Dividend stocks may provide investors with a source of income over and above any share price appreciation. Many investors gravitate towards stocks that pay dividends because regular dividend payments are often seen as a sign of financial stability from the company and may be an effective way to grow a long-term investment portfolio.

This article seeks to provide traders with foundational knowledge of dividend stocks and acts as a springboard for further stock related content featured on .

What are dividend stocks?

Dividend stocks refer to companies that release a portion of their net profit back to shareholders in the form of a cash dividend. Companies that issue regular dividends can be desirable for investors because they stand to benefit from any price appreciation as well as dividend income.

Additionally, dividend stocks can attract a lot of attention from individual investors as well as asset managers because a regular dividend may be a sign of a financially stability. After all, for a company to return a portion of its profits to its shareholders there had to have been profits in the first place; and a long-term track record of dividend payments may highlight a company’s history of profitability.

Dividends tend to be paid out four times a year (quarterly) but can also be paid annually, semi-annually, monthly or whenever viable in the case of ‘irregular’ dividends.

To calculate the dividend yield take a share’s annual dividend per share and divide it by the price per share

Dividend yield = Annual dividend per share / P rice per share

Learn about the fundamental ratios all stock traders should know by reading our article on market value ratios .

How do dividends work?

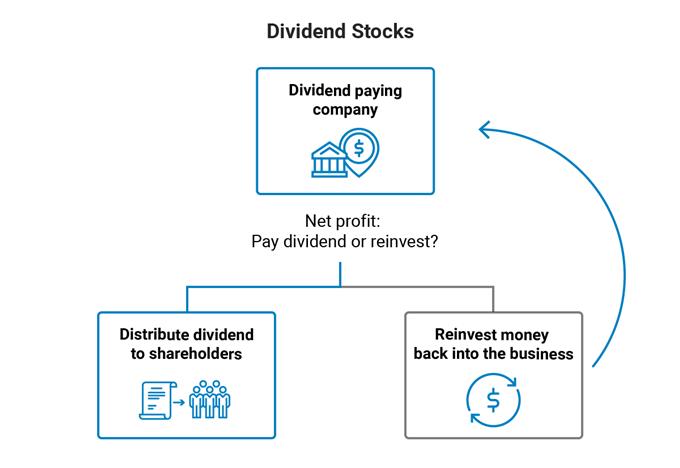

Profitable companies have the choice to use surplus money (net profit) to either reinvest in the business or to distribute this money to shareholders as a dividend. Upon approval from the board of directors, the company will announce the upcoming dividend and provide relevant dates for its distribution to eligible shareholders.

Example :

Company A reviews their quarterly audited financial statements and are delighted to report that it was a very profitable quarter of trading. After receiving approval from the board, the company announces on April 1st that a dividend payment will be made to eligible shareholders on May 10th. The public will also be provided with the record date and ex-div date. On the pay date the company will pay the dividend and the shareholders will see it reflect on the account.

What stocks pay dividends?

Broadly speaking, there are two main types of stocks, growth stocks and value stocks. Growth stocks often opt to retain earnings and use them to reinvest in the rapidly growing business, while value stocks refer to more mature companies that may have reached a plateau on the growth curve.

Value stocks may be more likely to pay dividends because despite a possible dominant position in the market, their growth opportunities can be constrained at the time and the most efficient use of the capital would be to distribute it to shareholders rather than reinvesting. Shareholders are then able to use their discretion as to how they wish to invest or spend the dividend payment.

While paying dividends seems like a logical concept, it does come with its fair share of risk. Once a company commits to paying dividends, it may be very difficult to go back. When companies experience weak earnings, they may have to reduce or scrap a dividend. This can provide a very negative signal to the market and can have a potentially disastrous impact on its share price if enough worried investors sell.

The stock sectors listed below are known for containing numerous dividend stocks:

- Utilities : Electricity, water and natural gas suppliers

- Energy : Oil and natural gas suppliers

- Telecommunications : Network providers and wireless services

- Consumer staples : Household products, medication, food/beverages, tobacco and alcohol.

- Real Estate : Real Estate Investment Trusts (REITs), commercial, residential

Traders and investors can make use of the IG Stock Screener to filter global stock markets and specific sectors to find the best dividend stocks. Filter by: market cap, earnings per share (EPS), dividend yield and normalized P/E ratio among others.

When are stock dividends paid?

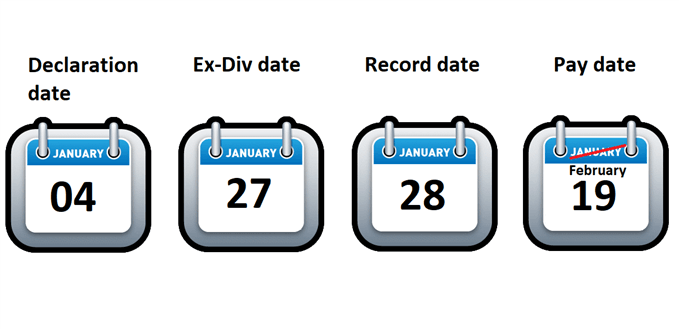

Dividends get paid on the ‘pay date’ specified by the company issuing the dividend but only to eligible shareholders that owned the share prior to the ‘ex-dividend date’. The process unfolds as follows:

- Declaration date : This is the date the board of directors communicate their intention to pay a dividend. Additionally, the board will announce the date of record and the pay date.

- Ex-dividend date (ex-div) : This is the first day that the share trades without the right to receive the dividend. Anyone who purchases the stock on this day onwards will not receive the recent dividend but will be eligible for future dividends if they hold onto the share at least until the next ex-div date.

- Record date : The record date is the date that the company documents exactly who are the shareholders eligible for the dividend. The reason the record date is one business day after the ex div date is because the settlement of stocks takes two days (T+2) to reflect on a company’s record books. Therefore, those who owned the stock the day prior to the ex-div date will be recorded as eligible for the dividend the day after the ex-div date.

- Pay date : This is the date the money will be paid over to the shareholders of the company and is usually a number of weeks after the record date.

How to Invest in Dividend Stocks

There are a number of key fundamental factors and market ratios that investors ought to keep an eye on before investing in dividend stocks.

We have dedicated an entire article on the topic of how to invest in dividend stocks , using a worked example that dissects important factors to consider such as: dividend yield, P/E ratio, payout ratio and dividend growth.

Dividend Stocks FAQs

What is stopping me from simply buying the share before the ex-div date to receive the dividend and selling the share on the ex-div date to make a quick profit?

Investors consider a number of methods when researching how to value a stock . One of these methods is the dividend discount model which forecasts future dividends and discounts them to arrive at a present day value. Therefore, when there is one less dividend to receive, the market will price this in, resulting in a drop in the price of the share on the ex-div date roughly equal to the amount of the dividend per share.

Example: Company X is trading at $10.20 the day before the ex div date and is issuing a $0.20 dividend per share. On the ex-div date (the first day the share trades without the right of the shareholder to receive the dividend) the share is likely to be trading around $10.00 to account for the fact that the shareholder in not entitled to an additional $0.20 payment.

Further reading on the stock market

- Go back to basics with our guide to trading stocks for beginners

- Explore the world’s most traded stock indices and follow live prices

- Bookmark our guides to global stock market trading hours and stock market holidays.