-

View Larger Image

Peloton (PTON)

This week’s stock analysis is Peloton (PTON) which has benefited greatly from the COVID-19 stay at home economic lockdown. Peloton has 3.1 million members and has rallied over 440% in 2020. Over the last eight years it has established itself as the premium at home fitness platform. Peloton generates most of its revenue through sales of bikes and treadmills which range in price from $1895 to $4295. Monthly subscriptions to its digital fitness platform are available and range in price from $12.99 to $39 a month for an All Access membership.

Peloton revised its revenue estimate for the fiscal year to $3.9 billion, up 10% from the prior estimate of $3.5 billion. Subscriptions for the digital exercise platform grew 137% year over year to 1.3 million users.

In this particular study we do not focus on things like earnings as we are focusing on short term swings in the markets. Earnings are vitally important to the long term vitality of a company, but they are what longer term investors will focus on with a buy and hold mentality.

In November, shares also got a giant price boost when Peloton announced a partnership with recording artist Beyonce. The partnership will begin with themed workout classes and donations of Peloton digital memberships to students of historically Black colleges and Universities. December also saw the launch of the highly requested Pilates vertical of the Peloton digital studio. While this story is explosive in nature, a.i,. traders are trained to wait for the a.i. to signal that an uptrend is underway.

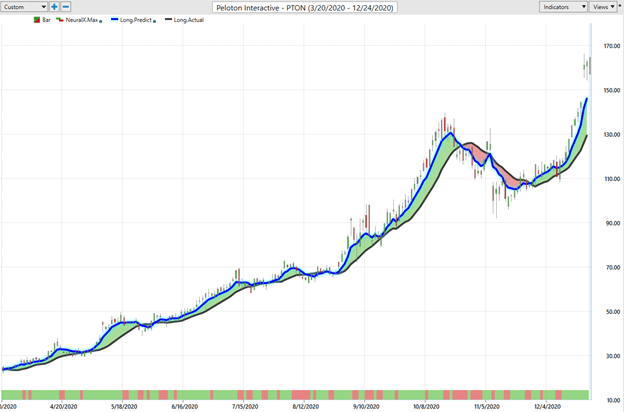

As you study the chart below notice how PELOTON has outperformed the major market indexes from the March lows. As the nation, moved to a remote working environment, Peloton was positioned to capture a large share of fitness marketplace that was no longer going to gyms to exercise.

VantagePoint Software Prediction

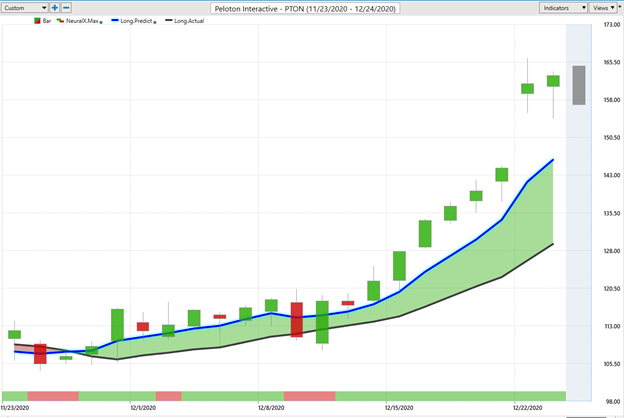

For this Weekly Stock Study we will focus upon the price action of Peloton from November 27 th forward which is when the artificial intelligence last signaled an uptrend. But as you study the chart above you can observe how the artificial intelligence is focused on keeping traders on the right side of the trend at the right time.

In the Vantagepoint Software the predictive blue line is the indicator that highlights future trend direction. Whenever the predictive blue line passes above the black line, the artificial intelligence is indicating that the future price direction of the underlying asset is UP. This occurred on November 27 th . The price of Peloton was $108.98.

VantagePoint confirmed signs of this upward trend change on PTON on 11/27/20 with the Neural INDEX being GREEN.

Please notice how the close on 11/27 was directly on the predictive blue line.

These two indicators when paired together provide a very reliable guide for determining future price action as indicated by the explosive move higher the following day.

Power Traders monitor the value of the predictive blue line as their value zone. Over the next two weeks there were numerous opportunities to buy at or below the predictive blue line before Peloton exploded higher in price. The predictive blue line acts as a “value boundary” for traders. Two closes below the predictive blue line are an indication that the trend is changing.

Observe how on 12/9 PTON closed below the blue line and quickly bounced back the following day. From that point forward the price has never retraced to the predictive blue line “value zone.”

Let’s consider the common-sense metrics: Over the last 52 weeks Peloton has traded as high as $166.23 and as low as $17.70. This provides us with an annual trading range of $148.53.

When we divide the annual trading range by 52 weeks, we can determine that the average annual weekly trading range is $2.85

The artificial intelligence has captured $53.40 a share in just the last 19 trading sessions.

This upward advance highlights the explosive nature of this trend in PTON and is far beyond what would be considered normal for the stock.

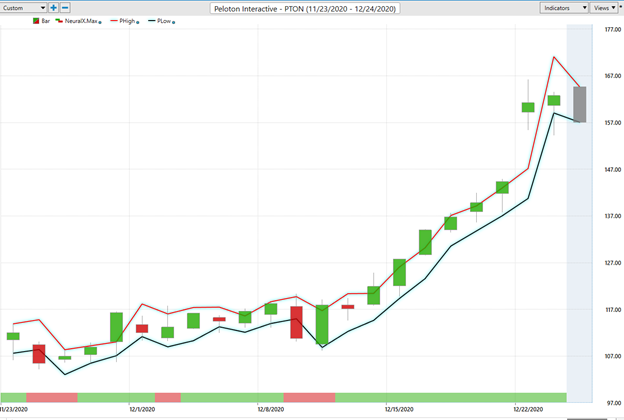

Another extremely valuable aspect of the Vantagepoint software is that it provides forecasts for the next trading days high price and low price. This is a feature which allows for short term swing traders to fine tune their order placement when they are looking for a better trade entry and and viable exits. This feature of the artificial intelligence is extremely popular among a.i. traders in that it helps tremendously in creating better positioning.

It is unquestionable that when you combine the a.i., with the neural network and the predictive blue line that you will know the trend is UP and you will have multiple areas where you want to get long in the market.

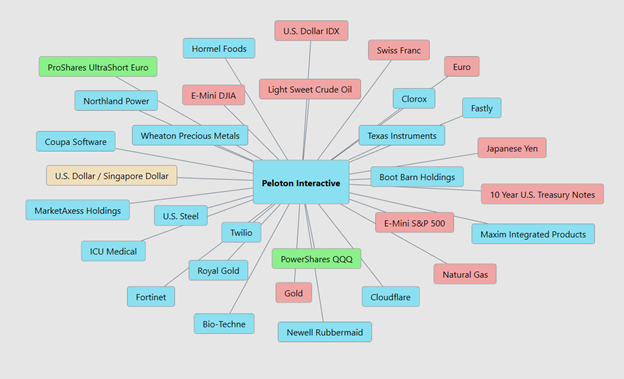

Intermarket Analysis of Peloton (PTON)

The unique patented processes of the Vantagepoint software is its ability to analyze the intermarket correlations for stocks and other financial instruments.

This powerful feature quickly highlights the key drivers of an underlying assets price. These key drivers are the statistically most correlated assets to PELOTON (PTON).

These are all of the stocks, ETF’s, mutual funds and Futures contracts most closely aligned with PELOTON price movement. This is very useful information because it very quickly allows you to see the ETF’s, mutual funds and commodities that are very tightly aligned with the price movement of PTON.

With the giant price action that Peloton has experienced this year it should be no surprise that APPLE (AAPL) is looking to step into the digital fitness space due to the popularity of the APPLE Watch.

The long-term outlook for Peloton remains positive as Covid-19 closures look to bolster Pelotons business for the near future.

Bottom line: A.I. Traders should look for sharp pullbacks in Peloton to position themselves for quick swing trades based upon the value zones provided by the a.i. and neural networks.

We recommend add the stock to their trading watchlists, and keep an eye out for a new proper entry.

About PELOTON (PTON)

Peloton is an American exercise equipment and media company that was founded in 2012 and launched with help from a Kickstarter funding campaign in 2013. Based in New York City, Peloton’s main products include a stationary bicycle and treadmill that allow monthly subscribers to remotely participate in classes that are streamed from the company’s fitness studio. Much of the company’s popularity stems from its now-celebrity fitness instructors. Cofounder and CEO John Foley spent 3 years pitching the company to thousands of potential investors, who rejected the idea.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.