Stock market volatility is an integral concept for traders to understand. Knowing the stocks with the highest potential for significant price movement, as well as how to trade them optimally, can mean exciting opportunities. In this piece, we explore high volatility stocks in more depth, look at how to identify the most volatile stocks, and provide best practice tips for trading them.

What is volatility in stocks?

Stock market volatility refers to the range of price movement of a stock over time. A more volatile trade has the potential for significant gains, but also substantial losses. Volatility in stocks can be understood using the following measures:

1) Standard deviation

Standard deviation is the average amount the price of a stock has differed from the mean over a given period. Bollinger bands can be used by chartists to analyze standard deviation.

2) Beta

A stock’s Beta is a measure of its volatility in relation to the wider market. The market has a beta of 1.0, with more volatile stocks having a value greater than this (eg 2.0), and less risky stocks having a value closer to zero.

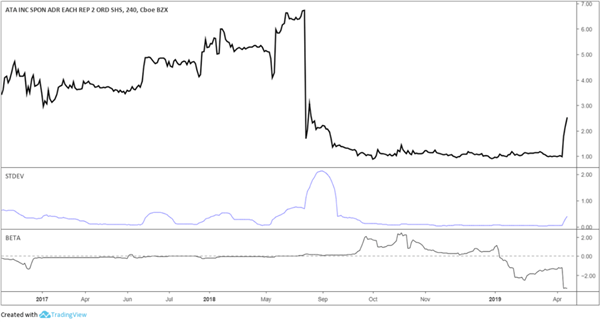

The chart below shows the price for the ATA Inc. stock (ATAI), listed among the most volatile by TradingView as of April 2019, with both the standard deviation and Beta measures of volatility included on the chart.

What are the most volatile stocks?

When it comes to volatility and stocks, there is no one set of stocks that are always more volatile than another. Stocks can be classed as ‘currently volatile’, describing those stocks with current high swings, or ‘expected to be volatile’, meaning stocks that may be stable at this moment but have potential for high volatility in the future.

As can be seen in the above example, stocks can have periods of high volatility, for example showing a Beta near zero, then an increasing Beta to 2.0, and then falling back to near zero months later.

Identifying high volatility stocks

When identifying high volatility stocks, traders can use a stock screener, search the derivatives market, and use third party websites.

Stock Screener/Filter

A stock screener or stock filter is an automated program that reveals a list of stocks that fit certain criteria.

For example, using a stock screener to monitor the stocks that had the biggest percentage gains or losses in a prior trading session, making sure each has enough volume per day, can be helpful to ascertain subsequent volatility. Helpful criteria to find volatile stocks may include ‘show stocks where the average day range (50) is above 4%’

Searching the derivatives market

Traders can use parameters in the corresponding derivatives market such as put call ratio, which is a tool to gauge market sentiment, open interest, the number of contracts outstanding on an exchange at any one time, and implied volatility, a market forecast of likely price movement. For these indicators, it is advisable to go to the official exchange website.

Third party websites

TradingView, for example, rounds up the most volatile stocks by percentage price changes.

How to trade stock market volatility

Trading stock market volatility successfully involves effective hedging , knowing when to sell stocks, employing sound risk management , and spotting buying opportunities when renowned stocks see a fall in price.

Hedging

Hedging against spikes in volatility is important to offset losses. This can be done by buying put options, which allow the sale of assets at an agreed price on or before a particular date, and trading inverse exchange-traded funds, which act as the inverse of the index or benchmark it tracks. Traders can also explore aggregated stocks through an index to protect against volatility (see below).

Selling stock/managing risk

If extreme volatility is affecting your mindset, it may be wise to sell off some stock and put your money into less dynamic securities. This leaves you free to trade another day without risking more than you are prepared to lose.

Practising sound risk management is essential when dealing with aggressive price action . Volatile stocks can lose you a lot of money and should not be traded if your mindset isn’t right that day, particularly if day trading.

Spotting buying opportunities

Sometimes a buying opportunity arises when high volatility hits the price of high-quality stocks. For example, in early 2019 the NASDAQ and S&P 500 constituent Apple cut its earnings forecast, leading to its price dropping 10-15% in the following days. However, just three months later, it completely recovered and approached a $1 trillion valuation once more. Identifying opportunities to go long when the market conditions reverse is one way traders look to speculate when coupled with prudent trade management techniques.

Volatile Stocks for Day Trading

Like the most volatile currency pairs , volatile stocks can show significant movement throughout the day, making them potentially an attractive option for day traders. While some stocks may move 0.5% in a single day, others may move as far as 5% in the same period, meaning traders should be constantly alert.

To find a volatile stock for day trading, watch a stock you found with your stock screener for intraday movement. If a stock opens down 10% and starts moving, as opposed to staying static, it is being day traded and may be worth consideration.

Due to the speed of price movement, executing day trades can be a physical endeavour and good reflexes win the day.

Volatile Stocks for Swing Trading

Swing traders hold positions for more than a day, making the effects of volatility potentially smaller than when day trading. Stocks that may be suitable for swing trading include large cap stocks such as Apple, Facebook and Microsoft, because they have a large volume of shares changing hands at any given point.

Summary tips on trading stock market volatility

When it comes to trading stock market volatility, the following tips are useful:

- Be aware that price movement usually shares a strong correlation with the performance of the major stock indices on which the stock is traded.

- In addition to macroeconomic themes, don’t forget that single stocks are beholden to microeconomic concerns like regulation, liability and performance of the management. To ward off unforeseeable risks, a trader can explore aggregated stocks through one of the major stock indices such as FTSE 100 , DAX and CAC 40 . Trading an index removes some of the smaller risks and while still granting exposure to the equity asset class.

- Index trading is vulnerable to liquidity concerns in times of extreme volatility and crisis. To combat a potential lack of liquidity in a stock market, currency markets can offer a much deeper pool of participants and capital.

Further reading on the stock markets

For more on stock markets, why not check out the following articles and boost your equities expertise.