Update on Waste Management (WM) Weekly Stock Study

On April 22 nd our stock study was (WM) Waste Management. We concluded that stock study with the following analysis:

“Our suggestion – The consensus of analyst’s opinions shows that WM is fairly valued around $135. The high-end estimate over the short term is $149. We think the 52-week high at $135.46 will provide short-term resistance to the current advance. However, we do think that as long as the UP forecast remains in place that purchasing weakness in this market will prove to be rewarding. Longer-term we estimate that we will surpass the higher end of the analysts estimates at $149.”

Since that analysis we have witnessed the stock continue to move 3% to 4% higher and on 5/13/21 we are anticipating the A.I. will provide us with a down forecast – leading many traders to close out their trades.

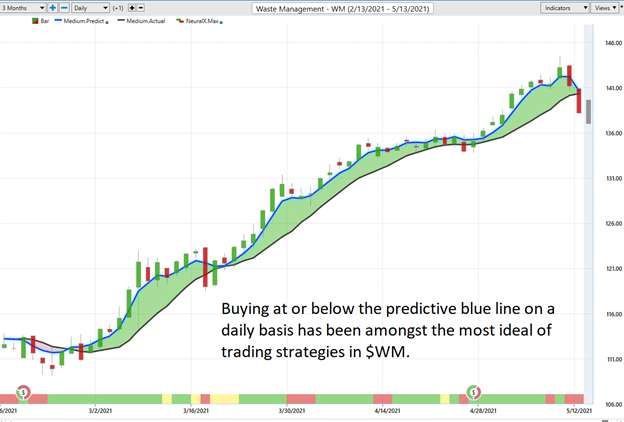

Here is the current Vantagepoint A.I. trend forecast on Waste Management (WM). Once again pay close attention to the relationship between the black line which is just a simple 10-period moving average and the predictive blue line which is the VantagePoint artificial intelligence.

The slope and direction of the predictive blue line determines the medium-term trend. Many traders are now out of (WM) and we will allow the A.I. to guide us in our future trading endeavors.

Let’s Be Careful Out There!

It’s Not Magic, It’s Machine Learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.