-

View Larger Image

Signature Bank (SBNY)

This week’s stock analysis is Signature Bank (SBNY) .

Let’s first start off with the common-sense metrics and an annual look at the chart.

By simply eyeballing the chart we can quickly see that it has been a very volatile year for Signature Bank and all other banking stocks. Essentially the stock is finishing the year very close to where it started but due to the COVIS-19 lockdown and other factors SBNY saw a 50% drop which it retested twice throughout the year.

SBNY has traded as low as 68.98 and as high as $148.64 during the year. This provides us with an annual trading range of $79.66. When we divide this annual trading range by 52 weeks we can quickly determine that the average weekly trading range for SBNY is $1.53.

This number is a guide to try and define “average” and “normal” which many traders will utilize for stop placement and taking profits.

So far the artificial intelligence has captured $36.68 per share in only 36 days. This is far beyond what the common sense metrics would define as normal.

Signature Bank ‘s has seen improving revenues and a robust balance sheet position, aided by a rise in deposits and loan balances. However, a low interest rate environment remain problematic for the company and the entire banking sector.

In other words, how else can the bank make money if monetary policy continues to favor a close to zero interest rate environment?

While investors in SBNY might want to spend time studying the earnings, cash and the net interest compounded annual growth rate for the company we are focused on finding short terms swing trades which emphasize a strong trend which we can exploit for short term gains.

VantagePoint Software Prediction

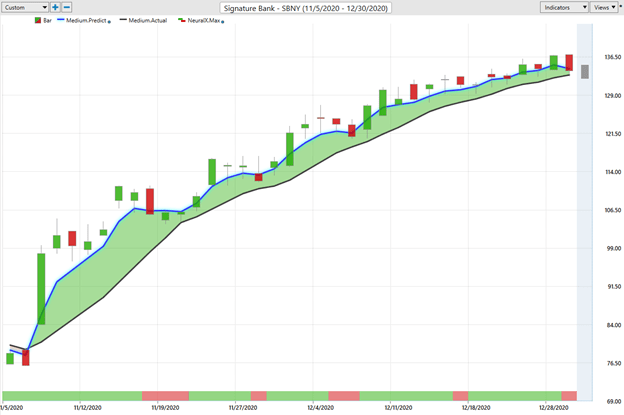

In the Vantagepoint Software the predictive blue line is the indicator that highlights future trend direction. Whenever the predictive blue line passes above the black line, the artificial intelligence is indicating that the future price direction of the underlying asset is UP.

For this Weekly Stock Study e will focus upon the price action of Signature Bank (SBNY) from November 9 th forward which is when the artificial intelligence last signaled an uptrend. On November 9 th SBNY exploded upward closing the day at 97.76 up 21.75 points on the day.

Power traders focus on the predictive blue line in the Vantagepoint Software to anticipate trend direction. Trying to buy at or below the predictive blue line is referred to as a value zone. As you study the chart observe how the predictive blue line often acts as very strong support, verifying that strong demand enters the market at the price level where the predictive blue line is defining value.

At the bottom of the Vantagepoint Software chart for SBNY is the Neural Index. This Index forecasts the short-term anticipated strength or weakness in the market. Note how when the neural index is green the price tends to increase, and when the neural index is red the price has a tendency to trade closer to the predictive blue line.

These two indicators when paired together provide a very reliable guide for determining future price action.

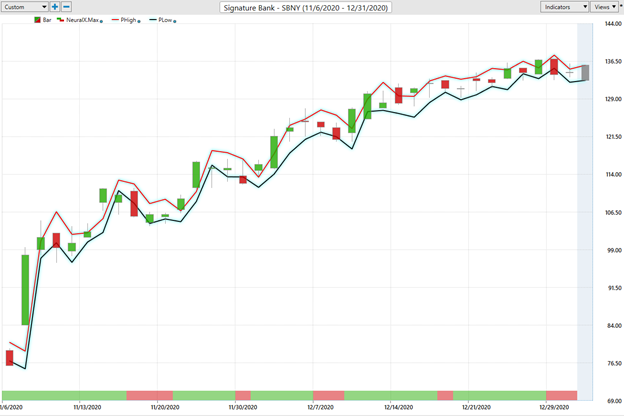

Another extremely valuable aspect of the Vantagepoint software is that it provides forecasts for the next trading days high price and low price. This is a feature which allows for short term swing traders to fine tune their order placement when they are looking for a better trade entry and and viable exits. This feature of the artificial intelligence is extremely popular among a.i. traders in that it helps tremendously in creating better positioning.

The predictive daily high and low forecast in the Vantagepoint software is a very powerful feature that traders use to find tune entries and exits.

At Vantagepoint Software we place attention on where the asset is trading in relation to its annual trading range. You can read an article which elaborates on this point here. It is not uncommon for the 52 week high to act as very stiff resistance over the short term. However, once that level is successfully breached it will often behave as long term support. We suggest traders place SBNY on their watchlists and use the a.i. to fine tune their entries.

Further Research (SBNY)

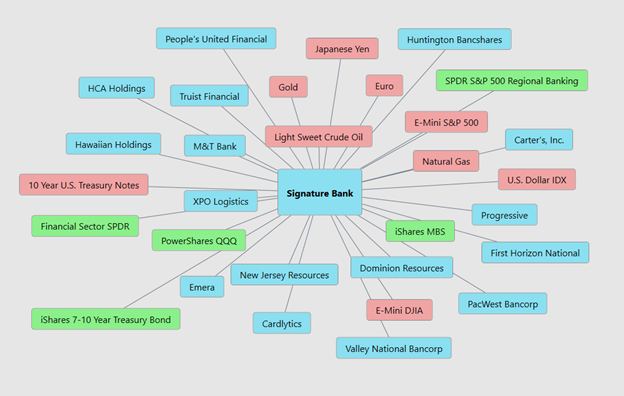

There is great value to be had in studying and understanding the key drivers of SBNY’s price action. The banking sector has been hit very hard in 2020. We would also advise that you familiarize yourself with these correlations as they are what will drive future price action.

About Signature Bank (SBNY)

Signature Bank is a New York-based full-service commercial bank with 36 private client offices throughout the New York, Connecticut, California, and North Carolina. Signature Bank’s specialty finance subsidiary, Signature Financial LLC, provides equipment finance and leasing. Signature Securities Group Corporation, a wholly owned subsidiary, is a licensed broker-dealer and investment adviser offering investment, brokerage, asset management, and insurance products and services.

As of 2020, the bank had total assets of $60.3 billion, deposits of $50.2 billion, and loans of $39.1 billion.

It has been dubbed “NY’s most successful bank” by Crain’s New York Business and was ranked as the Best Business Bank, Best Private Bank and Best Attorney Escrow Services provider by the readers of The New York Law Journal in the publication’s 2018 survey for the third consecutive year; it was also awarded second place in the Best Private Bank category. In 2015, Forbes ranked the bank as No. 1 in its America’s Best & Worst Banks evaluation. Forbes’ 2016 ranking of it as No. 6 marked the sixth consecutive year that the bank was among the Forbes top ten.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.