Many people think that trading foreign exchange (FX) requires a lot of time to research the market and to identify trading opportunities. However, the 24-hour nature of FX makes it easier for part time day traders to take advantage of trends in currencies because they are not bound by when an exchange allows them to trade . Therefore, forex trading can be convenient for individuals who cannot afford to invest large quantities of time on trading.

Part-Time Day Trading - Main Talking Points:

- Why Trade Forex Part-Time? Advantages of Trading for Shorter Durations

- How Part-Time Traders Can Improve Their Workflow

- An Effective Breakout Trading Strategy for Part-Time Traders

Why Trade Forex Part-Time? Advantages of Trading for Shorter Durations:

Part -time trading allows for an increase in trading efficiency, with less chance of ‘under and over-trading’ . Under-trading doesn’t allow for funds to be used at the appropriate times to exploit potential trading opportunities. With full-time traders, there is often an overload of financial information to absorb. This can be daunting because of the lack of clarity. Part-time trading leaves the trader with a simplified outlook to the markets with marginal uncertainty. The time invested is minimal, resulting in more quality time for social activities.

How Part-Time Traders Can Improve Their Workflow

Practicality is crucial for a part-time trader for obvious reasons. The list below highlights some simple techniques that can be implemented to make the trading process more efficient.

- Identify a simple strategy

- Match strategy to relevant environment

- Use entry orders

- Repeat!

An Effective Breakout Trading Strategy for Part-Time Traders:

There are several different strategies to approach the market if you are short on time. The strategy included below is called the ‘Simple DNC Breakout’. The tools involved in identifying trades for this strategy are fairly intuitive even if you have never traded forex previously.

Before I get into some specifics of the strategy, you may be wondering how a trader can effectively find good trades if they are not constantly watching the market? The essence of this approach is that the trader will place orders to enter into the market at strategic price points.

When the market trades through these prices , this will be the signal to enter the trade, and the resting order will take care of the entry and exit automatically.

Therefore, the strength of this strategy depends upon the strength of the trend. The success of this strategy is to utilize the strongest trends in the market at a given moment - the stronger the trend the better. When these strategic price points are reached, traders look to enter trades in the direction of that strong trend.

As a result, there are 2 significant benefits to this type of strategy:

1. No need to baby-sit the trades :

Place orders to enter the market at specified prices, then simply let the market enter these trades at these strategic prices. Many of these trades will trigger without the trader’s attention on the market, making it convenient for part-time traders.

2. This strategy can keep you out of ‘some’ losing trades :

This does not mean every trade will be 100% correct. However, it happens frequently where a trading idea is incorrect but the trade is not entered in to as the market never trades at the strategic price point. That is, your entry into the market does not get triggered, meaning you are kept away from the losing trade.

Learn How to Take Trading Losses

The Simple DNC Breakout Strategy

Tools Needed:

- A price chart set to the daily bar

- The Donchian Channel (DNC) indicator

- A strong trend

- 30 minutes of time to identify strategic price points

To get started, open up a price chart of a currency pair that has been in a strong trend . A daily price chart means each bar or candle on the chart represents one day’s worth of price action.

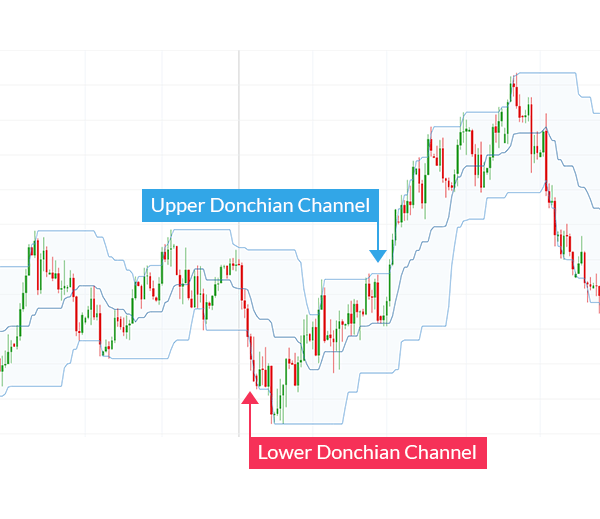

Secondly, add the DNC indicator to the chart (most charting packages include this for free). The DNC indicator will calculate the highest high and the lowest low price for the past X number of bars. Set the input value of the DNC indicator to 8. This means the highest high price and the lowest low price for the past 8 days’ worth of trading as seen below:

Identifying the Strategic Price Points

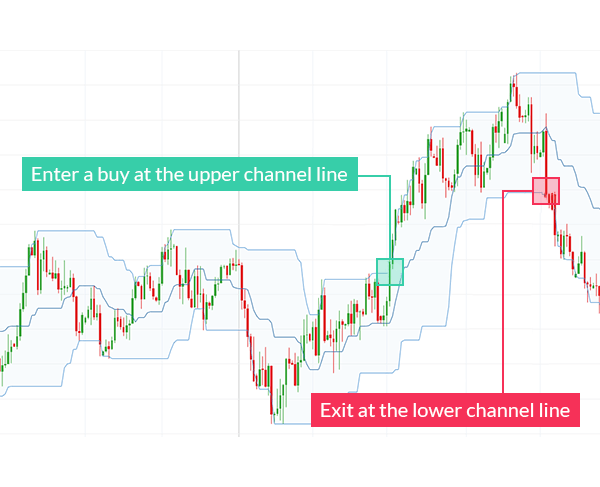

Since the AUD/USD has been in a strong up trend, filtering trades for long positions is key. Conversely, in a strong down trend would filter for only sell trades. Setting up the trade is a simple 4 step process.

Rules to ‘Buy’:

- Use the upper DNC line as are strategic price point to enter the position as a buyer (green square).

- Lower DNC line as our stop loss.

- Manually trail the stop loss at the lower DNC line.

- Exit the trade when price reaches the lower DNC line (pink square).

Rules to ‘Sell’:

- Use the lower DNC line as the strategic price point to enter a sell trade.

- Use the upper DNC line as the stop loss point.

- Manually trail the stop loss at the upper DNC line.

- Exit the trade when price reaches the upper DNC line.

Part-Time Trading: A Summary

Part-time trading is very easy to fit it into your already busy schedule. Individuals don’t have to give up on trading because of time constraints be it work, school or family. Following a simple strategy as outlined in this article can allow for a well-balanced trading routine.

Refine your trading skills

- Unsure of the exact trading style to employ? Discover what approach is best suited to your personality with our DNA FX Quiz .

- Traders have different styles and strategies . Explore these thoroughly to find out if this type of analysis suits your personality.

- Psychology of trading is essential, especially trusting the employed strategy. Take a look at how to build confidence in trading .

- Register for free to view our live trading webinars which cover various topics related to the forex market like central bank movements , currency news, and technical chart patterns.