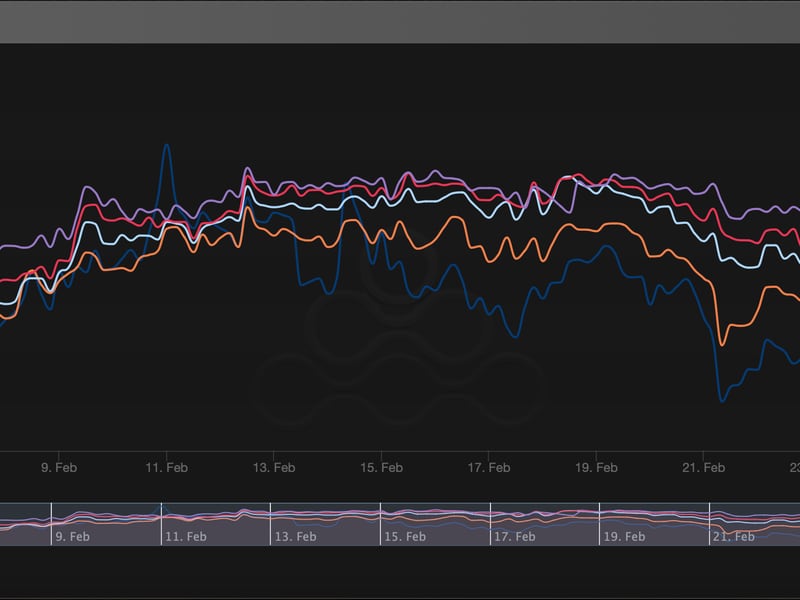

Bitcoin (BTC) has gained over 40% in four weeks and is just 10% short of challenging its record high near $69,000. The surge is consistent with the cryptocurrency’s record of rallying ahead of and after the quadrennial mining reward halving . That said, bitcoin call-put skews, which measure the cost of call options relative to puts over different maturities, suggest investors’ bullish expectations have materialized too soon. Data tracked by Amberdata show longer-duration call-put skews no longer exhibit a stronger call bias than short-duration skews and both have converged at around 5.5%. “This may be due to the heightened speculative sentiment among investors, which has led to a decrease in demand for far-month options. But we cannot rule out another possibility: As prices rise, investors’ expectations are realized ahead of schedule, and they are relatively cautious about the possibility of further sharp rises,” crypto financial platform BloFin said on X.