When it comes to buying and selling forex, traders have unique styles and approaches. This is because the forex market is one of the most liquid and largest in the world and as a result there is no one single way to trade.

Knowing when to buy and sell forex depends on many factors, but there tends to be more volume when markets are volatile because of the associated higher risk. This article will explore the concept of buying and selling currencies using practical examples as well as additional resources to boost your forex trading experience.

What it means to buy and sell forex

Buying and selling forex pairs involves estimating the appreciation/depreciation in value of one currency against the other. This could involve fundamental or technical analysis as a foundation of the trade. Once a basis has been formed, the trader will look to other technical and fundamental aspects. Key levels of entry and exit will follow, keeping in mind risk management processes.

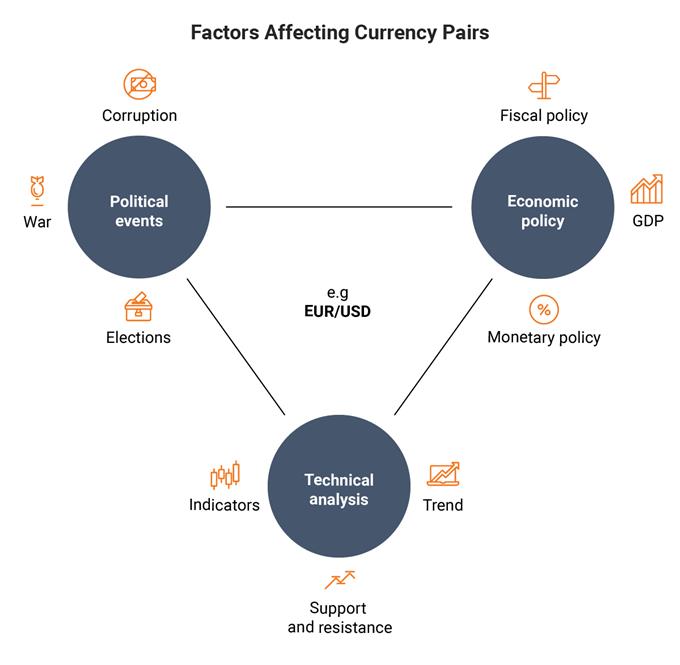

Factors which affect currency pairs

Political events

Government instability, corruption and changes in government can affect the value of a currency – for example, when president Donald Trump was elected the Dollar soared in value!

Economic policy

From a fundamental standpoint , forex traders keep a close eye on unemployment figures, GDP , monetary and fiscal policies (just to name a few) which have influence over the value of currencies. Our economic calendar shows upcoming events which may shake up the financial markets.

Technical analysis

Technical traders tend to favor key price levels ( support & resistance ), trends and other indicators to form a basis for their forex trades.

How to buy and sell EUR/USD

Using the EUR/USD currency pair, we will provide an example of how and when to buy or sell forex. Let’s say you want to buy the EUR/USD . If the EUR goes up in value relative to the USD once the trade is sold, you could have made a profit (depending on commission and other fees). A trader in this example would be buying the EUR and selling the USD at the same time. As an example, if the EUR/USD pair was bought at 11300 and the pair moved up to 11504 at the time that the trade was closed/exited, the profit on the trade would have been 204 pips . This is shown in the chart below.

In this example the technical perspective was utilized:

- Entry level - Morning star candlestick pattern shows a potential entry point, which was substantiated by the use of the RSI indicator which displays an oversold signal.

- Exit level – Using key price levels of to set initial take profit level.

Similarly, a fundamental trader could trade the USD/JPY currency pair by following political and economic news. For example, if a fundamental trader expected the Fed to hike interest rates , this may attract greater foreign investment into the US, and thus more demand for the home currency (USD). The trader could then look to enter into a long (buy) position in anticipation of the USD to appreciating in value. Of course, this is not absolutely certain as economic principals/theory do not always translate to real world conditions. Taking short positions on forex pairs is slightly more complex as opposed to buying. Read more on how to short forex to gain more insight.

Understanding risk management when buying and selling forex

Risk management is essential to longevity in forex trading. This does not simply include a positive risk/reward ratio but understanding the potential swings in volatility as well. Factors affecting forex pairs can have significant impacts at times so preventing adverse effects on your trade can be managed by implementing proper risk management techniques. Buying and selling forex can be complex, therefore understanding the mechanics behind it, such as how to read currency pairs , is essential prior to initiating a trade. We also recommend reading our forex guide for beginners to get a crash course on the basics of forex trading.

Further reading and tools to support your forex trading

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders . Incorporate these traits to give yourself an edge in the markets.

- Traders often look to retail client sentiment when trading popular FX markets. provides such data, based on IG client sentiment .

- The forex market has evolved over centuries. For a summarized account of the most important developments shaping this $5 trillion-a-day market read more on the history of forex .