Cyclical and non-cyclical stocks can help diversify a trader’s equity portfolio. This article will outline the fundamentals of these kinds of shares and how they may be integrated into stock portfolios under the following headings:

- What are cyclical stocks?

- Differences between cyclical and non-cyclical stocks

- What are cyclical sectors?

- Cyclical stocks: FAQs

What are Cyclical Stocks?

Cyclical stocks are shares that are expected to fluctuate in conjunction with correlating economic conditions. That is, cyclical stock prices are more likely to rise in the presence of a healthy economy and conversely fall during a downturn. In other words, cyclical stocks can be reliant on consumer incomes whereby their ‘wants’ are serviced as opposed to needs – see difference table below.

Differences Between Cyclical and Non-Cyclical Stocks

Some differences between cyclical and non-cyclical/ defensive (counter cyclical) stocks are:

| Cyclical Stocks | Non-Cyclical Stocks |

|---|---|

| More volatile to economic conditions | Relatively less dependent on economic conditions |

| Cyclical companies provide for consumer wants which vary with the economy (e.g. luxuries such as vacations) | Non-cyclical companies deliver on consumer essentials (e.g. soap and toothpaste) |

| More appealing for those looking to trade a strong economy | Can be preferred by investors during periods of poorer economic circumstances |

Investors can often look to diversify their outlooks and portfolios by incorporating cyclical and non-cyclical stocks. This opens the door for hedges against economic upturns and downturns. There are other stock types that can be integrated but for the purposes of this article, we will focus solely on cyclical and non-cyclical shares.

Although traders can incorporate both cyclical and non-cyclical stock types, it is important that they are cognisant of current business cycles and possible future climates. There are some risk-averse investors who prefer higher percentages of non-cyclical stocks – such as defensive shares - to compliment low risk appetite. Meanwhile, other more risk-seeking investors may look to trade a higher share of cyclical stocks on both sides (long and short trades).

Cyclical stocks generally come with greater risk. That is, possible short-term gains from a burst in economic activity can be offset by a turnaround in growth down the road. Meanwhile non-cyclical shares in a similar timeframe, all else being equal, can help smoothen out returns at the cost of greater yield.

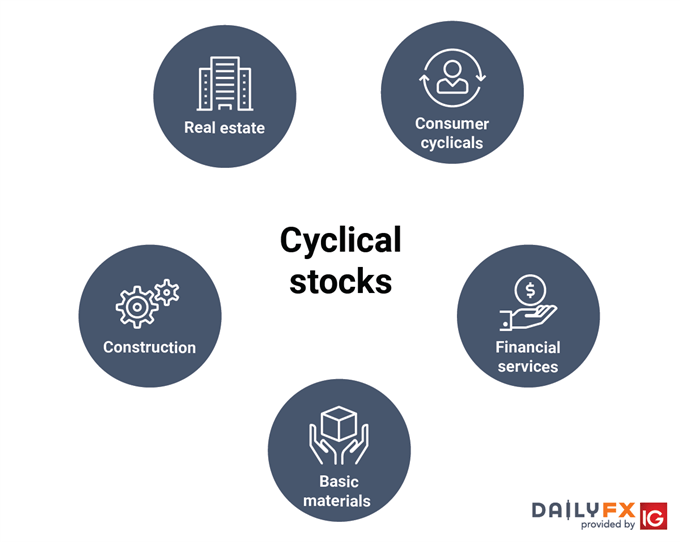

What are the Cyclical Sectors?

Different types of cyclical stocks can be grouped under distinct sectors. There is no official list of sectors, but the following are widely accepted examples:

Construction Sector:

This sector includes companies involved in construction and real estate development. In times of an economic downturn, businesses often reduce inventory levels, postpone purchases and delay expansions. The inverse is typically true for economic upturns whereby the construction sector expands.

Real Estate Sector:

This sector includes mortgage companies, property management businesses, and real estate investment trusts (REITs). Demand for land usually increases in a healthy economy as rental costs and property values follow suit depending on the supply of overall housing.

Basic Materials Sector:

There are companies that manufacture chemicals, building materials, and paper products. This sector also includes businesses engaged in commodity exploration and processing.

Financial Services Sector:

This segment includes businesses that provide financial services. These are often banks, asset management companies, investment brokerage firms and insurance agencies.

Consumer Cyclical Sector:

This sector includes retail stores, auto and auto parts manufacturers, companies engaged in residential construction, lodging facilities, restaurants and entertainment.

Cyclical Stocks: FAQs

Is Banking a Cyclical Industry?

Banks are considered cyclical because of their dependence on the credit market. Banks tend to extend more credit in times of good economic health and less when there is a downturn.

Is the Insurance Sector Cyclical or Defensive?

The insurance sector is primarily seen as defensive. Policyholders do not necessarily tend to cancel their coverage due to an economic downturn. This may then reduce the negative impact of a recession on insurance agencies, helping to cushion the blow on their shares. Health insurance is generally essential to overall wellbeing and in most cases is not easily discarded in times of financial difficulty. The other side to the argument is that new transactions can fall during harsh times as people will not look to take on further insurance policies.

Further Your Knowledge on the Stock Market and other Share Types

- In times of economic downturns, traders also turn to safe-haven stocks for security

- Download our free equities forecast to get the latest updates on the global stock market, along with technical and fundamental factors affecting major stock indices . Brought to you by our expert analysts every quarter

- For more foundational concepts on the stock market, take a look at our guide on stock market basics