By Howard Schneider

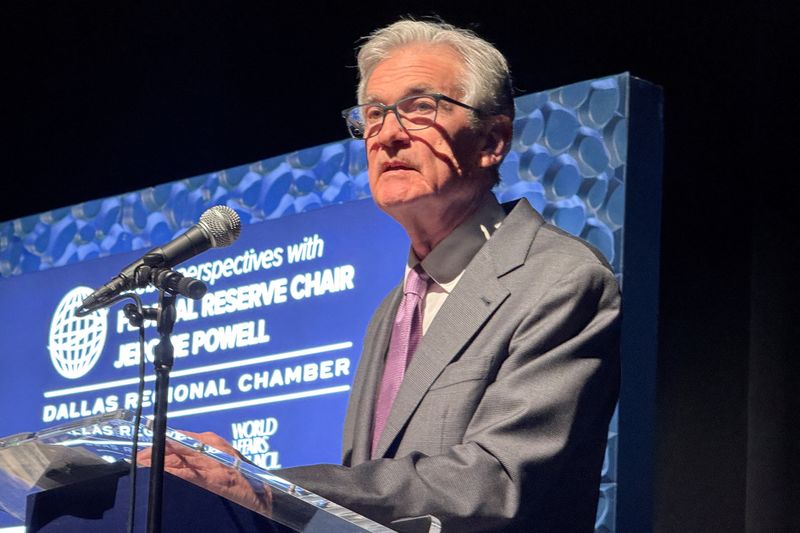

NEW YORK (Reuters) -U.S. Federal Reserve Chair Jerome Powell on Wednesday said the economy is stronger now than the central bank had expected in September when it began reducing interest rates, and appeared to signal his support for a slower pace of interest-rate cuts ahead.

“The U.S. economy is in very good shape and there’s no reason for that not to continue ...the downside risks appear to be less in the labor market, growth is definitely stronger than we thought, and inflation has come in a little higher," Powell said at a New York Times (NYSE: NYT ) event. "So the good news is that we can afford to be a little more cautious as we try to find neutral.”

His remarks during a wide-ranging half-hour interview that touched only lightly on monetary policy and the economy are likely his last before the Dec. 17-18 policy meeting, as the quiet period when Fed officials refrain from speaking about monetary policy ahead of a meeting starts on Saturday.

In-depth comments by some of Powell's key colleagues this week have pointed in the direction of a third straight interest-rate cut, with Governor Christopher Waller saying on Monday he was "leaning toward" a reduction even as others decline to pre-commit to that outcome.

Powell's own remarks on Wednesday appear to align him with that more cautious bloc of policymakers and largely echoed his last public appearance in mid-November, when he said the Fed could "carefully" deliberate over its rate cuts and need not be in a hurry.

Inflation and jobs data since then, and Waller's comments in particular, substantially pushed up market expectations of another quarter-point cut in the benchmark rate to a range of 4.25% to 4.50%.

As economists at BMO summed it up, "Powell said little to alter the market's view that the Fed will likely trim rates."

The Fed chair has pressed on the need for the central bank to keep its options open at a time of increased uncertainty about the shape of broader economic policy in the coming year, some concern that its progress on inflation has stalled, and evidence that a feared drop-off in the job market has been avoided.

Powell on Wednesday said the Fed's half-point interest-rate cut in September was meant to be "a strong signal that we were going to support the labor market if it continued to weaken." At the time the unemployment rate had ticked up and payroll growth had slowed, and at least one Fed official worried publicly that the Fed's next problem could be too-low inflation.

"What happened instead was in the couple of months after that, we got some data revisions, which strongly suggests that the economy is even stronger than we thought," Powell said.

Fed officials will get fresh data on the labor market on Friday, and on inflation next week, that will help shape not just the decision at their final policy-setting meeting of the year but also their policy outlook for next year.

As Powell spoke the Fed published a survey showing businesses across the country are optimistic about rising demand in coming months, though at the same time worried about the potential inflationary implications of tariffs promised by President-elect Donald Trump.

With exact policies yet unknown, though, decisions the Fed will make today "are not about that; they are about what's happening in the economy now," Powell said on Wednesday.

Earlier on Wednesday, two other Fed officials - the heads of the regional banks in Richmond and St. Louis - held their cards close.

"I'm keeping all my options open," St. Louis Fed President Alberto Musalem said at a Bloomberg monetary policy conference, adding he will look at incoming data before deciding whether rates need to come down again in two weeks.

Richmond Fed President Thomas Barkin said at the CNBC CFO Council he believes both inflation and employment are heading in the right direction, but with more data to come before the meeting, he won't prejudge the outcome.

A key measure of inflation, the personal consumption expenditures price index excluding food and energy costs, has run sideways in a range of from 2.6% to 2.8% since May, well above the central bank's 2% target.

While Fed officials routinely say they feel price pressures are still set to ease, with housing costs in particular slowing in real time but not yet reflected in lagging government data, they also will want proof of that before cutting rates much further.

Ahead of Powell's appearance, a key business survey showed some cooling in the vast U.S. services sector and businesses fretting about the likelihood of a new round of tariffs on imports from the incoming Trump administration early next year, which they worry could mean higher prices ahead. At the same time, auto sales in November were the highest in more than three years, showing consumption remains healthy.

It's that ongoing mix of hot-and-cold data that is keeping Fed officials on guard and reluctant to offer much by way of concrete forward guidance, even as a few have noted that rates are still well above a level that would cease being a drag on the economy, and would still be even after another quarter-point reduction.

Waller, for one, hedged his "leaning toward" a rate cut this month with a proviso that data ahead of the meeting could alter his posture.