An ETF is a popular investment product that allows speculators to trade a variety of assets in one package. Read on for more on the different types of ETFs and the potential benefits of trading them.

What is an ETF?

An ETF, or Exchange Traded Fund, is an investment product that can comprise a range of assets, from stocks to bonds to commodities , in one package. Traded on the stock market, it can be easily bought and sold as a marketable security.

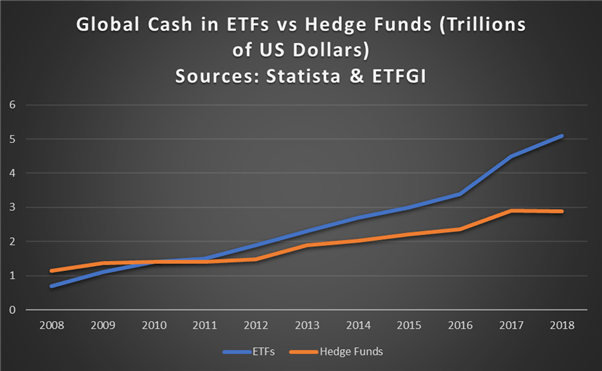

While falling far short of the figures for assets under management in mutual funds and pension funds, ETF investment has exploded in popularity in recent years. For example, in 2019 the funds invested in ETFs globally tallied some $6.1 trillion compared to $4.6 trillion the year before, according to data from Statista. Here’s a chart to demonstrate the rise compared to hedge funds this century.

What are the different types of ETFs?

The different types of ETF range from ETFs that are designed to track certain indices, to specialty commodity products. Broadly, the different types of ETFs can be defined as:

- Bond ETFs incorporating corporate, government and municipal bonds

- Commodity ETFs which invest in major commodities such as gold and/or oil

- Currency ETFS investing in currencies such as USD and CAD

- Industry ETFs which track particular sectors such as biotech or retail

- Inverse ETFS which focus on shorting stocks and attempting to profit from bearish trends.

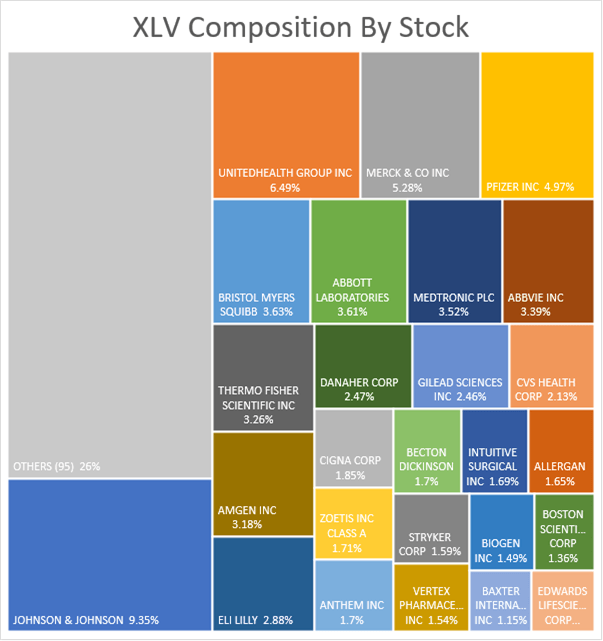

For example, the Health Care Select Sector SPDR Fund (XLV) is an industry ETF incorporating a range of healthcare companies. The below chart shows the proportional composition of this ETF by company.

What are the benefits on investing in ETFs?

There are many benefits of investing in ETFs, ranging from being able to buy and sell at any time of the trading day, through to a choice of a wide range of assets, possible tax efficiencies, and more. Here are some of the primary benefits in summary.

- Convenience : With ETFs, the investor has access to a range of assets across various sectors. Also, ETFs can be bought or sold at any time during the trading day, as opposed to mutual funds, which settle after the market close

- Cost: With ETFs there is no sales load, although brokerage commissions and expense ratios do apply

- Diversification: Risk can potentially be managed more effectively across a diverse portfolio

- Tax efficiency : ETFs often do not often distribute capital gains, enabling some investors to hold for longer periods of time in order to receive more favorable tax treatment from long-term stock investments

- Versatility: Due to being traded like stocks, different types of orders can be placed such as limit and stop orders and investors can buy on margin, which isn’t an option with mutual funds.

This said, it may be worth considering whether ETFs are the best instrument to use to trade particular markets. For example, with the EWA ETF, a trader can access companies with high exposure to Australia, effectively allowing access to the Australian consumer and economy. However, investors can also trade the performance of the Australian economy through the AUD/USD currency pair. It also has the benefits of the currency market which has 24/5 trading hours and potentially greater liquidity.

What is the most popular ETF?

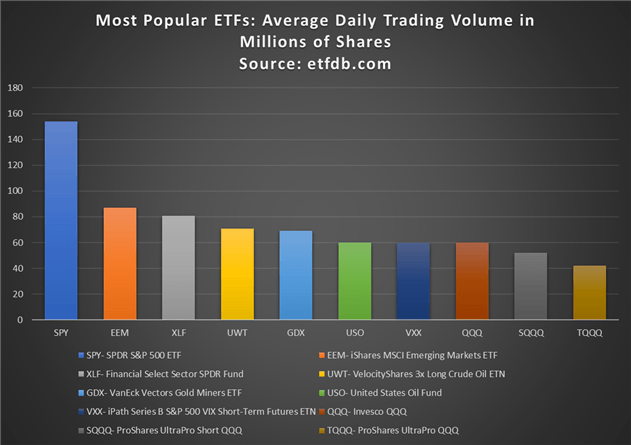

The most popular ETFs in terms of trading volume, as of March 2020, include the SPDR S&P 500 ETF, ( SPY ) which tracks the S&P 500 stock market index. Other popular choices include the iShares MSCI Emerging Markets ETF (EEM) which tracks emerging market equities, and the VanEck Vectors Gold Miners ETF (GDX), which follows the performance of the NYSE ARCA Gold Miners Index. Find out the largest ETFs by assets under management.

The below chart gives a picture of the ten most-traded ETFs by average trading volume, meaning the average number of shares traded in a day, again as of March 2020.

How to invest in an ETF

Now you know what an ETF is and what some of the most popular ones are, the next stage is investing in an ETF. To do so, investors will need to take the following steps:

- Open a brokerage account. Depending on the broker,investors will have access to a variety of ETFs which are traded like individual stocks. Some brokers allow commission-free trading of their own proprietary ETFs, some have partnerships with third-party ETF providers. On top of the potential brokerage commission to buy or sell, investors should look into the annual expense ratio of each ETF to understand how costly it will be for you to hold the trade.

- Plan the portfolio. It’s important to diversify when it comes to putting a portfolio together. Many ETFs contain similar holdings to others, so investors should make sure that their portfolio covers different asset classes, with a widerange of assets within. For example, while an investor may want to hold an ETF focused on established growth equities, they might also want to hold a small-cap ETF or one that has a different exposure by sector or geography to balance the risk. Look at trading volumes for a gauge of popularity and research the performance history of each ETF to get a feel for its recent performance. But please do note – past performance is not indicative of future results.

- Place the order . As with stocks, proceed with the order by identifying the ticker symbol, noting price, number of shares and order type, and decide whether to go for limits and stops where available.

Exchange Traded Funds: A Summary

In summary, trading an ETF can be an attractive investment option if researched thoroughly and executed as part of a balanced portfolio. Remember these key pointers:

- Know the ETF type. From bond ETFs to commodities ETFs, ensuring you know the assets that constitute each product will enable the investor to construct a balanced portfolio.

- Identify goals for the investment or portfolio. Whether it be tax efficiency or convenience, the investor should be mindful of whythey’re using this product over individual assets.

- Survey the market. What are the most popular ETFs to trade and why? Reading others’ experiences of trading certain ETFs may give offer some inspiration when building your a portfolio.

Once the research is done, the next steps are to open an account and place the order.

Become a Better Trader with Our Trading Tips

As mentioned, there are a range of ETFs that comprise a variety of different assets, and covers many of those assets – with a focus on forex, indices and commodities.

- For more on the equities that underpin stock ETFs, learn more about the types of stocks .

- Weighing up commodities vs stocks ? Learn more with our article.

- Prefer currencies? Find out how to become a forex trader .