Stocks are a key ingredient in the portfolio of millions of investors and traders. They can provide a long-term path towards passive income potentially hitting double-digit returns. But the stock market can also be confusing, and potentially costly or dangerous, with the process of picking the right stocks, at the right time, not always so clear. Read on and discover our guide on how to pick stocks for investors to move towards meeting their goals.

How to pick stocks: Step by Step

There are a variety of crucial factors to consider when approaching the question ‘How to pick stocks’. These considerations can determine the success of a stock portfolio and range from the financial health of the companies chosen, to liquidity and volatility of the stock in question, to wider fundamental events outside the company’s control. Investors should consider all of these influences to have the best chance of building a stock portfolio capable of meeting their goals. Here’s a step-by-step list below.

1. Establish a plan

Establishing a plan is key starting point when picking stocks. You’ll need to consider questions such as how many stocks to buy, what your likely plans are for the money down the line, and whether you’d prefer to trade stocks over the short term rather than invest for a longer-term approach. For example, long-term investors looking to buy and hold stocks for five years or more will obviously have a very different strategy to those looking for short positions in overbought market conditions like we saw frequently in the latter part of the 2010s.

If you’re in it for the short term, find out more on how to create a trading plan for technical analysis.

2. Assess your risk tolerance

Your tolerance for risk will play a key role in determining the kind of stocks to pick. To this point, if an investor is looking for a more risk-averse portfolio, they may want to weigh more towards defensive stocks such as those in utilities or consumer staples. Alternatively, a higher-risk approach could see an investor choosing companies in emerging economies or immature sectors, or companies that depend on key market events going a certain way for their targets to be realized. For example, a pharma company awaiting FDA approval for a new drug will be subject to the risk of that approval not happening – an event potentially devastating to its share price.

Find out more on navigating risk management with our helpful guide.

3. Do your research

Attractive stocks can be found in a variety of circumstances, but an investor may get a head start on the crowd if they know a couple of sectors and the companies within them inside-and-out.

Here are some of the key things to consider about the companies behind the stocks being analyzed, as well as the market conditions in which they might be most attractive.

Financial condition

Understand the state of the company’s balance sheet. What are its assets, liabilities, and cash flow situations? Research revenue in recent periods.

Management

Who’s steering the ship and what’s their industry track record? Do they enjoy shareholder confidence?

Innovation

How does the company innovate to stay ahead of and respond to its competition? How have new products and services been received by customers and shareholders?

Dividends

Is the company paying a dividend, and if so, how often and will it be increased? Find out more about how to invest in dividend stocks .

Price and valuation

Is the company undervalued? To find out, calculate the price-to-earnings ratio, or P/E, by dividing the company’s stock price by its earnings per share. A P/E of around 15 may be considered ‘cheap’ – but that doesn’t necessarily mean that it’s worth buying or inexpensive by industry standards. Being cheap may just mean investors lack confidence in its growth prospects. Find out more about how to value a stock .

Liquidity

Does the stock have sufficient trading volume to allow traders to enter and exit the market as straightforwardly as possible? Read more on stock market liquidity for a detailed picture.

Volatility

How volatile has the price movement been for this stock, and what are the reasons for any extreme fluctuations? With volatility naturally comes increased risk, but also potential opportunity. Read more on stock market volatility to discover how to take advantage.

Explore our in-depth guide on researching stocks for more information.

4. Use technicals and other tools where appropriate

If you are trading stocks in the short term, for example as a day trader, swing trader or scalper, you may want to investigate technical analysis tools to try and gauge price action in order to help time entries and exits. These tools include the moving average , MACD and RSI , as well as volume and support and resistance levels.

Naturally, these tools rely on historical price activity to inform choices, so while they can be useful for projecting trends, it is advisable to combine a technical approach with understanding of the fundamental factors that can override patterns and, of course, risk management.

Read more on technical indicators and how they can assist your analysis.

5. Pick the stock and trade it actively…or just wait

When it comes to the procedural process of picking the stock for a long-term investment or short-term trading endeavor, the clearest method is often via a trading platform/online brokerage account, which can be set up with proof of ID and a choice of funding method. After that, while short-term speculators may be actively trading the stock, long-term passive investors will usually be waiting it out. For the latter, while there’ll be ups and downs along the way, the mission is to capitalize on growth over a period of many years.

The Best Performing Stocks - Jan 00 to Jan 20

| Stock | Growth in Stock Price Jan 00-Jan 20 |

|---|---|

| Monster Beverage Corporation | 73,300% |

| Netflix | 34,400% |

| Apple | 20,000% |

| Tractor Supply Company | 17,000% |

| Amazon | 11,400% |

Most popular stocks

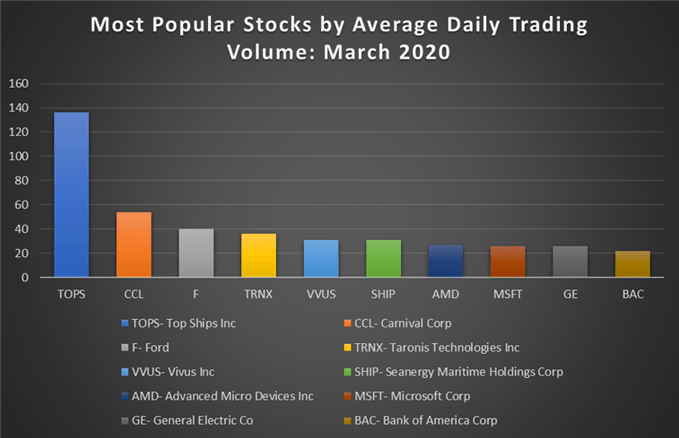

As mentioned above, the most popular stocks to trade by volume consistently show up as the likes of giant corporations Facebook, Amazon, Apple, Netflix and Alphabet, but different fundamental events can cause the stocks of various other companies to come out on top in shorter-term trading volume. The chart below shows the stocks with the highest global volume for the month at the end of March 2020.

The leading stock by volume, Greece-based tanker vessel operator Top Ships Inc, grew in popularity as an asset sale saw an influx of funding which allowed the company to greatly reduce its debt. The stock was likely even buoyed by circumstances surrounding the coronavirus pandemic, with surging product demand in areas such as cleaning supplies and paper products leading to increased shipping requirements.

Another company seeing unusually high volume in March was cruise line operator Carnival Corp, much of which was to the short side as the company suspended dividend payments and stock repurchases as voyage suspensions continued amid the coronavirus outbreak.

Rounding out the top three is Ford, which saw a seven-year high in trading volume, again mostly to the short side, as coronavirus decimated production and market demand.

What lesson can stock pickers learn from these examples? When a huge fundamental crisis hits, stocks are affected in different ways. Research on different sectors may shine a light on the industries that could pick up steam when others are going in the other direction. So read up, keep your eyes open, and focus on the goals of the portfolio.

FAQs

How do you decide what stocks to buy?

Deciding what stocks to buy is a multi-faceted process based on factors such as industry knowledge, corporate financials, timing, wider market fundamentals, and in some cases, technical patterns. Investors can put all or some of it together in the effort of building the most appropriate individualized approach.

When should you buy shares?

Timing is everything, but not all oversold shares are ready to be snapped up – after all, they were sold for a reason. Consider the growth potential of the industry and the company within it, and the fundamental factors that might affect its journey along with how that investment or trade may fit with the goals of the portfolio.

Is it worth it to buy 1 share of stock?

It depends on the stock- and the circumstances. Stocks are priced across the board, so owning one share of Berkshire Hathaway has very different ramifications for an investor’s financial position than owning one share of Facebook.

What stocks does Warren Buffett own?

Speaking of Berkshire Hathaway – some of Warren Buffett’s largest investments are currently in financial institutions such as Bank of America and Wells Fargo, consumer brands such as Coca-Cola and Kraft-Heinz, and technology giants such as Apple and Sirius.

How many stocks should I own?

That depends entirely on your plan and the companies you choose. Overall, it’s advisable to aim for a diversified portfolio, with a mixture of growth and defensive stocks, to ensure that risk can be managed effectively.

For more on stock trading, including the main types of stocks , a background on indices and why the stock market is important, check out our beginner’s guide to trading stocks .