Hybrid cryptocurrency exchange GRVT is the latest industry firm to secure regulatory approval from the Bermuda Monetary Authority (BMA).

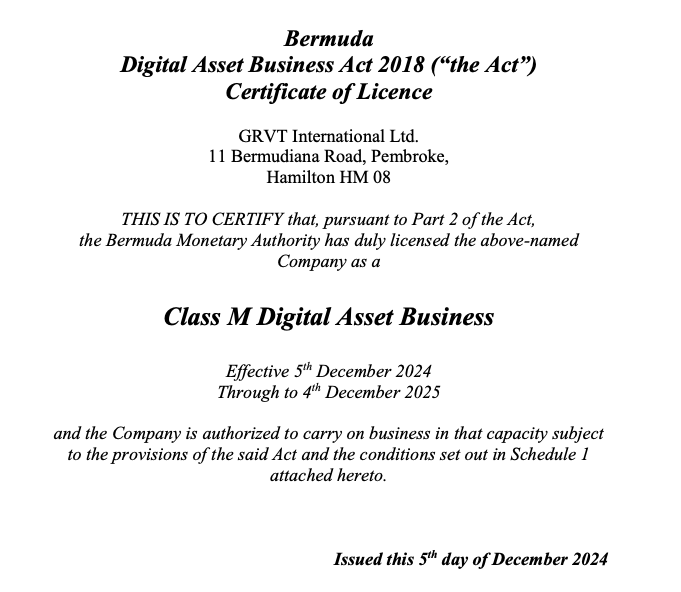

GRVT obtained a Class Modified (M) Digital Asset Business License from the BMA, allowing the exchange to operate as a regulated decentralized exchange (DEX), GRVT told Cointelegraph on Dec. 6.

After receiving the initial Class M license under the Bermuda Digital Asset Business Act (DABA), GRVT aims to secure a Class Full (F) license by mid-2025 and expand its operations beyond a sandbox environment, GRVT co-founder and CEO Hong Yea said.

In obtaining the license, GRVT joins more than 30 crypto companies licensed by the regulator, including major industry names like Coinbase, Bittrex, HashKey and others.

One of the first regulated DEXs

GRVT’s license acquisition in Bermuda makes it one of the first DEX operators, which allows it to unite decentralized finance (DeFi) and centralized finance (CeFi).

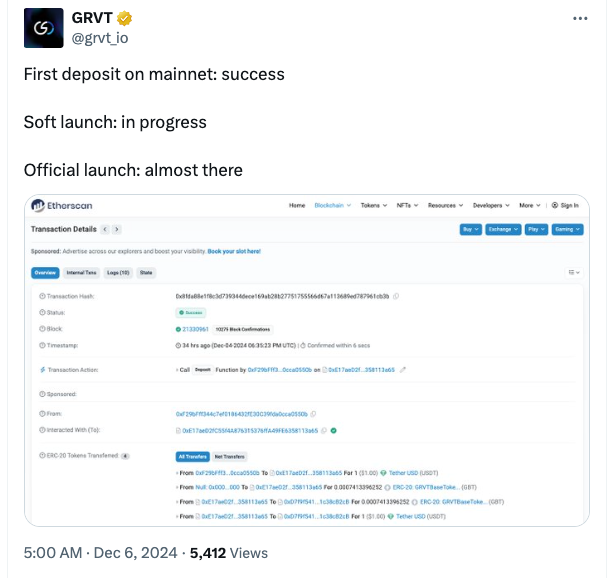

The company said it took 15 months to acquire the license, and that the acquisition time coincided with the platform deploying internal mainnet testing to institutions on Dec. 4.

“In about two weeks, we’ll officially launch our mainnet to all users. Our trading volume will then be available through major external data providers,” Yea told Cointelegraph.

Incorporated in November 2022, GRVT currently has 55 institutional partners and clients and 17 market makers trialing its testnet with a contractual commitment of a monthly trading volume of $4.2 billion. It also has more than 20,000 retail users who have undergone Know Your Customer (KYC) checks, Yea said.

CeFi and DeFi don’t need to be divided

CeFi and DeFi ecosystems do not need to be divided because the regulatory structure is well-positioned to help DEXs improve universal standards and other practices, Yea said.

“We are here to unify cryptocurrency and mainstream finance, creating a system where assets move freely and all forms of value coexist in one integrated ecosystem,” the CEO stated, adding:

“Decentralization distributes control away from central authorities, promoting transparency, security, and user empowerment. Regulation establishes standards to protect users, ensure market integrity and promote fair practices.”

Yea went on to say that regulation and decentralization are “not mutually exclusive,” as these concepts have the potential to be bridged in the digital ecosystem.

Related: Decentralized AI is key for self-sovereignty — Onicai executives

“If we look at the DeFi reality today, institutions still see DeFi as untested, unsafe, and unregulated. The unregulated status of DeFi is the biggest reason institutions avoid it,” he added.

CeDeFi concept gaining momentum

GRVT isn’t the first company to recognize the potential mutual benefits of CeFi and DeFi.

The concept of CeDeFi, which unites the core principles of CeFi and DeFi , has been growing in recent years, with more players moving into adopting it.

In November 2024, self-custodial crypto wallet firm SafePal said that its Telegram Mini App features CeDeFi principles as it offers a regulated crypto exchange with a digital crypto Visa card.

“Like it or not, TradFi has centuries of regulatory evolution and frameworks that allow it to stay mainstream despite systemic failures like the 2008 financial crisis. DeFi, by contrast, lacks regulatory standards, which has left it stuck in the margins, despite our grand vision for it,” Yea stated.

Magazine: Crypto has 4 years to grow so big ‘no one can shut it down’: Kain Warwick, Infinex