The launch of viral influencer Haliey Welch’s Hawk Tuah memecoin sparked outrage across social media as the newly launched token briefly pumped and then dumped rapidly following a controversial deployment involving allegations of snipers and insider wallets.

Welch has denied any insider sales or activity on behalf of her team or any affiliated entities.

The Hawk Tuak (HAWK) memecoin was launched at 10:00 pm UTC on Dec. 4 and quickly rose to a peak market cap of $490 million.

The price of the token then plummeted and was trading at a valuation of $41.7 million at the time of publication, marking a 91% downturn in less than three hours, according to DexScreener data .

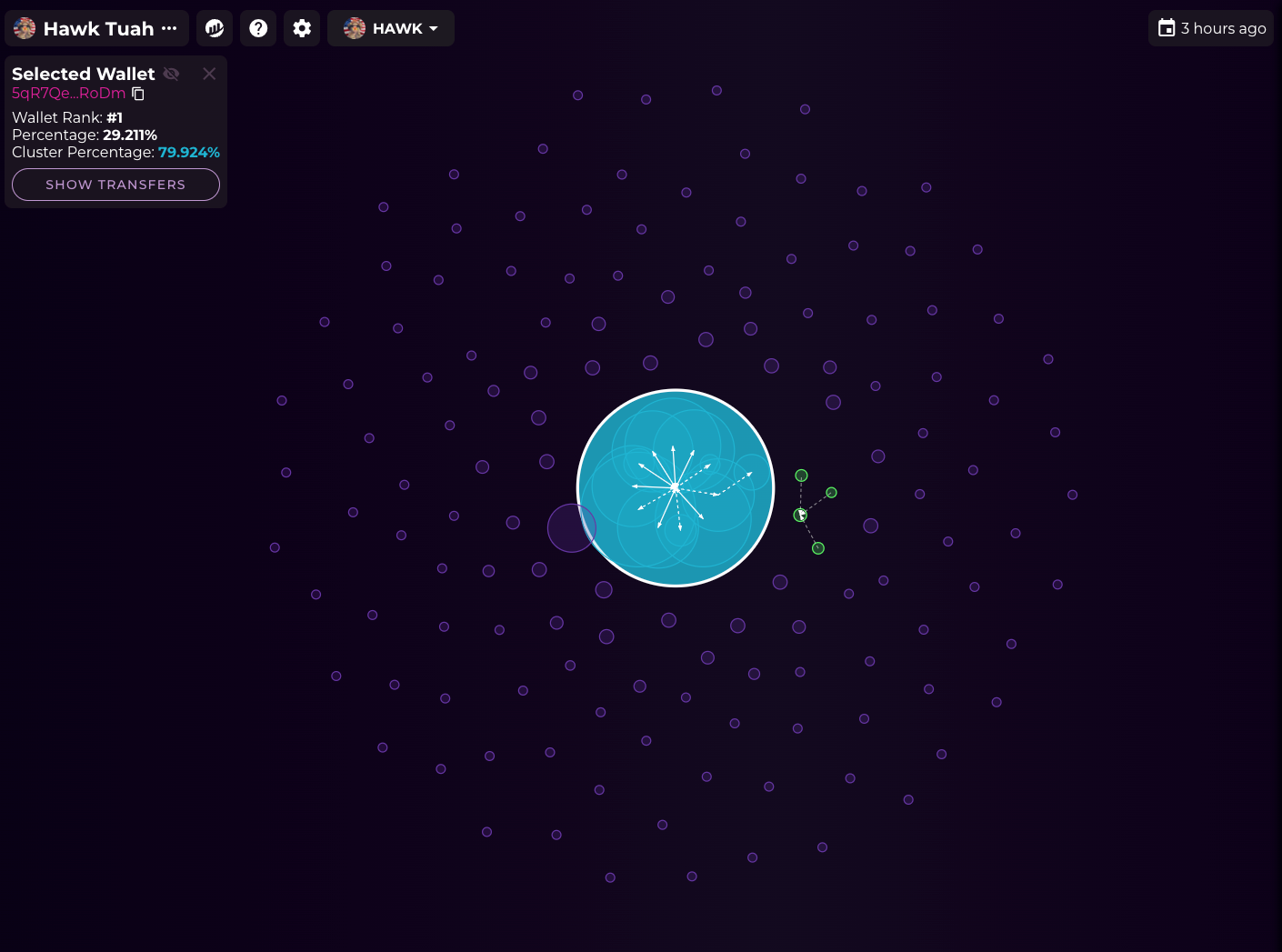

According to aggregated data from Bubblemaps and Dexscreener, a mix of insider wallets and snipers — entities that rapidly buy up huge amounts of a token’s supply at launch — controlled between 80%-90% of HAWK’s supply at launch.

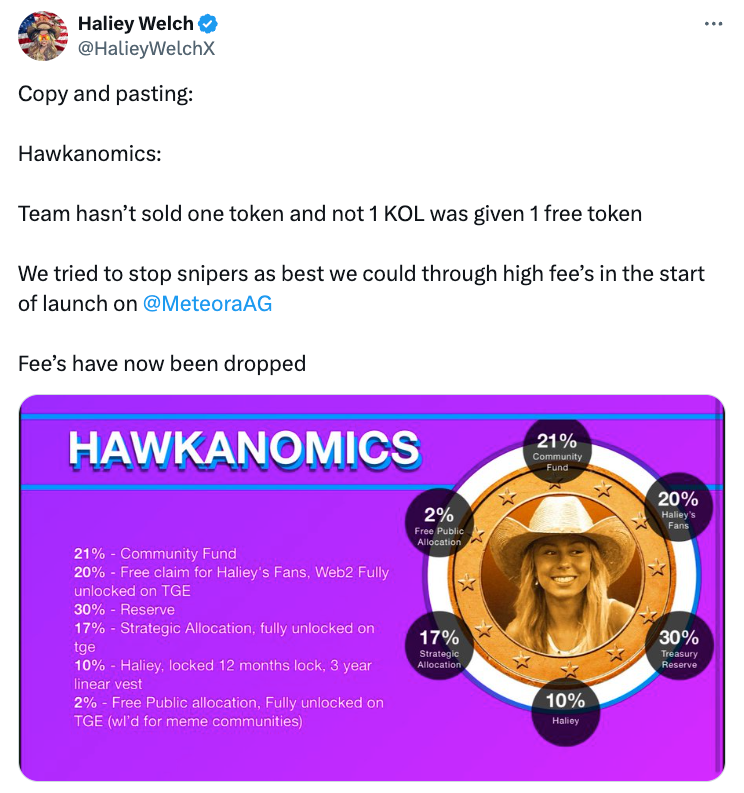

In a Dec. 5 post to X, Welch’s official account said that the team hadn’t sold any tokens and no key opinion leaders were given free coins. It added that they had launched the token on decentralized liquidity protocol Meteora to reduce sniping risk.

“Team hasn’t sold one token and not 1 KOL was given 1 free token,” she said. “We tried to stop snipers as best we could through high fee’s in the start of launch on Meteora.”

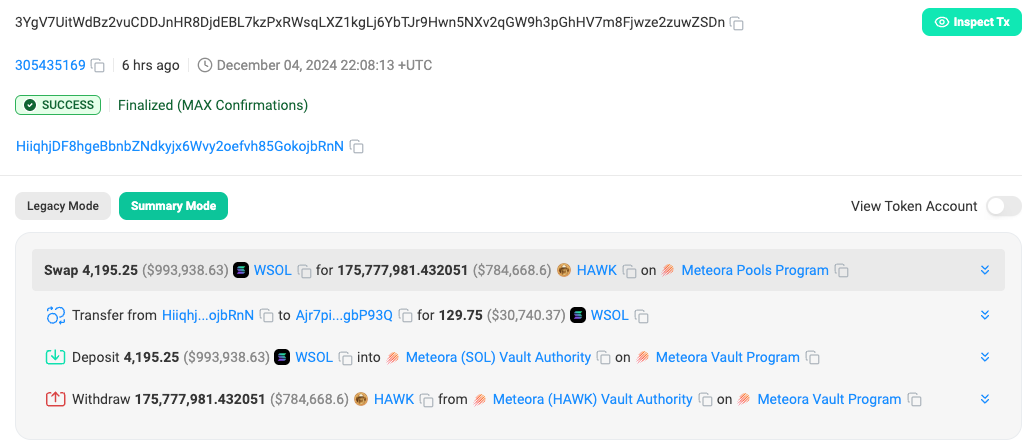

Still, according to data from Solana block explorer Solscanner, one wallet managed to snipe HAWK seconds after launch, purchasing 17.5% of the supply of the memecoin for 4,195 Wrapped Solana (WSOL) — worth $993,000 at the time.

Over the next one-and-a-half hours, the wallet sold 135.8 million HAWK tokens for a profit of $1.3 million.

“I really lost $43k apeing in ‘hawk tuah’ coin,” wrote one user on X.

According to onchain data cited by several users on X, one investor swapped about $1.4 million worth of another memecoin called MOODENG into the HAWK token, losing just over $1.3 million in the process.

HAWK memecoin risks legal backlash, say observers

Aside from the outrage around the token’s deployment, some observers suggested the launch could land Welch and her team in hot water with regulators.

Related: Is the ‘memecoin supercycle’ over already? Analysts weigh in

Several users on X claimed to have filed complaints with the SEC over the memecoin and law firms have begun advertising their services to those who lost money on the token.

In a Dec. 5 post to X, Burwick Law requested that anyone who lost money on the memecoin contact their firm and learn about their legal rights.

“If you lost money on $HAWK, contact our firm to learn about your legal rights.”

Magazine: Comeback 2025 — Is Ethereum poised to catch up with Bitcoin and Solana?