Key Takeaways

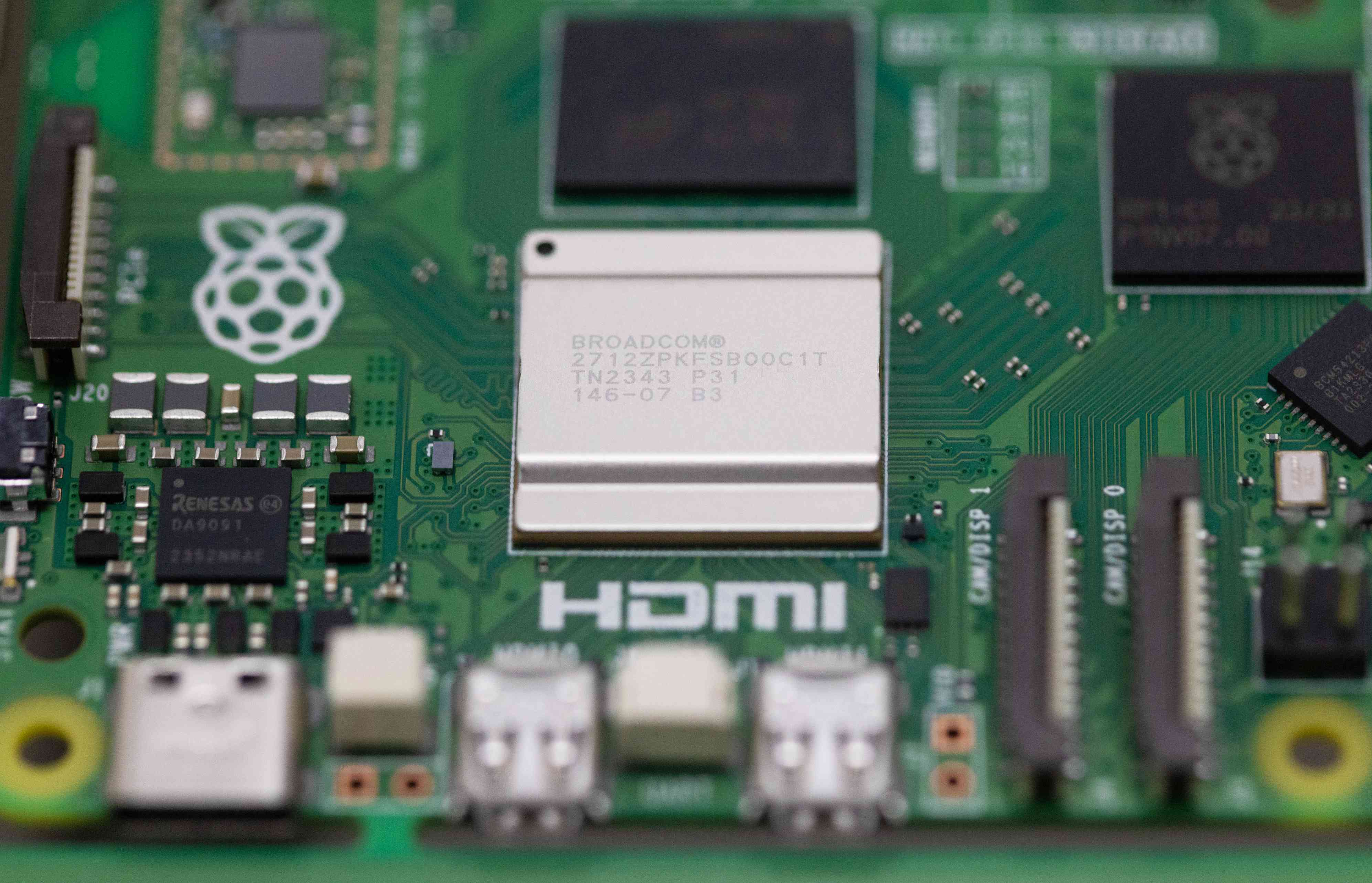

- Broadcom is catching up to Nvidia as a top pick among investors, Citi analysts reported after meeting with investors and discussing their sentiment toward stocks.

- Investors believe Broadcom is well-positioned with its custom AI chip customers while Nvidia is being affected by “investor fatigue,” Citi wrote.

- Both stocks have been big winners this year, though big tech shares were hit by a range of investor concerns last week.

Investors still love Nvidia ( NVDA ) — but Broadcom ( AVGO ) is catching up in terms of bullish sentiment, according to Citi analysts who recently met with investors to gauge their views on chipmaker stocks.

Citi’s analysts cited new customer growth and the effects of the VMWare acquisition, completed last year , as reasons investors were enthusiastic about Broadcom’s shares. Big tech companies are increasing spending to invest in AI , which could grow Broadcom’s custom AI chip customer list.

The analysts also said they believe there is some “investor fatigue” with Nvidia, shares of which have lately been subject to volatility amid concerns around trade restrictions and geopolitical tension .

Broadcom shares were recently up about 2%, while Nvidia’s added more than 4%. The chipmakers’ gains on Monday helped make up for losses last week when worries about tightening trade restrictions and geopolitical tensions fueled a sell-off in chip stocks . The prospect of lower interest rates also drew some investors away from big tech shares and toward smaller companies .

Overall, both Broadcom and Nvidia have been big winners this year. The former company is up more than 40%, while the latter has risen about 150%; both companies have split their shares 10-for-1 in 2024.