What is a trading journal?

A trading journal is a log that you can use to record your trades. Traders use a trading journal to reflect upon previous trades so that they may evaluate themselves, and you should too! You can use journals to evaluate where you can improve your trading. They are a useful form of record keeping.

Why trading journals are useful

Main reasons to keep a trading journal include:

- They help you identify weak points and strong points in your style.

- Journals could increase trading consistency.

- The journal could keep you accountable.

- The journal can help you choose your best trading strategy.

Keeping a journal is a simple yet extremely effective way to improve a trading plan . A trading plan is a set of rules and guidelines you will follow that includes strategy, risk management, and trader psychology.

How to create a trading journal

Creating a trading journal is simple and you can tailor one to your specific trading goals and style. The following steps are a basic guide, which are explained in more depth below:

- Choose between a book or a spreadsheet. We recommend using a spreadsheet.

- Identify what information you would like to record. (Date of trade, underlying asset, position size etc.)

- Record your trades directly after you have finished placing your stop losses and take profits.

- After a designated period (daily/monthly/weekly) compile the data and reflect upon the trades.

Step 1: Choose a book or spreadsheet

We recommend using a spreadsheet because of the built-in analytical functions. These can help you reflect upon the trades as we explain in step 4.

Step 2: Identify the information to record

The standard format of a trading journal will include these main criteria:

| Currency Pair | Size | Long/Short | Date | Conviction | Strategy used | Points | Successful or not? |

|---|---|---|---|---|---|---|---|

| USD/JPY | 1 lot | Long | 30 Jan 19 | High | Fundamentals | 100 | Successful |

The standard format is an example of a simple trade journal. It can help you reflect on your trades, but with a few extra criteria we can enhance the journal so that it provides much more useful information.

Useful information to consider adding include:

Reason for trade: The reason could be due to technical or fundamental analysis or a combination of both. Once you have executed several trades you can reflect on this information to see if your reasons for trading are bearing tangible results. This could also help you determine which strategy works better for you - technical analysis or fundamental analysis .

Conviction: Conviction is how you feel about the trade. If you are making the trade based on a technical pattern and if the pattern ‘checks off’ several guidelines, then we can list the conviction as ‘high’. However, if the pattern or fundamental story isn’t really clean, then the conviction may be ‘medium’ or ‘low’ depending on the factors basing the trade. By writing down your conviction, you can calculate the amount of successful trades you have had with each rank of conviction. This could help you determine whether you should only trade when you are very convinced or not.

Other: You can put whatever you feel is necessary to record in your journal. Some traders add a criterion for how they feel emotionally when placing the trade. Anything you feel will help you, write down.

Step 3: Record the trades directly after the trade

Get into the habit of recording the details of the trade directly after the trade, while it is still fresh. This way you won’t have to remember what your reasons were for taking the trade. Make sure to do this only after placing your stop-loss and take-profit.

Step 4: Compile the data and reflect upon the trades

After a certain amount of time, preferably a few months so you have enough data, you can compile the data in your trade journal.

If you have a conviction criterion in your journal, tally up the amount of successful trades made when your conviction was high, medium, and low. Once you have this data you can make the decision of whether it is worth trading only when your conviction is high or not.

For example, if you maintained a high conviction in 10 trades and eight of them were successful trades (Take-profits were hit) that’s as 80% probability of success on your historical trades. If your conviction was low on 10 trades and only two were successful trades that’s a 20% probability of success. Therefore, you would conclude that it is only worth trading when your conviction is high.

You can do this will all the different types of criteria so that you can reflect on your trading and improve.

Trading Journal Template

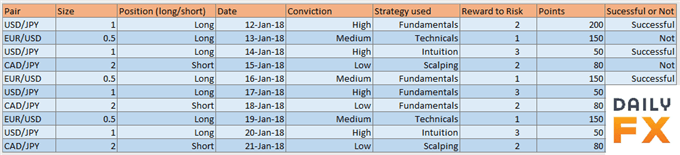

Here is an example of a trading journal template that includes type of trading strategy used as a criterion.

Having discussed the different criteria, you could include in your journal, the table above illustrates how you could organize all this information in a spreadsheet. You can download the template above for personal use from page five of our free building confidence in trading guide .

Trading Journals: A Summary

Having a trading journal should be one of the first steps traders implement when learning to trade. A journal is of utmost important to testing different strategies and finding which trading plans work for individual traders.

A trading journal is essential in testing whether a current trading strategy is working. To summarize:

- Trading journals are there to log your trading activity.

- They help traders test different trading plans and strategies.

- Trading journals can also help traders pinpoint strengths and weaknesses in a trading style.

To add to your knowledge see the Number One Mistake Traders Make where we analyzed thousands of live trades and came to a striking conclusion.

If you are a forex trader, you can read our article on keeping a forex trading journal that includes tips on finding the journaling method that fits you.