The stock market often reacts quickly to interest rate changes – certainly more quickly than many other areas of the economy, which may take up to 12 months to catch up. This can mean many opportunities for traders who analyze stock markets, both when buying and holding or employing a shorter-term speculative approach.

Interest rates and stock prices are closely linked: In this article, we will discuss interest rates in general before moving on to explore the overall impact they can have on stocks, and how to incorporate this information into analysis.

What are interest rates and why do they change?

Put simply, interest is the cost of borrowing money. There are different types of interest rates that will affect the stock market – the main distinction is:

- Bank rates: This is the rate at which banks lend to each other. It’s also the rate that directly influences the stock market. In the US, this is called the Fed Funds rate.

- Consumer interest rates: These are the rates charged on loans for consumers, such as a mortgage, or car finance. They may be based on bank rates, but they are independent and do not have to reflect recent changes.

While these two types of interest rates are distinct from one another, they’re also closely linked. When banks are lending money more cheaply with a lower interest rate, this can be passed onto the consumer by lenders, keeping rates lower for borrowing as well. Traders are impacted by these interest rates because they can affect the price of stocks, causing them to move up or down.

What is the overall impact of interest rates?

Interest rates are set with the intention of having a particular impact on the economy. As a general rule:

- Higher interest rates may slow economic growth . Borrowing becomes more expensive and there is more incentive to save money, so people may be encouraged to spend less.

- Lower interest rates may boost economic growth. Borrowing becomes cheaper and there is less incentive to save money, so people may be encouraged to spend or invest.

Central banks will try to control these functions by setting bank rates (the target interest rate for banks lending money to other banks from their reserve balances) in an effort to keep inflation in check. A central mandate of the Federal Reserve Bank (the Fed) is to maintain stable prices and employment, chiefly through the control of interest rates.

Bookmark the Central Bank Calendar to stay up to date with interest rate announcements.

How do interest rates affect stocks?

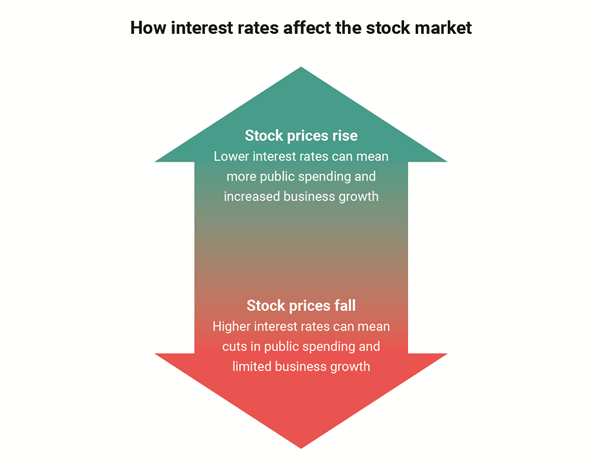

There are two main ways in which stocks are affected by interest rates: directly and indirectly. Here is a summary of how businesses, and therefore stocks, are affected by changes to interest rates:

1. Businesses are directly affected by bank rates because they affect the amount a company can afford to borrow. When interest rates increase, it’s more expensive for companies to borrow capital. If spending decreases, growth slows down, and this can negatively impact earnings. When interest rates decrease, it’s cheaper for companies to borrow capital with the aim of achieving growth, and this may encourage stock prices to rise.

2. Businesses are indirectly affected because higher interest rates mean less disposable income in the wider economy. This means less spending on products and services, which can again impact revenues and earnings, potentially causing stock prices to fall. Conversely, when interest rates are lower and people are spending more freely, this can be good for business and help to push stock prices higher as the company experiences stronger growth rates.

In the US, the Federal Open Market Committee (FOMC) sets the bank rate for the Fed, meeting eight times a year to confer on possible adjustments. Higher interest rates may mean lower stock prices, and lower interest rates may bring on higher stock prices.

How to analyze stocks based on interest rate decisions

Changes to bank rates can cause volatility , which means there’s often opportunity to trade around the changing prices of stocks. If interest rates are higher and stock prices are falling, this could present opportunity for traders who think the price will ultimately rise again over time.

It also presents potential to speculate on the stock market via indices and prediction markets. When central banks are due to announce changes in interest rates, this in and of itself can cause volatility around the markets. As mentioned previously, the stock market is quick to react to changes in interest rates , so traders will often be making their projections ahead of major central bank announcements . Increases and decreases in demand from traders will contribute towards this volatility and can further create instability in the stock market around rate announcements.

In order to trade stocks around interest rates and upcoming interest rate decisions , traders need to be aware of the key economic dates in the calendar. This is when the significant volatility may occur in the stock market, so any stock trader will want to be aware of what’s happening, especially if speculating on short-term price movements. Check the economic calendar to stay on top of potentially market-moving events.

Remember that volatility creates opportunity, but it also heightens risk, so it’s important that traders adhere closely to their risk management strategies and trading plan. This may help in the effort of mitigating losses when trading interest rate sensitive stocks, or volatile markets, around rate decisions.

Best stocks to analyze when interest rates fall

It may seem easier to find attractive stocks when interest rates fall because lower rates can lead to higher disposable income in an economy, along with potentially lower borrowing costs for companies. Some stocks that may embark on an bullish theme around these scenarios include:

- Retail sector stocks: When people have more disposable income to spend thanks to lower interest rates, the retail sector may get a boost. This can be a good time to investigate stocks of retailers.

- Utilities stocks : When interest rates are lower, this can be an attractive time to look into the potential of fairly steady dividend payments from utilities stocks. However, do be aware that rising interest rates can have a negative impact on utilities stocks.

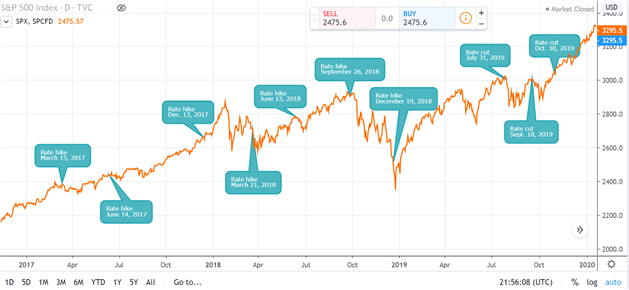

- Stocks listed on the S&P 500 index : This index measures stock performance of the 500 largest companies listed on US stock exchanges. If interest rate cuts affect the stock market, this can usually be tracked through the S&P 500 and traders can make buying or selling decisions based on this. Around the time of Federal Open Market Committee (FOMC) announcements, there can be significant volatility on S&P 500 stocks, signaling the potential for short-term trading opportunities.

Impact of Fed rate changes on the S&P 500

This chart tracks the S&P 500, along with the dates that Fed rate cuts and hikes were announced over a three-year period. It’s apparent to see that trends are not always clear cut: following a quarter point rate hike in December 2017, the S&P 500 went on to defy expectations and climb almost 6% in January 2018.

The chart also shows there can be significant shifts in stock prices around the time of Federal Open Market Committee announcements. Ahead of the rate cut in October 2019, there was a period of significant volatility; after it was announced, the S&P 500 closed at a record high. It’s important to monitor news, be aware of economic events that could affect stock prices and build these into the trading plan.

Best stocks to analyze when interest rates rise

It may be more difficult to find attractive stock investment opportunities when there is an interest rate hike. However, the opportunities will often still be there, though they may require some added caution. These are some of the more attractive market segments to follow when interest rates rise:

- Bank stocks: When interest rates rise, banks tend to make more in earnings from the higher rates that they can charge on loans, so their stock prices may rise in anticipation.

- High dividend stock: These types of stocks can be attractive when interest rates are rising, driving investor demand up which can subsequently keep stock prices rising as well.

- Highly liquid stocks : If interest rate rises bring on market volatility, an investor in a highly-liquid stock or ETF may have more flexibility with greater ability to maneuver out of the position without creating a large negative price impact.

Interest rates and stocks: key takeaways

There is no guaranteed strategy to trade stocks based on interest rates and most traders choose to have a diversified portfolio in the effort of hedging against losses. Highly liquid stocks can be beneficial when trading around interest rate decisions, as higher levels of liquidity can allow the investor or trader to position in or out of the stock without a large impact on the share price.

The main takeaways are to follow financial news and economic calendars , monitor the major stock indices to keep track of stock market movements, and employ strong risk management techniques to try to protect against heavy losses as interest rate decisions can create large moves in markets.

Further reading on stocks and trading indices

- Learn to trade stocks with our beginner’s guide to stock trading .

- Find out everything you need to know on the types of stocks .

- How does the stock market impact the economy ?