-

View Larger Image

Dollar Tree, Inc. is a discount variety retail store operator that sells items for $1 or less. The company has over 15,000 stores in the United States and Canada the operate under the Dollar Tree and Family Dollar brand names. It offers a wide range of general merchandise in numerous categories, including housewares, holiday goods, health and beauty care, stationery, books, candy, discount canned merchandise, personal accessories, toys, gifts, party goods, and other consumer items. The company is an extreme discount store. Its prices are primarily designed to attract financially disadvantaged or frugal customers.

The big risks to the Dollar Tree business model are supply chain disruptions, shipping delays and inflation. All of these pose the question of “Will it be possible for anyone to sell goods for $1 or less and still earn a profit?”

DLTR has had a nice 48% move upward in the last 36 days. It was disclosed after yesterday’s close that activist investor Mantle Ridge had invested $1.8 billion into Dollar Tree. Mantle Ridge wants Dollar Tree to strengthen its lagging Family Dollar chain. To assist with execution of this perspective they are enlisting Richard Dreiling, who previously served as CEO of rival Dollar General . Mantle Ridge also wants Dollar Tree to sell higher priced items at more stores. Mantle Ridge believes these moves will dramatically increase DLTR’s valuation. $DLTR has a market cap of $29.56 billion and trades on average 3.76 million shares a day. Over the last few days volumes has been three times that amount as investors think this news bodes very well for higher prices for $DLTR. Among the largest hedge funds holding Dollar Tree’s shares is Akre Capital Management LLC. It holds Dollar Tree’s shares valued at 343M.

In this weekly stock study, we will look at and analyze the following indicators and metrics as are our guidelines which dictate our behavior in deciding whether to buy, sell, or stand aside on a particular stock.

- Wall Street Analysts’ Estimates

- 52-week high and low boundaries

- Best Case – Worst Case Analysis

- Vantagepoint A.I. Forecast (Predictive Blue Line)

- Neural Network Forecast

- Daily Range Forecast

- Intermarket Analysis

- Our trading suggestion

We don’t base our decisions on things like earnings or fundamental cash flow valuations. However, we do look at them to better understand the financial landscape that a company is operating under.

Analysts Ratings

The first set of boundaries which we explore in our stock study is what do the professionals think who monitor the stock for a living. We can acquire this information by simply looking at the boundaries that the top Wall Street Analysts set for $DLTR. This initial set of boundaries provides us with an idea of what is expensive, fairly valued, and cheap.

Based on 9 Wall Street analysts offering 12-month price targets for Dollar Tree in the last 3 months. The average price target is $127.63 with a high forecast of $175.00 and a low forecast of $97.00 . The average price target represents a -2.91% change from the last price of $131.46 .

From this simple analysis we can see that $DLTR is slightly above fair value at present time but some on Wall Street think that is has the potential to run another $44+ dollars per share.

Dollar Tree has 224,910,000 shares outstanding. Their next earnings release is scheduled for November 22, 2021. Anticipated earnings per share for $DLTR are .96 cents.

52-week High-Low Chart

Over the last 52 weeks $DLTR has traded as high as $132.50 and as low as $84.26. This means provides us with an annual trading range of $48.24. We refer to these as the commonsense metrics which we use as baseline measurements of understanding normal value. When using artificial intelligence , we look to amplify our returns based upon these baseline measurements. When we divide the annual range by 52 weeks, we arrive on the metric that the average weekly trading range is .92. I also like to divide the annual range by the current price to provide us with a very broad estimate of volatility. When we divided $48.24 by $132.50, we arrive at 36.4%. This metric tells us that if the future behaves like the recent past it would have a very high probability for DLTR over the next year, to be trading in a range that is 36.4% higher and lower from where it is right now.

When we look at the 52-week chart on $DLTR we can see that up until very recently DLTR had broken down below the lowest Wall Street Analyst estimate before challenging its most recent 52 week high.

Whenever we trade, we always pay attention to where we are in relation to the 52-week trading range. It is very common to see the 52-week high provide very strong resistance to the market until it is breached. Often when the 52-week high is breached we will see the stock price explode higher very quickly over a very short period.

Stocks which breach their 52-week highs multiple times a year are often in very strong trends which we want to be aware of. The 52-week boundary often acts as significant resistance in thwarting trends. As price bounces off this level, we want to become extremely focused on what the artificial intelligence forecast is signaling.

I like to place all these boundaries, including the Wall Street Analysts Estimates on a chart to quickly visualize the history of the stocks performance and to be able to see how that relates to what professional analysts are thinking.

You can see in the following chart of $DLTR that the analyst markers of value accompanied by the 52-week range give us a very effective backdrop of “perceived value.” These boundaries are what we think drives the news narrative and informs us as to the most solid trading opportunities in the stock.

Best Case – Worst Case Analysis

Next, we want to evaluate $DLTR is in comparison to the performance of the major stock market indexes which we have greater familiarity with and then look at the drawdowns of the stock over the past year to get a worst-case scenario idea for any conclusions that we might reach when we trade this asset.

Over the past year $DLTR is up 34.49

The Dow Jones Industrials are up 20.93% over the past year.

S&P 500 is UP 29.87% over the last year.

Russell 1000 Small Cap is up 30.55% in the past year.

The NASDAQ is up 69.02%

You can see with Dollar Tree we have an asset that has performed better that the majority of stock indexes but also has had significantly more volatility.

As the chart above illustrates, we had 4 declines of 13% or larger over the past year. The maximum decline was 29.7% from the April high to the September lows. In the last 37 days it has rallied 53%.

The Vantagepoint A.I. Analysis

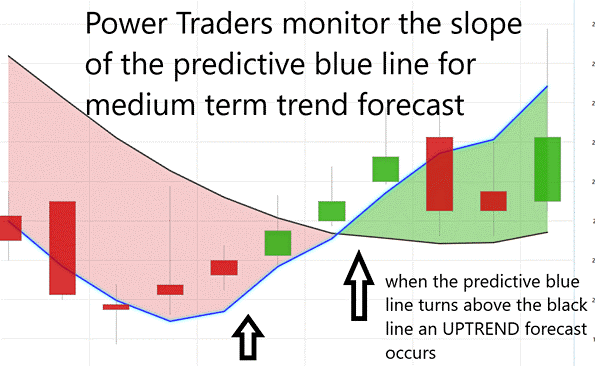

Using VantagePoint Software and the artificial intelligence, traders are alerted to trend forecasts by monitoring the slope of the predictive blue line. The black line is a simple 10 day moving average of price which simply tells you what has occurred in the market. The predictive blue line also acts as value zone where in uptrends traders try to purchase the asset at or below the blue line.

In studying the chart above pay close attention to the relationship between the black line and predictive blue line. The black line is just a simple 10 day moving average. It is calculated by taking the closing prices of the last 10 days and dividing that sum by 10. All that the black line tells you is what has occurred. It tells you where prices have been and what the average price over the last ten days is.

The predictive blue line, on the other hand utilizes that Vantagepoint patented Neural Network and Intermarket Analysis to arrive at its value. It looks at the strongest price drivers of an asset through artificial intelligence and statistical correlations to determine its value.

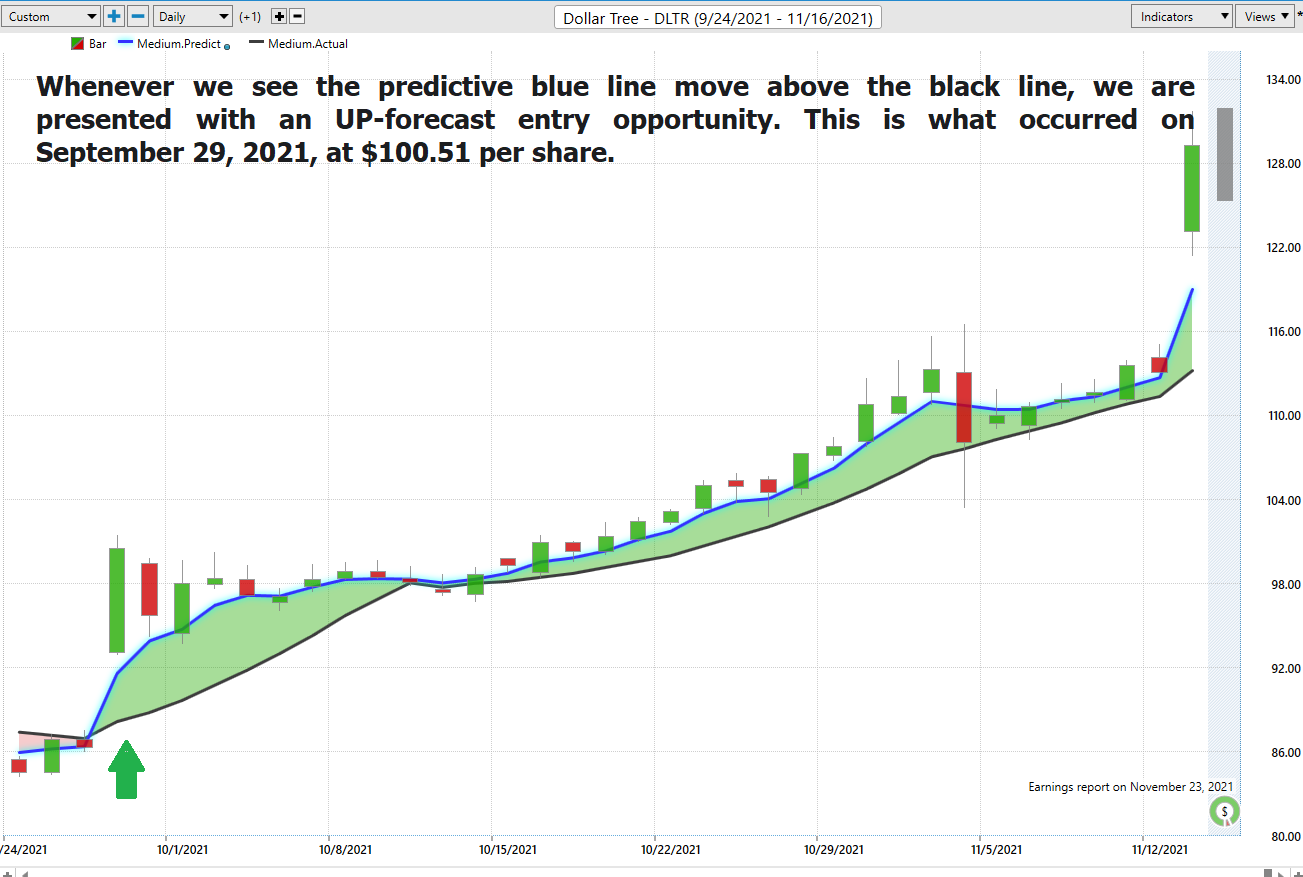

We will analyze the last six weeks for $DLTR stock so that you can appreciate the power of the artificial intelligence in a real-time trading situation.

Whenever we see the predictive blue line move above the black line, we are presented with an UP-forecast entry opportunity. This is what occurred on September 29, 2021, at $100.51 per share.

Power traders use the predictive blue line in helping to determine both the value zone as well as the trend direction. Pullbacks to or below the predictive blue line present buying opportunities at or below the value zone.

Observe how the SLOPE of the predictive blue line started moving higher a few days before its moving above the black line.

Fine Tuning Entries with The Neural Net Indicator

At the bottom of the chart is the Neural Network Indicator which predicts future strength and/or weakness in the market. When the Neural Net Indicator is green it communicates strength. When the Neural Net is Red it is forecasting short-term weakness in the market.

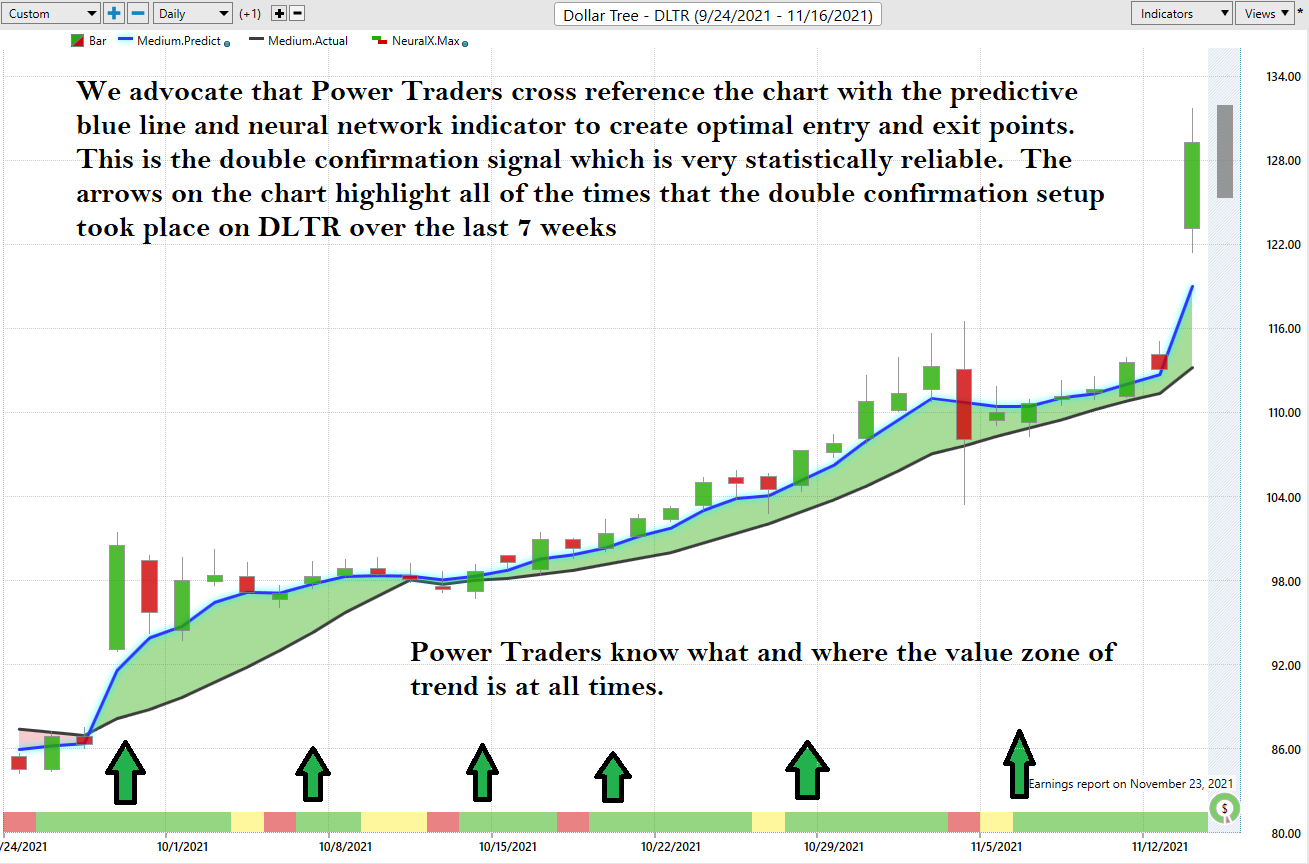

We advocate that Power Traders cross-reference the chart with the predictive blue line and neural network indicator to create optimal entry and exit points.

A Neural Net is a computational learning system that uses a network of functions to understand and translate massive amounts of data into a desired output, consistently monitoring itself and improving its performance.

Power Traders are always looking to apply both the neural network and A.I. to the markets to find statistically sound trading opportunities. We refer to this as a “double confirmation” setup and look for the predictive blue line to slope higher and to be confirmed by the Neural Net at the bottom of the chart.

We advise Power Traders to cross-reference the predictive blue line with the Neural Net for the best entry opportunities. Observe how the slope of the predictive blue line has remained positive from the time earnings were announced.

You can see in the chart above how the Neural Net offered several opportunities of double confirmation to Power Traders, when the predictive blue line and the Neural Net aligned with the same forecast. These instances provide very high probability trading opportunities to exploit the trend.

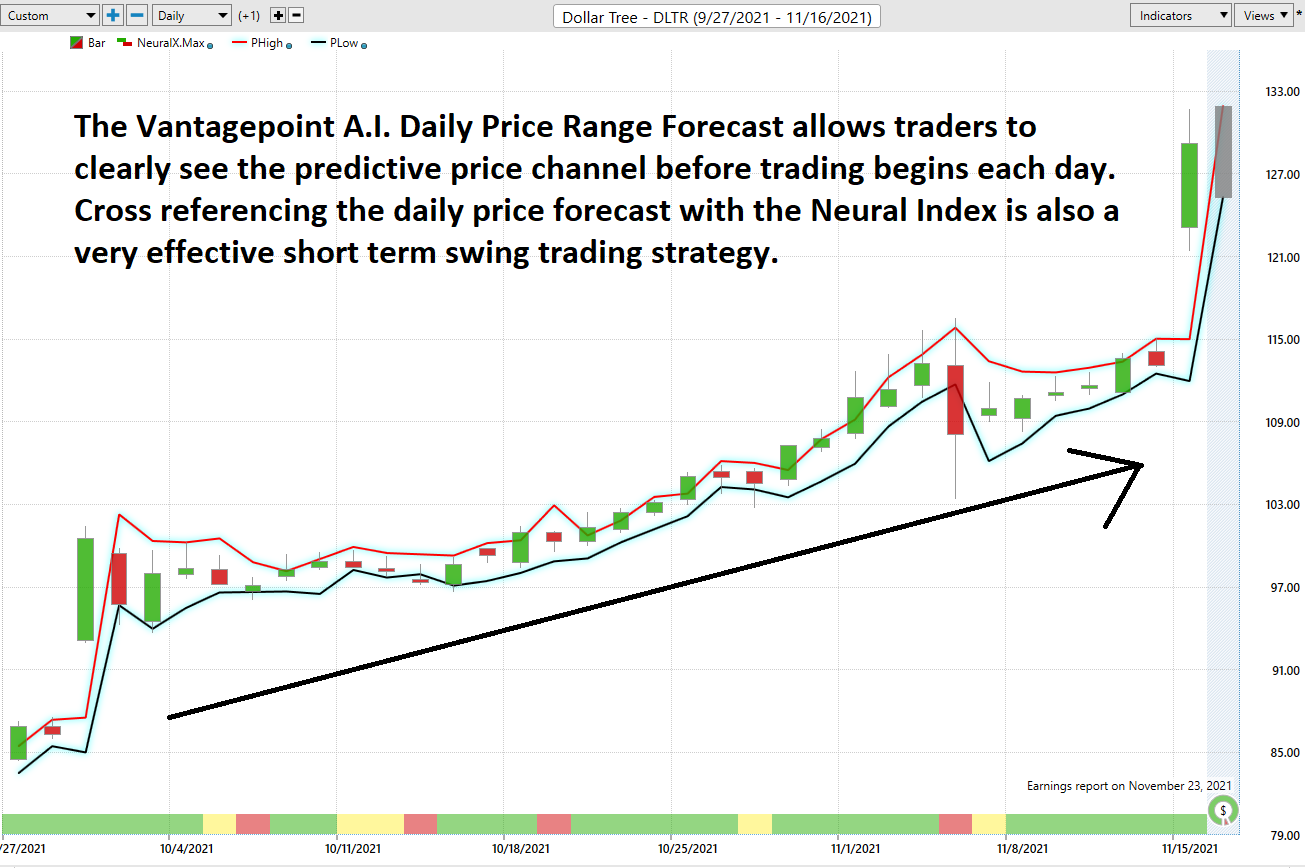

VantagePoint Software Daily Price Range Prediction

One of the powerful features in the Vantagepoint A.I. Software which Power Traders use daily is the Daily Price Range prediction forecast.

This forecast is what permits Power Traders to truly fine tune their entries and exits into the market.

Here is the price chart of $DLTR during the most recent runup featuring the Daily Price Range forecast and the Neural Net Indicator.

The $1 billion partnership and investment by TPG group was announced on October 11. Yet you can see that the daily forecast was clearly indicating higher prices for one month preceding the recent move.

Intermarket Analysis

What makes the Vantagepoint Software truly unique is its ability to perform Intermarket analysis and to locate those assets which are most interconnected that are responsible for driving the price of $DLTR higher or lower.

Studying the charts can always provide objective realities in terms of locating support and resistance levels which become very clear on a chart. But we live in a global marketplace. Everything is interconnected. The billion-dollar question for traders is always what are the key drivers of price for the underlying asset that I am trading?

These intangibles are invisible to the naked eye yet show very high statistical correlations.

Small changes in Interest rates, Crude Oil Prices, and the Volatility of the dollar amongst thousands of other variables affect the decisions companies must make to survive in these very challenging times. Trying to determine what these factors are is one of the huge problems facing investors and traders.

There is great value to be had in studying and understanding the key drivers of $DLTR price action.

By doing so you can often see which ETFs are most likely acquiring $DLTR as well as uncovering other industries which affect $DLTR price movement.

Trading Suggestion

$DLTR has had an incredible run over the past few weeks. While the trend is clearly UP as the worst-case analysis section of this study mentioned, $DLTR falls much faster than it rises. We are looking to buy but ideally, we need the price to break back into the “GAP” that is most recent on the chart which lays between $115 and $121.

We think that this asset can go much higher but at the present time we would expect the stock to revert to the value zone identified by the predictive blue line.

While it is reassuring that activist investor Mantle Ridge has invested heavily in $DLTR and is offering the former CEO of Dollar General to optimize the Family Dollar brand more effectively, investors are going to need to see results before further buy-in will occur. It is a great narrative, but earnings will drive the price of $DLTR. Everything else is noise. Earnings will be released November 22 nd .

The HUGE risk in DLTR’s business model is supply chain breakdowns and shipping delays. Even with that risk the company will do over $26 billion in sales. It has beaten Wall Street estimates in nine out of ten last quarters. This momentum bodes very well for the future of DLTR.

The predictive blue line is the guidance that we will be following going into the earnings announcement next week. Wall Street Analysts are slowly revising their estimates upward with the announcement that Mantle Ridge is an activist Investor looking at much higher stock valuations.

Our advice: Follow the a.i. trend analysis and practice good money management on all your trades . The chart looks very strong on $DLTR but the risk is much higher now that prices have moved 55% in the last 6 weeks.

We will re-evaluate this analysis based upon:

- Wall Street Analysts’ Estimates

- 52-week high and low boundaries

- Vantagepoint A.I. Forecast (Predictive Blue Line)

- Neural Network Forecast

- Daily Range Forecast

- Intermarket Analysis

Let’s Be Careful Out There!

Remember, It’s Not Magic.

It’s Machine Learning.

Disclaimer: THERE IS A HIGH DEGREE OF RISK INVOLVED IN TRADING. IT IS NOT PRUDENT OR ADVISABLE TO MAKE TRADING DECISIONS THAT ARE BEYOND YOUR FINANCIAL MEANS OR INVOLVE TRADING CAPITAL THAT YOU ARE NOT WILLING AND CAPABLE OF LOSING.

VANTAGEPOINT’S MARKETING CAMPAIGNS, OF ANY KIND, DO NOT CONSTITUTE TRADING ADVICE OR AN ENDORSEMENT OR RECOMMENDATION BY VANTAGEPOINT AI OR ANY ASSOCIATED AFFILIATES OF ANY TRADING METHODS, PROGRAMS, SYSTEMS OR ROUTINES. VANTAGEPOINT’S PERSONNEL ARE NOT LICENSED BROKERS OR ADVISORS AND DO NOT OFFER TRADING ADVICE.