-

View Larger Image

Scotts Miracle-Gro (SMG)

Scotts was founded in 1868 by Orlando M. Scott as a premium seed company primarily serving the U.S. agricultural industry. In the early 1900s, the company diversified and began a lawn grass seed business for homeowners. Prior to 1924, Scotts products were only available through the mail. By 1940, Scotts’s sales had reached $1,000,000 and the company had 66 associates.

In 1971, privately owned O.M. Scott & Sons was purchased by ITT , an international business conglomerate. In 1992, Scotts became a publicly-traded company with an initial offering of $19.00 a share and three years later merged with Miracle-Gro, a gardening company, to create the Scotts Miracle-Gro Company.

The five analysts offering 12-month price forecasts for Scotts Miracle-Gro Co have a median target of 270.00, with a high estimate of 290.00 and a low estimate of 240.00.

The stock from a fundamental perspective is fairly-valued and trading at approximately $240 a share.

The Commonsense Metrics

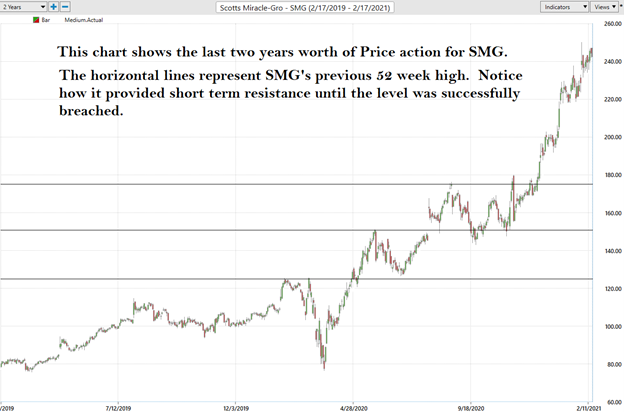

Let’s start our analysis with the commonsense metrics. Over the last 52 weeks it has traded as high as $250 and as low as $76.50. This tells us that the annual trading range is $173.50. The average weekly trading range is $3.33. On average it trades 329,000 shares a day.

SMG is hedged play on the continued legalization of cannabis across the world. SMG has served the slow-and-steady lawn care market, helping people grow and maintain beautiful yards and gardens. A few years ago, management decided it wanted to diversify into the marijuana market. Instead of growing the plant, it stuck to its fundamentals and bought its way into the hydroponic supply space. Scotts is one of the biggest players in the hydroponic niche, with sales of $303 million in its hydroponics-focused Hawthorne division in its most recent quarter. This is a massive business — and it is growing, with management estimating that organic sales were up nearly 72% year over year through the first nine months of fiscal 2020.

Company-wide sales for the first nine months increased 22 percent to $3.24 billion compared with $2.66 billion a year ago. Sales in the U.S. Consumer segment increased 15 percent, to $2.33 billion. Hawthorne sales increased 59 percent to $731.7 million.

Since the company has exposure to the cannabis industry it benefits as states and countries continue talks on the legalization of medical marijuana. SMG management calculates that as further marijuana adoption occurs domestically that Scotts can provide them all with the tools and supplies they need. Scotts Miracle-Gro doesn’t offer the pure earnings growth potential of a highly leverage pot stock, since slow-and-steady lawn care represents 75% of its bottom line. But as the marijuana market continues to grow as Wall Street expects, Scotts offers a way to play the space without the need to own a marijuana grower.

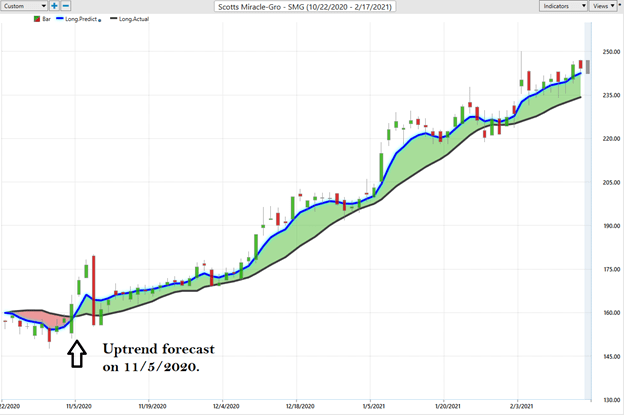

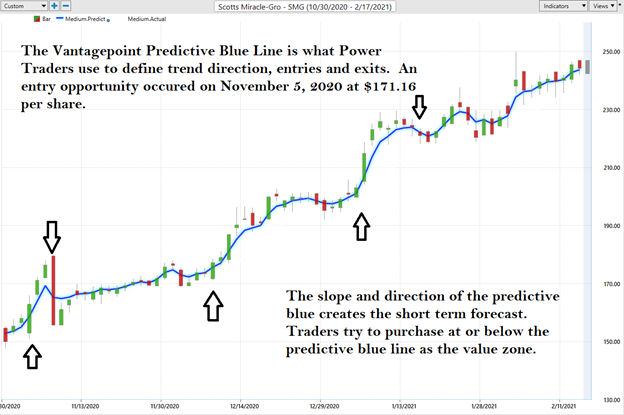

The black line on the chart is a simple 10 day moving average. All that it does is show you where price have been. Whenever the predictive blue line crosses over the black line an UPTREND forecast occurs. This is what happened on November 5, 2020 at $171.16 per share.

Power traders use the predictive blue line in helping to determine both the value zone as well as the trend direction.

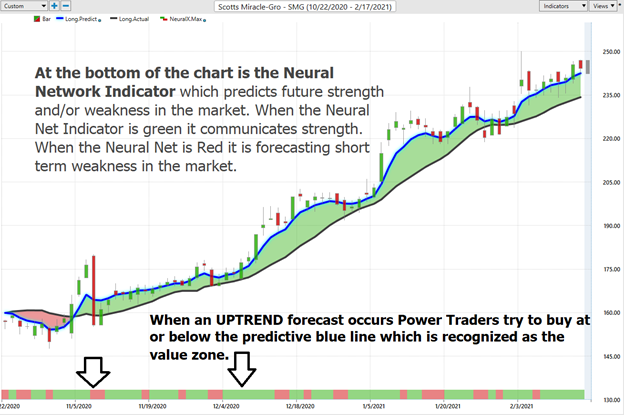

At the bottom of the chart is the Neural Network Indicator which predicts future strength and/or weakness in the market. When the Neural Net Indicator is green it communicates strength. When the Neural Net is Red it is forecasting short term weakness in the market.

We advocate that Power Traders cross reference the chart with the predictive blue line and neural network indicator to create optimal entry and exit points.

Power Traders are always looking to apply both the neural network and A.I. to the markets to find statistically sound trading opportunities.

SMG rallied almost $73 in 69 trading sessions resulting in 42.6% gains.

Fine Tuning Entries and Exits

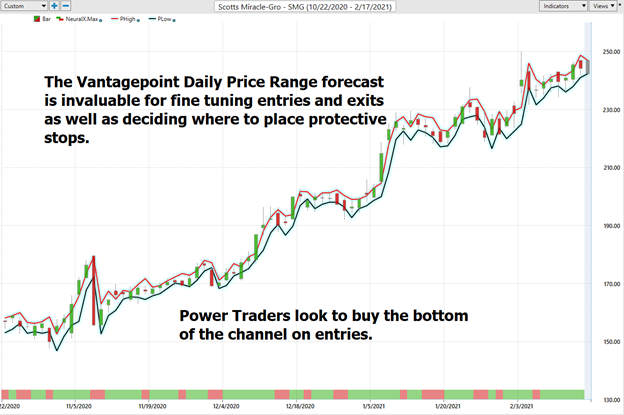

One of the powerful features in the VantagePoint Software which Power Traders use on a daily basis is the Price Range prediction forecast.

This forecast is what permits Power Traders to truly fine-tune their entries and exits into the market. At 6:30pm after the market close the software updates and all of the price predictions change based upon what the machine learning, A.I., neural networks, and intermarket analysis anticipate moving forward.

Here is the price chart of SMG during the most recent runup featuring the Daily Price Range forecast with the NeuralNet Index at the bottom of the chart. By utilizing these tools simultaneously Power Traders can locate precision entries and exits with high probabilities of success and are capable of exploiting short-term swing trading opportunities.

Power Traders minimize risk by placing protective sell stops below the predictive low price in case a sudden reversal was to occur. Observe how the predictive price low also provided numerous short term entry opportunities for traders to buy SMG as it was trending higher.

Intermarket Analysis

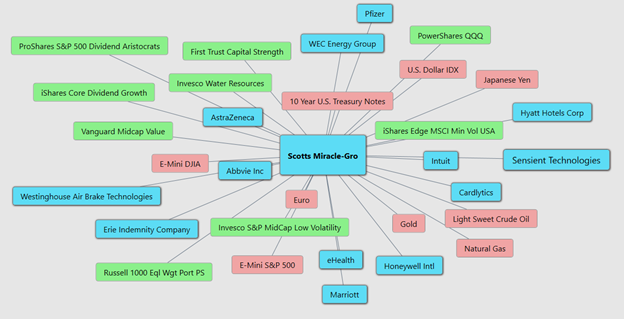

It is unquestionable that we live in a global marketplace. Everything is interconnected. The billion dollar question for traders is always what are the key drivers of price for the underlying asset that I am trading?

Small changes in Interest rates, Crude Oil Prices, and the Volatility of the dollar amongst thousands of other variables affect the decisions companies must make to survive in these very challenging times. Trying to determine what these factors are is one of the huge problems facing investors and traders.

There is great value to be had in studying and understanding the key price drivers of SMG price action. universe and the most statistically correlated assets. These factors are all displayed from a standpoint of statistical correlations which show the strongest interconnectedness of prices.

The blue rectangles represent the US stocks most statistically correlated to SMG’s price action.

The green rectangles represent the ETF’s most statistically correlated to SMG’s price action.

The red rectangle s represents the futures contracts most statistically correlated to SMG’s price action.

Putting It All Together

Power Traders by using the Vantagepoint software are alerted to the trend forecast and the value zone. The Neural Net Indicator informs the trader of upcoming short-term strength or weakness in the market. By cross referencing these two forecasts with the daily price forecast Power Traders are prepared for whatever uncertainty the market will create. This is the type of information that puts the winning probabilities strongly in the trader’s corner.

Our Opinion

SMG has offered some incredible short term trading opportunities for Power Traders. As the marijuana market continues to grow as Wall Street expects, Scotts offers a way to play the space without the need to own a grower.

Fundamentally it is fairly valued at present time.

Finding opportunities below the blue predictive line in uptrends has proven to be a great short term swing trading strategy.

About Scotts Miracle-Gro

Scotts Miracle-Gro is the largest provider of gardening and lawncare products in the United States. The majority of the company’s sales are to large retailers that include Home Depot, Lowe’s, and Walmart. Scotts Miracle-Gro can sell its products at a higher price point than its competition because of a well-recognized portfolio of brands that include Miracle-Gro, Roundup, Ortho, Tomcat, and Scotts. Scotts is also the leading supplier of cannabis-growing equipment in North America through its Hawthorne business.