Trading bias allows traders to make informative decisions when dealing in the market. This relates to both novice and experienced traders alike. This article will cover:

- What a bias is in trading

- Why traders need a bias

- How to develop trading bias using technical indicators

- Further reading to develop a successful trading mindset

What is bias in trading?

Trading bias is a predisposition or perspective of the financial markets whereby traders believe there is a higher probability of a certain outcome as opposed to any other alternate possibilities.

These trading biases are determined by technical and/or fundamental factors that support a specific outlook that explains market behaviour. This often relates to market trends being either bullish/bearish which signals appropriate trading strategy and style.

Why do Traders Need Bias?

Traders need bias in order to form trade decisions that align with their specific trading strategy . The end goal is to make good decisions with real money on the line. There are so many decisions to be made on each trade that it can be overwhelming and can often lead to errors.

For example, a trader needs to determine what market to trade, when to get in, how long to hold the trade, when to get out, and what trade size. There are many other decisions that enter in as well such as, do I move my stop loss , do I take partial profits and scale out (there are many more choices to be made, but you get the point).

In the trading world, a newer trader often gets hung between the potential for profit and the possibility of loss. They don’t have enough experience to produce and overwhelming emotion about the trade set up. They in essence, lack the confidence and ability to ‘control’ a positive outcome and wind up freezing with indecisiveness. As a result, they let other things improperly anchor that emotion for them like their recent demo results.

Newer traders tend to rely solely on outcomes to develop their perceptions. The problem with the outcomes is that even though some of those trades may have been profitable, they are likely riskier over the long run.

The below are the main components a trader needs to determine a trading bias:

- What market to trade?

- What direction do I trade?

- When to get in?

- When to get out?

- Trade size?

What market to trade

The market to trade is often a confusing place to begin for novice traders. Traders often gravitate toward popular markets that do not provide the relevant trade opportunities. At , the sentiment tool can help traders select the appropriate market by producing long/short retail percentages.

This is not the only method by which traders can select a market to trade. Many traders use their specific trading strategy (e.g. trend trading) to identify appropriate markets. Other traders prefer using fundamental analysi s ; exploring such as political news or macroeconomic events as a foundation as to which markets to trade.

What direction do I trade

Trade direction is usually linked to the market trend which again ties into the trading strategy. This could be short- or long-term trend indications depending on the trader's preference for trading time horizon.

When to get in and out

Trading the markets encompass technical and fundamental analysis . These can be traded in isolation or a combination to determine buy and sell points . These entry and exits are generally determined by technical tools such as indicators (moving averages) or by trading breakouts using price action.

Trade size

Trade size is essential to any trading plan . Novice traders often overlook this aspect and trade irrationally. Trade size needs to be taken into consideration according to account size/balance. At , we suggest using a trade size so that you are not risking more than 5% on all open positions.

How to Develop Trading Bias using Technical Indicators

Supporting information provided by technical indicators - such as the moving average - can assist traders in acquiring a trading bias.

Moving averages are another tool traders can use to determine a trading bias. Typically, traders use a 200-period simple moving average (MA) . Traders can apply this indicator to any graph and see if price is either above or below the moving average. If price is above the average, traders can take a bias that the trend is up and look for opportunities to buy. Conversely if price is below the average, traders can say that the trend is down while having a trading bias to sell.

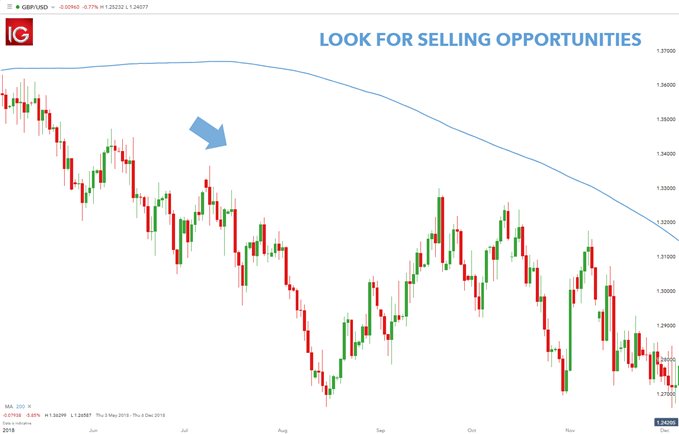

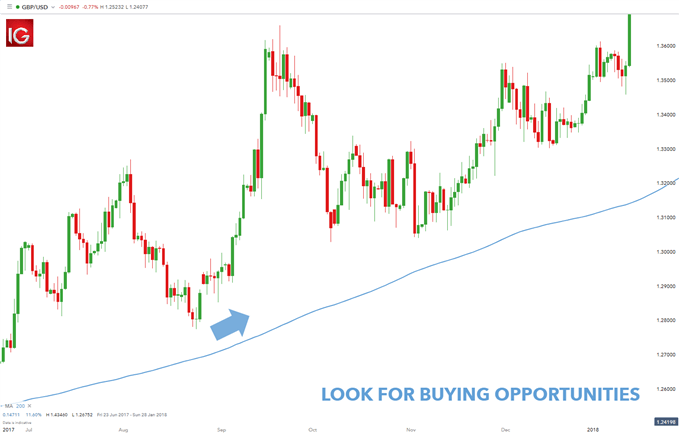

The charts below show trading bias using moving averages on GBP/USD . The 200 period MA has been added, and price is trading well below the indicator. Knowing this, short term day traders can take this information and form a bias to look for sell positions. This bias could be held until prices start to move back up towards a higher high and penetrate the moving average line. The opposite is true for prices trading above the MA as seen in the second chart.

Bearish trading bias:

Bullish trading bias:

The first way to identify a trading bias is through price action. Traders can view a chart and see if prices are generally rising or falling through the identification of a swing high or low. If prices are getting higher, and the lows are advancing as well, traders should form a bias to buy. If prices are declining (lower lows and lower highs), traders should have a specific bias to sell. By reviewing 200-300 periods on the chart, this technique can be used with virtually any trading strategy.

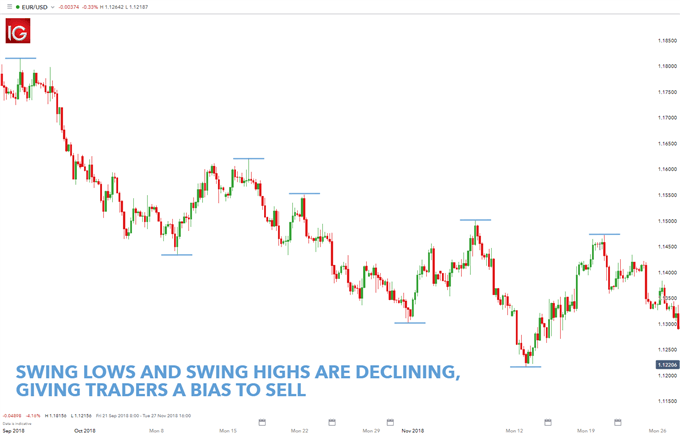

EUR/USD price action trading bias:

The chart above depicts a EUR/USD four-hour chart. Traders will begin their analysis by looking back on nearly two months’ worth of data. This will show traders approximately 300, four-hour candles. Notice how prices are slowly moving down to new lows for the period selected. This shows that the market is in a downtrend, which can allow traders to form a bias to sell.

Further reading to develop a successful trading mindset

- Consistency in trading begins with identifying a forex trading strategy that best suits particular needs and resources. When it comes to implementation, traders generally gravitate towards technical or fundamental analysis .

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders . Incorporate these traits into your strategy to give yourself an edge in the markets.