Key Takeaways

- The S&P 500 advanced 0.3% on Thursday, March 21, 2024, adding to its record high after the Fed reiterated its rate cut forecast for 2024.

- Semiconductor stocks posted strong gains, with shares of Micron Technology soaring after the firm beat quarterly estimates amid strong AI demand.

- Shares of Accenture dropped after the consulting firm reduced its guidance, citing macroeconomic uncertainties.

Major U.S. equities indexes moved higher on Thursday, adding to the all-time highs posted in the previous session.

The record-setting rally comes after the Federal Reserve said it would hold interest rates steady yesterday, but reiterated projections for three rate cuts in 2024.

The S&P 500 advanced 0.3% on the day. The Dow and the Nasdaq were up 0.7% and 0.2%, respectively.

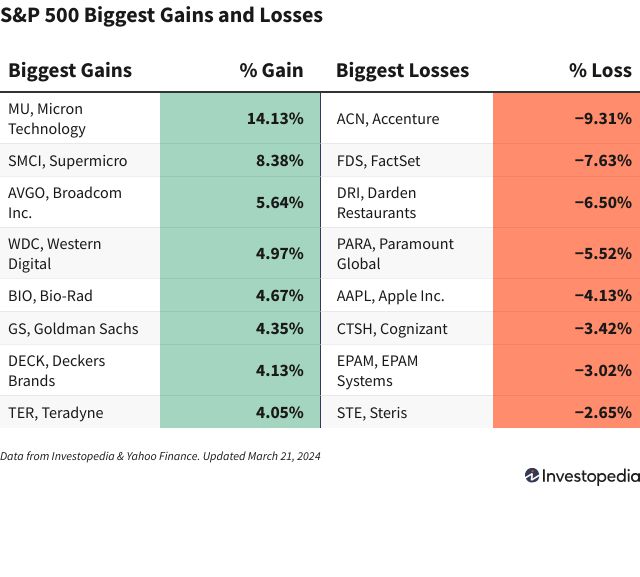

Enthusiasm for semiconductor firms that stand to benefit from the proliferation of artificial intelligence (AI) technology took center stage once again. Shares of Micron Technology ( MU ) led the S&P 500 higher, soaring 14.1% after the manufacturer of memory and storage chips beat quarterly sales and profit estimates amid strong AI-driven demand.

Server manufacturer Super Micro Computer ( SMCI ) saw its shares jump 8.4% on Thursday, recovering some of the losses posted in the previous session after the firm said it would sell around $2 billion worth of stock. Despite the issuance of additional shares, the company has made strategic investments that could boost its position as a supplier to AI-focused companies. Super Micro Computer stock debuted on the S&P 500 earlier this week.

Other semiconductor stocks also traded higher. Broadcom ( AVGO ) shares gained 5.6% after TD Cowen upgraded the stock and lifted their price target. Broadcom’s AI infrastructure event helped convince the analyst team that the chipmaker’s custom silicon and back-end AI networking products could drive strong growth.

Shares of Accenture ( ACN ) suffered the heaviest losses on the S&P 500, tumbling 9.3% after the consulting firm reduced its guidance amid a slowdown in sales and new bookings. Accenture’s CEO noted the company was facing an “uncertain macro environment.”

Financial data and analytics provider FactSet Research Systems ( FDS ) posted mixed financial results, beating earnings estimates but falling short on revenue, and its shares dropped 7.6%. The company also said it expects full-year revenue to come in at the low end of its previously issued guidance.

Darden Restaurant ( DRI ) shares slipped 6.5% after the operator of Olive Garden, LongHorn Steakhouse, and other restaurant chains posted lower-than-expected quarterly revenue and cut its full-year sales outlook. Although Darden got a boost from Ruth’s Chris Steak House, which it purchased last year, same-store sales declined at Olive Garden, its biggest revenue generator.