-

View Larger Image

August 21, 2021

Every trader I know keeps abreast of the industry through newsletters, email services, and other news feed services. It’s important to stay aware of what’s going on in the markets and the world.

But, it can also be confusing! How do you trust what you’re hearing? Every “guru” has a great “story”; but really, those stories are their opinions, and you could “invest” in a very painful (and expensive) trading education by following those opinions.

Here’s the type of email I often get from our traders:

Lane, I’ve been following ******* ****** for many years. He’s often referred to as one of the great traders and investors in the marketplace. I’ve invested quite a bit of money in his subscription newsletters and paid for his subscriber advisory service with a history of beating the S&P 500 for years. Boy, did I take a huge hit on one of his top picks, CAG. I wish had I trusted VantagePoint and my own trading instincts.

We don’t want to throw stones at any financial gurus. What we do want to do is ensure independent traders are empowered to make smart trading decisions with confidence.

So please, heed this advice:

It’s critical when you see someone on national television recommending a stock that you do your own due diligence.

- Are they trying to create demand for their position to create a better exit?

- Or are they legitimately making a recommendation where they are not front running their audience?

There is no way to know.

But there is a way to protect yourself and insulate your capital — artificial intelligence. We know that traders can use our A.I. to help fine-tune entries and exits and warn traders when to clearly stand aside.

May 24, 2021

An advisory was published on Yahoo Finance recommending traders take a look at ConAgra Brands (CAG).

Here’s the advisory:

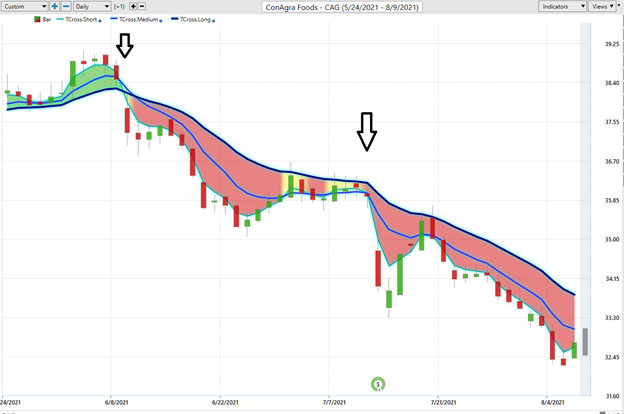

Here is what the chart of ConAgra Brands looked like on the day of the advisory.

The stock was bumping up against its 52-week highs at $39.34.

We certainly had it on our trading radar.

However, we were watching and letting the artificial intelligence fine-tune the recommendation.

This is what has unfolded in ConAgra Brands over the past 10 weeks.

Over the last 53 days, CAG has sold off 14.33%.

For a large volume trader, like the one who made this recommendation, CAG is just .41% of his portfolio. So even a 15% decline will only represent a drawdown of less that 1% of his net asset value. That’s great money management… when you’re trading millions. But for most independent traders who followed this recommendation and not the a.i., this was a gut punch and a very expensive trading education.

Let’s look at how the artificial intelligence and machine learning kept us on the right side of this market at the right time.

When trading with a.i., we utilize the pattern recognition, momentum, machine learning (NeuralNet) and our patented intermarket analysis. All of these elements are represented in a daily forecast which communicates the best move forward.

One glance at the chart below and you will see that the artificial intelligence turned negative on June 9 th , 2021, and has remained negative ever since. CAG stock has slipped 14% or $5.77 since that time frame.

We love the ConAgra story. It’s a great company. Great management.

But as of right now that “IS” just a story that price has not aligned itself with.

The trend is down, and we have no interest in getting long into a falling market.

When the a.i. turns positive we will be paying attention and looking for a nice rally from this massive selloff.

Seven Wall Street analysts have issued ratings and price targets for Conagra Brands in the last 12 months. Their average twelve-month price target is $36.38, predicting that the stock has a possible upside of 10.80%.

- The high price target for CAG is $41.00

- The low-price target for CAG is $34.00.

There are currently 1 sell rating, 5 hold ratings and 1 buy rating for the stock, resulting in a consensus rating of “Hold.”

But here’s the bigger lesson and why I bring this up:

- A stock may have a very alluring story.

- A stock may have a very effective management team.

- A stock may have incredible earnings.

- A stock may have infrastructure, partnerships, uniqueness, etc.

But, if these elements are not reflected in the price, you are focused on what “SHOULD” occur in the market.

I would like to point out that the word SHOULD is responsible for more losses in trading than any other.

Bad traders obsess on the SHOULD. Every other word out of their mouth’s is SHOULD.

If only I had just a nickle for how many times a trader has told me all of the reasons why his portfolio is heavily invested in a stock because of a great story, in spite of the stock being in a firm downtrend! It’s actually horribly painful to listen to because I know it doesn’t have to be that way.

The beauty of neural networks, artificial intelligence and machine learning are that they are fundamentally focused on pattern recognition to determine the best move forward. When these technologies flash a change in forecast – pay attention, it is newsworthy.

We often do not understand why something is occurring but that does not mean that we cannot take advantage of it.

Remember What’s Important

Price is the only thing that matters when we are trading. It is what can make you wealthy or decimate your account. Everything else is just noise.

Are you capable of finding those markets with the best risk/reward ratios out of the thousands of trading opportunities that exist?

Knowledge.

Useful

knowledge.

And its application is what A.I. delivers.

It’s important that you find out more. Join us for a FREE, Live Training. We’ll show you at least three stocks that have been identified by the A.I. that are poised for big movement… and remember, movement of any kind is an opportunity for profits !

Discover why artificial intelligence is the solution professional traders go-to for less risk, more rewards, and guaranteed peace of mind.

Visit with us and check out the A.I. at our Next Live Trainin g.

It’s not magic. It’s machine learning.

Make it count.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.