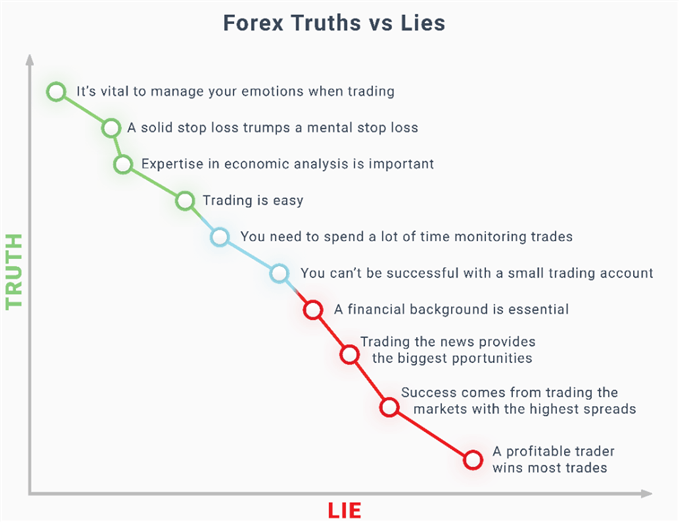

Do you know the truths about forex trading?

Traders face a barrage of information when they start out in the markets – and being able to sort the wisdom from the folly could be the difference between success and failure. Should you risk 1% of your account per trade, or 5%? Does RSI work better than stochastics ? And is Bitcoin really a reliable store of value? Granted, some topics will always be debatable, but with the help of our expert analysts, we uncover the truth about forex trading, the lies, and the murky bits in between.

First, learn the truth about your own forex journey with our DNA FX Quiz , helping you discover the kind of forex trader you are.

Truth or Lie: Traders Need a Financial Background

“Trading has little to do with ‘finance’ and more to do with understanding what is involved in performance-related endeavors” - Paul Robinson , Currency Strategist

A financial background can be useful for understanding how forex and other markets work. However, more beneficial are skills in math, engineering and hard sciences, which better prepare traders for analyzing and acting on economic factors and chart patterns. It doesn’t matter how much awareness you have about financial markets – if you can’t process new data quickly, methodically and in a focused manner, those same markets you thought you knew so well can eat you alive.

ANSWER: LIE

EXPERT TIP: To prepare for trading, focus on developing analytical skills rather than boning up on financial knowledge.

Recommended reading:

Truth or Lie: Trading is Easy

“ Trading is definitely easy. Being profitable is where the difficulty lies” - Peter Hanks , Analyst

Trading is like running a business. In order to be successful, you need to learn from mistakes and have rules in place to help protect your capital. Like a business, it’s crucial to have appropriate strategies on hand for varying market conditions. Setting up a business is easy, and similarly, trading is easy too. Developing successful strategies and making money? That’s the hard part.

ANSWER: TRUTH

EXPERT TIP: It will seem easy if your early trades go well, but long-term profitability is a different matter altogether. Make your life easier by researching your trades, using the right position size, setting stops and keeping a handle on your emotions.

Recommended reading:

- Download our Free New to Forex Guide

- Top Forex Trading Strategies

- Three Things I Wish I Knew When I Started Trading Forex

Truth or Lie: You can’t be successful with a small trading account

“A 20% return is a 20% return regardless of the account size” - Paul Robinson

Can you be successful with a small trading account ? It depends on your definition of successful. An account needs to be large enough to accommodate proper risk parameters. But success is relative; a high rate of return is based on percentages and not on monetary amounts.

For example, a 20% return is a 20% return regardless of the account size. However, if your 20% return isn’t worth enough in hard cash, it might be hard to incentivize yourself to improve as a trader.

ANSWER: IT DEPENDS

EXPERT TIP: Your account size will depend on your goals and your prior success. Naturally, experienced traders will have a larger account but to begin with, concentrate on that rate of return percentage.

Recommended reading:

- How Much Capital Should I Trade Forex With?

- How to Determine Your Position Size

- What is Margin Call in Trading?

Truth or Lie: A profitable trader wins most trades

“Think quality of trades, not quantity of trades” - Nick Cawley , Analyst

Bragging rights be damned: the number of trades you win is irrelevant. Profitable traders simply make more money than they lose.

Say you win five trades and make $5,000, but lose one trade and lose $6,000 – you have won more trades than you have lost but are still down overall. Profitable traders will set rigid risk-reward parameters for a trade – for example they might risk $500 to make $1,000, a risk-reward ratio of 1:2.

If a trader makes five trades using this method, loses three of them and wins two of them, the trader is still $500 in profit ($2,000 profit-$1,500 loss). Don’t be afraid of taking a few hits: if your process is sound, one big winning trade can reverse your fortunes.

ANSWER: LIE

EXPERT TIP: Many successful traders will be losing more trades than they win, but oftentimes it won’t bother them. Focus on getting the right setups rather than worrying about the ones that got away.

Recommended reading:

- What is a Good Win Ratio?

- How Many Pips Should be Targeted Per Day?

- Trading is Not About How Often You Win or Lose

Truth or Lie: You need to spend a lot of time monitoring trades

“Spending too much time monitoring trades can work against you as the temptation to micromanage becomes too great” - Paul Robinson

How much time you spend trading, and monitoring trades, will depend on your trading style . Those employing a scalping strategy , for instance, will make a large number of transactions per day, entering and exiting many positions, and will need to pay close attention to their trades on the shortest timeframes.

However, position traders won’t need to spend as much time monitoring, as their transactions may last weeks, months or even longer – meaning long-term analysis will account for short-term fluctuations.

ANSWER: IT DEPENDS

EXPERT TIP: Ask yourself what type of trader you are. Shorter timeframes will mean monitoring and analyzing constantly – being ‘always on’. If you favor a more relaxed approach you may be suited better for position trading.

Recommended reading:

- Trading With Confidence in the Forex Market

- How to Trade Consistently Without Having the Perfect S trategy

- The Time Frames of Trading

Truth or Lie: A solid stop loss trumps a ‘mental stop loss’

“Reckless traders use a mental stop loss. Disciplined traders use a real stop loss” - Nick Cawley

Some traders advocate a ‘mental stop loss’ when the market gets tough – that is, relying on oneself rather than a computer to set a level at which to exit a losing position. The problem is, a ‘mental stop loss’ is just a number that makes you worried about the money you’re losing. You may fret about the direction of the market - but you won’t necessarily be compelled to exit your trade.

A fixed forex stop loss is completely different – if your stop loss price trades you are out of the position, no ifs or buts. Exercising proper money and risk management means setting solid stops. Period.

Answer: TRUTH

EXPERT TIP: It can be so easy to neglect your stop loss. When a trade is going your way, the dollar signs can blind you - but you should protect yourself against the market turning.

Recommended reading:

Truth or Lie: Success comes from trading markets with the tightest spreads

“The best opportunities shouldn’t be fragile enough in profit potential that a larger-than-normal spread is going to make or break the ability to be profitable” - Paul Robinson

Spreads may represent the primary cost of trading, but they aren’t the be-all-end-all when it comes to choosing your market. You may find an asset that has a wide spread but represents a strong opportunity due to its volatility . Similarly, you may find an asset with high liquidity and a tight spread, but that isn’t showing much trading potential. Above all, you should let your trading decisions be governed by setups presented by the market, not the size of the spread.

Answer: LIE

EXPERT TIP: The spread can represent a significant cost to traders – but don’t let it be the sole factor dictating your choice of asset.

Recommended reading:

- What Does a Forex Spread Tell Traders?

- Forex Spreads Trading Strategies and Tips

- Download our free Traits of Successful Traders Guide

Truth or Lie: Expertise in economic analysis is important

“Economic analysis is only one part of trading. Economic analysis and technical analysis go hand-in-hand” - David Song , Currency Strategist

The economic analysis key to a fundamental approach helps give traders a broader view of the market. Sound knowledge of the underlying forces of the economy, industries and even individual companies can enable a trader to forecast future prices and developments. This is different to technical analysis , which helps to identify key price levels and historical patterns, and provides conviction for entering/exiting a trade.

It’s true to say that expertise in economic analysis is important. However, so too is expertise in the technicals. Many successful traders will look to combine fundamental and technical analysis so as to be in a position to draw on as wide a range of data as possible.

Answer: TRUTH

EXPERT TIP: It may be worthwhile to devise a strategy accounting for the nuances of both technical and fundamental analysis.

Recommended reading:

Truth or Lie: Trading the news provides the biggest opportunities

“Correctly capturing a broader theme can be far more fruitful than ‘trading the news’ per se” - Paul Robinson

News can create big moves in the market, but that doesn’t mean trading the news leads to the biggest opportunities. For a start, the volatility of important news events often makes spreads wider, in turn increasing trading costs and hitting your bottom line. Slippage, or when you get filled at a different price than you intended, can also hit your profitability in volatile markets. On top of these drawbacks, traders could get locked out, making them helpless to correct a trade that moves against them.

ANSWER: LIE

EXPERT TIP: ‘Trading the news’ can seem like a fashionable thing to do, but market movements can be unpredictable at the time of major releases. It’s often best to steer clear during such high volatility.

Recommended reading:

Truth or Lie: Managing your emotions when trading is vital

“Negative emotions like fear and greed can be managed without suppressing positive ones” - Paul Robinson

Excluding emotions from trading is an impossible endeavor. It can lead to more internal conflict than benefits, which is why managing emotions is a better way of looking at it. You have negative emotions like fear and greed that need to be managed without suppressing positive ones like conviction that help drive you towards the best opportunities.

Answer: TRUTH

EXPERT TIP: Even the most experienced traders feel emotion in the heat of the markets, but how they harness that emotion makes all the difference.

Recommended reading:

- What is FOMO in Trading?

- Becoming a Better Trader: A Checklist Before Entering Any Trade

- Psychology and Trading podcast

Anything we didn’t mention? Leave a comment to give us your own truth about trading, and make sure to share this article on social media.