The disastrous launch of influencer Haliey Welch’s Hawk Tuah (HAWK) memecoin this week was marred by allegations of sniping and insider trading, with the token plunging 91% in just three hours.

Welch has denied these claims, and authorities have not announced any investigation.

However, if the United States Securities and Exchange Commission or the Department of Justice (DOJ) decide to investigate the controversial launch, Welch and her team could face significant legal scrutiny.

According to Yuriy Brisov, partner at law firm Digital and Analogue Partners, the SEC can pursue civil charges for securities fraud, alleging misrepresentation or deceit in the sales of securities if HAWK qualifies as a security under the Howey test. The DOJ might consider criminal charges like wire fraud or money laundering, especially if there’s evidence of intentional deception or financial misconduct.

On Dec. 4, Welch launched the HAWK memecoin, which briefly surged to a peak value of $490 million before plummeting over 90% to $30 million in a few hours.

The launch was marred by allegations of insider trading, as well as having a supply allegedly controlled almost entirely by a small number of addresses, fee extortion and sniping.

Brisov said whether the allegations constitute insider trading depends on whether the token is classified as a security:

“Insider trading traditionally involves trading securities based on material, non-public information, breaching a duty of trust or confidence. In the context of cryptocurrencies, the legal framework is still evolving. If Welch’s team possessed non-public information about the token’s launch or had pre-arranged strategies to sell significant portions of the supply, leading to the token’s price collapse, such actions could be scrutinized under fraud or market manipulation statutes.”

Welch publicly denied any insider trading activity on behalf of her team or any affiliated key opinion leaders (KOLs).

“Team hasn’t sold one token and not 1 KOL was given 1 free token,” she said in a Dec. 5 X post.

“We tried to stop snipers as best we could through high fees in the start of launch on Meteora.”

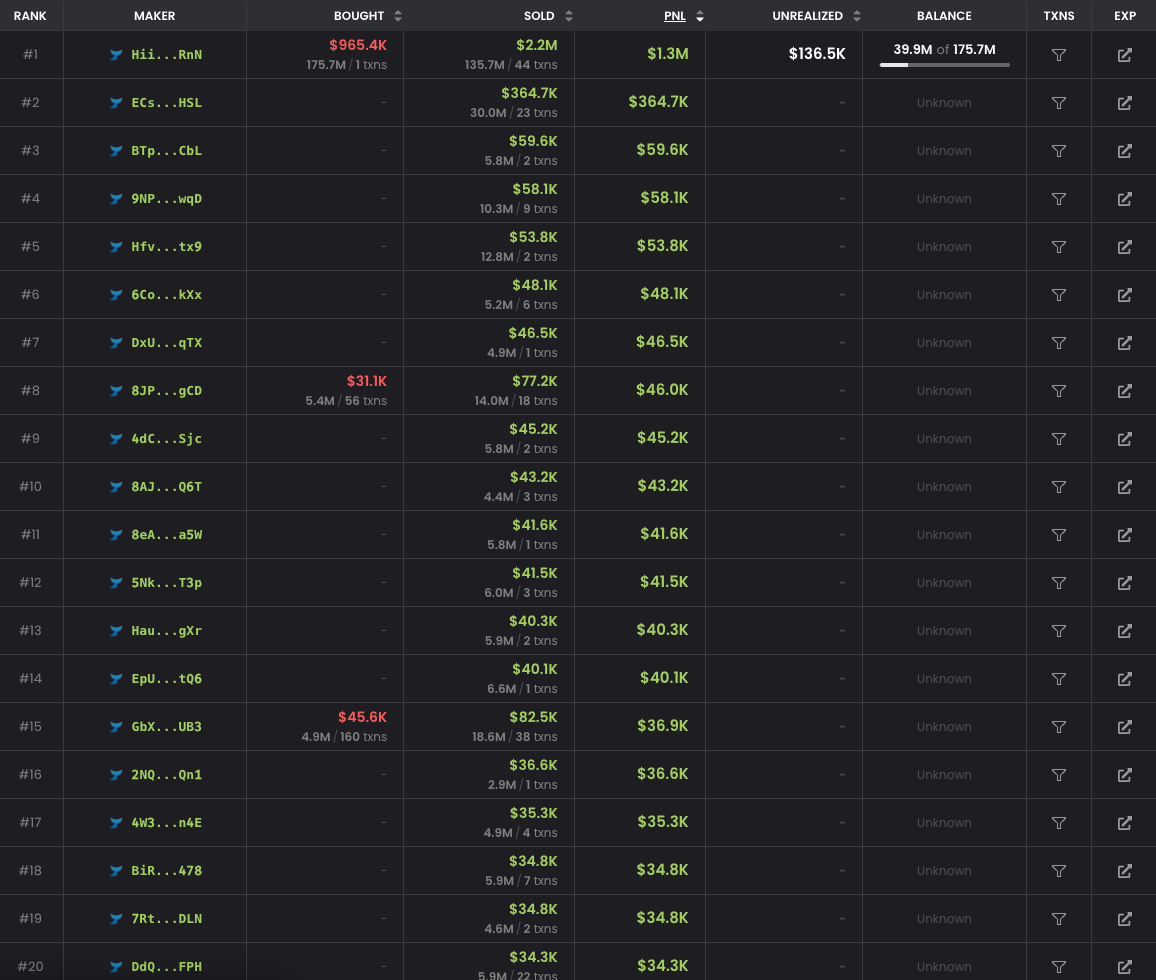

However, aggregated data from Dexscreener and Solana block explorer Solscan shows a string of more than 80 wallet addresses that had not purchased the token — suggesting they were allocated tokens before the launch — all of which sold their HAWK holdings for between $10,000 and $365,000 in profits.

Joni Pirovich, a crypto lawyer at the law firm B’das*l told Cointelegraph that any evidence of trading on insider knowledge would add to the severity of any future legal repercussions for Welch and her team.

“Profiting from insider knowledge is a serious legal issue itself, but knowingly lying to or misleading the public adds to the severity of what has occurred and what has been alleged,” Pirovich said.

Liability for a memecoin launch hinges on how the SEC treats crypto assets on US soil. Currently, most crypto tokens are defacto treated as securities by the Gary Gensler-led SEC, which means that anyone issuing a token would need to register with the agency beforehand. However, the status of memecoins is not clear.

Though memecoins often lack intrinsic value or traditional asset backing, they could be deemed as securities if marketed in a way that leads investors to expect profits from the promoter’s effort, Brisov said.

Kathryn Umi, a junior partner at crypto law firm OnChain Advisors said that if allegations were proven and the tokens were securities, then a list of potential legal violations may include inadequate disclosure charges, failing to register as a broker, unregistered broker-dealer activity, violations of the investment advisors act, and if the team failed to adhere to AML/KYC laws, they could also be charged under the Bank Secrecy Act and Patriot Act.

Umi also noted that there’s the possibility that the Department of Justice could get involved in any potential criminal charges, noting the recent involvement of the agency in charging the founder of the Bitcoin Fog crypto mixer to 12.5 years in prison.

“The SEC can also enforce civil penalties, and investors may file a class-action lawsuit,” she added.

Related: Is the ‘memecoin supercycle’ over already? Analysts weigh in

The penalties for securities fraud range from large fines all the way to a maximum sentence of 25 years in prison, while penalties for market manipulation range from fines of up to $5 million all the way to 20 years in prison.

Pirovich added that it’s still not yet crystal clear whether or not memecoins are immediately considered securities on US soil. Additionally, a more pro-crypto approach under the incoming Donald Trump administration could see the legal treatment of crypto assets change drastically in the coming months.

“But there is increasing harm and financial losses being suffered by everyday people trying to make money from memecoin trading,” Pirovich said.

“If Haliey and her team haven’t already retained legal counsel, they should do so as soon as possible. The turn of events, consequences for those affected, and allegations against Haliey and her team are extremely concerning.”

Magazine: ‘Normie degens’ go all in on sports fan crypto tokens for the rewards