The global stock market can be categorized into specific groups or ‘stock market sectors’. Organizing the vast number of stocks in this way helps traders to view assets in a more manageable way when trading.

Stock sectors’ performance can substantially differ – some sectors follow the fortunes of the underlying economy while others perform better during economic downturns. Knowing the characteristics of different stock sectors enables traders to progress to more advanced equity analysis, for example, how to value a stock .

This article analyzes each sector relative to the broader economy while providing additional resources to assist in your trading journey. As a complementary guide, it may be helpful to read how the stock market affects the economy as this article refers to some of the topics that are discussed there.

The 11 stock sectors are presented in accordance with the Global Industry Classification Standard (GICS).

Industrials

The industrial sector is comprised of companies that produce or provide services relating to machinery and equipment that is used in manufacturing and construction.

In general, stock market sectors are related in varying degrees to the underlying economy and industrial stocks happen to be particularly sensitive to its ups and downs. Stocks that move in a similar manner to the general economy are called ‘ cyclical stocks ’ – as their performance is closely related to where the economy is situated in the business cycle.

When the economy grows, factories increase their capacity to meet increased aggregate demand, resulting in increased revenues. When the economy is in a slump, businesses and consumers spend less. Reduced spending (demand) has a knock-on effect resulting in lower sales and lower revenues for industrial shares.

Therefore, whenever trading industrial stocks or any other cyclical stocks, it is beneficial to have a solid understanding on where the economy is currently and where it might be headed. Traders often use an equity index as a benchmark for the performance of the wider economy. Top indices can be viewed on our major stock indices page and include: S&P 500 , FTSE 100 , DAX 30 , ASX 200 and the Hang Seng Index .

Popular industrial stocks include:

- General Electric Co. (CE )

- Caterpillar Inc. (CAT

- Uber Technologies (UBER)

- United Airlines Inc. (UAL)

Basic Materials

Basic materials or raw materials include oil , gold , paper and stone. The most common materials in the stock sector are mined products, like metals and ore for example. This sector therefore includes companies involved in the discovery, development and processing of raw materials.

Many businesses rely on companies in this sector for inputs they need to produce a final product. For example, furniture manufacturers rely on companies that physically cut down, collect and transport trees that are then refined into usable wood to be used in the final product.

Generally speaking, basic materials occur naturally, and most are finite in nature. Others are reusable but are still constrained in supply at any point in time.

Popular basic materials stocks include:

- DuPont de Nemours Inc.

- BHP Billiton

- ArcelorMittal

- Rio Tinto

Energy

The energy sector comprises stocks that are directly or indirectly involved in the production or distribution of power for the economy. These companies operate in one or more of the following: oil and gas drilling and production, pipeline infrastructure, electricity and natural gas utilities, mining companies, renewable energy and chemicals.

The companies within the industry fall into either the non-renewable or renewable energy category. The latter has seen increasing interest in recent years.

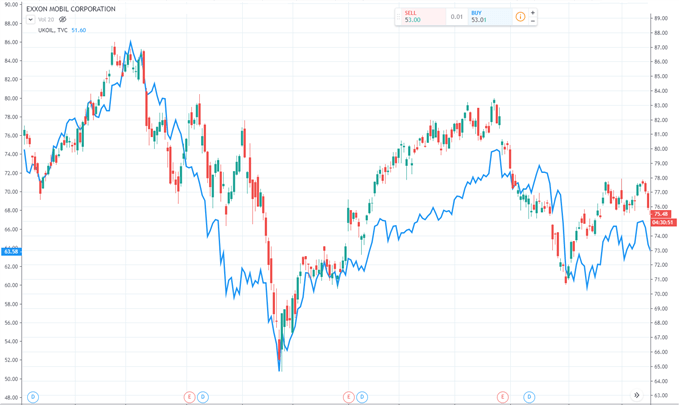

Energy stocks tend to fluctuate based on the price of the underlying commodity , among other factors. This relationship makes sense because the price of the underlying commodity determines what the producer can sell it for.

The chart below depicts how closely Exxon Mobil had moved with the price of oil :

Therefore, when trading energy sector stocks it is essential to keep an eye on the price of the underlying commodity as well.

Discover the most traded commodities along with what moves the market by visiting our commodities page.

Popular energy sector stocks include:

- Exxon Mobil

- BP

- Royal Dutch Shell

- Chevron

Consumer Staples

The consumer staple sector includes all stocks that provide essential products , things that consumers are not prepared to go without. Some of these products are staples such as bread, rice and maize meal, but the range has been expanded to include items like alcohol and tobacco.

The sector can be broken down into 6 industries:

- Food products

- Food and staples retailing

- Beverages

- Household products

- Personal products

- Tobacco

Consumer staples are considered to be non-cyclical, defensive or ‘ safe haven stocks ’ because people require basic necessities to live irrespective of whether the economy is booming or in a recession . As a result, consumer staples are usually characterized by steady dividends and earnings but tend to suffer from low growth of the overall business. The non-cyclical nature of consumer staple stocks means that they are often sought after when more cycle-sensitive stocks decline during an economic downturn.

Consumer staples are a highly competitive industry because companies are selling similar products with little to differentiate their offering from competitors. Therefore, it’s essential for these companies to minimize expenses and constantly seek new and innovative technologies in an attempt to contain costs.

Popular consumer staples stocks include:

- Pepsi Co.

- Colgate-Palmolive Co.

- Philip Morris International Inc.

- The Kroger Co.

Consumer Discretionary

A consumer discretionary stock is a company that markets a product or service considered to be ‘non-essential’. This stock market sector includes companies such as Amazon and Nike that provide quality goods and services appealing to consumers with greater disposable income.

Consumer discretionary stocks tend to thrive when the economy is doing well . When economies are close to full employment, aggregate demand for goods and services increases and people tend to have more money left over after buying the essentials.

Traders or investors often favor consumer discretionary stocks in economies where there is a rapidly growing middle class or when an economy enters the recovery phase of the economic cycle.

Popular consumer discretionary stocks include:

- Macy’s Inc

- Amazon

- Nike

- Ford Motor Co

Healthcare

The healthcare stock market sector consists of companies that provide medical services, medical insurance and manufacture medical equipment or drugs.

The healthcare stock sector benefits from advances in technology and research that helps provide life-saving treatment or drugs. Pharmaceutical stocks within the sector tend to be non-cyclical as patients require essential medication regardless of the state of the economy.

This stock sector is also somewhat dependent on demographics. Consider the ‘baby boomer’ generation: its out-sized cohort is now retired, elderly and in need of increased medical care. This means that demand for goods and services in the healthcare sector may increase, resulting in greater revenue for the sector.

However, there are some potential pitfalls. Pharmaceutical companies looking to introduce a new drug often invest millions of dollars into research and development, which can all be for nothing if – for example –the regulating body denies approval of the drug. This can result in huge swings in the share price as optimism turns into panic.

Popular healthcare stocks include:

- Pfizer

- Novartis

- Johnson & Johnson

- Indivior PLC

Financial

The financial stock sector combines companies that provide financial services to retail and commercial customers. The sector is rather vast due to advancements in fintech having led to new entrants in recent years. The stock sector comprises banks, investment firms and insurance companies.

The financial sector is crucial to the overall economy and its health is usually a sign of overall strength. This is because individuals and businesses rely on banks for financing, whether it be a mortgage to purchase a new home or a commercial loan to help expand operations. Increased spending buoys consumer confidence which is the lifeblood of any economy. Similarly, individuals rely on insurance companies to protect their assets against loss.

The financial sector tends to perform well when the economy is in a recovery phase and often even more so when the economy operates close to its maximum capacity.

However, when the economy experiences extended periods of distress, the financial sector is usually one of the hardest hit. Central banks lower interest rates to help induce borrowing and spending, which reduces the profit margins on a bank’s loan book and this leads to reduced revenue and lower (or no) dividend payouts.

Investment firms witness outflows and early redemptions when clients see losses in their invested capital, which in turn impacts the firm’s bottom line.

Popular financial sector stocks include:

- Goldman Sachs

- Citi Bank

- American International Group (AIG)

- Berkshire Hathaway Inc

Information Technology

The information technology sector, also known as the ‘technology sector’, includes companies that research, develop or distribute technological goods and services.

Tech stocks tend to trade at a premium due to the accelerated growth rates typically observed in the sector. As a result, they often attract substantial valuations and their management may prefer to reinvest surplus cash instead of paying dividends.

Tech indices :

- US Tech 100 ( Nasdaq 100 Index) – Tech stocks make up roughly 50% of the index

- US Fang (FAANG index) – Facebook, Amazon, Apple, Netflix and Alphabet (Google)

With the expansion of the internet, the introduction of ecommerce and the rise of data protection laws, tech companies have become the subject of scrutiny in the way they use, analyze and disseminate user data. This has been one of the biggest challenges faced by the sector recently.

The sector can be further broken down into 4 sub-sections:

- Semiconductors

- Software

- Networking and Internet

- Hardware

Popular tech stocks include:

- Nvidia

- Salesforce

- Microsoft

- Apple

Telecommunication Services

The telecommunications sector is made up of companies that transmit data in words, audio, voice or video across the world. These companies enable global communication networks. With advancements in technology, this process is becoming cheaper and cheaper.

Mobile services have led the most recent advancements over traditional fixed line infrastructure. Telecommunications have shifted away from voice, towards the transmission of video, text and data.

Telecommunication services form an integral part of the economy . The industry has grown to a level where investors are able to select value or growth stocks for their portfolios. Growth investors may see value in smaller companies that offer wireless services. In contrast, larger companies that deal with equipment and related services tend to provide a more conservative, income-focused option for investors.

Popular telecommunications stocks include:

- Verizon

- AT&T

- T-Mobile

- Vodafone Group PLC

Utilities

The utilities sector is comprised of companies that provide basic amenities such as natural gas , water, sewage services, electricity and dams.

Utility companies provide an essential service and are therefore, often subject to stringent regulation .

These rules prohibit utility companies from simply raising their rates to increase revenue. As a result, the sector usually provides a steady dividend and may exhibit lessened volatility in share price.

Since basic amenities are non-negotiable, investors reason that there will always be demand for these goods and services even in a recession. Investors may lean towards this sector during economic downturns in an attempt to preserve their capital while other cyclical stocks become highly volatile.

Popular utility stocks include:

- NRG Energy Inc.

- CenterPoint Energy Inc.

- NextEra Energy

- Duke Energy

Real Estate

The real estate sector generally consists of companies that buy and sell property or hold it to receive an income. This can be done in the residential, commercial and industrial sub-sectors.

Residential real estate deals with the buying and selling of properties that are used as residences/homes. These could be in the form of houses, apartments, condos or planned unit developments.

Commercial real estate invests in property that is used for business purposes such as shopping malls, retail, hotels or office spaces.

Industrial real estate deals with properties used for manufacturing and production for example, warehouses, factories and plants.

There are four main avenues in which investors can gain exposure to the real estate sector:

- To physically buy a property/properties

- Purchase shares of publicly traded companies that invest directly in property

- Invest/trade Real Estate Investment Trusts (REITS)

- Real estate sector indices

Real estate firms tend to be cyclical in nature and suffer in economic downturns. This is because people aren’t usually prepared to commit to 20 - 30 year home loans in a downturn, when fears of job cuts and retrenchments are prevalent.

Stock Sectors FAQs

What are the best performing stock sectors?

Many people ask this question in the hope of finding the magic sector that outperforms all of the others consistently. In reality, each stock sector has periods of positive performance as well as negative performance which requires a more balanced or diversified approach. Stocks can also exhibit positive correlations which can be great in an uptrend but disastrous in falling market. A common way to diversify is to gain exposure to different asset classes, like the forex market or the commodity market for example. Read up on forex vs stocks and commodities vs stocks .

What sectors do well in a recession ?

The sectors that often do the best in a recession, historically speaking, are non-cyclical sectors such as the consumer discretionary stock market sector, utilities sector and even parts of the healthcare sector. When economic growth and consumer sentiment decline or become negative, these sectors tend to be robust as people still need essentials like food, beverages, heat, essential healthcare and electricity, for example.

How can I invest in stock market sectors?

Traders looking for exposure to a particular stock sector can choose to trade the individual stocks within the sector or, could simply trade an Exchange Traded Fund (ETF) that tracks the industry as a whole. There are advantages and disadvantages associated with both approaches that trades should be aware of in order to make an informed decision.