What is Contractionary Monetary Policy?

Contractionary monetary policy is the process whereby a central bank deploys various tools to lower inflation and the general level of economic activity . Central banks do so through a combination of interest rate hikes, raising the reserve requirements for commercial banks and by reducing the supply of money through large-scale government bond sales, also known as, quantitative tightening (QT).

It may seem counter-intuitive to want to lower the level of economic activity but an economy operating above a sustainable rate produces unwanted effects like inflation – the general rise in the price of typical goods and services purchased by households.

Therefore, central bankers employ a number of monetary tools to intentionally lower the level of economic activity without sending the economy into a tailspin. This delicate balancing act is often referred to as a ‘soft landing’ as officials purposely alter financial conditions, forcing individuals and businesses to think more carefully about current and future purchasing behaviors.

Contractionary monetary policy often follows from a period of supportive or ‘accommodative monetary policy’ (see quantitative easing ) where central banks ease economic conditions by lowering the cost of borrowing by lowering the country’s benchmark interest rate; and by increasing the supply of money in the economy via mass bond sales. When interest rates are near zero, the cost of borrowing money is almost free which stimulates investment and general spending in an economy after a recession.

Contractionary Monetary Policy Tools

Central banks make use of raising the benchmark interest rate, raising the reserve requirements for commercial banks, and mass bond sales. Each is explored below:

1) Raising the Benchmark Interest Rate

The benchmark or base interest rate refers to the interest rate that a central bank charges commercial banks for overnight loans. It functions as the interest rate from which other interest rates are derived from. For example, a mortgage or personal loan will consist of the benchmark interest rate plus the additional percentage that the commercial bank applies to the loan to provide interest income and any relevant risk premium to compensate the institution for any unique credit risk of the individual.

Therefore, raising the base rate leads to the elevation of all other interest rates linked to the base rate, resulting in higher interest related costs across the board. Higher costs leave individuals and businesses with less disposable income which results in less spending and less money revolving around the economy.

2) Raising Reserve Requirements

Commercial banks are required to hold a fraction of client deposits with the central bank in order to meet liabilities in the event of sudden withdrawals. It is also a means by which the central bank controls the supply of money in the economy. When the central bank wishes to reign in the amount of money flowing through the financial system, it can raise the reserve requirement which prevents the commercial banks from lending that money out to the public.

3) Open Market Operations (Mass Bond Sales)

Central banks also tighten financial conditions by selling large amounts of government securities, often loosely referred to as ‘government bonds’. When exploring this section, we will consider US government securities for ease of reference but the principles remain the same for any other central bank. Selling bonds means the buyer/investor has to part with their money, which the central bank effectively removes from the system for a long period of time during the lifetime of the bond.

Foundational Trading Knowledge

Macro Fundamentals

Learn about the importance of major central banks

Start Course

The Effect of Contractionary Monetary Policy

Contractionary monetary policy has the effect of lowering economic activity and lowering inflation.

1) Effect of Higher Interest Rates : Higher interest rates in an economy make it more expensive to borrow money, meaning large scale capital investments tend to slow down along with general spending. On an individual level, mortgage payments rise, leaving households with lower disposable income.

Another contractionary effect of higher interest rates is the higher opportunity cost of spending money. Interest-linked investments and bank deposits become more attractive in a rising interest rate environment as savers stand to earn more on their money. However, inflation still needs to be taken into account as high inflation will still leave savers with a negative real return if it is higher than the nominal interest rate.

2) Effect of Raising Reserve Requirements : While reserve requirements are used to provide a pool of liquidity for commercial banks during times of stress, it can also be altered to control the supply of money in the economy. When the economy is overheating, central banks can raise reserve requirements, forcing banks to withhold a larger portion of capital than before, directly reducing the amount of loans banks can make. Higher interest rates combined with fewer loans being issued, lowers economic activity, as intended.

3) Effect of Open Market Operations (Mass Bond Sales) : US treasury securities have different lifespans and interest rates (‘T-bills’ mature anywhere between 4 weeks to 1 year, ‘notes’ anywhere between 2- 10 years and ‘bonds’ 20 to 30 years). Treasuries are considered to be as close as you can get to a ‘risk-free’ investment and therefore are often used as benchmarks for loans of corresponding time horizons i.e., the interest rate on a 30-year treasury bond can be used as the benchmark when issuing a 30-year mortgage with an interest rate above the benchmark to account for risk.

Selling mass amounts of bonds lowers the price of the bond and effectively raises the yield of the bond. A higher yielding treasury security (bond) means it’s more expensive for the government to borrow money and therefore, will have to reign in any unnecessary spending.

Examples of Contractionary Monetary Policy

Contractionary monetary policy is more straight forward in theory than it is in practice as there are plenty of exogenous variables that can influence the outcome of it. That is why central bankers endeavor to be nimble, providing themselves with options to navigate unintended outcomes and tend to adopt a ‘data-dependent’ approach when responding to different situations.

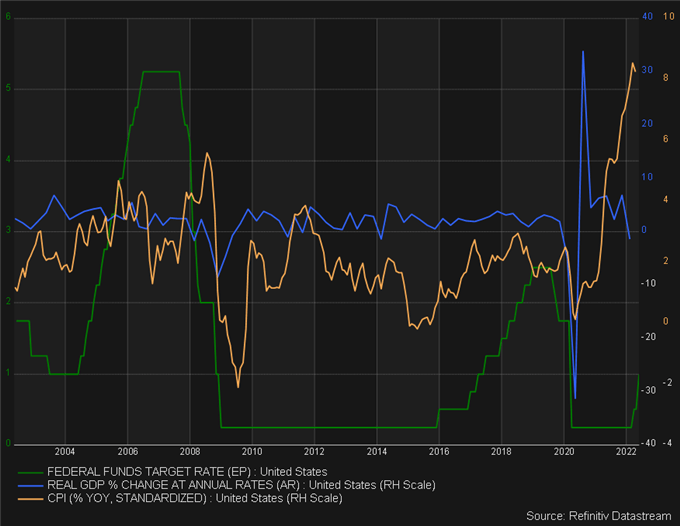

The example below includes the US interest rate (Federal funds rate), real GDP and inflation (CPI) over 20 years where contractionary policy was deployed twice. Something crucial to note is that inflation tends to lag the rate hiking process and that is because rate hikes take time to filter through the economy to have the desired effect. As such, inflation from May 2004 to June 2006 actually continued its upward trend as rates rose, before eventually turning lower. The same is observed during the December 2015 to December 2018 period.

Chart: Example of Contractionary Monetary Policy Examined

Source: Refinitiv Datastream

In both of these examples, contractionary monetary policy was unable to run its full course as two different crises destabilized the entire financial landscape. In 2008/2009 we had the global financial crisis (GFC) and in 2020 the spread of the coronavirus rocked markets resulting in lockdowns which halted global trade almost overnight.

These examples underscore the difficult task of employing and carrying out contractionary monetary policy. Admittedly, the pandemic was a global health crisis and the GFC emanated out of greed, financial misdeeds and regulatory failure. The most important thing to note from both cases is that monetary policy does not exist in a bubble and is susceptible to any internal or external shocks to the financial system. It can be likened to a pilot flying under controlled conditions in a flight simulator compared to a real flight where a pilot may be called upon to land a plane during strong 90 degree crosswinds.