Money Reimagined: Understanding the Bullish Case For Bitcoin

Back in the mid 1970’s when Inflation was ravaging the American Economy, Former Federal Reserve Chairman, Alan Greenspan was Head of President Ford’s Council of Economic Advisers. In one of the most blatant public relations stunts ever witnessed from a financial authority, the Council of Economic Advisers put out buttons, brochures, and press releases promoting they were going to “Whip Inflation Now,” complete with caricatures of Uncle Sam cracking a whip towards a dastardly villain.

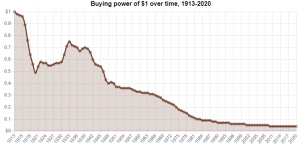

The infamous “Whip Inflation Now” campaign was a 1974 attempt to spur a grassroots movement to combat inflation in the US, by encouraging personal savings and disciplined spending habits in combination with public measures, urged by U.S. President Gerald Ford. It always surprised me that when Alan Greenspan became Federal Reserve Chairman in 1987, he was never questioned about the effectiveness of the Whip Inflation Now campaign. Maybe, because in the 13 intervening years, cumulative prices had increased 130% and inflation had averaged almost 7% a year resulting in a 57% loss of purchasing power for the U.S. Dollar. This campaign, and all its problems, is at the heart of the U.S. Legacy financial system. Is a 57% loss of purchasing power in 13 years the way that INFLATION is WHIPPED into submission?

Over the past fifty years there has been a tremendous amount of research and attention paid to wealth inequality and social justice. In other words, the system is unfair because the rich get richer and poor get poorer. History clearly shows our system of money creation, financial illiteracy, and repeated monetary interventionism contributes to this injustice, over and over again. It is the poor and the financially illiterate who are hurt the most by the very system that claims to have their best interests at heart!

The largest and most successful hedge fund manager of all time is Ray Dalio of Bridgewater Associates. Mr. Dalio in his speeches and presentations at conferences communicates one truth that everyone should pay attention to. Dalio regularly quips that, “cash is trash.” Why would the most successful Hedge Fund manager make this type of reference to cash? After all his hedge fund manages over $160 billion in assets.

What Dalio is communicating is that the financially literate do not hold a lot of cash relative to their net worth. Whenever the Federal Reserve makes credit available those who have access get the “easy money” and they immediately convert it to assets like Real Estate, Stocks, Bonds, Numismatics, Art, etc. to escape the depreciating value of the currency. This is a luxury that the poor and financially illiterate do not have. This unfortunate “truth” is what causes wealth inequality.

According to the Bureau of Labor Statistics consumer price index, today’s prices in 2020 are 536.54% higher than average prices since 1971 when President Richard Nixon eliminated any gold convertibility to the U.S. Dollar. The U.S. dollar experienced an average inflation rate of 3.85% per year during this period, according to official government statistics, causing the real value of a dollar to decrease.

In other words, $100 in 1971 is equivalent in purchasing power to about $636.54 in 2020, a difference of $536.54 over 49 years.

That house that 30 years ago cost $75,000 today is worth over $200,000.

Why? The house is not worth 2 2/3 times as much, your currency has depreciated by more than 60%.

Most people think of money as a medium of exchange, but they ignore that the most desired characteristic of money is that it also be a store of value. When money is not a good store of value the people who hold it get hurt the most by its continual devaluation. We tend to think that money originates with governments, but the truth is that money originates quite naturally amongst people who are seeking to trade and improve their conditions. Today there are many competing monetary goods to choose from. Most of these goods arise from governmental control of a nations money supply and that is one of the issues that alternative forms of currency are addressing.

Throughout history different things have acted as money. Cattle, Salt, Butter, Cocoa, Shells, Beads, Silver and Gold are among assets people used as money to trade goods with one another. In looking at these goods we can begin to understand the difference between easy money and hard money by looking at the durability of a particular asset. Historically what has always proven to make a money valuable is that it be rare and difficult to produce. This can be measured arithmetically using what is known as the stock to flow ratio. This ratio measures the current total existing supply of an asset and compares it to the new production of that asset for the given year. The higher the stock to flow ratio the more the item is suited in playing a monetary role. The lower an asset’s stock to flow ratio the more precarious it would be in attempting to be used in a monetary role.

Simply stated the stock-to-flow ratio is just the inverse rate of supply inflation each year.

Take for example Gold. The latest figure for all the gold in the world is 190,000 tonnes. On the other hand, only 2,600 to 2,900 tonnes of new Gold are capable of being mined every year. This makes the stock to flow ratio roughly 66 to 1. The inverse of this number represents the percentage of new gold that would be added to the supply every year which is roughly 1.5% per year. This is why Gold is defined as hard money. It is durable and very hard to produce.

Comparatively, the U.S. Dollar is not considered to be hard money because of how easy it is to produce. According to the Fed, the M2 Money Supply figures in July 2019 were $14.7 trillion. This represents the total actual amount of money in circulation. By July 2020 the M2 Money Supply was $18.2 trillion showing a $3.5 trillion increase. (Much more is projected in stimulus for 2020 as well.)

Chart of M2 Money Supply from The Saint Louis Fed

With these figures, we see that the stock-to-flow ratio of the U.S. Dollar in 2020 is about 4.2, indicating that U.S. Dollar is very soft and very easy to produce.

And by taking the inverse of their stock-to-flow ratios, we see that gold’s supply inflation is only 1.5 percent, while the USD’s is about 23.8% for 2020. This basic arithmetic demonstrates how difficult it is to debase Gold and how easily fiat currencies are devalued.

It’s not costly for the U.S. government to increase the flow of U.S. Dollars which makes the money very easy to be debased. Theoretically, if a government wants to increase supplies of fiat money in a given year, the capital cost to do so is trivial. On the surface this sounds very benign, but it is worrisome to advocates of sound money primarily because it makes activities like prolonged warfare very easy for governments to finance and entertain. If all that a country has to do is run the printing press to inflate away war expenditures, they most often will choose to do so. This explains to a very large extent why the 2005 United Nations Development Report analyzed death from conflicts over the past five centuries and found the 20 th Century to be deadliest on record. While Gold has not restricted governments from going to war, it has forced governments to finance warfare from taxation of its citizens which is usually quite unpopular and unsuccessful.

But to really comprehend the problem of printing press easy money simply try and assume the perspective of a business owner/wine maker trying to plan the necessary production of their business based upon a runaway printing press. They know that the Central bank has added 23.8% new money to “save the economy.” They are now faced with four options with how to respond:

- They can continue selling their wine product at the same price, even though they know that the value of each dollar has declined massively due to debasement. Doing so, means they will in theory absorb a 23.8% loss.

- Water down their wine by 23,8% or use cheaper ingredients, thereby decreasing the production cost and the quality of their wine but continue selling it for the same price to maintain their profit margin.

- Increase the selling price of their wine by 23.8%, to get the same value for their wine denominated in post-inflation dollars.

- Produce a 23.8% smaller size serving of wine to sell at previous prices to disguise and try to hide the inflation from consumers. (This solution is quite popular and very obvious in your local supermarket!)

This fiat legacy financial system penalizes savers while the reality of Inflation forces them to weigh their own financial wellbeing against moral integrity. In this regard, inflation is a disease which affects society’s moral fabric.

Most people are not financially literate. They do not know much about what money is, how it is produced or how it is devalued. It is within this ignorance that Central Planners at The Federal Reserve have operated over the last 107 years making it very hard to distinguish whether they are the arsonist or the fire department when an economic catastrophe occurs. According to the Bureau of Labor Statistics consumer price index, today’s prices in 2020 are 2,504.01% higher than average prices since 1913 when the Federal Reserve took over their managing of the American economy. Inflation is built into the current fiat system. “Whip Inflation Now!” Yeah, right!

The following graphic shows you the perils that purchasing power has suffered over the last 107 years of the Fed’s reign.

The dollar from 1913 is worth less than 3 cents today!

It was within the cataclysm of the 2008 Financial Crisis that an anonymous programmer by the name of Satoshi Nakamoto launched the first Bitcoin counterfeit-proof digital currency into the world and forever challenged the existing fiat currency system with an alternative “store of value.” Bitcoin at its essence is a decentralized, borderless, digital, peer-to-peer, value transfer network, which is totally transparent and whose currency is quite literally the antithesis of fiat.

Commodity money derives its value from its intrinsic value, like precious metals salt, or even shells. Fiat money has attributed value only because a government declares it legal tender – it has no intrinsic value. While trust vested in fiat currencies is ensured through the money supply issued by a central bank, the trust vested in cryptocurrencies is founded on the cryptocurrencies unchangeable immutable code, its underlying programmed principles and technology.

Over the past century economists have offered many theoretical solutions to the problem of money that societies face. Many things can assume a monetary role in society however if they are easy to produce they are no longer a store of value and destroy the wealth of saver. For a good to assume a dominant monetary role within a society it must exhibit superior hardness as measured by the stock to flow ratio than other competing monetary goods. This is the primary reason why Bitcoin has become the primary competitor of fiat money. Among its most unique features, Bitcoin can be spent and received by anyone, anywhere, and at any time without the need for a bank or a government. This is what makes Bitcoin so revolutionary and attractive.

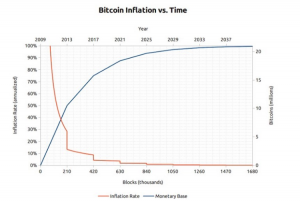

Only 21 million Bitcoin will ever be created. Today we have already mined over 18.5 million

One of the most exciting features of Bitcoin is that it has a finite limited supply. There will only ever be 21 million Bitcoin ever created. This in and of itself makes Bitcoin scarcer than Gold.

Applying the Stock-to-flow ratio to Bitcoin there is an existing supply of 18.375 million bitcoin, and over the next year less than 328,500 new Bitcoin will be mined. We arrive at a Stock-to-Flow figure of 56. This means that in 2020 the new supply of Bitcoin coming to market will only amount to 1.7% which is very similar to Gold’s statistics.

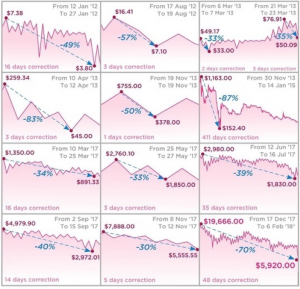

Undoubtedly, if you have followed Bitcoin at all you are aware of its immense volatility. Over the last ten years there have been numerous times when it has lost a very large percentage of its value very quickly in market selloffs. This can easily be explained by recognizing that relative to other monetary assets Bitcoins market capitalization is still very, very small. Stated another way, if one wealthy person wants IN or OUT or Bitcoin if they were to place a large enough order they could move the market all by themselves. But when you examine the Volatility of Bitcoin closer you also quickly see how resilient it is in bouncing back.

More importantly, as Bitcoins market cap grows its volatility will become comparable to other leading monetary asset classes.

The following graphic shows 12 different Bitcoin crashes which certainly made media headlines.

Charts of 12 different Bitcoin crashes

This volatility is what most likely has kept traders away from owning Bitcoin. The truth is that the ideas of “overbought” and “oversold” are essentially meaningless in reference to monetary goods. The price of a monetary good is a measure of how widely adopted it has become in comparison for the various roles of money.

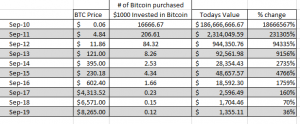

Let’s look at Bitcoin as a store of value and compare it to the U.S. Dollar. We know from looking at the Bureau of Labor Statistics that the U.S. Dollar has been devalued through inflation on average by about 2% per year. This means that $1,000 invested in U.S. Dollars in 2010 would have lost roughly $182.00 in purchasing power over the last 10 years. Anytime you go to the store you notice that your money is not purchasing as much as it used to. In other words, you would be down 18.2%.

Consider had you invested $1,000 into Bitcoin at any of the following points over the last 10 years and just HELD it as a store of value. The results are nothing short of incredible.

In September 2010, you could have purchased Bitcoin for 6 cents, if you had held it till today it would be worth over $186 million dollars! Even if you would’ve come to the Bitcoin party in September 2019 you would’ve purchased Bitcoin at $8265 and would be up roughly 36% today.

If you had the bad fortune of purchasing Bitcoin on December 15, 2017, the all time high of Bitcoin, at $19,337 you would be sitting on a 43% loss today.

But comparatively speaking over the last ten years Bitcoin has proven itself to be the top performing asset, over and over again. Also there has never been a 36 month period in Bitcoin where it did not trade higher 36 months later. This implies that between now and December 2020 we could well see Bitcoin go to new all time highs.

What would drive Bitcoin to new highs?

Bitcoin is vying to replace the U.S. Dollar as the global reserve currency. It still has quite a way to go before this can occur but many believe that it certainly is plausible. Today many trading agreements between nations are settled in U.S. Dollars. But it appears that it is only a matter of time before nations begin to settle trade with one another using Bitcoin.

Here are some landmarks to watch for:

Bitcoins market cap is currently is only about $200 billion.

Gold has a market cap of $9 trillion. For Bitcoin to match Golds market cap its price would have to increase 45 times from current levels to roughly $500,000 per Bitcoin.

The New York Stock Exchange has a market cap of $30 trillion. For Bitcoin to match the NYSE market cap its price would have to increase 150 times to roughly $1.6 million per Bitcoin.

The Bond market has a market cap of $100 trillion. It also is facing negative yields on numerous new offerings. For Bitcoin to match the Bond market cap the price would have to increase 500 times or $5.6 million per Bitcoin.

While these numbers will appear completely unrealistic, exaggerated, and outlandish to an uneducated observer, simply consider that banks are beginning to supply custodian services for Bitcoin and publicly traded companies are starting to convert their balance sheet cash to Bitcoin. (Remember what Ray Dalio said, “cash is trash.”)

Yesterday morning, MicroStrategy Incorporated (NASDAQ: MSTR) has taken $250 million of its balance sheet capital and purchased 21,454 bitcoin. Here is what CEO Michael Saylor, CEO stated after making this announcement.

“ Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders. This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.

MicroStrategy spent months deliberating to determine our capital allocation strategy. Our decision to invest in Bitcoin at this time was driven in part by a confluence of macro factors affecting the economic and business landscape that we believe is creating long-term risks for our corporate treasury program ― risks that should be addressed proactively. Those macro factors include, among other things, the economic and public health crisis precipitated by COVID-19, unprecedented government financial stimulus measures including quantitative easing adopted around the world, and global political and economic uncertainty. We believe that, together, these and other factors may well have a significant depreciating effect on the long-term real value of fiat currencies and many other conventional asset types, including many of the assets traditionally held as part of corporate treasury operations.”

We find the global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utility, and community ethos of Bitcoin to be persuasive evidence of its superiority as an asset class for those seeking a long-term store of value. Bitcoin is digital gold – harder, stronger, faster, and smarter than any money that has preceded it. We expect its value to accrete with advances in technology, expanding adoption, and the network effect that has fueled the rise of so many category killers in the modern era.”

MicroStrategy (MSTR) is not in the Bitcoin or blockchain business. They have no crypto related products to sell. This is a tactical decision by a team looking to protect shareholder value in very chaotic times.

In the weeks and months ahead, we will see many more publicly traded companies move to do likewise. The first dominos are falling in this regard. After this occurs it is simply a matter of time until we see Central banks/nation states add Bitcoin to their reserves.

The rationality behind why individuals, corporations, and central banks will move to Bitcoin as the worlds reserve asset is simple. Bitcoin is sound money built for a digital world that will accept nothing less. What the internet did for information, Bitcoin is only starting to do for money.

In 1844 Samuel Morse tapped out his first telegraph message, in what was later to be known as Morse Code, the precursor to the telegram.

He tapped four words, now seen as very appropriate. 21 clicks that threatened to overthrow a deeply entrenched industry:

Those four words: “What hath God wrought?”

It’s clear that Morse, in heart and mind understood the depth of what those very first electro-mechanical clicks represented: The potential to change the world. The ability to traverse time and space with a new language. Distance no longer mattered. he flattened the earth in a single keystroke.

Every new, valuable, accessible innovation is born to both enormous fear, and incredible opportunity. A series of simple clicks could replace horse and rider in one fell swoop. The courier industry, based on horses, tireless riders and wax-stamped security measures was about to be tap-tap-tapped away.

As a technology Bitcoin is as revolutionary as the wheel, phone or knife. It offers users tremendous benefits that so far civilization has been unable to match. It can’t be changed, tampered or argued with. It cannot be corrupted. As people, businesses and organizations wake up to its benefits the financial authorities are forced to put away their “Whip Inflation Now” propaganda or legislative decrees and genuinely compete on a transparent value to value basis.

The new innovations that are shaping finance were developed by quickly observing and recording how and what benefits users. That is a very good thing. But be forewarned, old technology always suppresses new technology. The Luddites who are richly rewarded by the status quo do not go quietly.

The internet is changing our core definitions of what is possible. Although technology is a potent force in creating change, as businesses the underlying concern is how do you harness the power of innovation that technology makes possible?

I invite you to learn how to trade Bitcoin at our Next Live Training.

It’s not magic. It’s machine learning.

Make it count.