Key Takeaways

- Nvidia shares tumbled nearly 7% in early trading Thursday, extending the previous session’s steep decline, before moving into positive territory as investors ‘bought the dip.’

- Nvidia, the poster child for investors looking at AI-related opportunities, has stumbled lately amid a broader rotation out of mega-cap tech stocks.

- Despite recent declines, Nvidia shares are still up more than 130% so far this year.

Shares of Nvidia ( NVDA ) rebounded from an early morning dive on Thursday as investors ‘ bought the dip ‘ amid an extension of yesterday’s tech stock sell-off.

Nvidia shares slumped as much as 6.8% Thursday morning, extending Wednesday’s 6.6% decline. The chip giant, which briefly became the world’s most valuable company earlier this year, weighed on the S&P 500, which slipped as much as 0.7%.

Tech stocks sold off yesterday after earnings reports from Tesla ( TSLA ) and Alphabet ( GOOGL ) shook Wall Street’s confidence in the AI trade that had propelled stocks to record after record this year. The S&P 500 shed 2.3%, its first daily decline of 2% or more since February 2023. The Nasdaq Composite lost 3.6%, its biggest drop since October 2022.

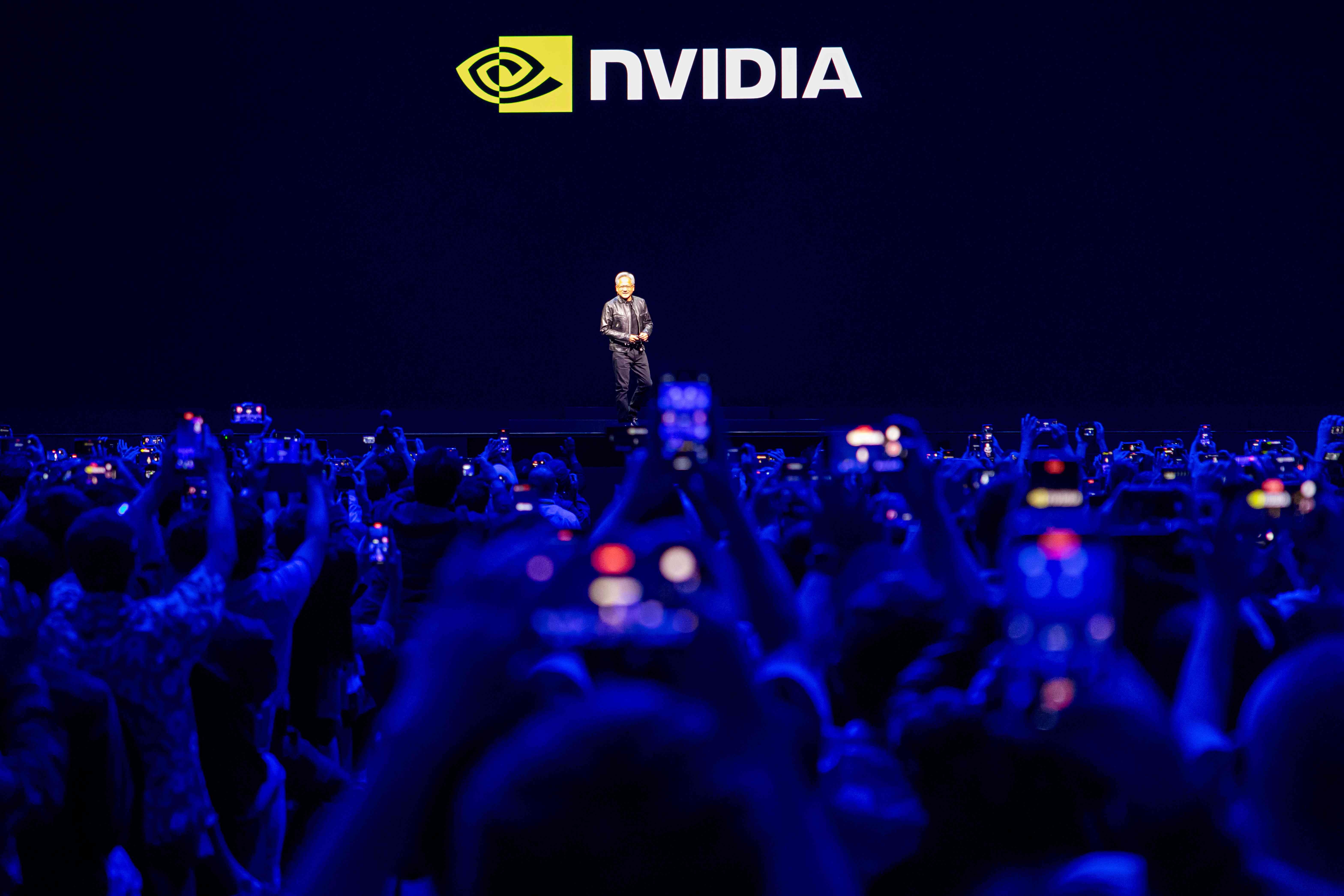

The AI Poster Child Has Stumbled

Nvidia was the poster child of last year’s bull market. Shares rose 239% in 2023 as booming demand for its AI chips sent sales and profit soaring. The stock gained another 172% this year before the equity market was turned on its head earlier this month.

A soft inflation report on July 11 boosted optimism that the Federal Reserve will cut interest rates soon, sparking an investor exodus from cash-rich big tech companies to the smaller companies that are likely to benefit the most from lower rates. Since then, Nvidia shares have slumped more than 15% while the small-cap Russell 2000 has risen 10%.

TradingView

Despite its recent declines, Nvidia remains the second-best performing stock in the S&P 500 this year, having returned 133%. The stock was up about 0.5% on heavy volume in afternoon trading.