Is Our Money Broken?

The concept of a kingdom seems to be quite primitive when perceived though the lens of a modern democracy or constitutional republic. In a kingdom, a king was deemed to be the sovereign ruler, selected by God through birth and entitled by divine right to pass whatever laws they thought were best for the kingdom and its citizens. Speaking against the throne was a treasonous offense often punishable by death.

History is replete with examples of instances when a kingdom faced with massive expenses would force the king to call in all of the coins in the kingdom to determine the value of the kingdoms monetary supply. During these tabulations, the king would clip the edges of all of the coins so that he could pay the kingdoms debts and return the clipped coins to its citizens. The citizens of the kingdom horrified that their currency had been stolen from them feared to say anything at the risk of death. Merchants in the kingdom observed that prices for goods and services increased sharply after the coin clippings because the money was worthless.

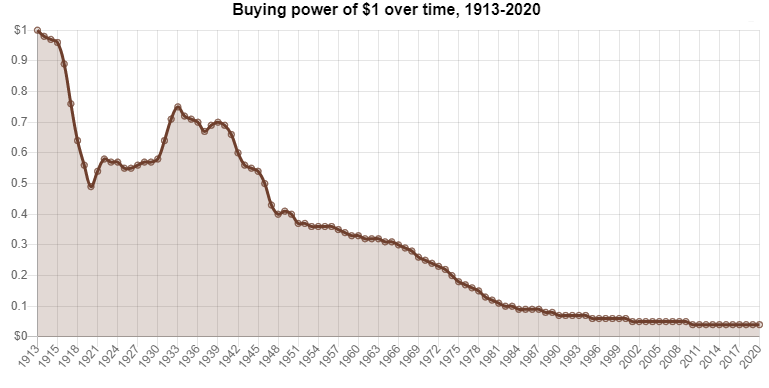

This is how currency was originally debased in olden times. Today, our monetary authorities unfortunately are not much different. They no longer go to the trouble of clipping coins. Instead they simply turn on the printing press and create money out of thin air. This monetary alchemy, the process of creating currency from nothing has been center stage for the last 107 years since the Federal Reserve Act was passed in 1913. Since that time the U.S. Dollar has lost almost 99% of its purchasing power. This reality is forcing consumers to look for alternative sources of money.

Throughout history almost every imaginable good or item has acted as money. Shells, beads, tobacco, livestock, stones, precious metals, cocoa beans, salt, butter, etc. As you begin to examine all of these different forms of money you quickly understand one of the major problems of money. That being, money is valuable because of the time and difficulty required to produce it. Once an item is recognized to be money, that good is immediately in high demand, and more of it will be attempted to be created.

The simplest way to understand this is to answer the following question:

How would you most like to be paid? You can choose any ONE thing which will act as money for you.

As you contemplate answering that question, you will quickly realize that every civilization has had to confront this problem. What makes good money possible?

Money is essentially a tool for trading human time. History clearly shows us that the corruption of monetary systems leads to social unrest and decay. The challenge of all civilizations is to create a standard of money that is incorruptible and the temptation to manipulate money has always proven to be too strong for mankind to resist. Political interests gravitate towards positions where they try to sway how money can and will be used in society.

Money can become corrupted when it is too easy to produce. When this occurs the value of money comes into question and other forms of money arise.

Take for example an important historical reference of monetary corruption with aggry beads in Africa. In the 16 th century decorative glass beads were used by early Europeans to purchase African resources. Glassmaking was not common in Africa, so it was highly valued by the locals. The beads were used for currency and wealth storage.

aggry beads

When early European traders visited Africa in the 16th century, it was quickly apparent to them that aggry beads were treasured there. In Europe, glass making technology was much more advanced and aggry beads could be mass produced at a very low cost. Recognizing a huge economic opportunity, European merchants began arranging huge expeditions into Africa, shipping counterfeit aggry beads which had been mass produced in European glass making facilities. European cargo ships arrived on African shores, with hulls packed full of glass beads. This began a multi-decade long plunder of African wealth, natural resources, people and ultimately time. This counterfeiting operation was the genesis of the slave trade and crippled African society for many generations. European merchants traded counterfeit beads for real wealth and literally entire villages of people. This horrible period of human history clearly illustrates how counterfeiters corrupted a monetary system to literally create generations of slaves which they exported to the Americas. It is estimated that about 12.5 million African locals were sold into slavery between 1501 and 1806 during this African holocaust. Aggry represent how vulnerable monetary systems are towards value being corrupted by “hackers.”

When you study the evolution of money you quickly recognize that historically there has been a good that was very valued by people. This good was considered to be MONEY. If this MONEY was difficult to trade with because of storage, portability or divisibility what people did is they created pieces of paper which represented the actual commodity. Then they simply traded the pieces of paper instead of the actual good. Unfortunately, this is the only technological innovation that has occurred with regards to money until Bitcoin was invented.

The “hack” to this paper monetary system was that bankers, where the commodity was stored, quickly noticed that people very rarely requested the actual commodity which the pieces of paper represented. So, these monetary authorities simply printed more slips of paper because they had their own printing press to enrich themselves with all the things those new pieces of paper could acquire. Notice how similar this scam was to the aggry bead counterfeiting episode. The allure of counterfeiting is powerful. If you can do it without getting caught, you are able to print your own money and buy whatever you want with it. Counterfeiting is the ultimate technology for people who want to get something for nothing.

The challenge for anyone who observes the financial markets is to determine for themselves how easy it is for monetary authorities to create money today and the effect that will have on your own personal wealth.

Good money needs to be durable and scarce. If money does not have these properties it has no store of value and can often become worthless. A money that possesses no store of value is an ongoing source of wealth inequality in a society.

Here is why it matters.

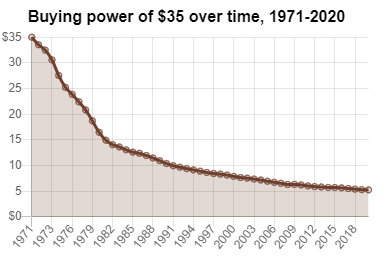

On August 15, 1971 when President Nixon removed Gold convertibility from the US dollar an ounce of Gold cost $35. After almost 50 years we can see the results of how monetary policy had affected any choice made with that $35.

If you buried that $35 in a coffee can in your backyard, it would be worth about $5 today in 1971 purchasing power.

Buying power of $35 since 1971

If your $35 matched government inflation statistics exactly your $35 would be worth $223.06 today for a gain of 537%. This means that your $35 from 1971 would have to be worth $223.06 for you to just break even on the purchasing power front.

Gold in 1971 was priced at $35 an ounce. Today that same ounce of Gold is worth over $1900. This represents a gain of $5,328%.

Based simply upon these facts, what type of money do you want to store your time, energy, and wealth in?

Consider the following:

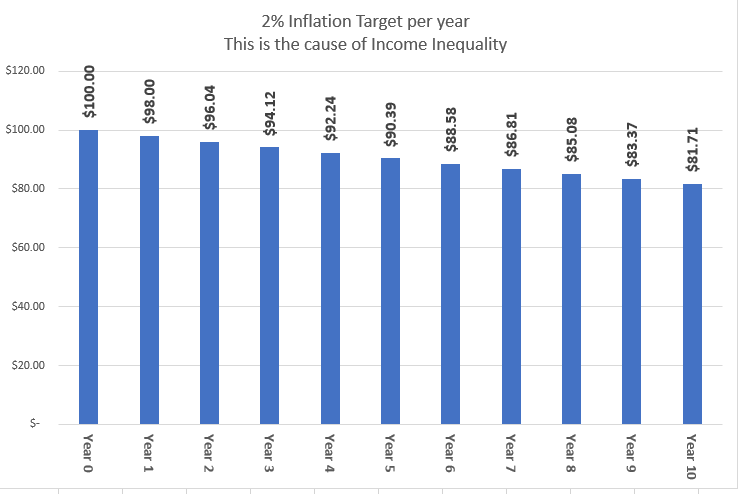

A few weeks ago, Fed Chair Jerome Powell gave a speech in Jackson Hole, Wyoming. In his talk he discussed how the Fed is targeting a 2% inflation rate moving forward.

This talk was heralded by the financial media as “visionary.” I hate to be a stickler for financial details here but let me spell out what a 2% inflation rate means moving forward. You deposit $100 in your bank today, and in one year it is only worth $98. In 5 years that $100 is only worth $90.39. In ten years, that original $100 is only worth $81.81. How is that visionary? Inflation is theft through currency debasement there is nothing visionary about it.

2% inflation per year

If I break into your house every year and only steal 2% of your belongings is it theft? If you don’t think so you can probably get a gig writing for political financial media.

Printing press money makes it easy for governments to justify things in the name of the greater good. Ever wonder why wars never end? Just run the printing presses every time to cover those pesky expenses. After all it’s only 2% inflation.

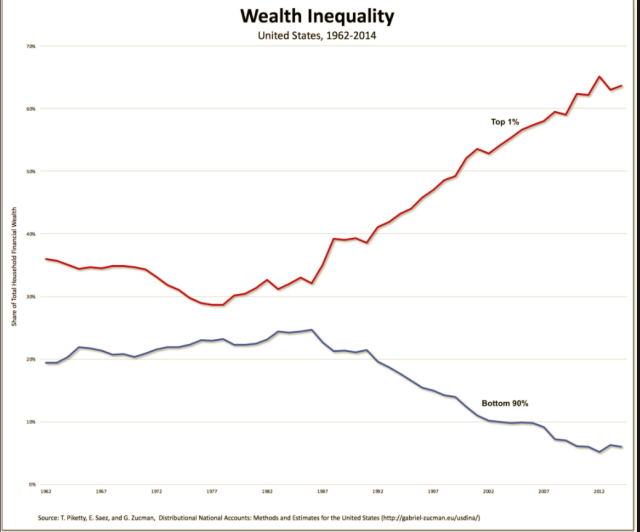

Investopedia defines “income inequality” as an extreme concentration of wealth or income in the hands of a small percentage of a population,” which is usually referred to as the top 1%.

This unequal distribution of income is traditionally blamed on things like globalization, loss of unionization power, skill-based technological change, immigration of less educated workers, cost of college premiums, drug use, politics, and race.

But the key driver of income inequality that often goes unspoken is — inflation. The lack of conversation around inflation’s impact on income is because it is baked into the fiat monetary system. The inflationary design of all fiat currencies enriches the wealthy and drives the poor into deeper poverty. This has been occurring for over 100 years in the United States because a majority of the American population does not understand how money or the economy works. The simple guiding light that the wealthy follow is to keep as little of their wealth as possible in cash so that it cannot be debased.

As of August 15, 1971 the U.S. Dollar was severed completely from GOLD by President Richard Nixon. Our current monetary system is referred to as FIAT. This is a currency system that is decreed to be legal by the full faith and power of governments. The money is only backed by political promises. All governments today manage FIAT currencies. While I would like to give central bankers the benefit of the doubt, it is very difficult to ignore that under their stewardship the value of the U.S. Dollar has lost almost 99% of its purchasing power.

Buying power of $1 since 1913

Furthermore, please evaluate for yourself what value the U.S. dollar will hold in one or two years since the monetary authorities have added close to $5 trillion of new money during 2020. Since that new money is not backed by any commodity or product it is appears that this will only debase the currency further.

Bitcoin. There’s a New Sheriff in Town!

Bitcoin is the first cryptographic currency that is decentralized, borderless, and impossible to counterfeit. At its essence, Bitcoin is digital scarcity. Since all other digital products can be easily reproduced and “counterfeited”, Bitcoin does for money, what the internet did for information.

Against the backdrop of the 2008 financial crisis, an anonymous programmer by the name of Satoshi Nakamoto was putting the finishing touches on a cryptographic currency protocol called Bitcoin. On the very first block of the Bitcoin blockchain he wrote: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” He was referencing the following article:

Since its launch in 2009, Bitcoin has taken the financial world by storm. In 2010, one bitcoin was worth $0.003, and in December 2017, Bitcoin hit its all time high of almost $20,000, an increase of 6.6 million times. It has been the best performing asset of all time.

Today the price of a Bitcoin hovers at around $11,000 a bitcoin. It is estimated that there are about 30 million people who hold a portion of their wealth in bitcoin.

But Bitcoin’s story is about more than just price – it is also deeply rooted in an ideology that believes in that government should never be able to counterfeit or confiscate your wealth for any reason. This idea in and of itself is the fuel that drives people to study and commit to really understanding bitcoin before they fall down the “bitcoin rabbit hole.”

Consider the following:

Every fiat currency in the world has the same identical structure.

- They are backed by a government.

- They are not pegged to any commodity of value

- Their currencies are all slowly debased by inflation.

- The average lifespan of a fiat currency is about 50 to 75 years.

- The rate of debasement is set and established by a group of monetary authorities and experts who we are required to trust will manage the value of the currency effectively.

When citizens are confronted by this reality, wealthy citizens immediately treat fiat currency like a hot potato. They use it to acquire other assets to store their wealth in. Things like real estate, stocks, precious metals, collectibles, art, numismatics, etc. become money magnets to avoid the slow destruction that all fiat currencies eventually face.

However, the financially illiterate, unaware of the dangers associated with fiat currency leave their wealth in cash only to see it debased by the monetary experts.

But what is even more impressive about Bitcoin is that it is currently the 6 th largest currency in the world . The countries with larger currencies than Bitcoin are the United States, Europe, China, Japan and India. Most impressive is that bitcoins growth has occurred in a period of only 11 years!

Historically, debasement is something that is built into all fiat currencies. Central banks feel that they can debase a currency to better manage an economy

A currency is an important part of an economy, but it is not the economy.

One of the other amazing innovations about Bitcoin is that it has a very clearly defined limited supply of 21 million. There have been over 18.5 million bitcoin already created in the last eleven years. But the remaining 2.5 million bitcoin will take over the next 120 years to be produced. This make Bitcoin the hardest money in the history of the world.

Rather than creating more money out of thin air, Bitcoin has a deflationary monetary policy. The creation of new bitcoin is created in a transparent code which anyone can audit at any time. No backroom deals. No small powerful groups of self-interested politicians claiming they have the solution as to how much money should be printed this week.

Bitcoin was created to put a global, digital, peg on fiat currency. Since 1971, money around the world has not attached to any intrinsic value. This is why we see so much financial engineering in everything today.

Central bankers know digital currencies are better than the current versions. They are scurrying to introduce new currency because of the threat that bitcoin poses to their power.

Soon we will see a digital dollar. A digital yuan. A digital euro.

The design of these currencies will have changed. But their fiat nature is what will continue to make them dangerous to embrace.

People all can sense that something is systematically wrong in our economy. The world we all knew 40 years ago is not the same world we live in today. Fiat money, runaway fiscal spending and inflationary monetary policy is causing the boom-bust cycle to accelerate. Future episodes of the Great Financial Crisis and the Current Economic Lockdown are all but guaranteed because it is exponential debt growth which has caused them and further debasement of fiat currency will only strengthen this trend.

Central bankers know that they are directly responsible for the widening wealth inequality gap that exists. Their job is not to manage wealth inequality, or the sustainability of the currency, their primary function is to manage the economy.

We are witnessing a loss of faith in the fiat system and that model of governance. Press releases from the Federal Reserve do very little to change the reality of this income inequality chart which has been documenting the abuse that fiat currency creates for decades.

Wealth Inequality 1962 to 2014 In The United States

Our money is broken.

It is too easy to produce. While the U.S. Treasury will introduce a digital currency they are doing so only to prevent unlawful counterfeiting by those who would mimic their own behavior with graphic cards and high quality printers.

Fiat offers no long-term store of value.

More and more people are beginning to recognize the massive problems this creates in society.

Intrigued? I invite you to attend one of our live training master class webinars where we show how artificial intelligence picks up on all of these signals to create trading forecasts that are up to 87.4% accurate.

Join us.

Click here – Next Free Live Training .

It’s not magic. It’s machine learning.