Blockpit, a crypto tax tool, streamlines crypto tax compliance and portfolio optimization, easing reporting in a constantly changing regulatory landscape.

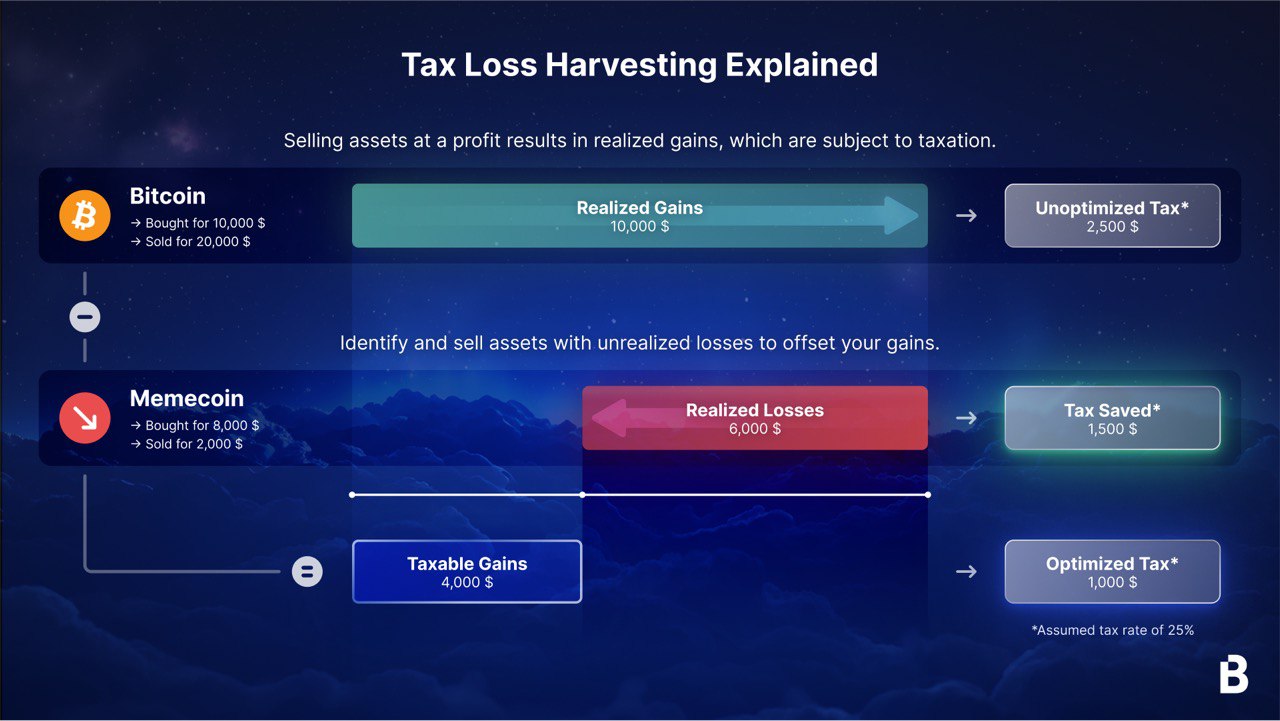

Investors often turn to crypto tax loss harvesting as a strategic method to offset capital gains by selling cryptocurrencies that have declined in value. This approach reduces overall taxable income and helps in optimizing returns and rebalancing portfolios in a market known for its volatility.

However, as crypto gains popularity as an investment asset, dealing with its tax implications has become increasingly complex. While crypto trading is fast and accessible, it creates a web of tax obligations that can easily overwhelm even experienced investors. The frequent movement of assets across exchanges and wallets adds to the complexity, compounded by ever-changing tax regulations that differ across jurisdictions.

For many investors, keeping track of losses and gains manually is a daunting task. Recording every transaction, calculating potential savings and filing compliant tax reports demand precision and time. Technology plays a key role here, providing tools to calculate taxes and guide investors through crypto tax regulations.

Streamlined tools for crypto tax management

Blockpit , a crypto tax app for web and mobile, helps users track, calculate, optimize and report cryptocurrency taxes. Created with an understanding of the fast-moving crypto market, it aims to continuously provide investors with tools to simplify tax-related decisions, focusing on accuracy and compliance without unnecessary complexity.

One of Blockpit’s standout features is the Crypto Tax Optimizer , which is designed to identify opportunities within an investor’s portfolio. By scanning for underperforming assets —including crypto and NFTs—, it offers actionable insights that help users maximize potential tax savings through informed tax loss harvesting .

To further enhance tax planning, Blockpit introduces the Sell Simulation feature. This tool models various tax scenarios, enabling investors to preview the outcomes of different strategies before making trades. By testing these approaches, users gain confidence in choosing options that align with their tax goals.

Unified access to crypto portfolios

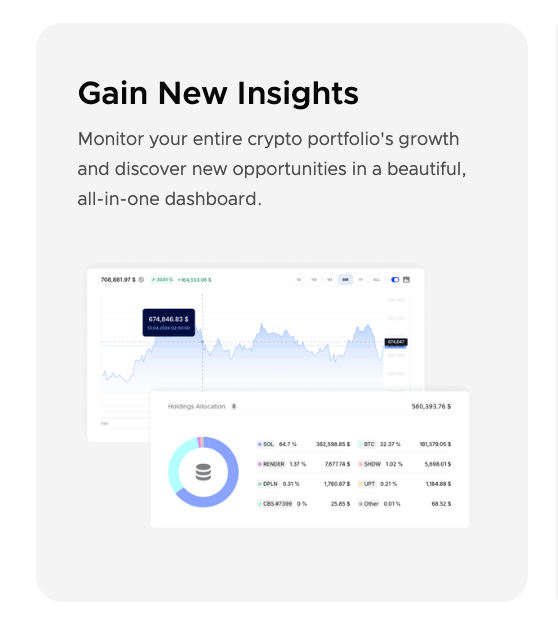

Blockpit also focuses on integration, connecting seamlessly with a wide array of wallets, exchanges and blockchains. This completely free portfolio tracking feature consolidates an entire crypto portfolio into one unified interface, eliminating the need to juggle multiple platforms and making asset tracking far more efficient.

The platform offers the capability to generate country-specific tax reports with pre-filled tax forms. Tailored to align with local regulations , these reports provide users with clarity and confidence when filing their taxes. For global investors, this feature is particularly valuable, offering straightforward compliance across diverse jurisdictions.

Expanding capabilities through strategic growth

Blockpit has gradually gained recognition in crypto tax management since its establishment in 2017. Through the acquisitions of Cryptotax and Accointing, two major competitors, the platform has broadened its competence and capabilities — strengthening its position in the European market. The software is also licensed by tax authorities in Germany and Austria, which further validates its commitment to compliance and accuracy.

Looking ahead, Blockpit aims to enrich its offerings with AI-supported tools for tax professionals, expanded portfolio tracking and the upcoming Blockpit Academy — which will provide users with practical information about crypto tax management.

“The idea for Blockpit originates in my own misery - I was lucky to enter the crypto market early on, but was soon faced with thousands of transactions, hundreds of assets and more than 30 different exchange accounts and wallets,” says Florian Wimmer, Blockpit CEO, adding that tax reporting process, and especially tax optimization, should be mostly automated: “The crypto space is developing at a rapid pace and offers almost unlimited possibilities to make use of your assets and hopefully multiply them. The increasingly complex topic of taxation should not be something the user has to deal with. We want to make sure everybody can enjoy a good night’s sleep without the phobia of waking up to a sudden and unprepared tax audit.”

Blockpit envisions a world where crypto tax reporting is stress-free and automated. Tax loss harvesting, when approached with the right resources, helps reduce tax burdens and brings clarity and confidence to an investor’s financial strategy. As regulations grow and markets mature, Blockpit and similar platforms will continue to play a pivotal role, helping investors stay ahead in this dynamic ecosystem.

- #Blockchain

- #Cryptocurrencies

- #Taxes

- #Adoption

- #Regulation

Disclaimer. Cointelegraph does not endorse any content or product on this page. While we aim at providing you with all important information that we could obtain in this sponsored article, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor can this article be considered as investment advice.