F OMO vs J OMO: that one letter makes all the difference. JOMO substitutes ‘fear’ for ‘joy’, suggesting that not only is it OK to miss out – it’s actually something to be relished. JOMO is an important concept for traders, emphasizing the need to take a step back, think, plan and enjoy, rather than rushing into trades through the anxiety of missing out.

In this article, learn all about the differences between FOMO and JOMO, including the reasons why it’s time to leave FOMO behind. Explore what JOMO is, what it looks like when trading, and discover seven key steps to turn your FOMO into JOMO.

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Why you Should Say Goodbye to FOMO

The concept of FOMO in trading applies to those who fear missing out. This could be a fear of missing a move on the markets, not knowing the latest financial news, or having a lack of knowledge compared to other traders. As a result, a FOMO trader is usually anxious and dissatisfied.

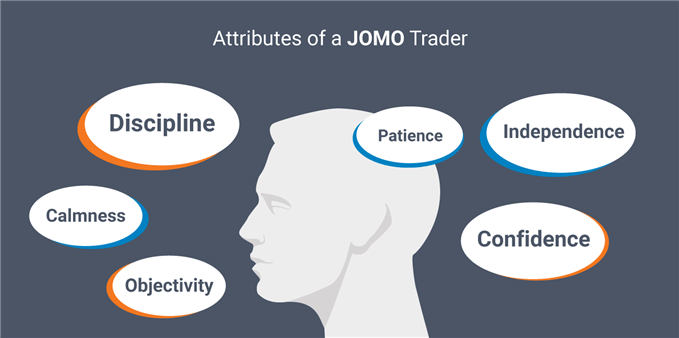

JOMO has been described as the ‘emotionally intelligent antidote to FOMO.’ JOMO in trading embodies calmness and discipline – traits that serve traders well. A JOMO trader knows their own mind, has a solid trading plan and doesn’t chase the markets, instead waiting for opportunities that fit with their trading strategy . This is in stark contrast to a FOMO trader, who is continually burdened with the fear of missed opportunities.

Are you a JOMO trader?

JOMO traders think differently to those driven by FOMO. Which trader’s logic most closely resembles your own?

| FOMO trader | JOMO trader |

|---|---|

| “Everyone else is making that trade – there’s no reason why I shouldn’t.” | “ GBP/USD seems volatile. It’s too late to enter according to my trading plan, though. I’ll wait this one out.” |

| “I really want this trade to end in the money. Fingers crossed!” | “I don’t want to gamble with my money. I trade on the back of detailed research, not guesswork.” |

| “I might place that trade… I’ll think about it and come back to it later.” | “I’ve carried out all my research and analysis – I know the trades I want to place.” |

| “Apparently this is a good time to trade crude oil . I saw it on Twitter under #FinTwit.” | “I’ve watched webinars and read the latest market news. I know exactly what’s happening.” |

| “I’m concerned I’ll miss an opportunity. I watch the charts for most of the day.” | “I’ve automated some processes. I won’t miss opportunities. If I don’t trade, it’s through choice.” |

There are distinct patterns in the behavior of these two traders. These are some of the attributes of a JOMO trader:

Of course, it’s not always as clear cut as this. In the fast-paced, ever-changing worlds of forex and commodities, traders can experience a rollercoaster of emotions. Fear, greed , anxiety, elation, and many more can all be triggered by a change in the charts or a volatile market. FOMO can affect anyone, and if it does, it’s not something that should cause negativity.

Every trader knows there’s room for improvement, even the professionals. Why not join our trading psychology webinars with analyst Paul Robinson to find out more about trading psychology and becoming a better trader?

If you're puzzled by trading losses, why not take a step in the right direction? Download our guide, "Traits of Successful Traders," and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

What Does JOMO Look Like in Trading?

There is no single way that JOMO in trading occurs, but it is generally discernible in calm, confident traders – those who are happy with their own strategies.

It can still be difficult to pinpoint specific trading habits and understand how they impact success, especially when a trader is considering their own practices. Here are some examples of common trading scenarios, and the actions a trader might take depending on their outlook:

| FOMO trader | JOMO trader | |

|---|---|---|

| Scenario 1: The price of gold reaches a six-year peak! How exciting! |

Jumps on the trend and goes long on gold. Outcome: Enters the trade too late, just as the market reverses. |

Consults charts and fundamentals. Outcome: Realizes the opportunity has passed. Sits this one out. |

| Scenario 2: The markets seem slow at the moment… when will there be a good opportunity? |

Searches for opportunities, fears missing out. Outcome: Places a trade, panics, exits early, makes a loss. |

Doesn’t feel the need to trade 24/7. Happy to miss out. Outcome: Knows there’ll be more opportunities – relaxes! |

| Scenario 3: The trade war is making the US Dollar volatile and traders have already profited. Is this a good time to trade again? |

Buoyed up by previous wins, enters another trade with little thought. Outcome: The trend reverses and the trader hangs on too long, out of greed, fear and FOMO. They make a significant loss. |

Considers the markets alongside their trading plan. Outcome: Waits for the right opportunity. There will be one that’s a perfect fit for their trading plan. |

A JOMO trader doesn’t win every trade, but that’s fine. They feel less pressure to trade and use a sensible strategy – they stand a much better chance of achieving long-term success.

7 Steps to Turn your FOMO into JOMO

Don’t fear missing out – embrace it! Here are seven steps to turn your FOMO into JOMO:

- Develop a trading plan . This is a framework that guides traders and keeps them focused. A good plan will ensure a trader knows when to enter trades – and when to leave them well alone.

- Keep a trading journal . This is a log of previous trades, allowing for analysis and reflection. It should be used alongside a trading plan to formulate strategies and develop better awareness. Keeping a journal makes traders more accountable to themselves, rather than following the herd for fear of missing out.

- Use expert, authoritative resources. When traders keep up with recent news and technical analysis , they have less need to rely on other traders. This helps break the FOMO cycle . Following the crowd through fear and anxiety feels less important; traders learn what to trade and what to ignore.

- Set processes. Traders are at their most efficient when they have established their own routines and ways of carrying out analysis. Often, the most efficient traders aren’t those who spend all day in front of a computer screen. They are the ones who have their own strategies and preferred markets, which enables them to focus their analysis and find their ideal trades.

- Listen to others – but filter the information. JOMO isn’t about cutting ties with the rest of the trading world. It is about taking information on board and sifting through it to make the right decisions. By all means, use #FinTwit and @ and have discussions with fellow traders. Just don’t feel pressurized to follow the herd.

- Improve your trading psychology . This term refers to the multitude of emotions that can inundate traders and influence decision-making. Improving trading psychology can help turn weaknesses into strengths, and turn FOMO into JOMO

- Have a healthy relationship with trading. Even professionals who make a living from trading sometimes need to relax and take a step back. Trading at any level should never impact wellbeing and should be a rewarding activity, with opportunities to improve and develop. As traders develop confidence, they learn to trust their own skills, and place the right trades for them.

To learn how professionals handle pressure and what their daily routines look like, watch our series ‘A Day in the Life of a Trader ’ .

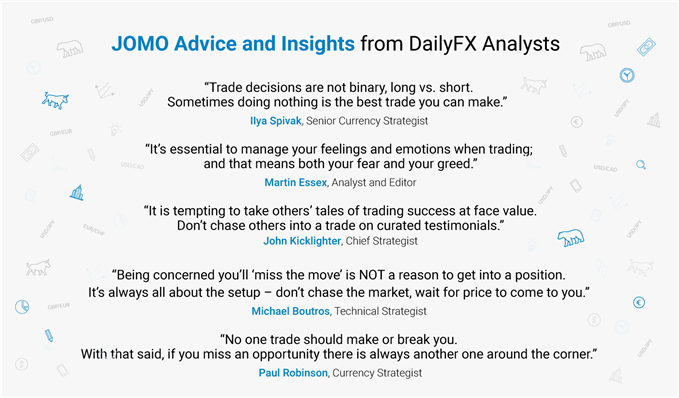

How to Achieve JOMO: Advice from Analysts

We asked our analysts and strategists to share their JOMO wisdom – here are their thoughts about eliminating fear and swapping it for joy:

Learn More About FOMO and How to Manage Emotions in Trading

- Learn to manage FOMO so you can trade more successfully. Read our guide to overcoming FOMO and stop it in its tracks.

- Get more tips on how to manage emotions when trading .

- Remember JOMO is just one attribute of successful traders. Explore the key traits of successful traders and how to apply them to your trading.