The stock market and the wider economy have historically shown a correlation. Where a bull run in stocks occurs, you can often expect an economic upturn too. But is this always the case? How does the stock market affect the economy, what do crashes mean for the wider economic environment, and what are the key takeaways for traders?

Why is the stock market important?

The stock market is important for a variety of reasons. It enables traders and investors the opportunity to profit from its moves and generate personal wealth, can provide a benchmark of a country’s commercial and industrial health, and gives businesses an opportunity to scale and prosper, benefiting the wider economy. As a result, a well-functioning equities market is valuable for business, individuals and nations alike.

Learn more about equities with our Beginner’s Guide to Stock Trading .

Three ways the stock market impacts the economy

The stock market and economy relationship can be broadly characterized by investment fueling economic growth , the enabling of company ownership that increases personal wealth, and equities providing a measure of economic health. We’ll explore these three factors below.

1. Stock Market Investment can Spark Economic Growth

The money that investors put into companies allows enterprises to invest in growth. When a business starts out, it may have to bootstrap, or survive on little capital. But when it offers shares to the public via an IPO, it has a chance to transform into a leading organization in its sector through taking on staff, driving innovation, and achieving economies of scale. In turn, companies can build revenues and achieve real competitive advantage in the marketplace, directly impacting GDP and boosting the economy.

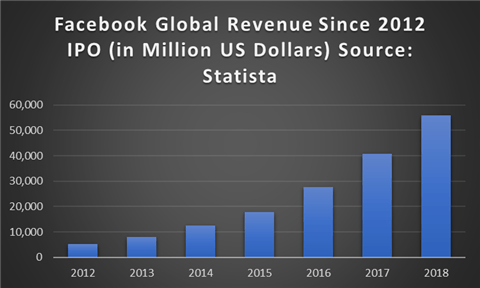

In 2012, Facebook’s global revenue was already some $5 billion, with around 5,000 employees on the payroll. However, the company’s IPO that year raised in excess of $16 billion, which helped build the company to a market cap of $630 billion by January 2020, with 2018 figures showing some $55 billion in global revenue and more than 40,000 employees worldwide – all demonstrating the considerable economic impact of the IPO.

2. Company Ownership can Enable Impressive Returns

While representing a risk to capital, investing in stocks and major stock indices is a potential way for individual investors – not just venture capitalists – to take an ownership in successful enterprises and accumulate wealth. This capital can then be reinvested or spent, impacting the economy. Stocks have historically proven the best way to beat inflation in the long term, with some indices showing triple digit returns since the beginning of the century.

INDEX PERFORMANCE JAN 2000-JAN 2020 (SOURCE: IG)

| Index | Gain |

|---|---|

| CAC 40 | 5.2% |

| FTSE 100 | 20.7% |

| Nikkei 225 | 21.7% |

| Hang Seng Index | 77.7% |

| DAX 30 | 94.3% |

| S&P 500 | 135.2% |

| Nasdaq 100 | 155.7% |

| Dow Jones | 163.8% |

3. Stock Markets can Measure Economic Strength

The stock market can often be viewed as a reliable economic barometer. It reveals how major companies are doing and in turn gives insight into the drivers of economic health, such as consumer spending.

Rising stock prices can mean higher business and consumer confidence; falling stocks naturally the opposite. If an index such as the tech-centric Nasdaq is on a bull run, this might suggest a range of things, for example: investor confidence in demand for electronics, and faith in the financial strength of the tech giants such as Microsoft and Apple that have a larger impact on the index due to market cap weighting.

Any of these things and more can move the index, and confidence itself can breed confidence. However, as mentioned below, just because there is an upturn in stocks, doesn’t necessarily mean the wider economy is improving, just as a fall in stocks doesn’t necessarily mean the wider economy is contracting.

How does a stock market crash affect the economy?

A stock market crash can devastate the economy. When a downturn in the business cycle happens, significant amounts of value can be erased from share prices. In turn, this means lower returns and dividends for individual investors, a smaller market capitalization for businesses, less wealth for pension funds, and less funding for companies in the near future.

Such a lack of finance can mean businesses aren’t able to grow, meaning potential cost saving measures are necessary, such as staff cuts and the delaying of expansion projects. Smaller pension pots may also mean delayed retirement for older employees, and an uncertain economy landscape may mean dampened consumer spending, hitting GDP.

However, while a stock market crash can clearly cause the economy to contract, this isn’t always the outcome. Similarly, a bull run in stocks doesn’t necessarily mean a thriving economy. As long as irrational exuberance of investors and overvaluation exists, stock market performance can function independently of wider economic data.

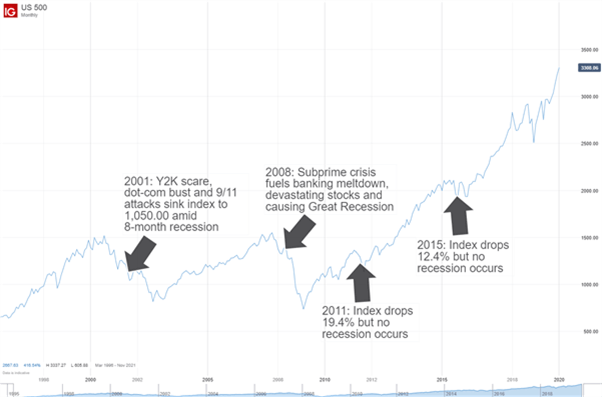

For example, while the chart below shows how the S&P 500 crashes of 2001 and 2008 coincided with recessions, it also shows how the S&P index falls of 2011 and 2015 didn’t.

The stock market and the economy: FAQs

When it comes to the relationship between the stock market and economic growth, traders and investors should consider the following FAQs:

1. How does the economy impact the stock market?

The economy can have a significant impact on the stock market, with fundamental drivers such as non-farm payrolls, elections, interest rates, inflation, and natural disasters all capable of influencing price. Market practitioners should make sure they have a handle on these factors and more, in order to obtain the most complete picture of potential market movements.

2. Does a downturn in equities mean recession?

A sharp downturn in equities does not necessarily mean the onset of recession, just as a long bull run does not necessarily represent continued economic strength. The former may be caused by an isolated fundamental factor for example, while the latter may mean stocks are becoming overvalued due to excess speculation.

3. What are growth stocks vs safe haven stocks?

When a bull market hits, many investors will look to incorporate traditional ‘growth’ stocks like Amazon and Facebook into a portfolio, and include fewer so-called safe haven stocks like consumer staple or healthcare businesses. However, during wider economic difficulties the latter may perform well due to the enduring necessity of the products they offer, even in tough times.

FURTHER READING ON STOCKS AND TRADING INDICES

For traders and investors interested in investigating stock markets, the following resources may help boost equities knowledge.