Stock Market Trading Hours Explained

- The various stock markets of the world have different trading hours which can impact global capital flow

- Overlapping sessions can result in higher aggregate volume and/or smoother market conditions

- Conversely, thin trading volume and holiday periods can urge volatility.

Due to technological advancements and global interconnectedness, traders have the ability to check the pulse of equity prices at almost any time of day through a variety of media. Still, not all stock markets can be traded at any time.

Each stock market, whether it be the Dow Jones , DAX 30 or Nikkei 225 has a strict schedule when shares can be traded by market participants according to exchange times. Knowing the trading hours of operations for each index, and thereby when the most heavily-traded markets overlap, can help contextualize market conditions and potential price reactions to breaking news.

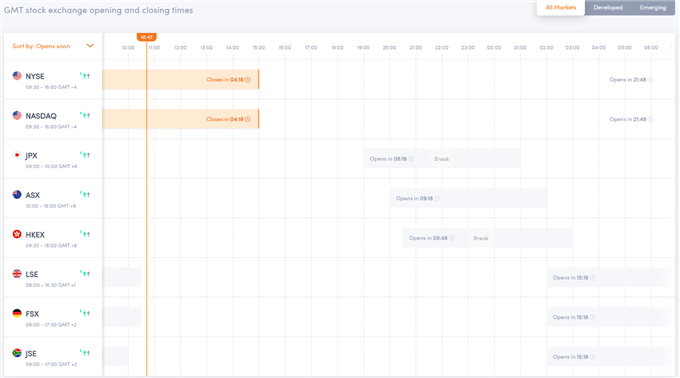

Opening & Closing Times of Major Stock Exchanges

| Stock Index | EST Trading Hours | GMT Trading Hours |

|---|---|---|

| Dow Jones , Nasdaq 100, S&P500 | 9:30AM to 4:00PM | 2:30PM to 9PM |

| FTSE 100 | 3:00AM to 11:30AM | 8:00AM to 4:30PM |

| DAX 30 | 3:00AM to 11:30AM | 8:00AM to 4:30PM |

| CAC 40 | 3:00AM to 11:30AM | 8:00AM to 4:30PM |

| Nikkei 225 |

8:00PM to 4:00AM Lunch 10:30PM to 11:30PM |

1AM to 9:00AM Lunch 3:30AM to 4:30AM |

| Shanghai Composite |

9:30PM to 3AM Lunch 11:30PM to 1:00AM |

2:30AM to 8:00AM Lunch 3:30AM to 5:00AM |

| ASX 200 | 8:00PM to 2:00AM | 1:00AM to 7:00AM |

Overlapping sessions during stock market trading hours

Given the dispersion of the major stock exchanges , trading overlap exists only at a few periods each day, typically as one region of the world winds down and passes the torch as the next region comes online for the day. As a result, global trading volume temporarily increases and liquidity is bolstered, usually fostering smooth price action in the event of scheduled and breaking news within the timeframe.

Check out our market snapshot page which includes the opening and closing times for the major exchanges.

The opposite also holds true. When the US trading session winds down and Asia is still offline, there is a period of usually thin liquidity than can see news events spark amplified price reactions like flash crashes or trading gaps . Each trading day has differences in volume and liquidity depending on the backdrop at the time, like whether there was a Central Bank announcement coming up on the economic calendar .

Stay updated on stock market holidays

Holiday periods are one notable example of liquidity distortion, where many traders may have left their desk for vacation and the market is scheduled to close for a special event. In turn, the number of participants are reduced alongside the available exchange-based trading hours which can potentially stoke massive price moves if fundamental developments occur. Similarly, there are seasonal influences like the summer months whereby markets naturally experience lower volume compared to the other seasons, a phenomenon known as the summer doldrums.

View the annually-updated guide to Stock Market Holiday Hours .

Further reading on the stock market

Clearly, tracking the tide of equity exchanges is a simple yet fundamental step in stock market trading as it can have subtle influences on price action each day and for prolonged periods. To stay informed, keep an eye on market news , and bolster your trading strategy with our expert education articles on understanding the stock market .