Unlike many, I don’t have a taste for politics. Frankly, I distrust all politicians, regardless of party, and my skepticism extends to every piece of rhetoric I hear. This approach isn’t cynicism — it’s pragmatism — and it has served me well in growing my portfolio. I mention this upfront because in this article, I’m going to constructively critique policies that hinder excellence and wealth creation. Let me be clear: I am not anti-Republican or anti-Democrat; I am resolutely pro-excellence and pro-wealth. When political decisions obstruct the path to progress, it’s my purpose to call them out. By doing so, I feel we can better navigate the financial landscape and continue to succeed despite the obstacles politicians sometimes place in our way.

Over the past month, financial markets have been riding a wave of optimism following the election of President Donald Trump. Stock indexes have soared to their 54th all-time high this year, a testament to the market’s faith, or perhaps its exuberance. Yet, amid the celebratory headlines, I find myself grappling with a growing sense of unease. We’re on the cusp of welcoming an administration that openly supports a weaker dollar and is floating the idea of negative interest rates as the key to economic revival. This is being pitched as a prescription for prosperity, with assurances that these policies will usher in the greatest boom America has ever seen. But let’s not sugarcoat it — this is economic gaslighting at its finest. The propaganda machine is working overtime to convince us that devaluing the dollar and penalizing savers will somehow be the secret sauce for sustained growth. It’s a narrative that demands scrutiny, not blind acceptance.

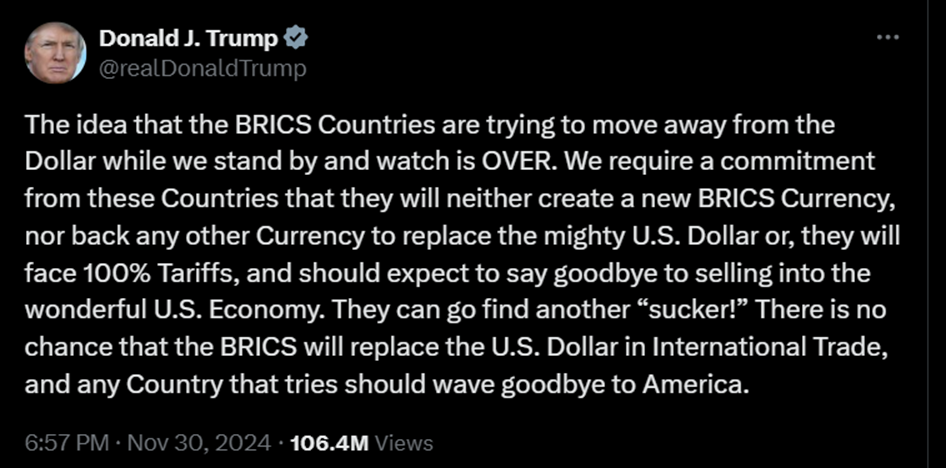

Last week President-elect Trump tweeted the following message which is what I want to address today.

One of the things I admire about President Trump is his unparalleled experience in negotiation. Over the course of his career, he has brokered hundreds of massive deals, building an empire of properties and resorts that span the globe. This isn’t a feat achieved through sheer luck — it’s the product of mastering the art of hardball negotiation. The ability to extract concessions from the other side, often against tough odds, requires a level of skill and strategic thinking that many take for granted.

When Trump discusses tariffs and free trade, I’ve always interpreted it as more than policy — it’s a tactic. A way to bring trading partners to the table and hammer out deals that are not just “fair” but favorable to the United States. Free trade, after all, is a two-way street, yet for years, the U.S. has been saddled with massive tariffs from trading partners who use these barriers to keep American products out of their markets. Trump’s approach, while often dismissed by journalists and economists as reckless or simplistic, always struck me as an effort to level the playing field. His hardball stance wasn’t about destroying relationships — it was about resetting them in a way that served American interests, a move that, in my view, was largely misunderstood by those critiquing it.

When I first read Trump’s recent tweet threatening to impose 100% tariffs on BRICS nations if they continue building their alliance, my immediate thought was his Twitter account must have been hacked. The idea seemed so out of character with the strategic, hardball negotiating approach I’ve always admired. Maybe I’m missing something, but this feels like a significant departure from leveraging tariffs as a calculated tool to improve trade deals.

What really puzzles me is the implication behind such a move. The BRICS nations — Brazil, Russia, India, China, and South Africa, along with their newer members — are simply pursuing their own strategic interests, much like we do. Whether it’s de-dollarization or strengthening their economic bloc, these nations are taking steps they believe will benefit their economies. In the words of free market economist Thomas Sowell: “The most basic question is not what is best, but who shall decide what is best.”

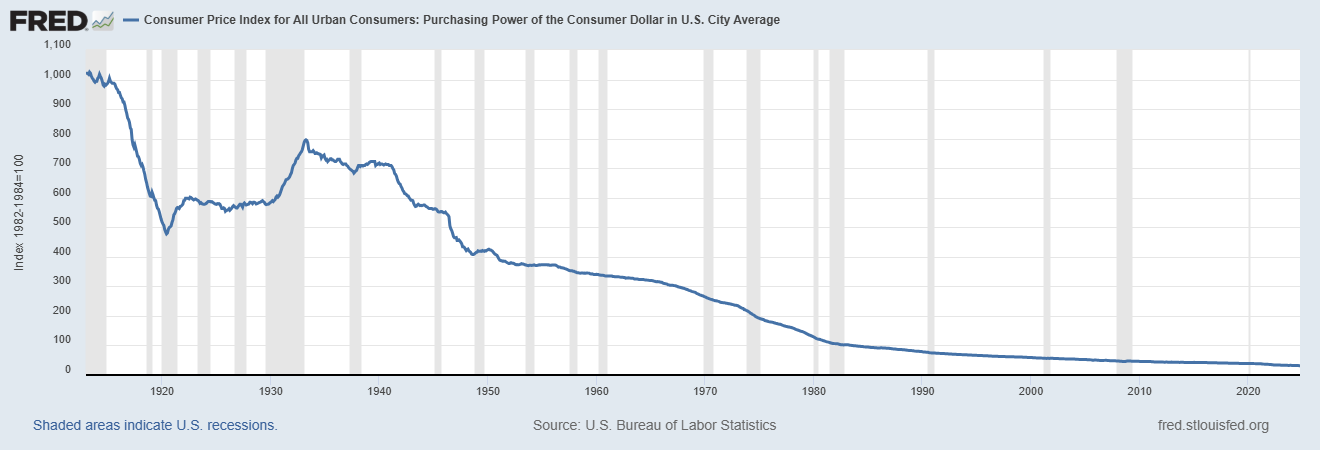

When you study the history on money you will quickly come to appreciate the track record of government handling money is a masterclass in failure — peppered with a few fleeting moments of competence, but overwhelmingly dominated by fraud, deception, and broken promises.

All you need to understand is that all FIAT currency eventually goes to zero.

Not comprehending this is a huge obstacle towards wealth creation.

The essence of diplomacy and negotiation lies in respecting sovereignty while finding common ground to protect and promote mutual interests. Threatening a blanket tariff doesn’t just risk economic fallout; it risks undermining the very principles of free trade and self-determination. If anything, this tweet raises more questions than answers — about the strategy behind it, the potential repercussions, and whether this aligns with the principles of hardball negotiation or crosses into something far less constructive.

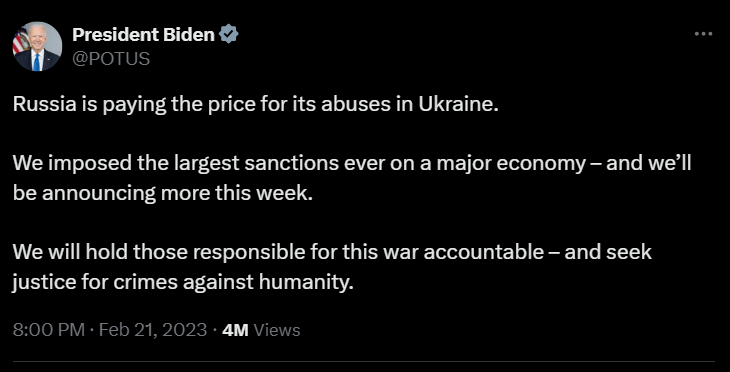

I would even go so far as to juxtapose Trump’s tweet with President Biden’s decision to impose sanctions on Russia and expropriate $650 billion in Russian assets. At their core, I don’t see much difference between the two approaches. Both reflect a heavy-handed reliance on brute force rather than persuasion or diplomacy.

Instead of engaging in dialogue, building consensus, or leveraging the art of negotiation — tools that have historically advanced global stability and economic growth — we resort to unilateral measures that can provoke backlash and escalate tensions. Whether it’s tariffs or asset seizures, these actions send a message that “might makes right,” disregarding the potential for collaboration and mutual benefit.

This approach raises an important question: are we sacrificing long-term influence and credibility for short-term displays of power? Diplomacy and persuasion require patience and skill, but they have proven time and again to be more effective at shaping the global order in our favor. When we abandon these tools for direct coercion, I personally feel we risk not only alienating allies and partners but also solidifying adversarial blocs like BRICS in their efforts to counterbalance U.S. influence. In doing so, we may inadvertently accelerate the very outcomes we seek to prevent.

Over the past several years, since the U.S. imposed sanctions on Russia and expropriated $650 billion of its assets, I believe the U.S. dollar has suffered a significant erosion of trust on the global stage. Let me explain. When a country weaponizes its currency or financial system, it sends a clear message: the rules can change if you’re on the wrong side of our politics. This kind of unpredictability is why many nations and intelligent investors alike are turning to de-dollarization — the deliberate shift away from reliance on the U.S. dollar in trade and reserves.

The push for de-dollarization isn’t just a geopolitical phenomenon; it’s also a financial awakening for those paying close attention. Over the years, savvy investors who are alert to the U.S.’s fiscal and monetary troubles have recognized the importance of diversifying away from the dollar. The writing has been on the wall for some time, and a quick glance at the St. Louis Federal Reserve’s chart showing that the U.S. dollar has lost 97% of its purchasing power over the past 111 years makes the case clear.

How is this tolerated?

As a financial educator, I’m obsessed with the topic of currency debasement because it’s one of the most toxic and deceptive forces in the economic world. The alarming part is that almost no one notices it when it’s happening. Maybe one in a thousand people, if we’re lucky, truly grasps the mechanics of it. But the effects are profound: when a currency is debased, everything priced in that currency rises in price. This isn’t hyperbole — it’s basic economics. It’s math. A weaker dollar makes stocks, commodities, and real estate appear to soar, even if the underlying value hasn’t changed.

This currency devaluation allows bureaucrats to spin a tale of economic triumph, convincing the public that the economy is thriving, and the future looks brighter than ever. It’s a dangerous illusion, one that masks declining purchasing power and growing inequality under a veneer of rising markets. For those who understand the mechanics of debasement, the question isn’t whether the dollar’s role will diminish — it’s how fast it will happen and whether you’re prepared to protect your wealth in the process.

What is De-dollarization?

At the center of it all is de-dollarization , the deliberate effort by major global players to reduce reliance on the greenback for trade, investment, and reserves. The aim? To weaken the dollar’s geopolitical leverage, which has underpinned American influence for decades.

The BRICS alliance — Brazil, Russia, India, China, South Africa — recently expanded its ranks to include Iran, Egypt, Ethiopia, and the United Arab Emirates. Together, these nations represent some of the world’s largest emerging economies and a staggering 45% of the global population. Their collective ambition is clear: to challenge the dollar-dominated financial system by exploring non-dollar trade mechanisms and financial settlements.

What’s at stake here is more than just currency competition — it’s a geopolitical struggle over who controls the levers of global finance. Trump’s proposed tariffs against BRICS nations further escalate this showdown, signaling that the U.S. is willing to fight to maintain its economic influence.

As the BRICS bloc pushes forward with de-dollarization efforts, the question is whether their ambition will lead to meaningful change or whether the dollar’s entrenched position will prove insurmountable. One thing’s certain: the battle for global economic supremacy is far from over.

Understanding Trade Deficits

Imagine you have a lemonade stand and your best friend has a cookie stand. Every day, you trade your lemonade for their cookies. But let’s say you love cookies so much that you end up trading more lemonade for their cookies than they trade cookies for your lemonade. Over time, you’re always giving them more than you’re getting back. That’s kind of like what a trade deficit is like. It happens when a country buys more stuff (imports) from other countries than it sells to them (exports).

Trade deficits are a critical yet often misunderstood aspect of global economics. They occur when a country imports more goods and services than it exports. While they may seem like an abstract concept, their impact is anything but — shaping economies, influencing currencies, and even altering global power dynamics. To grasp the issue fully, it is essential to examine how trade deficits arise, their long-term consequences, and what solutions might address persistent imbalances.

At their core, trade deficits reflect an imbalance between what a country buys and what it sells. This imbalance often stems from several interconnected factors. First, some countries heavily depend on imports because foreign goods are cheaper or because they lack the resources to produce enough domestically. Manufacturing industries, for instance, often source parts from abroad due to cost advantages, even if it reduces demand for local alternatives. Second, a lack of competitive products or services can limit a country’s ability to sell goods abroad. If a nation’s offerings don’t meet the quality, price, or demand standards of the global market, exports dwindle, further widening the trade deficit. Finally, currency strength plays a major role. A strong national currency can make imports more affordable but exports less attractive. When the dollar is strong, Americans can buy foreign goods cheaply, but it becomes more expensive for other countries to purchase U.S.-made products, exacerbating trade imbalances over time.

While trade deficits aren’t inherently harmful, persistent deficits can create significant economic challenges. One major consequence is debt accumulation. When a nation continuously imports more than it exports, it often relies on borrowing to bridge the gap, leading to rising national debt and creating a cycle of dependency on foreign capital. Trade deficits can also result in job losses. Industries that cannot compete with cheaper imports may shrink or shut down entirely, leading to economic dislocation and unemployment. Manufacturing jobs are often vulnerable in this scenario, as factories struggle to compete with low-cost labor overseas. Over time, an overreliance on imports for essential goods weakens a country’s self-reliance and economic resilience, leaving it exposed to global supply chain disruptions or trade disputes.

One of the most deceptive consequences of trade deficits is their impact on purchasing power. When a country sends more money abroad to pay for imports, it effectively drains wealth from its own economy. Over time, this weakens the national currency, reducing its value relative to others. For everyday consumers, this means that imported goods — from toys to electronics to food — become more expensive. A weaker dollar also makes traveling abroad costlier and diminishes the savings of ordinary citizens. The illusion of prosperity from cheap foreign goods often masks the long-term erosion of economic stability.

Addressing trade deficits requires both strategic planning and long-term investment. One solution is for nations to focus on producing better goods by investing in innovation and quality to create products that are competitive on the global stage. High-value exports such as technology, pharmaceuticals, and green energy can help balance trade. Promoting locally made goods is another important step, as it supports domestic industries and keeps money circulating within the economy. Governments can also reform trade policies by negotiating better trade deals to level the playing field. While tariffs can be controversial, they may incentivize domestic production and curb excessive imports. Perhaps most importantly, countries must invest in education and research. A skilled workforce and cutting-edge technology are the cornerstones of global competitiveness, enabling nations to create the next generation of must-have products and services.

In simple terms, trade deficits are like spending more money at the mall than you earn from selling lemonade. To fix it, you either need to sell more lemonade, spend less at the mall, or invent a new lemonade flavor everyone wants. For countries, the same principle applies: producing better goods, reducing dependency on imports, and fostering innovation are essential steps to addressing persistent trade imbalances. Trade deficits are not just numbers on a ledger; they reflect the health and resilience of an economy. By recognizing their causes and consequences, nations can take the necessary steps to ensure long-term prosperity and stability, even in an interconnected global market.

Take the BRICS nations as a prime example. In 2023, the U.S. imported $578 billion worth of goods from this bloc, with China alone accounting for a staggering $427 billion of that total. That translates to a trade deficit of $433.5 billion with BRICS, a figure that underscores just how reliant the U.S. is on this group for everything from machinery to pharmaceuticals.

But the implications go far beyond raw numbers. The BRICS nations are signaling a growing dissatisfaction with the dollar’s dominance in global trade and finance. While the greenback still represents 58% of global foreign exchange reserves, BRICS countries are accelerating efforts toward “de-dollarization.” Whether it’s Russia and China amassing gold reserves or the bloc exploring alternatives to the U.S.-led financial system, the moves point to a shifting economic order.

This dynamic has serious implications for U.S. trade policy. The BRICS bloc is not just a major trading partner — it’s also an emerging challenger to the financial systems that have underpinned American economic leadership for decades. Understanding this interplay is critical for investors and policymakers alike. The question isn’t just whether the U.S. can manage its trade deficit—it’s whether it can adapt to a global economy where its dominance is no longer a given.

Free marketers argue that tariffs are a flawed economic policy that often backfires despite their political appeal. Their criticism stems from a deep belief in the power of free markets, voluntary trade, and competition to drive economic growth. While tariffs may sound like a good idea to protect domestic industries, free marketers see them as counterproductive measures that harm consumers, distort markets, and slow innovation.

At the heart of the argument is the impact on consumers. Tariffs are essentially taxes on imported goods, which inevitably increase prices for consumers. When governments impose tariffs, they force people to pay more for items that could otherwise be cheaper, undermining one of the key advantages of free trade: access to affordable, high-quality goods from around the world.

Free marketers also emphasize the inefficiencies created by protectionism. Tariffs shield domestic industries from foreign competition, but this comes at a cost. By propping up industries that may not be globally competitive, resources are diverted from more productive sectors of the economy. The result? Slower growth, less innovation, and a weaker economic foundation over time.

Politically, tariffs often serve as tools of expediency. Governments impose them to win favor with specific voter groups or industries, regardless of the broader economic harm. Free marketers see this as an example of political interests overriding economic common sense. Policies that cater to short-term political wins often lead to long-term economic losses.

Trade is not a zero-sum game. Whether a country imports more than it exports doesn’t change the fact that voluntary trade benefits both sides. Consumers get better goods at lower prices, and businesses find new markets for their products.

Free-marketers also warn about the unintended consequences of tariffs. Retaliatory measures by other nations often escalate into trade wars, disrupting global markets and harming economic cooperation. Domestically, industries reliant on imported materials face higher production costs, making them less competitive on the global stage. The ripple effects are far-reaching and rarely anticipated.

Ultimately, the case against tariffs is about seeing the bigger picture. While tariffs might provide temporary relief for certain industries, free marketers argue that they weaken the economy in the long run. Competition, innovation, and efficient resource allocation thrive under free trade — not protectionism. Governments that embrace free markets instead of resorting to tariffs set the stage for sustainable prosperity, even if the path isn’t always politically easy. The long-term benefits far outweigh the short-term disruptions, and that’s the perspective free marketers never lose sight of.

We recently had the privilege of speaking with market wizard and trading superstar Larry Williams about his outlook for the markets and the economy in 2025. Larry summed it up in a way only he could, describing the future as a scene straight out of a Clint Eastwood movie: “The Good, The Bad, and The Ugly.” After hearing his perspective, we couldn’t agree more. The key to understanding his forecast lies in grasping the profound effects of a weaker U.S. dollar and the looming specter of negative interest rates.

Larry may be homing in on something else but from my perspective, here’s The Good. A weaker dollar, on the surface, can provide some benefits. For U.S.-based exporters, a declining dollar makes American goods more competitive in global markets. Multinational corporations could see a boost in overseas revenues, which are converted back into dollars at more favorable rates. Historically, a weaker dollar has been correlated with stronger stock market performance, at least in nominal terms, as companies with international exposure benefit from this currency dynamic.

But then comes The Bad . While a weaker dollar may help exporters, it takes a toll on everyday consumers. A depreciating currency makes imported goods more expensive, driving up costs for items like food, electronics, and energy. Inflation, which is already a concern, could accelerate, eroding purchasing power and disproportionately affecting lower-income households. And for savers, a weaker dollar is a silent thief, diminishing the value of hard-earned savings without them even realizing it.

Finally, I arrive at what I would consider The Ugly — negative interest rates. The mere idea of penalizing savers for keeping money in the bank feels like an assault on fundamental economic principles. Negative rates distort the natural flow of capital, discouraging saving and encouraging risk-taking in ways that could destabilize markets. For retirees or those on fixed incomes, it’s an even bigger nightmare. The concept that dollars today are worth less tomorrow upends traditional financial planning, leaving many scrambling for alternatives to preserve wealth.

Larry’s insight reminds us that these forces don’t operate in isolation—they intertwine, creating ripple effects across the economy and markets. A weaker dollar might boost corporate profits and nominal asset prices, but the inflationary pressures and economic distortions that accompany it cannot be ignored. Negative rates might be sold as a “stimulus,” but they come with a cost: eroding trust in financial institutions and incentivizing behaviors that could lead to bubbles and instability.

Understanding the good, the bad, and the ugly of this potential market future isn’t just about forecasting; it’s about preparing. Investors must remain vigilant, adaptive, and informed, recognizing the opportunities while guarding against the risks that accompany these dramatic shifts. Larry Williams may have framed it like a classic Western, but the stakes for 2025 are as real as they get.

The Financial Markets Are Changing — Are You Ready?

In times of economic turmoil and uncertainty, fortunes are lost—but they’re also made. The question is: will you be among those who seize this moment? The drama unfolding in today’s markets — currency devaluation, the specter of negative interest rates, and relentless inflation — is unlike anything we’ve seen before. But with every challenge comes opportunity.

That’s why I’m here to tell you: there has never been a better time to learn how to trade with artificial intelligence .

In the world we’re entering, you can take everything you thought you knew about finance, economics, trading, and investing and toss it straight into the garbage can. That’s not hyperbole — it’s reality. The financial landscape is shifting so rapidly, so unpredictably, that traditional knowledge is becoming obsolete. To quote the legendary futurist Alvin Toffler, “The future will happen faster and faster.” But let me take it one step further: not only is the pace of change accelerating, but the old theories of what should happen can no longer be trusted. The only thing that matters is what is happening — and your ability to respond accordingly.

Trump promises to be first pro crypto President, and no one knows exactly what that means for traditional finance. I’m not urging you to trade crypto, that’s not the point of this article, I’m trying to warn you that massive change is upon us and that creates opportunity for those that are prepared and risk for those that aren’t.

Here’s the truth: if you don’t adapt, you’ll fall behind. Fast. The beauty of artificial intelligence is that it’s designed for this very moment. It doesn’t rely on outdated theories or gut instincts. Instead, it laser focuses on what’s actually happening in the markets, analyzing massive amounts of data in real time to identify trends with unparalleled precision. This makes A.I. the ultimate tool for trend analysis—and trend analysis will be the critical edge for traders in the years to come.

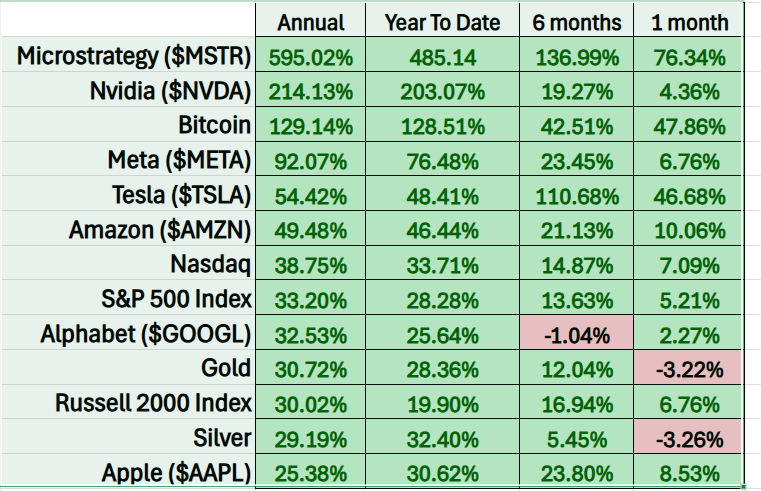

Don’t just take my word for it, look at the facts. Below are some of the top 13 trends of the past year. Ask yourself this: how do they compare to your portfolio? Did you spot these opportunities? Were you positioned to capitalize on them? Or did they pass you by while you were relying on outdated methods and assumptions?

Artificial intelligence isn’t just a tool — it’s a revolution. And it’s your chance to align yourself with the trends shaping the markets, not just react to them after the fact. The future is already here. The question is: will you seize it? Or will you let it leave you behind? The choice is yours, but I urge you to act. Because in this rapidly accelerating world, those who adapt will thrive — and those who don’t will be left wondering where it all went wrong.

Think about it. A.I. has already revolutionized how we live and work. It’s beaten humans at chess, poker, and even Go — the ancient game that experts said no machine could ever master. And let’s not forget its victory on Jeopardy! If A.I. can conquer games of strategy, deception, and intuition, why should trading the markets be any different?

The truth is trading is EXACTLY where A.I. thrives. It analyzes billions of data points faster than any human could. It detects patterns we can’t see. It eliminates emotional decision-making — the Achilles’ heel of even the best traders. And most importantly, it adapts in real-time to changing market conditions.

This isn’t just the future of trading — it’s the present. And it’s why I’m inviting you to our Free Live Online MasterClass: How to Trade with Artificial Intelligence.

Why This MasterClass Is Different?

This isn’t a generic webinar filled with fluff and theory. This is a hands-on, no-nonsense MasterClass where you’ll discover exactly how A.I. is reshaping the trading world — and how you can use it to your advantage.

Here’s what you’ll learn:

– How A.I. identifies high-probability trades in real-time so you can capitalize on trends others miss.

– Why traditional strategies are failing in today’s volatile markets — and how A.I. cuts through the noise to deliver actionable insights.

– How to harness A.I. to level the playing field against Wall Street pros , giving you the edge you need to succeed.

Whether you’re a seasoned trader or just starting out, this MasterClass will open your eyes to a new way of approaching the markets — one that’s faster, smarter, and more consistent than anything you’ve seen before.

Time Is of the Essence

Every day you wait is a day you risk falling behind. The markets are evolving at lightning speed, and those who don’t adapt will be left in the dust. Don’t let this happen to you.

Secure Your Spot Now

Don’t miss your chance to learn the strategies that are already helping traders around the world thrive in this new era. It’s free, it’s live and it’s your opportunity to transform the way you trade forever.

Click the link below to reserve your spot now.

The future of trading is here — let us show you how to master it.

Let’s Be Careful Out There!

It’s Not Magic.

It’s Machine Learning.

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.IMPORTANT NOTICE!

DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CAN’T AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.