Stock diversification can help investors through volatile periods within the stock markets . Understanding the basic concepts behind a diversified portfolio and how it can be implemented can go a long way in distributing portfolio risk. This article will cover the following concepts on stock diversification:

- What is a diversified portfolio?

- Systematic and unsystematic risk

- Why is it important to diversify stocks?

- 4ways to diversify your stock portfolio

- Mistakes investors make when they diversify

- Key takeaways to achieve a diversified stock portfolio

What is a diversified portfolio?

Diversification in a general sense is the broadening of a range of products. In finance, diversification of a portfolio is utilised to reduce the risk of exposure to one particular asset or event. In the case of stocks, portfolio diversification, this is achieved by incorporating different investments in terms of stock sectors, allocation amount, location, stock investment type and other assets.

Why is it important to diversify a stock portfolio?

It is important to diversify a stock portfolio to reduce the risk of being over exposed to one particular industry. This safeguards against “putting all your eggs in one basket.”Stock diversification is improved by holding some stocks that have a negative correlation with other held stocks. This results in a stock portfolio that manages risk and reduces the effect of market volatility. Although a portfolio may seem well diversified, it is never fully diversified even in terms of unsystematic risk.

Systematic and Unsystematic Risk

To fully understand why diversification is important, investors need to distinguish between systematic and unsystematic risk.

Systematic risk:

Systematic risk is the risk central to an entire market. This type of risk is commonly known as undiversifiable risk as it is impossible to completely evade. Systematic risk is volatile in nature making it difficult for companies to protect against. Examples of systematic risk include political events, war etc. Therefore, an individual company cannot control this type of risk.

Unsystematic risk:

Unsystematic risk is the risk associated with a specific company/stock. These types of risks can be controlled by the company and can be reduced through diversification techniques. Examples of unsystematic risk include competitors, business risk (internal operational or external legal factors) and financial risk (capital structure).

Unsystematic risk is what stock investors wish to diminish when diversifying their stock portfolios. If stock diversification is achieved, it is important to remember that the portfolio will still be subject/exposed to systematic or market-wide risk.

5 Ways to Diversify a Stock portfolio

1. By Sector

Stock sectors give investors the ability to spread risk throughout different industries. Being largely exposed to a single sector can be harmful to investors if this sector falls in value. Make sure to study each sector to gauge how they may fit into the overall financial goal of the portfolio as some industries can be spuriously correlated.

Risk-averse investors may look to add more safe haven stocks to give some downside protection during tumultuous market conditions, while risk-seeking investors may include a larger percentage of growth stocks to safe haven stocks. Still, it is important to keep in mind that even “safer” stocks may fall in a broader market downturn.

2. By Company size

Bringing in companies of different sizes (small, medium and large caps) is another popular way to diversify a stock portfolio. Generally, large-cap stocks are considered safer investments as opposed to small/mid-cap stocks, but smaller companies can offer intriguing growth opportunities.

3. Geographical

Geographical diversification can relate to stocks exposed to a specific country or location (financial, political etc.) With increasing globalization and market access, investors can invest in stocks that have exposure to other locations or countries. This can mean investing in the same stock market in a company that has dealings in other locations/countries or, gaining access to stocks in other stock markets around the world. Geographical investing has recently been made more accessible with the advent of exchange traded funds (ETFs).

4. Stock ETFs

In recent years, stock ETFs have become increasingly popular amongst investors. ETFs are a basket of stocks that is available to invest in through one investment vehicle. This makes it easier and often cheaper for investors to diversify without having to make multiple stock purchases. For example, the iShares Core S&P 500 ETF (IVV) is an ETF that tracks the S&P 500 index. Thus, an investor can gain exposure to the entire S&P 500 index through the purchase of a single IVV share.

5. Asset class

Incorporating other asset classes into an investment portfolio is another way to diversify. Typically, investors look to safer investment options such as bonds but this is not limited to bonds only as investors do venture into instruments such as commodities and forex. For example, gold is often viewed as a haven asset while currencies like the Japanese Yen and Swiss Franc are traditionally viewed as safer than their alternatives.

Uncover more with our article on stocks vs bonds.

Stock Diversification Example

Below is an example of diversification during the coronavirus crash. This gives a practical situation whereby the coronavirus pandemic has affected global markets, and how stock investors may mitigate substantial losses.

Delta Air Lines vs Gilead Sciences:

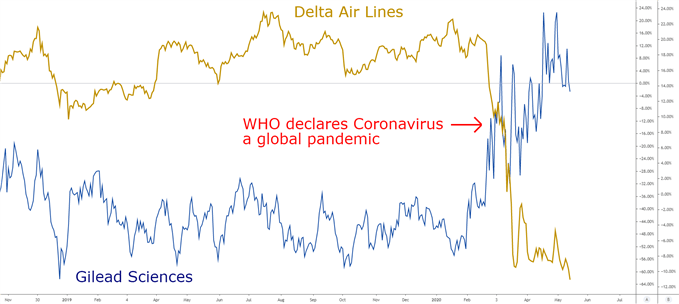

Chart: TradingView

The chart above shows an overlay of two stocks Delta Air Lines and Gilead Sciences respectively, prior and post to the coronavirus pandemic. The coronavirus pandemic spread worldwide which caused airline stocks to plummet on a global scale. While Delta was not the only airline stock to fall, it clearly highlights the adverse reaction in price.

Gilead Sciences on the other hand, is a pharmaceutical company conducting research into a coronavirus treatment. Prior to the World Health Organization (WHO) announcing coronavirus as a global pandemic, the two aforementioned stocks had mostly a positive correlation. After the announcement, it is clear from the chart that the two stocks moved in largely opposite directions (negative correlation). As a simplistic example, if these two stocks were the only stocks in the portfolio, this may have protected the investment from significant losses.

It is important to note that while this negative correlation is true in the single instance above, the two sectors may have a positive correlation overall.

The example shows how stocks from two different stock sectors can produce risk-adjusted returns in volatile situations.

Mistakes investors make when they diversify

1) Over diversifying

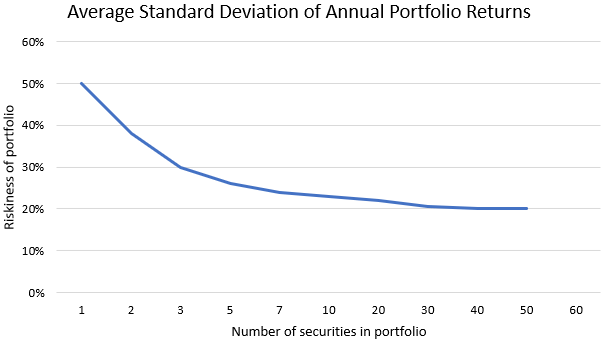

Stock investors often include too many stocks in the portfolio. Many studies have shown that excessive stock inclusions do not actually reduce risk after a certain number of stocks (+/- 30 stocks). This asymptote-like curve of risk vs number of stocks does not do ETFs and mutual funds any favors as these instruments often contain well over 30 stocks (see image below). Investors then choose to hold multiple ETFs and mutual funds thus multiplying this problem.

2) Investing in negatively correlated stocks

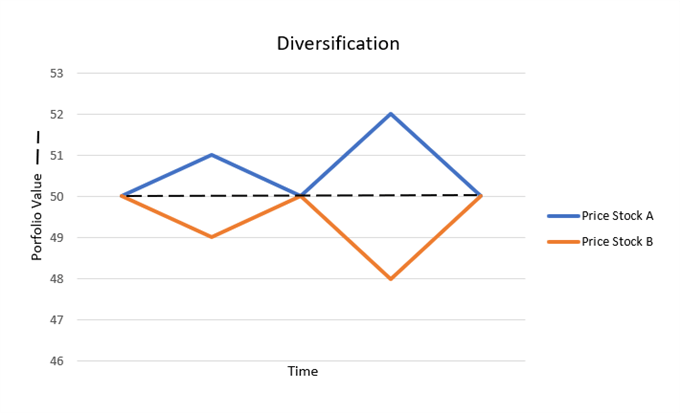

Although this has been used in the example above, investors often intentionally try include stocks that do not rise and/or fall together. If the whole stock portfolio is managed in this manner, it is obvious to see that portfolio value gains are negated by the opposite movement of the diversified portion of the stock portfolio (see chart below). While extreme, the example below is purely meant to illustrate how a negatively correlated portfolio can eliminate portfolio value increases.

3) Simplified chart of perfect negative (-1) correlation:

4) Misjudging time of investment

Managing a diversified portfolio can seem straightforward in theory, but the time investment needed can be overwhelming for some investors. This often leads to mismanaged portfolios.

In extreme bear market circumstances, markets tend to fall as a whole. There is basically no escape from the decline, even with a ‘well diversified’ portfolio. Situations such as these can make the use of other asset classes crucial in warding off deeper losses.

Key Takeaways to Achieve a Diversified Stock Portfolio

In conclusion, investors need to fully realise their financial goals (term, risk etc.) and budget constraints prior to undertaking any form of investment. Once this is understood, investors may then look at diversification within their portfolio. To successfully diversify, the following points should be reflected on:

- How much risk are you willing to take on?

- Do not include too many stocks

- Understand how the stocks are correlated

- Risk can never be completely erased

- Consider diversifying across different asset classes

Stock diversification: FAQ

How many stocks make a diversified portfolio?

There is no correct/accurate answer for this as studies continue to produce contradictory results. The general consensus amongst equity analysts and scholars point to anywhere from 15 - 30 stocks. Despite this large range and uncertainty, investors looking to diversify need simply follow the points outlined in the article above.