindhoven, Netherlands and Austin, Texas. The company employs approximately 31,000 people in more than 35 countries. They generate $9.41 billion in revenue and trade an average volume of 2.1 million shares a day. NXPI has a market cap of $45.15 billion.

NXP is the fifth-largest non-memory semiconductor supplier in the world, and the leading semiconductor supplier for the secure identification, automotive and digital networking industries.