-

View Larger Image

WKHS Workhorse Group, Inc. (WKHS)

This week’s stock analysis is Workhorse Group Inc. (WKHS) .

Workhorse Group Incorporated is an American manufacturing company based in Cincinnati, Ohio, currently focused on manufacturing electrically powered delivery and utility vehicles. The company was founded in 1998 by investors who took over the production of General Motors’ P30/P32 series step-van and motorhome chassis. By 2005, they were taken over by Navistar International which had been selling them diesel engines. Navistar then closed the plant in 2012 to cut costs after having suffered heavy losses. In March 2015, a company called AMP Electric Vehicles took over Workhorse Custom Chassis, changing the company name to Workhorse Group Incorporated, and began offering a range of electric vehicles.

Workhorse is focused on manufacturing electric powered delivery and utility vehicles. It’s a niche strategy that has lots of growth potential. Year-to-date, Workhorse stock is up nearly 1,500%. During the market crash in March of this year, the company’s share price was just $1.32.

The 6 analysts offering 12-month price forecasts for Workhorse Group Inc have a median target of 25.50, with a high estimate of 29.00 and a low estimate of 19.00. The median estimate represents a -25.48% decrease from the last price of 34.22. The company has a market cap of $4.4 billion and it trades on average 16.8 million shares a day.

Let’s start our analysis with the commonsense metrics. Over the last 52 weeks it has traded as high as $40.45 and as low as $1.32. This tells us that the annual trading range is $39.13. The average weekly trading range is .75 cents.

Recently, when President Biden signed a “Buy America” executive order, he made a comment that could have major implications for Workhorse Group. “The federal government also owns an enormous fleet of vehicles, which we’re going to replace with clean electric vehicles made right here in America, by American workers,” Biden said.

Much interest in Workhorse Group relates to the potential for a $6 billion government contract to replace postal service vehicles. Workhorse is on the shortlist for a U.S. Postal Service contract to purchase 180,000 new trucks to upgrade its national delivery fleet. Winning that contract would represent a windfall for Workhorse and its shareholders. While the Postal Service contract has been delayed several times, it is now being reported that the contract will be awarded in the first quarter of 2021.

In anticipation of the U.S. Postal Service contract being awarded, Workhorse is negotiating with General Motors (NYSE: GM ) to takeover the Lordstown assembly plant a 6.2 million square foot manufacturing plant in Lordstown, Ohio that Workhorse already owns a 10% stake in.

The electric vehicle market has been growing exponentially in recent years and there are expected to be more than 250 million electric vehicles driven around the world by 2030. North America is expected to hold the largest electric commercial vehicle market share as major companies like Walmart (NYSE: WMT ) and Amazon (NASDAQ: AMZN ) convert their vehicle fleets to electric. The transition to electric commercial vehicles will be driven, in large part, by legislation from state and federal governments that mandate a move away from fossil fuels in the coming decade.

The Vantagepoint A.I. Analysis

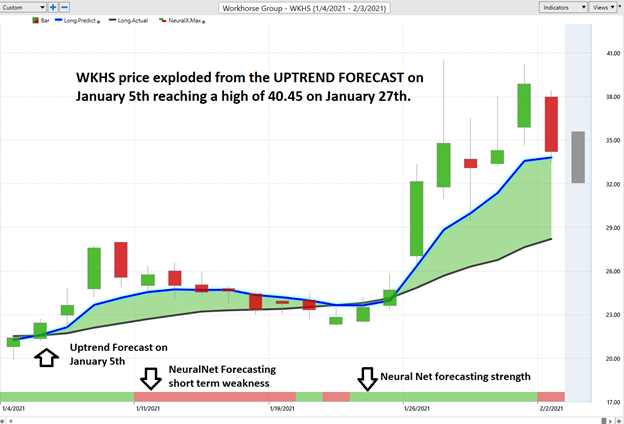

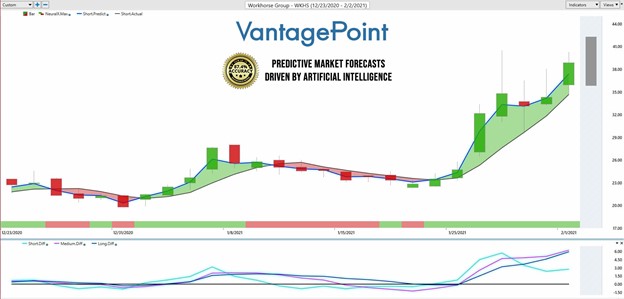

Using the Vantagepoint A.I. Software traders were alerted that the ideal value zone on this uptrend was trying to purchase WKHS at or below the predictive blue line on the chart . There were seven trading sessions where traders could’ve purchased WKHS between the price of $22.66 and 24.74.

Power traders use the predictive blue line in helping to determine both the value zone as well as the trend direction.

At the bottom of the chart is the Neural Network Indicator which predicts future strength and/or weakness in the market. When the Neural Net Indicator is green it communicates strength. When the Neural Net is Red it is forecasting short term weakness in the market.

We advocate that Power Traders cross-reference the chart with the predictive blue line and neural network indicator to create the optimal entry and exit points.

Power Traders are always looking to apply both the neural network and a.i. to the markets to find statistically sound trading opportunities.

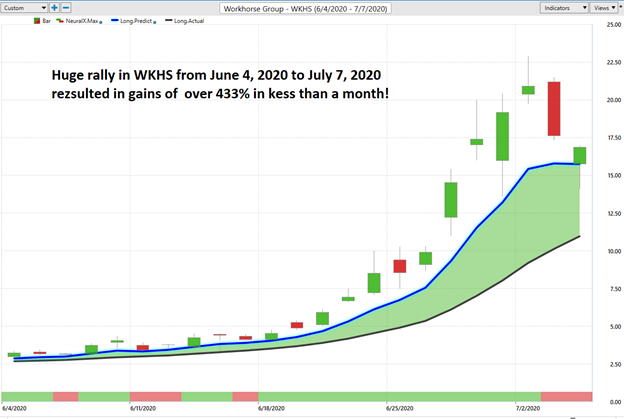

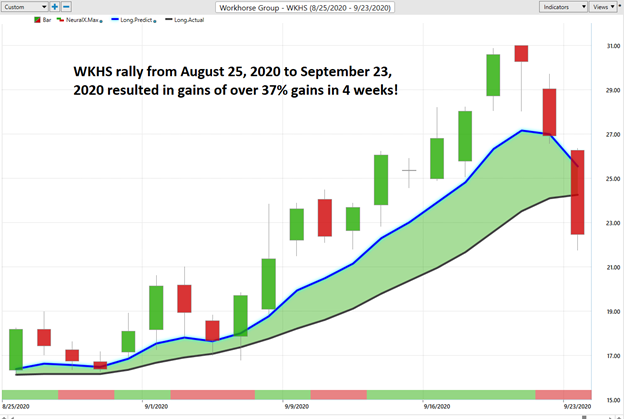

Here are a handful of other rallies that occurred in WKHS during 2020 which presented phenomenal swing trading opportunities.

Power Traders have had multiple opportunities to exploit nice gains in WKHS by monitoring the artificial intelligence forecasts.

Fine Tuning Entries and Exits

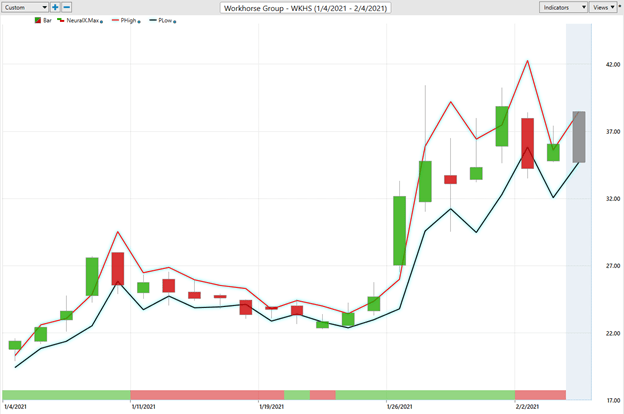

One of the powerful features in the Vantagepoint A.I. Software which Power Traders use on a daily basis is the Price Range prediction forecast.

This forecast is what permits Power Traders to truly fine tune their entries and exits into the market.

At 6:30pm after the market close the software updates and all of the price predictions change based upon what the machine learning, a.i., neural networks, and intermarket analysis anticipate moving forward.

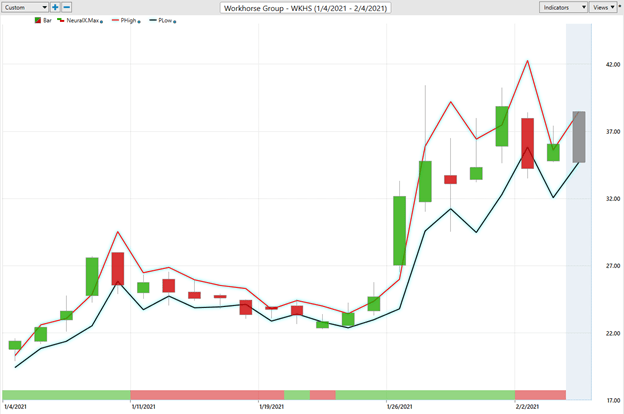

Here is the price chart of WKHS during the most recent runup featuring the Daily Price Range forecast with the NeuralNet Index at the bottom of the chart. By utilizing both of these tools simultaneously Power Traders can locate precision entries and exits with high probabilities of success and are capable of exploiting short term swing trading opportunities.

Power Traders use a price level below the predictive low price to place their protective sell stops in the market in case a sudden reversal was to occur. Observe how the predictive price low also provided numerous short term entry opportunities for traders to buy WKHS as it was trending higher.

Intermarket Analysis

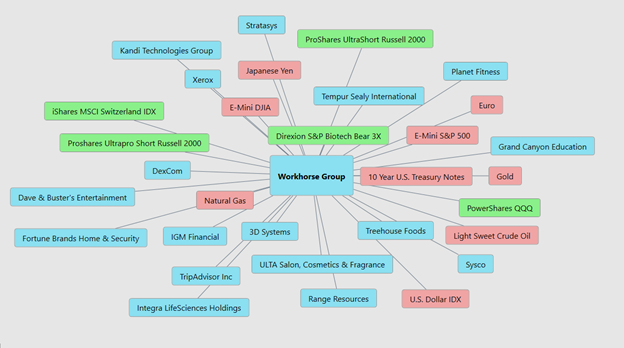

We live in a global marketplace. Everything is interconnected. The billion-dollar question for traders is always what are the key drivers of price for the underlying asset that I am trading?

Small changes in Interest rates, Crude Oil Prices, and the Volatility of the dollar amongst thousands of other variables affect the decisions companies must make to survive in these very challenging times. Trying to determine what these factors are is one of the huge problems facing investors and traders.

There is great value to be had in studying and understanding the key drivers of WKHS price action. The universe and the most statistically correlated assets. These factors are all displayed from a standpoint of statistical correlations which show the strongest interconnectedness of prices.

WHAT EXACTLY HAPPENED with WKHS?

Context is very important whenever doing an analysis. This most recent rally in WKHS occurred during the same time frame that a short squeeze was taking place in GameStop (GME).

There was over a 33% short position against the outstanding float. While this is within normal parameters over the past several weeks that position has been liquidated to a large extent by short-sellers further driving the price higher. Currently, the short position stands at roughly 28%.

We approach our analysis not from a valuation perspective but from a pure trader’s viewpoint. Currently, the stock appears marginally overvalued as it awaits news of its large potential contract with the United States Postal Service.

Our suggestion – Follow the a.i. trend analysis and practice good money management on all of your trades. WKHS has proven over and over again to be a good candidate for short term swing trading opportunities.

Let’s Be Careful Out There!

Remember, It’s Not Magic.

It’s Machine Learning.