South Korea’s Financial Services Commission (FSC) denied reports that it intends to publish a roadmap permitting corporate crypto accounts by the end of the year.

Unidentified sources cited by Korea Economic Daily claimed the FSC had prepared a phased plan to allow corporate crypto trading, starting with universities and local governments in 2025. Corporations and financial institutions are expected to follow in subsequent stages, the outlet reported.

However, in a Dec. 4 statement, the FSC said no decisions were finalized and discussions were still ongoing.

“The issue of corporate real-name accounts for virtual assets is set to undergo further discussion, and specific measures have not yet been finalized. Therefore, please exercise caution in reporting,” the FSC said .

The FSC recently launched a crypto committee that held its inaugural meeting on Nov. 6 to discuss lifting restrictions on institutional crypto participation .

Related: South Korea’s crypto investor surge drives CEX profits by 106%

In South Korea, corporations face a de facto ban from trading cryptocurrencies on exchanges that offer fiat-to-crypto services.

Local regulations require investors to use real-name accounts at licensed banks partnered with cryptocurrency exchanges. Only five exchanges have established such partnerships, and banks generally prohibit corporations from opening such accounts to comply with Anti-Money Laundering guidelines.

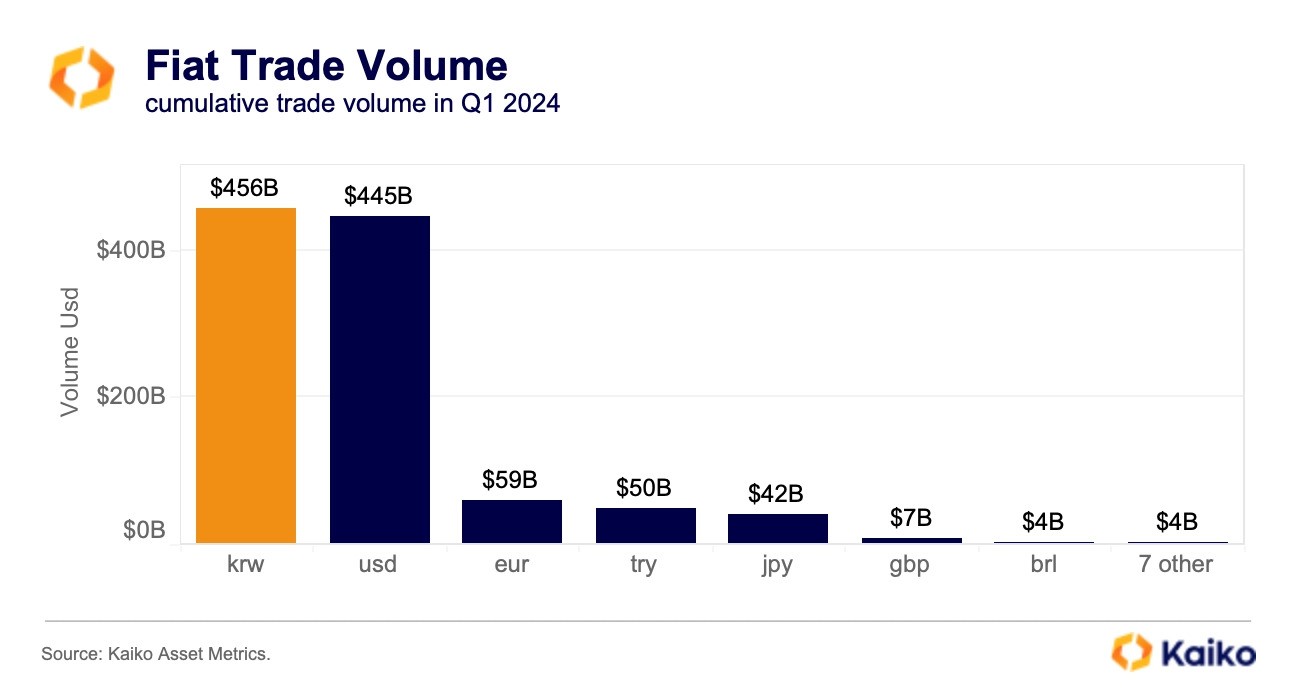

Without corporate participation, South Korea’s crypto market has been driven primarily by retail investors, solidifying the Korean won as one of the world’s top fiat trading pairs for cryptocurrency earlier this year.

The scale of South Korea’s crypto market was highlighted this week during a brief political crisis. President Yoon Suk Yeol declared martial law, a decision overturned by the National Assembly and subsequently retracted by the president within six hours.

Related: BTC/KRW pair dipped 30% as South Korea’s president declared martial law

This six-hour window was part of the nation’s nearly $35 billion in 24-hour crypto trading volume, according to local media analysis .

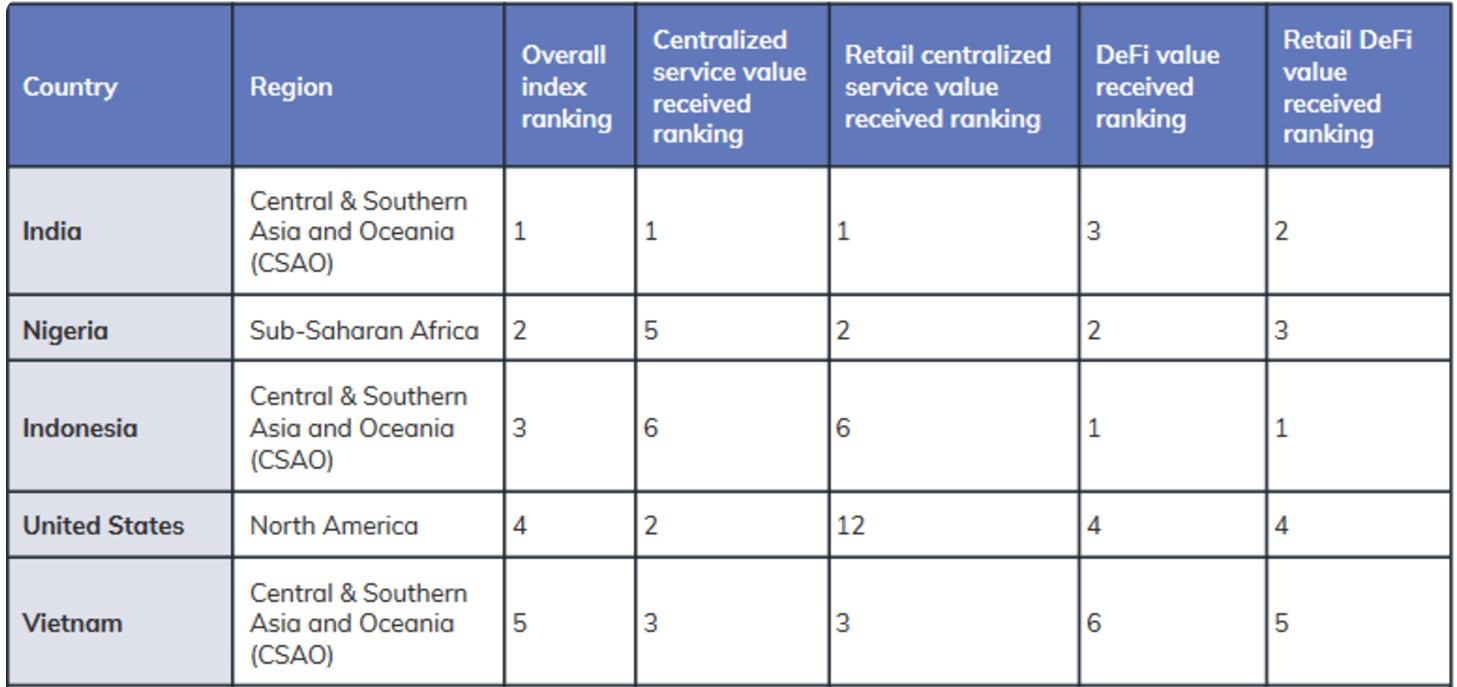

This figure eclipsed Indonesia’s total cryptocurrency trading volume for all of 2024 up to October. Indonesia ranks third on the Chainalysis Global Crypto Adoption Index .

Magazine: Dragon Ball, One Piece studio’s Web3 game, Sun is top Trump crypto holder: Asia Express